Target-date funds are a popular investment option for those saving for retirement, with more than $2.8 trillion invested in them at the end of 2022. They are a type of mutual fund or exchange-traded fund that automatically rebalances and reallocates assets as the investor gets closer to retirement, typically shifting from riskier investments such as stocks to more conservative investments such as bonds and cash. The main advantage of target-date funds is that they simplify the investment process, allowing investors to take a set it and forget it approach. However, there are also some disadvantages to consider, such as potentially high fees and the fact that they may not be tailored to an individual's specific retirement needs.

| Characteristics | Values |

|---|---|

| Investment type | Mutual fund or exchange-traded fund |

| Investment strategy | Aggressive (high-risk, high-reward) to conservative (low-risk, low-reward) |

| Investor involvement | Hands-off |

| Asset allocation | Well-diversified stocks and bonds |

| Asset rebalancing | Automatic |

| Investment selection | Automatic |

| Advice | Cost-effective |

| Investment returns | Positive |

| Fees | Low |

| Suitability | Young workers, hands-off investors, DIY investors |

What You'll Learn

- Target-date funds are a set-it-and-forget-it investment option

- They are a good option for investors who are hands-off and wouldn't rebalance their investments on their own

- They are a more comprehensive strategy than picking stocks based on past performance

- They are good for young workers as they own mostly stocks, providing a great foundation for growing returns over the long term

- They are cost-effective as they provide investors with advice at a very low cost

Target-date funds are a set-it-and-forget-it investment option

Target-date funds are a "set-it-and-forget-it" investment option, making them a simple and stress-free way to invest for the future.

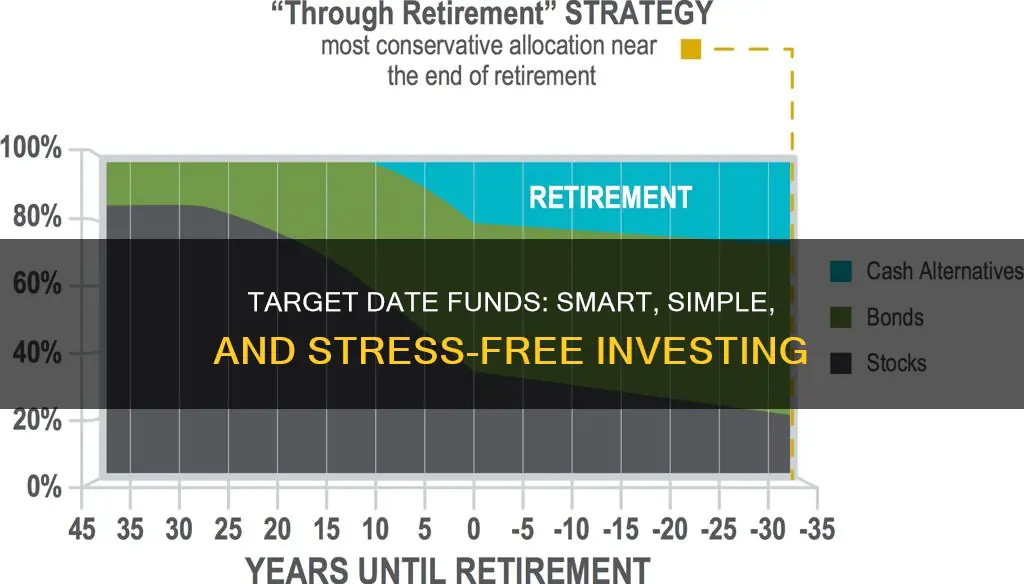

They are a type of mutual fund or exchange-traded fund that automatically rebalances and reallocates assets as you get closer to retirement, typically shifting from riskier investments, such as stocks, to more conservative investments, such as bonds and cash. This means that investors don't need to constantly monitor and adjust their portfolio, reducing the stress associated with financial planning.

The process of building a well-diversified portfolio can be overwhelming for those who are not investing experts, and target-date funds simplify this process. They offer investors the convenience of automatically allocating assets from day one, and can also improve returns. Studies have shown that a large proportion of an investor's return depends on how money is divided between various asset classes, and target-date funds handle this allocation for the investor.

Target-date funds are particularly popular in 401(k) plans, and they are often a default investment option for employees. They are a good option for investors who want a hands-off approach and who might not rebalance their investments on their own. They are also a good starting point for young investors, as they provide a well-balanced mix of stocks and bonds with an appropriate level of risk for the investor's age.

However, it's important to note that target-date funds may not always be the best option for all investors, and there are some disadvantages to consider. For example, they may not be suitable for retirees who want to continue growing their wealth, as they can become too conservative too quickly. Additionally, fees can add up, and it's important to compare expense ratios before selecting a fund.

Mutual Funds for NRIs: Best Indian Investment Options

You may want to see also

They are a good option for investors who are hands-off and wouldn't rebalance their investments on their own

Target-date funds are a good option for investors who want a hands-off approach and don't want to have to worry about rebalancing their investments. They are designed to be a "set it and forget it" investment option. Once an investor has chosen a target date fund, their asset mix will automatically adjust over time, becoming more conservative as they get older and closer to retirement. This is known as a "glide path".

For example, an investor who plans to retire in 2040 would select the 2040 Fund. Over a 20-year period, their money will first be put in aggressive, high-risk, high-return stock mutual funds, then gradually move to conservative, low-risk, low-return bond funds. This gradual change in asset allocation over time is known as the "glide path".

Target-date funds are also a good option for investors who don't have the time or inclination to monitor and adjust their portfolio regularly. They can be a simple solution for people who don't want to deal with investing or who are intimidated by money. They are also a good option for DIY investors, as they are a more comprehensive strategy than picking stocks based on past performance, which is often an unsuccessful strategy.

