Municipal bonds are debt obligations issued by states, cities, counties, and other government entities to raise funds for public projects. Vanguard offers a variety of bond and fixed-income funds that cater to individual investors' needs. Vanguard's bond funds provide investors with simplicity and low fees. Vanguard's fixed-income funds have consistently outperformed their benchmarks and offer multiple benefits to investors, including low fees and capital preservation.

- Vanguard High-Yield Tax-Exempt Fund Investor Shares (VWAHX)

- Vanguard Intermediate-Term Tax-Exempt Fund Investor Shares (VWITX)

- Vanguard Tax-Exempt Bond ETF (VTEB)

- Vanguard High-Yield Tax-Exempt Fund Admiral Shares (VWALX)

What You'll Learn

Vanguard High-Yield Tax-Exempt Fund Investor Shares (VWAHX)

Municipal bonds are debt obligations issued by states, cities, counties, and other government entities to raise funds for public projects. Interest is usually paid semiannually, and maturities can vary from short-term to thirty years or more. Most municipal bonds are issued and traded in $5,000 denominations.

The Vanguard High-Yield Tax-Exempt Fund Investor Shares (VWAHX) is a long-term municipal bond fund that prioritises high yet sustainable income that is exempt from federal taxes. With net assets of $14.7 billion and a yield to maturity of 4.3%, VWAHX has a diverse portfolio of 3,275 bonds, predominantly maturing between 20 and 30 years (35.3%) and 10 to 20 years (31.8%). The fund's benchmark is the Bloomberg Municipal Bond Index, which covers most investment-grade tax-exempt bonds issued by municipalities.

VWAHX has consistently outperformed its benchmark, delivering returns of 1.88% and 2.92% over five and ten years, compared to the index's returns of 1.65% and 2.28% respectively. Vanguard requires a minimum initial investment of $3,000 for VWAHX, followed by an annual net expense ratio of 0.17%. This expense ratio is notably lower than the average for similar municipal bond funds, which is 0.88% according to Vanguard.

When considering VWAHX or any other investment, it is important to consult a financial professional to ensure that the investment aligns with your goals, risk tolerance, and investment capital.

Mutual Funds in the Philippines: Best Places to Invest

You may want to see also

Vanguard Intermediate-Term Tax-Exempt Fund Investor Shares (VWITX)

Municipal bonds are debt obligations issued by states, cities, counties, and other government entities to raise funds for public projects. Vanguard Intermediate-Term Tax-Exempt Fund Investor Shares (VWITX) is a municipal bond fund that falls within Morningstar's muni national intermediate category.

The fund's objective is to provide investors with a moderate but sustainable level of federally tax-exempt income. It has about 12,700 to 12,959 bonds in its portfolio, with more than 40% of the portfolio comprised of bonds that mature within 10 to 20 years. The fund is managed by the Vanguard Fixed Income Group and requires a minimum investment of $3,000. The fund's expense ratio is 0.17% or 0.19%, which is lower than the average expense ratio of similar municipal bond funds.

VWITX is designed for investors seeking a tax-exempt fixed-income holding and is considered a conservative fund by Morningstar. The fund's benchmark is the Bloomberg 1-15 Year Municipal Index, and it has slightly outperformed this benchmark over a 10-year period.

The fund's risk is considered average when compared to other funds in the same category, and its level of return is deemed above average. As of November 27, 2023, the fund's total assets were almost $66.20 billion, and it has returned 2.69% over the past year, -1.89% over three years, 1.25% over five years, and 1.94% over the past decade.

Best Mutual Funds for Tax Savings: Where to Invest?

You may want to see also

Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX)

Municipal bonds are debt obligations issued by states, cities, counties, and other government entities to raise funds for public projects. They are generally exempt from federal and state taxes. Vanguard offers a variety of bond and fixed-income funds that cater to individual investors' needs.

One such fund is the Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX). This fund is considered one of the safest and best Vanguard bond funds. It has a low expense ratio compared to other funds in the market and performs relatively well against its benchmark index.

VBTLX is a fixed-income fund, which means it provides investors with fixed payments at regular intervals until the investment matures. Fixed-income funds are known for offering safety, security, capital preservation, and steady income. They are a good option for investors seeking a low-risk investment with a steady stream of income.

VBTLX has an initial minimum investment requirement of $3,000. It charges an annual expense ratio of 0.17%, which is significantly lower than the average ratio for similar funds.

Adding bond funds like VBTLX to your portfolio can help diversify your holdings and spread the risk from other securities, such as stocks and exchange-traded funds. It is important to consult a financial professional before making any changes to your investment portfolio.

Best Vanguard Index Funds to Invest $1000 Minimum

You may want to see also

Vanguard Long-Term Treasury ETF (VGLT)

Municipal bonds are debt obligations issued by states, cities, counties and other government entities to raise funds for public projects. Interest is usually paid semi-annually and maturities can vary from short-term to thirty years or more.

By investing in VGLT, investors gain exposure to a diversified portfolio of U.S. Treasury bonds, which are backed by the full faith and credit of the U.S. government. These bonds are generally considered low-risk investments and provide a steady stream of income. The interest income on municipal bonds is typically exempt from federal taxes and from state taxes in the state of issuance.

