North Carolina is a state in the southeastern region of the United States, boasting a diverse geography and a thriving economy. With a population of over 10 million people, it has experienced significant growth over the past decade, making it one of the fastest-growing states in the country. This economic growth has been driven by various factors, including tax incentives, a low cost of living, and a strong infrastructure. North Carolina's diverse economy includes robust sectors such as technology, banking, healthcare, education, and aerospace & defence. The state has also seen substantial investment from Indian companies in recent years, with the Economic Development Partnership of North Carolina (EDPNC) playing a pivotal role in attracting foreign direct investment.

In this context, investing in North Carolina can be a wise decision for those looking to diversify their portfolios. The state offers stable and safe investment opportunities, particularly in real estate and land. North Carolina's population growth and economic prosperity have led to a booming real estate market, with cities like Raleigh, Charlotte, and Winston-Salem attracting significant attention from investors worldwide. Additionally, land in North Carolina has historically shown steady appreciation and provides valuable diversification benefits due to its low correlation with other asset classes.

What You'll Learn

North Carolina's stable land investment

North Carolina is a stable and safe investment option for investors in India looking to diversify their portfolios. Here's why:

Stable and Safe Investment

North Carolina offers a stable and secure investment opportunity for those seeking a reliable asset. The state provides clear land ownership rights, protected by law, ensuring a safe option compared to regions with political instability or conflict.

Appreciation Potential

Historically, North Carolina land has demonstrated steady appreciation over time. While the rate of return may not match the dramatic highs and lows of stocks or cryptocurrencies, it consistently increases in value, similar to the regular inflationary index. This makes North Carolina an attractive option for long-term investors seeking stable growth.

Diversification Benefits

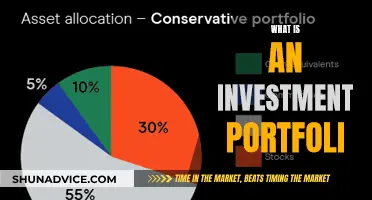

Including North Carolina land in your portfolio can provide valuable diversification. Land tends to have a low correlation with other asset classes, helping to balance the overall risk and volatility. This means that during market downturns, losses from other investments can be potentially offset by North Carolina land holdings.

Timber Value

Many properties in North Carolina offer the added benefit of timber value. Investing in land with mature trees or well-managed forests can generate income through timber harvests, enhancing overall investment returns and providing a buffer against market fluctuations.

Flexibility and Control

Investing in North Carolina land gives you flexibility and control. As a landowner, you can decide to hold the land for long-term appreciation, develop it for residential or commercial purposes, or even use it for recreational activities. This freedom allows you to shape the future of your investment according to your preferences and goals.

Strong Economic Fundamentals

North Carolina has a diverse and robust economy, with key industries such as technology, banking, healthcare, and education. The state has experienced significant population growth, a thriving economy, and a booming real estate market, making it a hotspot for investors worldwide.

High Demand for Rental Properties

Cities like Raleigh, Charlotte, and Winston-Salem are experiencing steady job growth, attracting new residents. This influx of workers increases the demand for rental properties, making the state appealing to real estate investors seeking stable, long-term returns.

Affordable Housing Market

North Carolina offers affordable housing options compared to the national average. This attracts a diverse range of residents, ensuring a broad rental market. The affordable housing market allows investors to benefit from lower initial investment costs and the potential for high returns, especially in the state's best rental markets.

Strong Industry Sectors

North Carolina has strong industry sectors that align with Indian interests, including information technology, pharmaceuticals, textiles, food processing, automotive, and aviation. The state's central location on the East Coast and its talented tech pool appeal to global companies looking to establish facilities closer to their US customers.

Business-Friendly Climate

North Carolina boasts a business-friendly climate with a low corporate income tax rate of 2.5%, the lowest among all US states. Additionally, the state offers affordable business operating costs, making it an attractive location for companies looking to expand or establish a presence in the US market.

Smart Ways to Invest 30 Lakhs in India

You may want to see also

The state's thriving real estate market

North Carolina's real estate market has been thriving, driven by the state's booming economy, steady job growth, population growth, and high renter population. The state's diverse geography, strategic location along the Eastern Seaboard, and low cost of living have attracted property investors from around the world.

Population Growth

North Carolina has experienced significant population growth over the past decade, making it one of the fastest-growing states in the US. This growth has been fuelled by the state's thriving economy and job opportunities, with businesses relocating to take advantage of its good tax incentives, low living costs, and quality infrastructure. The population of North Carolina is over 10 million, with a median age of 39.4 years, and 61% of the population is between 18 and 64 years old.

Job Opportunities

The state's economy is diverse, with robust sectors such as technology, banking, healthcare, education, aerospace & defence, automotive and heavy machinery, biotechnology and pharmaceuticals, information technology, textiles, and tourism. The presence of major research parks, such as the Research Triangle Park in Raleigh, has contributed to the concentration of high-tech jobs and the overall economic prosperity of the state.

