Mutual funds are a popular investment vehicle, with 82.8 million Americans owning them. They are an investment company that combines money from individuals and invests in a diversified portfolio of securities. Each investor is a shareholder who buys shares of the fund, with each share representing a proportion of ownership in the fund's assets. There are different types of mutual funds, including stock/equity, index, bond, hybrid, and money market funds, each designed for short-term or long-term investment strategies.

The International Marketing Group (IMG) is an institution that focuses on financial education and has over 28 membership benefits. Investing in mutual funds through IMG has several advantages, including zero sales load fees, free investment seminars, multiple investment options, in-person coaching, a do-it-yourself platform, and stockholders' meetings.

To invest in mutual funds, there are several steps to follow:

1. Decide on your mutual fund investment goals, whether long-term or short-term.

2. Pick the right mutual fund strategy, such as growth funds or balanced funds, based on your risk tolerance and investment horizon.

3. Research potential mutual funds using tools like the Mutual Fund Observer and Maxfunds, and consider factors like past performance, expense ratios, load fees, and management style.

4. Open an investment account, such as an employer-sponsored retirement plan, an individual retirement account (IRA), a taxable brokerage account, or an education savings account.

5. Purchase shares of mutual funds by depositing money into your investment account, keeping in mind the higher investment minimums that some mutual funds may have.

6. Set up a plan to invest regularly, which can help you benefit from dollar-cost averaging and make the most of compound interest.

7. Consider your exit strategy, including any backend load fees or taxes you may owe on capital gains.

| Characteristics | Values |

|---|---|

| Investment options | Over 60 mutual funds in the Philippines, 30+ of which are distributed by IMG |

| Sales load fee | Zero |

| Seminars and workshops | Free |

| Investment minimums | $100-$3000 |

| Investment account options | Individual retirement accounts (IRAs), taxable brokerage accounts, education savings accounts |

What You'll Learn

Zero sales load benefits

Zero sales load is a type of mutual fund that doesn't come with any sales charges or upfront fees. This means that investors can buy or sell shares of these funds without paying any commissions or transaction fees.

The International Marketing Group (IMG) is one such company that offers mutual funds with zero sales load. IMG is a financial education company that offers free workshops to promote financial literacy.

Lower Costs

Zero sales load funds are cheaper than load funds, which charge a commission when you buy or sell shares. The commission can be as high as 5% of your investment, which can significantly reduce your returns. Zero sales load funds, on the other hand, have no sales charges, so you can invest your entire amount without any deductions. This means you can save money on fees and invest more in your portfolio.

Greater Flexibility

Zero sales load funds offer greater flexibility than load funds. With load funds, you have to pay a commission every time you buy or sell shares. This can discourage you from making changes to your portfolio, as you will incur fees every time you make a move. Zero sales load funds, however, allow you to buy and sell shares without any fees, giving you the flexibility to adjust your portfolio as needed without worrying about costs.

Better Performance

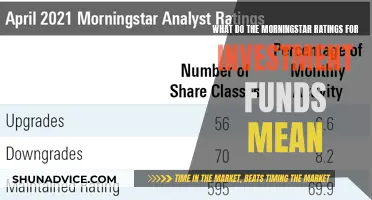

Zero sales load funds tend to perform better than load funds over the long term. This is because load funds have higher expenses, which can eat into your returns. Zero sales load funds, on the other hand, have lower expenses, which can boost your returns. According to a study by Morningstar, zero sales load funds outperformed load funds by an average of 0.44% per year over a decade.

Diversification

Zero sales load funds offer a wide range of investment options, which can help you diversify your portfolio. You can invest in different asset classes, such as stocks, bonds, and real estate, and across different sectors and geographies. This can help you spread your risk and reduce the impact of market volatility.

Ease of Access

Zero sales load funds are easy to access and invest in. You can buy them directly from the fund company or through a brokerage account. You don't need a financial advisor to invest in these funds, which can save you money on fees.

No Pressure from Salespeople

Load funds often have salespeople who are paid commissions to sell their products. These salespeople may pressure you into buying their funds, even if they are not the best option for you. Zero sales load funds don't have salespeople, which means you can make investment decisions based on your own research and analysis.

Apollo Fund: A Guide to Investing Wisely

You may want to see also

Free investment seminars

Zero Sales Load

Investing in mutual funds through IMG means you won't have to pay any sales load or entry fee, which is typically charged by other brokerages and can range from 1% to 5% of your investment. With IMG, you get to keep more of your money, which can lead to higher profits.

Free Mutual Fund Seminars and Stock Market Updates

IMG provides free seminars and workshops to educate its members about the concepts of investing, as well as updates on the latest performance of mutual funds and the stock market. This helps you make informed investment decisions and stay ahead of the market.

Multiple Investment Options

IMG offers over 30 mutual fund options from different companies, giving you the flexibility to choose investments that align with your objectives, time plan, and risk tolerance. This ensures that you can create a diversified portfolio that meets your unique needs.

In-Person Coaching

IMG provides its members with the opportunity to meet and talk with financial planners, mentors, and experts. This personalized guidance is often reserved for major clients at other institutions. IMG's in-person sessions provide a more engaging and effective learning experience.

Do-It-Yourself Platform

IMG empowers its members with the knowledge and skills to manage their finances independently. Through their seminars, trainings, and workshops, they teach you how to fill out investment forms, make online payments, and process paperwork. This gives you greater control over your investment journey.

Stockholders' Meetings

IMG members get exclusive access to stockholders' meetings, where they can receive firsthand information about the performance of their investments. This level of transparency and disclosure is not always available through other investment channels.

