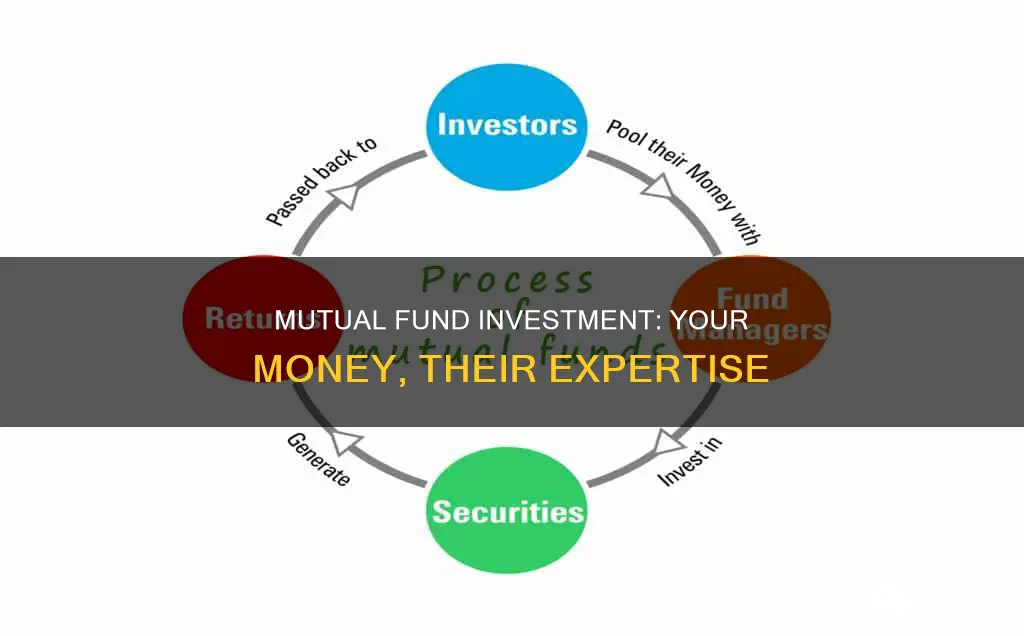

Investing in mutual funds is a popular option for those who want to diversify their portfolio without the hassle of picking and choosing individual investments. Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. This allows investors to benefit from a wide mix of assets selected for the fund by a professional money manager.

When investing in mutual funds, there are a few key steps to follow. First, you'll need to decide whether you want to invest in active or passive funds. Active funds are managed by professionals who aim to beat the market, while passive funds aim to mimic the market's performance. You'll also need to calculate your investing budget and decide where to buy mutual funds, such as through an online brokerage or directly from the fund company. It's important to understand the fees associated with mutual funds, as these can impact your overall returns.

By investing in mutual funds, individuals can benefit from professional management, diversification, and affordability. However, it's important to remember that mutual funds carry some level of risk, and past performance does not guarantee future returns.

| Characteristics | Values |

|---|---|

| Initial investment | Relatively low dollar amount for initial investment |

| Subsequent purchases | Relatively low dollar amount for subsequent purchases |

| Management | Professional management by fund managers |

| Diversification | Invests in a range of companies and industries |

| Affordability | Low costs |

| Liquidity | Shares can be redeemed at any time |

| Investment goals | Long-term, mid-term, or near-term |

| Investment strategy | Active or passive funds |

| Investment types | Money market funds, bond funds, stock funds, and target date funds |

| Fees | Expense ratios, load fees, management fees |

What You'll Learn

- Mutual funds are a safer, more affordable, and less complicated investment option than stocks

- They are professionally managed and offer diversification

- You can buy mutual funds through a brokerage account or directly from the company

- There are different types of mutual funds, including stock funds, bond funds, and target-date funds

- Mutual funds have fees and expenses that will impact your overall returns

Mutual funds are a safer, more affordable, and less complicated investment option than stocks

Mutual funds are an excellent investment option for those looking for a safer, more affordable, and less complicated alternative to stocks.

Mutual funds pool money from multiple investors, which is then used to purchase a diversified portfolio of stocks, bonds, or other securities. This diversification is a key advantage of mutual funds, as it allows investors to spread their investments across various holdings, thereby minimising potential losses. By investing in a mutual fund, individuals can gain exposure to a wide range of stocks, rather than just a few. This diversification also helps to reduce the risk of losing money, as even if some stocks perform poorly, others may compensate for those losses.

