The L&T India Value Fund is an equity fund launched on 8 January 2010. It is a moderately high-risk investment option with a CAGR return of 17.9% since its launch. The fund aims to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities in the Indian markets, with a focus on undervalued securities. The minimum SIP amount required for this fund is INR 500, while the minimum lump sum amount is INR 5000. The fund has provided returns of 51.6% over the last year, 26.8% over the last 3 years, 28.1% over the last 5 years, and 21.8% since its inception. The expense ratio of the fund is 0.77% as of 2 October 2024, and the NAV is INR 125.04 as of 1 October 2024. The top holdings of the fund include NTPC Ltd, ICICI Bank Ltd, and State Bank of India.

| Characteristics | Values |

|---|---|

| Investment Objective | To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities, in the Indian markets with a higher focus on undervalued securities. The Scheme could also additionally invest in Foreign Securities in international markets. |

| Investment Approach | "Fundamental research" as the foundation of the investment decision-making process. Focus on companies with an attractive combination of profitability and valuation. |

| Investment Suitability | Investors who have advanced knowledge of macro trends and prefer to take selective bets for higher returns compared to other equity funds. |

| Risk | Very High Risk |

| Minimum Investment | INR 5000 |

| Minimum SIP Investment | INR 500 |

| Additional Purchase | INR 1000 |

| Total Expense Ratio (TER) | 0.77% |

| Net Asset Value (NAV) | INR 125.04 |

| Total Asset Under Management (AUM) | INR 13872 Cr |

| Top Holdings | NTPC Ltd, ICICI Bank Ltd, State Bank of India, Jindal Stainless Ltd, Multi Commodity Exchange of India Ltd, KEC International Ltd, Mahindra & Mahindra Ltd, The Federal Bank Ltd, Indian Bank, Reliance Industries Ltd |

| Returns | 51.6% over the last 1 year, 26.8% over the last 3 years, 28.1% over the last 5 years, 21.8% since its inception |

What You'll Learn

Investment options: lump sum or monthly SIP

When it comes to investing in the L&T India Value Fund, you have two main options: a lump-sum investment or a monthly Systematic Investment Plan (SIP). Each option has its own advantages and considerations, which are detailed below.

Lump-sum investments refer to investing a one-time, fixed amount of money in the L&T India Value Fund. This option is suitable if you have a substantial amount of money available for investment. The minimum lump-sum investment amount required for the L&T India Value Growth Direct Plan is INR 5000. Making a lump-sum investment can be advantageous if you have a large sum of money available, as it allows you to invest a significant amount in the fund all at once. This can be beneficial if you believe the fund will perform well in the short term, as it enables you to maximise potential gains over a shorter period.

On the other hand, monthly SIPs allow you to invest smaller amounts of money at regular intervals. SIPs are a popular investment option as they offer several benefits. Firstly, SIPs provide discipline and help you cultivate a habit of investing regularly. By committing to a monthly investment, you can gradually build your investment portfolio without putting a strain on your finances. This makes SIPs a good option for beginners or those who prefer a more conservative investment approach. Additionally, SIPs enable you to benefit from rupee-cost averaging, which smooths out market volatility. When you invest a fixed amount regularly, you purchase more units when the price is low and fewer units when the price is high, potentially lowering your average cost per unit over time.

It's worth noting that the L&T India Value Fund has a minimum SIP investment amount of INR 500. This fund aims to generate long-term capital appreciation by investing predominantly in equity and equity-related securities in the Indian markets, with a focus on undervalued securities. The fund has provided returns of 51.6% over the last year, 26.8% over three years, and 28.1% over five years.

When deciding between a lump-sum investment and a monthly SIP, consider your financial goals, risk tolerance, and available funds. Lump-sum investments may be suitable if you have a substantial amount to invest and are seeking to maximise potential short-term gains. In contrast, SIPs offer a more conservative approach, allowing you to invest smaller amounts regularly and benefit from the power of compounding over time.

Strategies for Investing in DFA Funds Solo

You may want to see also

Investment minimums: INR 5000 lump sum, INR 500 monthly SIP

To start investing in the L&T India Value Fund, you can choose between a Monthly SIP (Systematic Investment Plan) or a one-time lump-sum investment. The minimum investment amount for a Monthly SIP is INR 500, while the minimum lump-sum investment amount is INR 5000.

SIPs are a great way to turn small, regular investments into a substantial corpus over time through the power of compounding. With a Monthly SIP, you decide on an amount to invest each month and set up a fund transfer to complete the investment process. This method is a good option for those who want to invest smaller amounts regularly.

On the other hand, a lump-sum investment allows you to invest a fixed income all at once. This approach is suitable if you come into some money and want to invest it in mutual fund shares. When considering a lump-sum investment, it's important to factor in mutual fund fees, such as the expense ratio and net asset value (NAV).

The L&T India Value Fund is an equity-value fund launched on January 8, 2010, with a moderately high risk. It aims to generate long-term capital appreciation by investing primarily in equity and equity-related securities in the Indian markets, with a focus on undervalued securities. The fund has provided strong returns, with a CAGR of 17.9% since its launch.

Finding the Right Mutual Funds for Your Investment Portfolio

You may want to see also

Returns: 51.6% over 1 year, 26.8% over 3 years, 28.1% over 5 years

The L&T India Value Growth Direct Plan has delivered strong returns over the past year, with an impressive 51.6% growth in the last 1 year, 26.8% over the last 3 years, and 28.1% in the last 5 years. This fund is a great choice for those seeking to build wealth and secure their family's future.

The minimum SIP amount required to invest in this fund is INR 500, and the minimum lump sum amount is INR 5000. The fund has a moderately high risk level and has provided a CAGR return of 17.9% since its launch in January 2010.