Financial Education Workshop

IMG is dedicated to promoting financial literacy by offering free workshops to its members. These workshops cover a range of topics, including practical money management, debt management, financial protection tools, and retirement planning. This holistic approach ensures that you make informed decisions about your financial future.

Zero Load Benefits to Various Mutual Funds

IMG has partnerships with several mutual fund companies, including Soldivo, Philam Asset Management Inc. (PAMI), Philequity, ATR Kim Eng, and Sunlife Financial. As an IMG member, you can invest in any of these mutual funds without having to pay load fees, making it a cost-effective way to diversify your portfolio.

In conclusion, attending free investment seminars offered by IMG can provide you with valuable financial education, multiple investment options, and cost savings. By taking advantage of these seminars, you can make more informed decisions about investing in mutual funds and work towards achieving your financial goals.

Dimensional Fund Investing: What Products Are Offered?

You may want to see also

Multiple investment options

International Marketing Group (IMG) members have access to a wide range of investment options. There are over 60 mutual funds in the Philippines, more than 30 of which are distributed by IMG. This includes funds from top-ranking companies in the country such as Philequity, First Metro, and Philam Asset.

The variety of options available means investors can choose an investment that fits their objectives, time plan, and risk appetite.

For example, if you are investing for a long-term goal, such as retirement, stock mutual funds are a great choice. You have plenty of time to weather the ups and downs of the stock market. If you are saving for a shorter-term goal, such as buying a home or a car within a few years, a bond market mutual fund might be a better option.

There are also different types of mutual funds, each designed to benefit from either a short-term or long-term investment strategy. These include:

- Stock/Equity funds: Invest in a variety of stocks

- Index funds: Equity funds that attempt to mirror the performance of a specific index, e.g. the S&P 500

- Bond funds: Invest in a variety of bonds

- Hybrid funds: Invest in a combination of stocks, bonds, and other securities

- Money Market funds: Invest in securities that generally mature in one year or less and are very liquid

Funding Your Chase You Invest Account: Easy Steps to Follow

You may want to see also

In-person coaching

Face-to-face Interactions with Experts

Practical and Effective Learning

IMG's in-person coaching sessions are designed to be practical and effective. During these sessions, you will undergo a comprehensive financial check-up and receive one-on-one coaching. This hands-on approach ensures that you not only gain theoretical knowledge but also learn how to apply financial concepts to your own situation.

Access to a Variety of Investment Options

IMG offers its members access to over 30 mutual funds from different companies in the Philippines. With such a wide range of options, you can choose investments that align with your objectives, time horizon, and risk tolerance. This flexibility ensures that you can create a diversified portfolio that meets your unique needs.

Skills for Independent Investing

IMG's in-person coaching empowers you to become an independent investor. Through their seminars, trainings, and workshops, they provide members with the necessary skills and knowledge to manage their finances effectively. This includes teaching you how to fill out investment forms, make online payments, and complete the necessary paperwork. Their Do-It-Yourself (D.I.Y.) platform equips you with the confidence to navigate the investing process on your own.

Building a Supportive Network

Long-term Career Opportunities

Investing through IMG is not just about financial gains; it can also open doors to new career paths. By becoming a member and participating in their programs, you may discover a passion for financial education and mentorship. This could lead to opportunities to become a speaker, educator, or financial advisor yourself, allowing you to help others while building a fulfilling career.

International Equity Mutual Funds: Diversify and Grow Your Wealth

You may want to see also

DIY platforms

Do-it-yourself (DIY) investing is a method where individual investors choose to build and manage their own portfolios. This approach is also known as self-directed investing. DIY investors typically utilise discount brokerages and online investment tools and platforms, such as online brokerage platforms, fund family accounts, robo-advisors, and personal account aggregators.

Online Brokerage Platforms

Online brokerage platforms, whether strictly virtual or operated by financial institutions, offer discounted commissions and fees, as well as robo-advisor-managed portfolios. Examples include E*TRADE, TD Ameritrade, and Robinhood. Most financial institutions and banks also offer their customers self-directed online brokerage accounts. For instance, Citibank and Wells Fargo provide investing platforms, while Vanguard, a mutual funds giant, offers one of the most popular DIY platforms.

These platforms usually offer a suite of research and analysis tools, expert recommendations, and insights to help investors make informed decisions. Investors can then execute trades through the platform's website or mobile app. While some platforms do not charge a commission for stock trades, others charge a small amount per options contract. They also allow investors to trade on margin, create options strategies, and invest directly in mutual funds, individual stocks, foreign exchange, and exchange-traded funds (ETFs).

Fund Family Accounts

Fund family accounts are suitable for investors who want to build portfolios of open-end mutual funds transacted directly with the fund company. DIY investors can choose to work with multiple fund families or a single investment company. Fund family accounts offer the benefit of exchange privileges, which allow investors to exchange funds within the fund family with low or no transaction costs. This helps manage investments through different market conditions and transition fund investments from aggressive to conservative holdings over time.

Robo-Advisors

Robo-advisors provide investors with automated portfolios based on modern portfolio theory. These portfolios typically have low annual advisory fees and use low-cost index funds. Robo-advisor services also offer frequent rebalancing, helping investors keep their portfolio allocation in line with their objectives.

Personal Account Aggregators

With the multitude of platforms and accounts available, many DIY investors turn to personal account aggregators for administrative assistance in monitoring budgets and investments. Examples of such services include Betterment and Quicken, which combine automated investing with financial planning services and recommendations.

IRA Investment Options: Mutual Funds or ETFs?

You may want to see also