Additionally, mutual funds are managed by professional portfolio managers who are responsible for selecting and managing the fund's investments. These experts make investment decisions on behalf of the investors, saving them from the complicated decision-making involved in investing in stocks. The fund managers aim to meet or beat the performance of a specific benchmark, and their expertise often leads to better investment choices.

Another benefit of mutual funds is the cost structure. While mutual funds do charge management fees, the cost of trading is spread across all investors in the fund, resulting in lower costs per individual. This makes mutual funds a more affordable option compared to stocks, where individuals bear the full cost of trading.

Furthermore, mutual funds offer convenience to investors. With mutual funds, individuals can defer the decision-making to investing experts, saving them the time and effort required to research and select stocks individually. Mutual funds also provide an easy opportunity to invest in specific industries or growth strategies, such as sector funds, growth funds, value funds, index funds, and bond funds.

In summary, mutual funds offer a safer, more affordable, and less complicated investment option than stocks. They provide diversification, expert management, lower costs, and convenience, making them an attractive choice for investors looking to build wealth while minimising risk.

Retirement Funds: Diversifying Your Future with Multiple Investments

You may want to see also

They are professionally managed and offer diversification

Mutual funds are managed by professional money managers who oversee the portfolio, deciding how to divide money across sectors, industries, companies, etc., based on the strategy of the fund. This professional management is one of the key benefits of investing in mutual funds.

The professional investment manager uses research and skillful trading to make and monitor investments. Mutual funds are a relatively inexpensive way for small investors to get a full-time manager to make and monitor investments. Mutual funds require much lower investment minimums, providing a low-cost way for individual investors to experience and benefit from professional money management.

Mutual funds are also subject to industry regulations meant to ensure accountability and fairness for investors. In addition, the component securities of each mutual fund can be found across many platforms.

You can research and choose from funds with different management styles and goals. A fund manager may focus on value investing, growth investing, developed markets, emerging markets, income, or macroeconomic investing, among many other styles. This variety enables investors to gain exposure not only to stocks and bonds but also to commodities, foreign assets, and real estate through specialised mutual funds. Mutual funds provide prospects for foreign and domestic investment that might otherwise be inaccessible.

Mutual fund managers are legally obligated to follow the fund's stated mandate and to work in the best interest of mutual fund shareholders.

Another key benefit of mutual funds is that they offer diversification. Mutual funds typically invest in a range of companies and industries, helping to lower your risk if one company fails.

Mutual funds offer investors a great way to diversify their holdings instantly. Unlike individual stocks, investors can put a small amount of money into one or more funds and access a diverse pool of investment options as a single mutual fund may be comprised of dozens of different securities.

Mutual funds also invest in a variety of different sectors. Some of the biggest mutual funds invest in S&P 500 companies or large-cap stocks. Others may specifically target companies with smaller market capitalisation or specific industries like technology, healthcare, or raw materials.

Hedge Fund Investment: Risks, Rewards, and the In-Between

You may want to see also

You can buy mutual funds through a brokerage account or directly from the company

There are two main ways to buy mutual funds: through a brokerage account or directly from the company that created the fund.

Buying Mutual Funds Through a Brokerage Account

If you're investing in stocks, you'll need a brokerage account. But with mutual funds, you have a few options. A brokerage account gives you access to a broad selection of funds from a range of companies. You can also benefit from the research and educational tools that brokerages offer. When choosing a brokerage account, consider factors such as affordability, fund choices, and ease of use. Be sure to compare the fees charged by different brokerages, as these can impact your returns over time.

Buying Mutual Funds Directly from the Company

You can also buy mutual funds directly from companies like Vanguard or BlackRock. However, this option may limit your choice of funds. Additionally, you may incur additional fees if you work with a traditional financial advisor to purchase funds.

Factors to Consider When Choosing How to Buy Mutual Funds

- Affordability: Compare the fees and expenses charged by different brokerages and fund companies. These can include transaction fees, expense ratios, and front- and back-end sales loads.

- Fund choices: Consider the range of funds available through a brokerage account versus buying directly from the company. A brokerage account may offer a wider selection of funds from different companies, while buying directly from the company may be more limited.

- Research and educational tools: If you're new to investing, look for brokerages that provide research and educational resources to help you make informed decisions.

