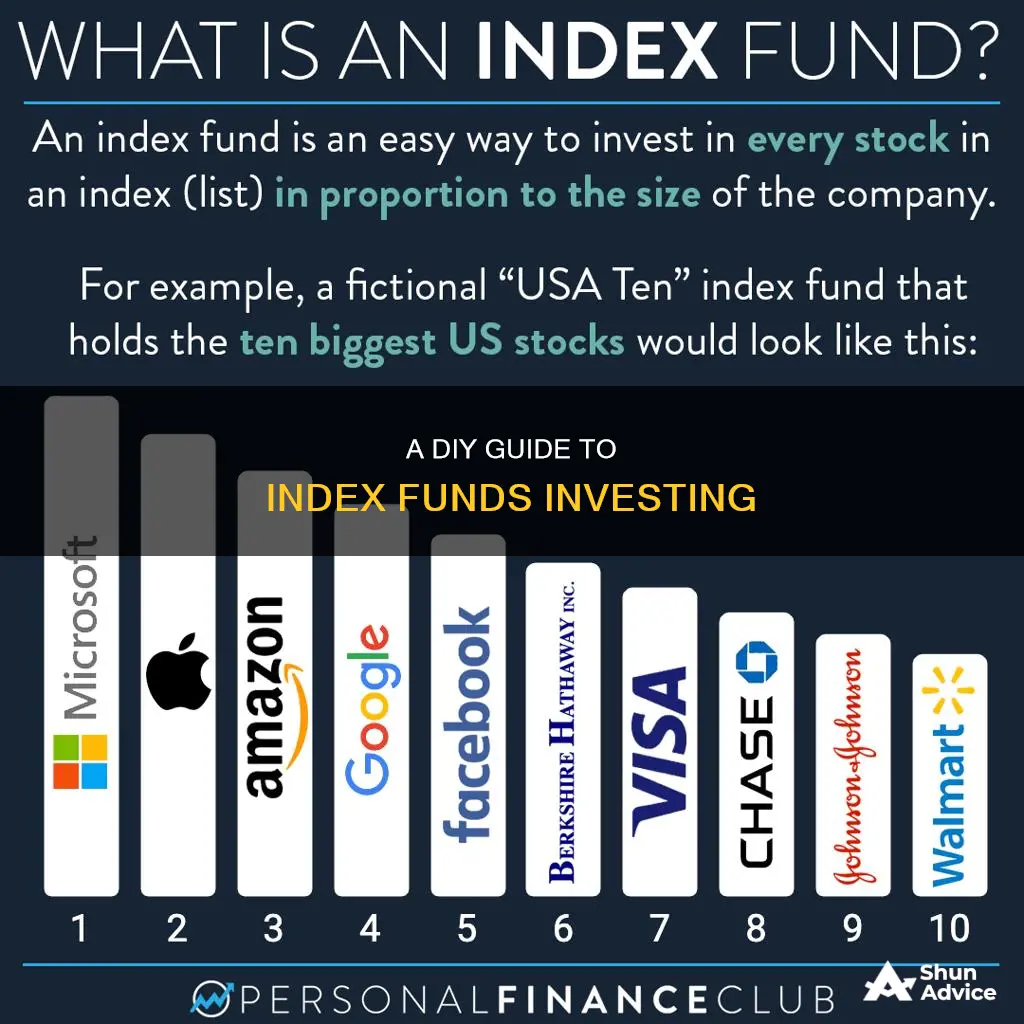

Index funds are a low-cost, easy way to build wealth. They are a type of mutual fund or exchange-traded fund (ETF) that is based on a preset basket of stocks, or index. Fund managers aim to replicate the index without active management, whether they create it themselves or rely on another company. Index funds are considered a form of passive investing because the fund managers aren't actively buying or selling assets to try to outperform the market; they're simply following it.

Index funds are popular with investors because they promise ownership of a wide variety of stocks, greater diversification, and lower risk – usually at a low cost. That’s why many investors, especially beginners, find index funds to be superior investments to individual stocks.

1. Research and analyze index funds: Consider the geographic location of the investments, the market sector the index fund is investing in, and the market opportunity.

2. Decide which index fund to buy: Compare the expenses of each fund, taxes, and investment minimums.

3. Purchase your index fund: You can either buy directly from the mutual fund company or through a broker.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual fund or exchange-traded fund (ETF) |

| Investment type | A basket of securities (e.g. stocks, shares, bonds) |

| Investment strategy | Passive, aims to mimic the performance of an index |

| Risk | Lower than individual stocks due to diversification |

| Cost | Low fees, expense ratios vary |

| Returns | Average market returns, historically high for some indexes |

| Access | Buy directly or through a broker |

| Investment minimum | Varies, some funds have no minimum |

| Taxes | May be more tax-efficient than actively managed funds |

| Trading costs | May be commission-free, but check with your broker |

What You'll Learn

Understand the benefits of index funds

Index funds are a great investment option for those looking to build wealth over the long term. Here are some of the benefits of investing in index funds:

Broad Diversification

Index funds provide instant diversification, reducing the risk of losing money. An index fund that tracks the S&P 500, for example, would hold about 500 different stocks. By investing in a fund that holds all of these stocks, your portfolio's performance matches the index itself. Diversifying your portfolio across many companies ensures that its value is not overly dependent on the performance of any single company.

