Investing in mutual funds is a great way to build wealth over time and reach financial goals, such as buying a house or retiring. However, for short-term goals, it is generally recommended to skip stock and bond mutual funds due to their volatility and instead opt for safer, short-term investment vehicles like savings accounts or money market funds.

When considering how to invest in mutual funds, it is important to first identify your investing goals and time horizon. If you are investing for the short term, you should focus on safety and preserving your principal rather than maximising returns. This means choosing less risky investments that offer liquidity and stable returns.

Mutual funds are baskets of stocks, bonds or other securities, providing investors with access to a diversified, professionally managed portfolio. They are relatively cheap and simple to invest in, and there are many different types to choose from, including stock, bond, money market, index and target-date funds.

When investing in mutual funds, it is essential to understand the fees involved, such as expense ratios, sales charges and redemption fees, as these will significantly impact your overall returns.

Overall, mutual funds can be a great way to invest for the long term, providing diversification, professional management and access to a wide range of assets. However, for short-term goals, there are other investment options that may be more suitable.

| Characteristics | Values |

|---|---|

| Time horizon | Less than three years |

| Investment type | Money market accounts, cash management accounts, short-term corporate bond funds, short-term US government bond funds, money market mutual funds, no-penalty certificates of deposit, short-term bond funds |

| Risk | Low |

| Returns | Low |

| Liquidity | High |

| Transaction costs | Low |

| Investment minimum | $500-$3,000 |

What You'll Learn

Avoid stocks and bonds for short-term investing

When investing for the short term, it is generally recommended to avoid stocks and bonds. This is because stocks and bonds are volatile and can be risky if you need your money within a short time frame.

If you are saving for a short-term goal, such as a wedding or a vacation, you may want to avoid putting your money in the stock market. Bear markets, defined as a 20% drop in the stock market, take place about once every four years. Therefore, if you need access to your money in the short term, it is best to opt for a savings account or money market fund, which is a special type of mutual fund that owns only short-term bonds.

Stocks and bonds are better suited to long-term investing, as they can ride out the market's inevitable ups and downs. The stock market has historically risen by an average of 10% annually over long periods, but this is only true if you are able to stick it out through the lows.

If you are investing for the long term, you can afford to take on more risk with stocks and bonds, as you will have time to recover from any losses. However, if you are investing for the short term, it is best to focus on safety and liquidity rather than high returns.

A Beginner's Guide to ETF Fund Investment

You may want to see also

Opt for short-term vehicles like savings accounts or money market funds

If you're looking for a short-term investment option, you might want to consider putting your money in a savings account or money market fund. These are a great way to keep your money safe and accessible while also earning a modest return. Here's what you need to know about these short-term vehicles:

Savings Accounts

Savings accounts are a great option if you're looking for a safe and insured place to keep your money. In the US, savings accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC) for banks and the National Credit Union Administration (NCUA) for credit unions, up to $250,000 per depositor. This means that your money is protected, even if the bank or credit union fails. Savings accounts usually offer a low interest rate, but some high-yield savings accounts can provide much higher rates. These accounts work just like a standard savings account, allowing you to deposit money and earn interest, which is compounded daily and paid monthly. You can also easily transfer funds between accounts or withdraw money, although there may be a fee for withdrawals over six times per statement cycle. It's important to shop around for savings accounts and compare promotional annual percentage yields (APYs), minimum balance requirements, monthly maintenance fees, and expiration dates on promotional rates. Overall, savings accounts are a stable and liquid option for your short-term investments.

Money Market Funds

Money market funds are a type of mutual fund that invests in short-term, high-quality debt instruments and cash equivalents. They are often used as a temporary holding place for cash that will be used for future investments or emergency funds. Money market funds aim to maintain a stable price of $1 per share, unaffected by market fluctuations. While they are generally safe, they are not insured by the FDIC or NCUA like savings accounts. Instead, they are regulated by the Securities and Exchange Commission (SEC). Money market funds can be purchased through brokers offering mutual funds, and some allow you to write checks off the fund. They are reasonably liquid, but you may be limited to six withdrawals per month. Money market funds charge an expense ratio, which can eat into your profits. Despite this, they are still considered conservative and relatively safe investments.

Mutual Funds and Bonds: A Beginner's Guide to Investing

You may want to see also

Choose an income fund for current income

If you're investing for the short term, you should skip stock and bond mutual funds. However, if you are investing for current income, you will likely want to go with an income fund. Income funds are a type of mutual fund or exchange-traded fund (ETF) that emphasizes current income, either on a monthly or quarterly basis, as opposed to capital gains or appreciation.

Income funds are often considered lower risk than funds that prioritise capital gains. They are often seen as the mutual funds for retirement investing. While fund holdings may rise in value, the primary goal is to offer a steady cash flow.

Income funds invest primarily in government and high-quality corporate debt, holding these bonds until maturity to provide interest streams. They may also invest in dividend-paying stocks, preferred stock, money market instruments, and real estate investment trusts (REITs).

