Index funds are a form of exchange-traded fund or mutual fund that contains a basket of stocks mirroring a particular index, like the Sensex or the Nifty. They are passively managed, aiming to replicate the performance of the index rather than outperform it, which results in lower operational costs and fees. ICICI Direct offers a range of investment options, including mutual funds, stocks, and IPOs. To invest in an index fund through ICICI Direct, you need to open a Demat account and complete the online registration process. Once your account is verified, you can start investing in various financial instruments, including index funds. ICICI Direct provides resources to help you learn about investing and make informed decisions.

| Characteristics | Values |

|---|---|

| Investment options | Mutual funds, stocks, and IPOs |

| Investment process | Open a Demat account and trading account, decide on the amount of funds available, the time duration of the investment, financial goals to fulfil, and risk factors |

| Benefits | Growing wealth over time, earning extra income, reaching financial goals, planning for retirement, saving on taxes |

| Best way to invest | Depends on goals, income, age, and risk tolerance |

| Types of index funds | General market index funds, market capitalization index funds, international index funds, earnings-based index funds, bond-based index funds |

| Advantages of index funds | Low expense ratio in management costs, better long-term returns due to focus on stable growth, ideal for passive investors |

| Disadvantages of index funds | Vulnerable to market fluctuations and crashes, lack of flexibility, vulnerable to cyber attacks, low returns |

| Who should invest in an index fund | New investors, long-term investors, cost-conscious investors, risk-averse investors |

| How to invest in an index fund | Open a brokerage account, pick an index fund, invest, take a long-term approach, automate |

What You'll Learn

Opening a brokerage account

Once the brokerage account is opened, the next step is to pick an index fund that aligns with your goals and risk tolerance. Broad market funds track the entire stock market, while sector funds are linked to a specific industry. After selecting the fund, you can proceed to invest by buying shares of the chosen index fund directly through your brokerage account.

It is important to note that investing in index funds is suitable for long-term financial goals. The market may experience fluctuations in the short term, but over time, it has historically risen. Therefore, investors need to be prepared to stay invested for several years to ride out the market cycles and achieve steady growth.

Additionally, setting up an SIP (Systematic Investment Plan) can help automate the investment process. This involves investing a fixed amount at regular intervals, allowing for gradual wealth accumulation.

Alternative Investment Funds: A Guide to Investing in India

You may want to see also

Picking an index fund

Index funds are a great investment for building wealth over the long term. They are a group of stocks that mirror a particular stock market index, such as the Standard & Poor's 500 index. An index fund will be made up of the same investments that make up the index it tracks. This means that the performance of the index fund usually closely mirrors that of the index, without the need for hands-on management.

- Company size and capitalisation: Index funds can track small, medium, or large companies, referred to as small-, mid-, or large-cap indexes.

- Geography: You can choose funds that focus on stocks trading on foreign exchanges or a combination of international exchanges.

- Business sector or industry: You can explore funds that focus on specific sectors, such as consumer goods, technology, or health-related businesses.

- Asset type: There are funds that track bonds, commodities, or cash.

- Market opportunities: These funds focus on emerging markets or other growing sectors.

When picking an index fund, it's important to consider your investing goals and budget. Here are some additional factors to keep in mind:

- Investment minimums and account minimums: The minimum required to invest in a mutual fund can vary, so be sure to check the requirements for the specific fund you're interested in.

- Expense ratio: This is one of the main costs of an index fund, representing fees subtracted from each fund shareholder's returns as a percentage of their overall investment.

- Tax-cost ratio: Holding the fund may trigger capital gains taxes if held outside tax-advantaged accounts, which can impact your overall returns.

- Tracking error: Look for funds with a low tracking error, as they are more likely to perform as expected.

Remember to do your due diligence and ensure that the index fund aligns with your risk appetite, financial goals, and investment horizon.

Large-Cap Funds: When to Invest for Maximum Returns

You may want to see also

Investing

- Understanding Index Funds: Index funds are a type of investment fund that aims to replicate the performance of a particular market index, such as the Nifty 50. They are passively managed, meaning they have lower operational costs and fees than actively managed funds. Index funds provide stability and are ideal for investors seeking predictable returns over the long term.