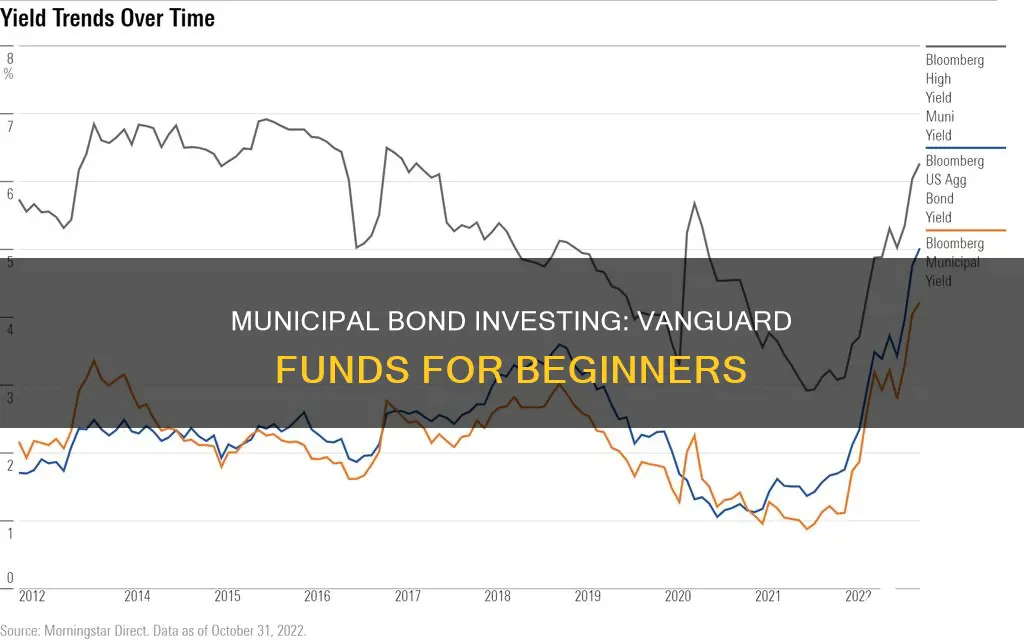

VGLT offers a relatively low-cost way to access the long-term U.S. Treasury bond market, with an expense ratio that is lower than the average for similar funds. It is important to note that bond yields and prices are influenced by interest rates and monetary policy. When interest rates fall, bond yields drop, making them more expensive to purchase.

As with any investment, it is recommended to consult a financial professional before making any changes to your investment portfolio.

Best Vanguard Funds to Maximize Your 401(k) Returns

You may want to see also

Vanguard Tax-Exempt Bond Index Fund Admiral Shares (VTEAX)

Municipal bonds are debt obligations issued by states, cities, counties, and other governmental entities to raise funds to pay for public projects. Interest is usually paid semiannually and maturities can vary from short term to thirty years or more. Most municipal bonds are issued and traded in $5,000 denominations.

The Vanguard Tax-Exempt Bond Index Fund Admiral Shares (VTEAX) is a municipal bond fund that offers investors exposure to the fixed-income market. Fixed-income funds provide investors with safety, security, preservation of capital, and steady income at regular intervals. The fund seeks to provide a high, yet sustainable income that is tax-exempt at the federal level.

The fund has a large number of bonds in its portfolio, with maturities ranging from a few years to thirty years or more. Under normal market conditions, the fund invests the majority of its total net assets in investment-grade municipal bonds determined by nationally recognized rating agencies. The fund's benchmark is the Bloomberg Municipal Bond Index, which includes most investment-grade tax-exempt bonds issued by municipalities.

Vanguard requires an initial minimum investment for this fund, after which investors are charged a low annual expense ratio, which is significantly lower than the average ratio of municipal bond funds with similar holdings.

Adding the Vanguard Tax-Exempt Bond Index Fund Admiral Shares (VTEAX) to your portfolio can help diversify your holdings and spread the risk from other securities, such as stocks and exchange-traded funds. Fixed-income funds, such as this one, can provide a degree of security for investors because payment structures are communicated in advance—usually when the investment is made.

It is important to consult a financial professional before making any changes to your investment portfolio to ensure that any investments you make align with your personal goals, risk tolerance, and investment capital.

Safe Mutual Fund Investments: Picking the Right Option

You may want to see also

Frequently asked questions

Vanguard's municipal bond funds offer simplicity and low fees. They also provide tax advantages, as municipal bonds are typically exempt from federal income tax.

Some top-performing Vanguard municipal bond funds include:

- Vanguard High-Yield Tax-Exempt Fund Admiral Shares (VWALX)

- Vanguard Tax-Exempt Bond Index Fund Admiral Shares (VTEAX)

- Vanguard Intermediate-Term Tax-Exempt Fund Investor Shares (VWITX)

- Vanguard High-Yield Tax-Exempt Fund Investor Shares (VWAHX)

Critical metrics to watch include credit rating distribution, yield to maturity, and average duration.

You can purchase Vanguard municipal bond funds directly from the Vanguard website or through a financial advisor.

As with any investment, there are risks associated with investing in Vanguard municipal bond funds. These risks include interest rate risk, credit risk, and inflation risk. Additionally, municipal bonds may be subject to event risk, such as economic, political, legal, or regulatory changes, which can impact the issuer's ability to make timely payments.