Low Costs

Index funds have lower costs compared to other types of investment funds. They have lower management fees because they are passively managed, i.e., they simply track an index by buying and holding the stocks in that index without actively trading. The expense ratios of index funds are typically between 0.05% and 0.07%, and some have no expense ratio at all. In contrast, actively managed mutual funds often have expense ratios ranging from 1% to 2%.

Index funds also have lower transaction costs since they hold investments until the index changes, which is infrequent. Additionally, their low turnover ratios result in lower taxes on capital gains.

Attractive Returns

Index funds have consistently outperformed actively managed funds over the long term. Even the smartest and most diligent portfolio managers rarely steer actively managed funds to beat index funds. According to research by Standard & Poor's, only about 23% of actively managed mutual funds outperform the S&P 500 over five years.

While individual companies may outperform or underperform the market, the overall stock market generally increases in value over time. As a result, index funds offer high returns for a low cost, making them an excellent value for investors.

Tax Efficiency

Index funds are tax-efficient compared to other investments. They generate less taxable income because they trade securities less frequently than actively managed funds. Additionally, by buying new lots of securities whenever investors put money into the fund, index funds can choose which lots to sell when necessary, selecting those with the lowest capital gains and, therefore, the lowest tax liability.

Minimal Investment Research

Index funds are passively managed, aiming to replicate the performance of a market index. This means you can rely on the fund manager to match the index's performance without needing to actively select stocks or time the market. This makes index funds a good option for those who want a more hands-off approach to investing.

Target Date Funds: A Guide to Investing for Retirement

You may want to see also

Choose a brokerage account

You can purchase an index fund directly from a mutual fund company or a brokerage. The same goes for exchange-traded funds (ETFs). These are like mini mutual funds that trade like stocks throughout the day.

When choosing where to buy an index fund, consider the following:

- Fund selection: Do you want to purchase index funds from various fund families? The big mutual fund companies carry some of their competitors’ funds. However, the selection may be more limited than what’s available in a discount broker’s lineup.

- Convenience: Find a single provider who can accommodate all your needs. For example, if you’re just going to invest in mutual funds (or even a mix of funds and stocks), a mutual fund company may be able to serve as your investment hub. But if you require sophisticated stock research and screening tools, a discount broker that also sells the index funds you want may be better.

- Trading costs: If the commission or transaction fee isn’t waived, consider how much a broker or fund company charges to buy or sell the index fund. Mutual fund commissions are higher than stock trading ones, about $20 or more. Compare that with less than $10 a trade for stocks and ETFs.

- Impact investing: Want your investment to make a difference outside your portfolio? Some funds target companies with a focus on environmental or social justice causes.

- Commission-free options: Do they offer no-transaction-fee mutual funds or commission-free ETFs?

If you don't have a brokerage account, you can open one online.

What to consider when choosing a brokerage account

- Brokerage fees: This is the fee you pay every time you buy or sell stocks or ETF units. If you plan to invest regularly in your index fund, you'll want to find a broker with a lower commission/brokerage fee.

- ETF screeners: Some brokers offer search tools that help you find ETFs depending on a set of criteria. For instance, if you wanted to find an ETF of major US tech stocks, you can use a screener to narrow down your choices.

- Dividend reinvestment: If you decide you want any index fund dividends reinvested back into the fund automatically, make sure your broker has this as an option.

- Access to the Australian Securities Exchange (ASX): If you plan to invest in a local index fund, you'll want to find a broker that offers access to the ASX.

- Inactivity fees: Some brokers charge inactivity fees if you don't make a certain number of trades per year. These brokers are typically better suited to active traders rather than long-term investors.

It's worth noting that some online trading platforms offer $0 brokerage on ETF purchase orders, meaning you can add funds to your ETF as often as you like without paying additional trade fees.

Target Funds: Diversification or All-In?

You may want to see also

Decide on your investment goals

Before investing in index funds, it is important to have a clear understanding of your financial goals and objectives. Index funds are a great investment option, especially for beginners, as they offer a simple and effective way to build wealth over time. Here are some key considerations to help you decide on your investment goals:

- Investment Horizon: Determine how long you plan to invest for. Are you saving for retirement, which is typically a long-term goal, or do you have shorter-term financial objectives? Index funds are generally suitable for long-term investing, as they tend to provide better returns over time due to their low fees and passive management strategy.