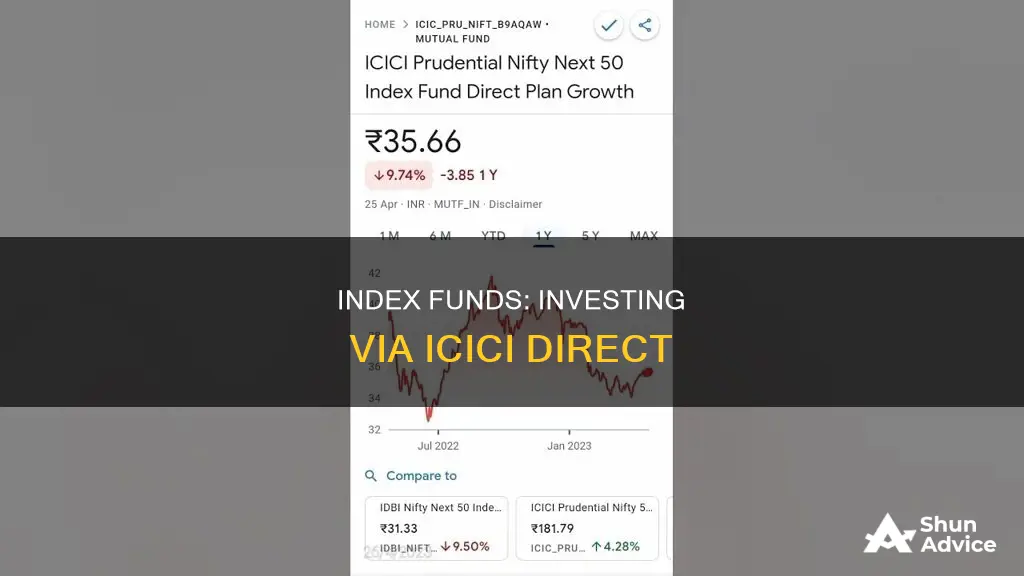

- Opening an Account with ICICI Direct: To start investing through ICICI Direct, you will need to open a Demat and Trading account. The account opening process can be completed online through their website. You will need to provide your Aadhaar for e-signing and complete your KYC details.

- Choosing an Index Fund: Consider your financial goals, risk tolerance, and investment horizon. ICICI Direct offers various index funds, including the Nifty 50 Index Fund, which tracks the 50 largest and most liquid companies on the National Stock Exchange of India.

- Investing in the Chosen Index Fund: Once you have selected your index fund, you can invest through your ICICI Direct brokerage account. You can set up a Systematic Investment Plan (SIP) to invest a fixed amount at regular intervals, which is a great way to build wealth over time.

- Long-Term Approach: Index funds are typically suited for long-term investment horizons of 7 years or more. They aim for steady growth, so be prepared to stay invested for several years to ride out any short-term market fluctuations.

- Benefits and Risks: Index funds offer low costs, diversification, passive investment strategies, and long-term growth potential. However, they may have lower returns than actively managed funds, are vulnerable to market crashes, and have limited upside potential. Ensure you understand the risks and rewards before investing.

Chanakya Opportunities Fund: A Smart Investment Strategy

You may want to see also

Long-term approach

Index funds are ideal for investors who are risk-averse and expect predictable returns over a long-term horizon. While index funds may undergo several fluctuations in the short run, these tend to average out in the long term, delivering good returns.

Understand Index Funds

Index funds are a form of passive fund management. They are a type of exchange-traded fund or mutual fund that contains a portfolio of stocks or bonds designed to emulate the performance of a particular market index, such as the Nifty 50. The fund manager's role is to replicate the performance of the index as closely as possible, rather than aiming to outperform the market.

Assess Your Investment Goals and Risk Tolerance

Before investing in index funds, it's important to consider your financial goals and risk tolerance. Index funds are generally suitable for investors seeking steady, long-term growth and are less suitable for those seeking short-term gains or explosive growth.

Open a Brokerage Account

To invest in index funds, you'll need to open a brokerage account, which will serve as your online window to buy and sell investments. Look for a broker with low fees and a user-friendly interface.

Pick an Index Fund

When choosing an index fund, consider your goals and risk tolerance. Broad market index funds track the entire stock market, while sector funds are tied to a specific industry.