- Ease of use: Choose a platform that is user-friendly and easy to navigate.

Mutual Funds vs Savings: Where Should Your Money Go?

You may want to see also

There are different types of mutual funds, including stock funds, bond funds, and target-date funds

There are different types of mutual funds, each with its own investment focus and strategy. Here are some of the most common types:

- Stock funds invest in corporate stocks. These can be further categorized into growth funds, income funds, index funds, and sector funds. Growth funds focus on stocks with high growth potential but may not pay regular dividends. Income funds, on the other hand, invest in stocks that pay regular dividends. Index funds track a specific market index, such as the S&P 500, while sector funds specialize in a particular industry segment.

- Bond funds invest in a range of bonds and typically carry higher risks than money market funds as they aim for higher returns. The risks and rewards of bond funds can vary significantly depending on the types of bonds they invest in. Some common types of bonds include government bonds, corporate bonds, and high-yield junk bonds.

- Target-date funds, also known as lifecycle funds, are designed for individuals with specific retirement dates in mind. These funds hold a mix of stocks, bonds, and other investments, and the asset allocation gradually shifts to a more conservative portfolio as the target date approaches. Target-date funds are often available through 401(k) plans and are a popular choice for retirement savings.

Each type of mutual fund offers different features, risks, and rewards, allowing investors to choose the ones that align with their investment goals, risk tolerance, and time horizon. It's important to carefully consider the fund's prospectus, investment strategy, and associated fees before making any investment decisions.

Mutual Fund Profits: Where to Invest and Why

You may want to see also

Mutual funds have fees and expenses that will impact your overall returns

- Annual fees: Mutual funds typically charge annual fees, known as expense ratios, which are calculated as a percentage of the fund's average net assets. These fees cover the fund's operating expenses, such as management fees, administrative costs, and marketing expenses. The expense ratio is deducted from the fund's returns, reducing the overall returns for investors. Over time, even small differences in expense ratios can have a significant impact on investment returns. It is important to carefully review the expense ratio before investing in a mutual fund.

- Sales charges or loads: Some mutual funds charge sales fees, known as "loads", when buying or selling shares. Front-end loads are charged when purchasing shares, while back-end loads, or contingent deferred sales charges, are assessed if shares are sold before a certain date. It is possible to find no-load mutual funds, which do not have commission or sales charges.

- Redemption fees: Some mutual funds charge a redemption fee if shares are sold within a short period after purchasing them, usually within 30 to 180 days. These fees are designed to discourage short-term trading and promote stability within the fund.

- Other account fees: In addition to the fees mentioned above, investors may also encounter other account-related fees. Some funds or brokerage firms may charge extra for maintaining an account or conducting transactions, especially if the account balance falls below a certain minimum threshold.

- Management fees: Actively managed mutual funds tend to have higher expense ratios because they include the cost of paying investment managers. Passive or index funds, which aim to replicate the performance of a specific index, generally have lower expense ratios as they do not incur the same level of management fees.

- Transaction fees: When buying or selling mutual fund shares through a brokerage account, investors may be subject to transaction fees. These fees vary depending on the brokerage firm and the specific fund.

It is important for investors to carefully consider the fees associated with mutual funds as they can significantly impact the overall returns on their investments. By comparing expense ratios, sales charges, and other fees, investors can make more informed decisions and choose funds that align with their investment goals and budget constraints. Additionally, investors should regularly review the fees they are paying to ensure they are getting value for their money and that the fees are not outweighing the returns generated by the fund.

Bond Funds: Best Time to Invest and Why

You may want to see also

Frequently asked questions

Mutual funds are a collection of investment assets packaged as a single investment. They allow investors to pool their money to invest in a diverse portfolio of stocks, bonds, or other assets.

Mutual funds are a popular investment choice because they offer professional management, diversification, affordability, and liquidity. They are also highly liquid, making them easy to buy or sell.

Most mutual funds fall into one of four main categories: money market funds, bond funds, stock funds, and target date funds. Each type has different features, risks, and rewards.

First, decide on your investment goals and the right mutual fund strategy for you. Then, research potential mutual funds and open an investment account. Finally, purchase shares of mutual funds and set up a plan to keep investing regularly.

Mutual funds charge annual fees, expense ratios, or commissions, which lower their overall returns. The main type of fee is the expense ratio, which is the percentage of the fund's assets that go toward annual fees.