- T. Rowe Price Equity Income Fund

- First Trust Morningstar Dividend Leaders Index ETF (FDL)

- IShares Select Dividend ETF (DVY)

- Nicholas Equity Income Fund (NSEIX)

- Invesco High Yield Equity Dividend Achievers ETF (PEY)

- Vanguard Equity Income Fund (VEIPX)

- Vanguard High Dividend Yield ETF (VYM)

- JPMorgan Equity Premium Income ETF (JEPI)

- WisdomTree U.S. High Dividend Fund (DHS)

Equity-Linked Mutual Funds: A Guide to Investing

You may want to see also

Understand the fees associated with mutual funds

When investing in mutual funds, it's crucial to understand the fees involved, as these costs will significantly impact your investment returns over time. Here is a detailed overview of the fees associated with mutual funds:

- Expense Ratio: This is an annual fee charged by mutual funds to cover their operating expenses, including management fees, administrative costs, and marketing expenses. The expense ratio is expressed as a percentage of the fund's average net assets and is deducted from the fund's returns. Over the last three decades, competition from index investing and exchange-traded funds (ETFs) has led to a significant reduction in expense ratios.

- Sales Charges or Loads: Some mutual funds charge sales fees, known as "loads," when you buy or sell shares. Front-end loads are charged when you purchase shares, while back-end loads (or contingent deferred sales charges) are assessed if you sell your shares before a certain date. However, some mutual funds are offered as "no-load" funds, which means they don't charge any sales commissions or fees.

- Redemption Fees: Some mutual funds charge a redemption fee when you sell your shares within a short period (usually 30 to 180 days) after purchasing them. This fee is designed to discourage short-term trading in these funds to maintain stability. The U.S. Securities and Exchange Commission (SEC) limits redemption fees to a maximum of 2%.

- Other Account Fees: In addition to the fees mentioned above, some funds or brokerage firms may charge extra fees for maintaining your account or conducting transactions. These fees may apply if your account balance falls below a certain minimum threshold.

- Brokerage Fees and Commissions: When purchasing mutual funds, you can often avoid brokerage fees and commissions by buying directly from the mutual fund company instead of going through an intermediary.

- Share Classes: The type of mutual fund shares you purchase can also impact the fees you pay. Traditionally, individual investors bought mutual funds with A-shares through a broker, incurring a front-end load of up to 5% or more, along with ongoing management and distribution fees (12b-1 fees). To address these high costs, investment companies have introduced new share classes, such as "level load" C shares, which generally don't have a front-end load but carry an annual 12b-1 distribution fee of up to 1%.

By understanding and carefully considering the various fees associated with mutual funds, you can make more informed investment decisions and maximize your returns.

Understanding 401(k) Investment: Timing Your Retirement Savings

You may want to see also

Compare different types of mutual funds

Mutual funds are a great way to invest in a diversified portfolio of stocks, bonds, or other securities. There are several types of mutual funds, each with its own investment focus and strategy. Here are the four main types:

- Stock Mutual Funds: These funds invest in stocks or equities of companies. They are typically defined by the size of the companies they invest in, such as "small-cap" or "large-cap" funds, or their investment objective, such as "growth" or "income" funds. Equity funds have a higher potential for growth but also come with more risk.

- Bond Mutual Funds (Fixed-Income Funds): Bond funds invest in government and corporate debt, offering a safer investment option than stocks. They provide a fixed rate of return and are ideal for investors seeking a more stable income.

- Money Market Mutual Funds: These funds invest in short-term debt instruments, such as government Treasury bills, and provide a low-risk investment option. While they offer better returns than savings accounts, they are not insured by the FDIC.

- Target-Date or Balanced Mutual Funds: These funds combine stocks and bonds in a fixed ratio, such as 60% stocks and 40% bonds. They are also known as asset allocation funds and gradually shift their investment mix as the investor's target retirement date approaches.

Other types of mutual funds include index funds, which aim to replicate the performance of a specific market index, and specialty or alternative funds, which include hedge funds, commodities, and socially responsible funds.

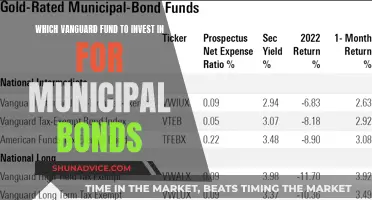

Vanguard Funds: Best Investment Options for Your Portfolio

You may want to see also

Frequently asked questions

Some good short-term investment options include high-yield savings accounts, cash management accounts, money market accounts, short-term corporate bond funds, and short-term US government bond funds.

Mutual funds offer diversification, professional management, and access to a wide range of assets. They are also relatively cheap and simple to invest in.

Mutual funds carry various risks, including market risk, interest rate risk, and management risk. The value of mutual funds can fluctuate, and there is no guarantee of returns.

When choosing a mutual fund, consider your investment goals, risk tolerance, fees, and minimum investment requirements. Research and compare different funds to find one that aligns with your objectives.

Short-term mutual funds, also known as short-duration funds, typically invest in debt and money market securities with a duration of 1 to 3 years. They offer stable returns with moderate risk and are suitable for investors with a short-term investment horizon.