Invest for the Long Term

Be prepared to stay invested for several years, allowing your index fund to weather the cycles of the market.

Set Up an SIP

Consider setting up a Systematic Investment Plan (SIP) to automate your investments. This involves investing a fixed amount at regular intervals, which is an effective way to build wealth gradually.

Diversify Your Portfolio

To manage risk, consider diversifying your investments across different types of index funds, such as general market index funds, market capitalisation index funds, international index funds, earnings-based index funds, and bond-based index funds.

Keep Costs and Taxes in Mind

Index funds typically have lower fees than actively managed funds, but it's still important to compare expense ratios between different funds. Additionally, be mindful of trading costs and taxes, such as capital gains tax, when buying or selling securities within your index fund.

Monitor Tracking Error

Tracking error refers to the difference between the return of an index fund and its corresponding benchmark. Choose funds with a lower tracking error, as they are more likely to perform as expected.

Long-Term Investment Horizon

Index funds typically perform better over longer periods, so it's recommended to invest funds that you can set aside for the long term.

Remember, investing in index funds through ICICI Direct or any other platform involves risks, and past performance does not guarantee future results. It's always a good idea to consult a financial advisor to determine if index funds align with your specific financial goals and risk appetite.

Schwab 1000 Index Fund: A Smart Investment Strategy

You may want to see also

Automating with an SIP

Systematic Investment Plans (SIPs) are a great way to automate your investments and build wealth gradually. Here's a guide on how to get started with automating your index fund investments through ICICI Direct using SIPs:

Understanding SIPs:

SIPs allow you to invest a fixed amount of money at regular intervals, such as monthly or quarterly. This helps you discipline your investment behaviour and benefit from the power of compounding. With SIPs, you don't have to worry about timing the market, as your investments grow through consistency.

Starting your SIP journey:

You can start your SIP journey with ICICI Direct by following a few simple steps. First, choose the mode of investment that suits you best. Then, enter the investment amount, keeping in mind that the minimum investment for SIPs can be as low as ₹100. You can use the SIP calculator to determine the future value of your investments.

Flexibility of SIPs:

One of the biggest advantages of SIPs is their flexibility. You can automatically increase your SIP amount periodically or pause your investments if you are unable to invest for a certain period. There is no maturity period for SIPs, giving you the freedom to redeem your wealth at any time to meet your financial needs.

Benefits of investing through SIPs:

SIPs offer a range of benefits, including higher returns compared to traditional investments or savings accounts. They help you beat market volatility by providing consistent returns over time. Additionally, you can skip a month's investment without incurring any penalties if you are on a tight budget.

SIP Step Up and Perpetual SIP:

SIP Step Up allows you to automatically increase your SIP amount periodically. This feature helps you take a break from your investments to meet financial commitments. With Perpetual SIP, you can set up a long-term investment plan without the hassle of tracking expiry dates.

Getting started with ICICI Direct:

To start investing in index funds through ICICI Direct, you need to open a brokerage account. Look for a broker with low fees and a user-friendly interface. Once you have chosen a broker, pick an index fund that aligns with your financial goals and risk tolerance. You can then proceed to invest by purchasing shares of the chosen index fund directly through your brokerage account. Remember to take a long-term approach, as index funds are designed for steady growth over time.

Real Asset Funds: Diversification and Long-Term Returns

You may want to see also

Frequently asked questions

To start investing in index funds through ICICI Direct, you first need to open a Demat account and complete the online registration process. After verification, you can start investing through ICICI Direct.

Index funds are a form of exchange-traded or mutual funds that contain a portfolio of stocks that aims to emulate the performance of a particular index. An index is a specific group of securities that define a particular market segment. For example, an index fund tracking the Nifty will contain shares from all 50 Nifty stocks in the same ratio.

Index funds are ideal for investors who are risk-averse and are looking for predictable returns over a long-term horizon. They have a low expense ratio, provide stability to your portfolio, and are less susceptible to short-term market volatility.

Index funds are vulnerable to market fluctuations and crashes, lack flexibility, and require very little human oversight, making them susceptible to cyber-attacks. They also have low returns and are therefore only feasible during a bull market or with a long-term investment plan.