However, it's important to note that target-date funds are not individualized for a person's specific situation. They treat every person who will retire in a certain year as the same, and don't take into account different income needs, lifestyles, and resources in retirement. Therefore, it's important for investors to do their research and consider all their options before investing in target-date funds.

TSP L Funds: Choosing the Right Investment for You

You may want to see also

They are a more comprehensive strategy than picking stocks based on past performance

Target-date funds are a more comprehensive strategy than picking stocks based on past performance. They are designed to reduce the risk of significant losses as you near retirement. This is achieved by automatically shifting the direction of your investments from high-risk, high-reward to low-risk, low-reward options.

High-risk, high-reward investments, such as single stocks, are riskier and more volatile than conservative options. However, they have the potential to earn higher returns. On the other hand, low-risk, low-reward investments, such as some bonds, certificates of deposit (CDs), or money market funds, are less risky but tend to generate more modest returns.

The goal behind the change in investment direction, or asset allocation, is to build a substantial nest egg first and then gradually shift the focus to protecting those savings as you approach retirement. This strategy helps prevent you from losing a large chunk of your savings right before you retire.

Target-date funds are also known as dynamic-risk, age-based, or lifecycle funds because they adjust their asset allocation over time based on your selected retirement age. This means that they gradually become more conservative as you get older, typically by reducing the proportion of stocks and increasing the proportion of bonds and cash in your portfolio.

This gradual shift in asset allocation is often referred to as the glide path, which is like an airplane coming in for a gentle landing by reducing the risk of a market crash that could destroy your nest egg.

Additionally, target-date funds are a good option for investors who prefer a hands-off approach and might not rebalance their investments on their own. They are also suitable for DIY investors who might otherwise pick stocks based solely on past performance, which is not always indicative of future growth.

In summary, target-date funds offer a comprehensive investment strategy that dynamically manages risk and helps investors build and protect their retirement savings.

Protect Your 401k: Invest in Mutual Funds for a Secure Future

You may want to see also

They are good for young workers as they own mostly stocks, providing a great foundation for growing returns over the long term

Target-date funds are a great option for young workers as they are a simple, hands-off investment strategy that provides a strong foundation for growing returns over the long term.

Young investors who opt for target-date funds initially own quite a bit of equities, though the ratio shifts in favour of fixed-income investments as they age. The chief appeal of target-date funds is their simplicity. All investors need to do is choose a target date for their retirement, and the fund managers take care of the rest. This makes them ideal for young workers who are either too busy or too intimidated to actively manage their investments.

For example, a 25-year-old in 2022 with a long investment horizon may pick a 2060 target date fund. Such a fund would be made up of around 90% stocks, providing the potential for high returns over the next few decades. As the investor gets older, the fund will gradually shift to more conservative investments, such as bonds, to protect their savings.

Target-date funds are also a good option for young investors because they provide easy diversification. For example, Vanguard's Target Retirement 2060 Fund offers investors access to a mix of domestic and international stocks and bonds in one neat package.

In addition, target-date funds handle rebalancing for investors. As investors age, their risk tolerance typically decreases, but it can be easy to ignore your retirement account for years and end up with a portfolio that no longer suits your needs. Target-date funds are structured to rebalance automatically, so investors can rest assured that their portfolio will remain appropriate for their age and risk tolerance.

Hedge Fund Insights: EDGAR Investment Info Source

You may want to see also

They are cost-effective as they provide investors with advice at a very low cost

Target-date funds are a cost-effective investment option. They provide investors with advice and remove the need for any portfolio management—all for a very low cost.

Firstly, target-date funds are associated with low fees. The average expense ratio for a target-date fund was 0.34% at the end of 2021, dropping to 0.32% in 2022. This is an all-in fee, reflecting the asset-allocation advice as well as the fund expenses. In fact, most target-date funds do not charge an additional fee for advice.

Secondly, target-date funds are a "set-it-and-forget-it" investment option. They are designed to be simple and require minimal effort from the investor. Once the investor has chosen their target retirement date, the fund takes care of the rest, including rebalancing and optimising asset allocation. This automated investment strategy means that investors do not need to constantly monitor and adjust their portfolio, reducing the stress associated with financial planning.

Thirdly, target-date funds can save investors money by preventing them from making poor investment decisions. Before the advent of target-date funds, it was common for inexperienced investors to select investments based on short-term performance, or to invest in funds with high returns and star ratings. By providing basic asset-allocation advice and ongoing oversight, target-date funds help investors make more informed decisions.

Finally, target-date funds are a good option for investors who want a hands-off approach. They are well-suited to investors who are intimidated by money or who would not rebalance their investments themselves.

Investments Funding Social Security: State-Sponsored Retirement Plans

You may want to see also

Frequently asked questions

A target-date fund is a mutual fund or exchange-traded fund that automatically adjusts the investor's asset allocation over time, typically shifting from riskier investments to more conservative options as the investor approaches their retirement age.

Target-date funds offer a "set-it-and-forget-it" approach to investing, simplifying the process for individuals who are not experts. They provide a well-diversified portfolio, handle the challenging task of rebalancing, and relieve investors of the need to constantly monitor and adjust their portfolio.

Target-date funds may not be suitable for everyone as they are not tailored to an individual's specific needs and circumstances. They may also be more conservative than what some investors desire, potentially limiting upside potential. Additionally, fees can add up over time, impacting overall returns.

When selecting a target-date fund, look for funds with low expense ratios and management fees. Ensure the fund is appropriately diversified and aligns with your risk tolerance. It's also important to consider the underlying investments and whether they match your values and preferences, such as socially responsible investing.