- Risk Tolerance: Consider your risk tolerance, which refers to how comfortable you are with fluctuations in the value of your investments. Index funds are considered less risky than individual stocks because they provide instant diversification across various stocks or assets. However, it's important to remember that the value of your index fund investments can still decrease if the overall market declines.

- Investment Amount: Evaluate how much money you want to invest. Index funds usually have low minimum investment requirements, and some have no minimum at all. This accessibility makes them suitable for a wide range of investors.

- Investment Goals: Define your specific investment goals. For example, are you investing for retirement, saving for a down payment on a house, or trying to generate passive income? Different index funds can help you achieve different goals. For instance, if you're investing for retirement, you might choose a mix of stock and bond index funds to balance growth and stability.

- Time Commitment: Assess how much time and effort you want to dedicate to investing. Index funds are passive investments, meaning they require less ongoing management compared to actively managed funds. This makes them a good choice for those who want a more hands-off approach to investing.

- Performance Expectations: Understand the potential returns and risks associated with index funds. While index funds have historically performed well over the long term, their performance is closely tied to the market. There is no guarantee of beating the market, and short-term downturns can occur.

Remember, it's crucial to do your own research and consider seeking advice from a qualified financial advisor to ensure your investment decisions align with your personal circumstances and goals.

Hedge Funds: Why Investors Still Find Them Attractive

You may want to see also

Pick your funds

When it comes to choosing an index fund, you have a variety of options to consider. Here are some key factors to keep in mind:

- Broad-market index funds: These are standard index funds that hold a collection of stocks from companies of all sizes and industries, aiming to represent the stock market as a whole. They are typically considered safer options due to their diversification across the market.

- Sector-based index funds: These funds focus on specific sectors or industries, such as healthcare, technology, or financials. They allow you to target particular areas of the market that you believe will perform well.

- Market-cap index funds: These funds invest in companies based on their market capitalisation or size. For example, a small-cap index fund will focus on smaller companies, while a large-cap fund will target larger, more established businesses.

- Smart-beta index funds: These funds track an index of stocks based on specific factors such as volatility, dividend payments, or the strength of a company's balance sheet. They add additional criteria to standard broad-market index funds.

- Commodity index funds: Instead of tracking stocks, these funds follow the performance of commodities or currencies, such as crude oil futures or foreign exchange rates. However, they are much riskier than ordinary stock market index funds.

- Bond index funds: These funds invest in bonds rather than stocks and are often used to lower the risk in investment portfolios. They can include a mix of local, global, corporate, or government bonds.

When deciding which type of index fund to choose, consider your investment strategy and risk tolerance. Broad-market index funds are generally suitable for long-term investors seeking a more conservative approach, while sector-based or commodity index funds may appeal to those seeking higher returns and willing to accept more risk.

Additionally, consider the fees associated with the fund. Index funds typically have lower fees than actively managed funds, but they can still vary. Look for funds with low expense ratios, management fees, and brokerage fees to maximise your returns.

Finally, if you're investing in index funds through an online stockbroker, use the platform's search tools or screeners to find funds that match your criteria. You can filter funds based on their focus, such as specific sectors or markets.

Vanguard Funds: Best UK Investment Options

You may want to see also

Buy shares

Once you've decided on an index fund, you can buy shares through a brokerage account, an individual retirement account (IRA), or a Roth IRA. You can also buy shares directly from a mutual fund company or a brokerage.

If you're buying shares through a brokerage, you'll need to open an account with the broker that offers the fund you want or with your preferred broker. Major brokers like Vanguard, Fidelity, and TD Ameritrade offer their own index funds, and performance should be similar across brokers. However, you may want to consider factors such as whether the broker is investor-owned, the ease of use of their website, and the availability of advanced trading tools when making your decision.

When buying shares, you'll need to buy enough to reach the fund's investment minimum. After that, you can typically buy fractional shares. The site may also ask about your preference for dividends—whether they should be used to purchase additional fund shares or deposited into your account as cash.

If you're investing for the long term, most experts recommend reinvesting your dividends as they have historically led to substantial investment growth. You can set up automatic investments that happen on a regular schedule to ensure that you continue to invest consistently.

It's important to note that investing is typically an ongoing practice, and you'll need to review your portfolio periodically and make adjustments as needed to keep it aligned with your goals.

IRA and Mutual Funds: A Smart Investment Strategy

You may want to see also

Frequently asked questions

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. Index funds are considered passive investments because they aim to replicate the performance of a particular index rather than trying to outperform it.

You can buy index funds directly from a mutual fund company or through a broker. If you're buying an ETF, you'll need to go through a broker.

There are several types of index funds, including broad-market, sector-based, market-cap, smart-beta, commodity, and bond index funds. Broad-market index funds are considered safer because they track a diverse range of companies across the entire market. Sector-based index funds focus on a specific sector, such as healthcare or technology.

Index funds offer several benefits, including low fees, diversification, and long-term performance. Index funds are also relatively low-maintenance and tax-efficient compared to other types of funds.