The investment objective of the L&T India Value Fund is to generate long-term capital appreciation by investing in a diversified portfolio of equity and equity-related securities in the Indian markets, with a focus on undervalued securities. The fund also has the option to invest in Foreign Securities in international markets.

The top holdings of the fund include NTPC Ltd, ICICI Bank Ltd, State Bank of India, and Jindal Stainless Ltd, among others. The fund is managed by Venugopal Manghat, Gautam Bhupal, and Sonal Gupta, ensuring your investments are in capable hands.

With its strong historical performance and experienced fund managers, the L&T India Value Fund is a compelling option for those looking to grow their wealth over the long term.

Invest in Your Health: Old National Bank HSA Guide

You may want to see also

Expense ratio: 0.77%

The expense ratio of 0.77% is an important metric to consider when investing in the L&T India Value Growth Direct Plan. This percentage represents the fee that the mutual fund charges for managing your investment. In other words, it is the cost of having professionals handle your money, make trades, and attempt to grow your investment.

Expense ratios are important to consider because they directly impact your returns. For example, if you invest 10,000 INR in a mutual fund with a 2% expense ratio, you will have paid 200 INR in fees to invest in mutual funds. This amount is usually deducted from the Net Asset Value (NAV) on a daily basis.

The expense ratio of 0.77% for the L&T India Value Growth Direct Plan is considered relatively low compared to similar funds. This is beneficial for investors because lower expense ratios lead to higher returns. This fund's expense ratio is in the bottom 25% of comparable funds, meaning that 75% of similar funds charge a higher fee.

It is also important to note that regular and direct funds have different expense ratios. Regular funds have a higher expense ratio because they include the commission paid to a broker or distributor. Direct funds, on the other hand, do not include this commission and therefore have a lower expense ratio.

When investing in mutual funds, it is crucial to understand all associated fees and costs. The expense ratio is one of the key mutual fund fees to consider, as it directly impacts your returns and can vary significantly between different funds.

Money Market Funds: Where Are Your Investments Going?

You may want to see also

Tax: 10% for long-term capital gains, 15% for short-term

When investing in the L&T India Value Fund, it is important to understand the tax implications, which can vary depending on the duration of your investment.

If you hold your investment for the long term, which typically means a period of one year or more, your capital gains will be taxed at a rate of 10%. On the other hand, if you choose to sell your investment within a shorter time frame, usually less than a year, you will be subject to a short-term capital gains tax of 15%.

These tax rates are essential to consider when planning your investment strategy, as they can significantly impact your overall returns. It is always advisable to consult with a financial advisor or tax professional to ensure you understand the specific tax obligations associated with your investments and how they fit within your broader financial goals.

Additionally, when investing in the L&T India Value Fund, it is worth noting that the fund aims to generate long-term capital appreciation by investing primarily in equity and equity-related securities within the Indian markets, with a particular focus on undervalued securities. The fund also reserves the right to invest in foreign securities in international markets.

Gilt Funds: When to Invest for Maximum Returns

You may want to see also

Frequently asked questions

The L&T India Value Fund is a moderately high-risk equity fund launched on 8 January 2010. The fund aims to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities in the Indian markets, with a higher focus on undervalued securities.

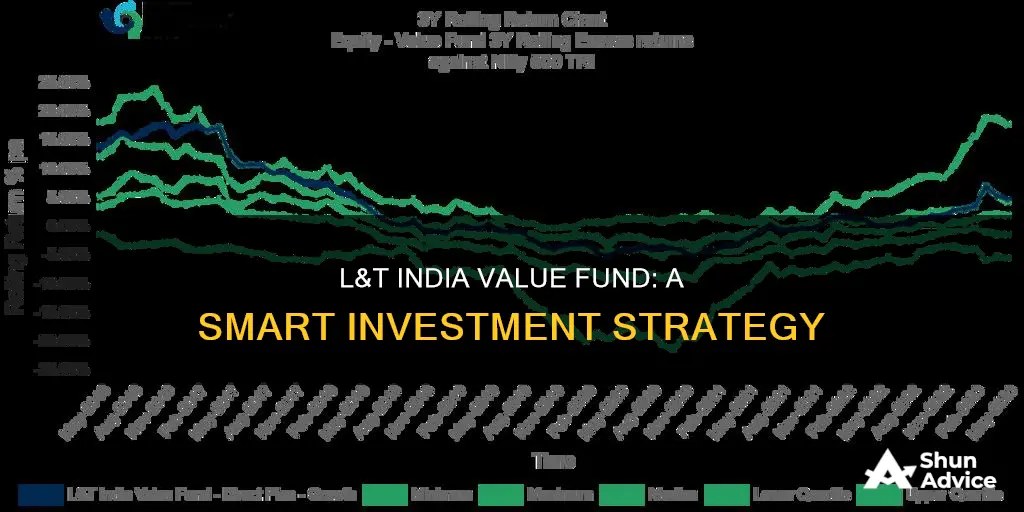

The L&T India Value Fund has delivered a Compound Annual Growth Rate (CAGR) return of 17.9% since its launch. In 2023, the fund returned 39.4%, 5.2% in 2022, and 40.3% in 2021.

You can invest in the L&T India Value Fund either as a lump sum or through a Systematic Investment Plan (SIP). The minimum lump sum investment amount is INR 5000, while the minimum SIP amount is INR 500. You can create an account on Kuvera to start investing in this fund.

As per SEBI regulations, the L&T India Value Fund is classified as a "Very High Risk" investment. The capital gains from this fund are taxed at a rate of 10% for long-term gains (holding period of more than one year) and 15% for short-term gains (holding period of less than one year).