Rental Markets

The high demand for rental properties in North Carolina is driven by the influx of new residents, particularly young professionals and students, attracted by the job opportunities and high quality of life the state offers. Cities like Raleigh, Charlotte, and Winston-Salem have experienced steady job growth in various sectors, resulting in an increased demand for housing.

Investment Opportunities

North Carolina offers a range of real estate investment opportunities, including long-term and short-term rental properties, commercial properties, and land intended for development. The state's diverse economy, high population growth, and affordable housing contribute to a thriving real estate market.

Top Cities for Real Estate Investment

Raleigh, Chapel Hill, Charlotte, and Winston-Salem are considered the top rental markets in North Carolina due to their thriving economies, job growth, and influx of new residents. Other notable cities for real estate investment include Durham, with its booming tech industry, and Asheville, known for its vibrant arts scene and historic architecture. Greensboro is also attracting attention for its robust job growth and high renter population.

Stable and Safe Investment

Land in North Carolina is considered a stable and safe investment, with secure and protected land ownership. North Carolina land has historically shown steady appreciation over time, making it a solid long-term investment strategy.

Challenges and Risks

One of the challenges of investing in North Carolina real estate is the lack of liquidity compared to other investments. Land sales tend to move at a slower pace, and investors should be prepared to hold onto their land investments for an extended period. Additionally, investors need to consider potential risks such as market fluctuations, maintenance and management costs, and zoning and land-use regulations.

BlackRock's Investment Strategies: Exploring India's Potential

You may want to see also

North Carolina's economic development partnership

The Economic Development Partnership of North Carolina (EDPNC) is a non-profit 501(c)(3) public-private partnership that serves as the driving force behind North Carolina's economic prosperity. The EDPNC is the state's premier economic development organisation, dedicated to boosting economic growth and creating sustainable jobs.

Mission

The EDPNC's primary mission is to recruit international investment, support existing businesses, and attract tourists and investors to the state. The partnership works closely with public and private sector partners at the state, regional, and local levels to achieve its goals.

Strategies

To achieve its mission, the EDPNC employs several strategies:

- Recruiting New Businesses: The EDPNC actively recruits new businesses to the state, showcasing the benefits of North Carolina's business-friendly environment, including low corporate tax rates, affordable business operating costs, and a talented workforce.

- Supporting Existing Businesses: They also provide support to existing North Carolina businesses, helping them navigate global exports and trade agreements, and providing startup assistance to entrepreneurs.

- International Trade: The partnership assists manufacturers in selling their products in international markets, helping them expand their reach and grow their businesses.

- Tourism Promotion: The EDPNC markets the state as a premier travel destination, highlighting its diverse culture, superior infrastructure, and natural attractions, such as the Blue Ridge Mountains and Atlantic coastline.

- Job Creation: A key focus of the EDPNC is sustainable job creation, ensuring that the economic growth of the state translates into tangible benefits for its residents.

Results

The EDPNC's efforts have yielded significant results. North Carolina has been ranked as America's Top State for Business for consecutive years, boasting a thriving economy, a talented workforce, and a low cost of living. The state has attracted investments from Indian companies, with over $209 million in capital investment and 3,700 new jobs announced from 2013 to 2017. North Carolina's diverse economy, with strong sectors such as technology, banking, healthcare, and education, makes it an attractive destination for investors worldwide.

Looking Ahead

The EDPNC continues to work towards securing a brighter future for North Carolina through strategic investments and collaborative efforts. By partnering with the EDPNC, investors become catalysts for positive change, contributing to the economic well-being and improved quality of life for all North Carolinians.

Morgan Stanley Investment Management: Institutional Investor Status Explained

You may want to see also

The state's diverse economy

North Carolina's economy is driven by a diverse range of sectors, making it an attractive destination for investors from India and beyond. Here is an overview of the state's diverse economy:

Technology and Innovation:

North Carolina is a hub for technology and innovation, with a strong presence in the Research Triangle Park, a world-renowned research hub. The state is home to leading technology companies such as IBM, SAS, Cisco, Citrix, and Indian-based HCL Technologies. The concentration of high-tech jobs and a talented tech workforce make North Carolina appealing to businesses and investors in the tech industry.

Banking and Financial Services:

Charlotte, the largest city in North Carolina, is a prominent financial centre, ranking as the third-largest banking centre in the US. The state is also home to major financial institutions such as Bank of America, Fidelity, and Credit Suisse. This well-developed financial sector contributes to North Carolina's economic diversity and stability.

Healthcare and Pharmaceuticals:

North Carolina boasts a robust healthcare sector, with significant players such as Grifols, Novozymes, Biogen, Novo Nordisk, and IQVIA. The state is also a leader in pharmaceuticals and life sciences, with employment in this sector growing at three times the national average over the past decade. North Carolina's talent pool in specialty pharma R&D and manufacturing makes it an attractive location for companies like Aurobindo Pharma.

Education:

The state's commitment to education is evident with over 100 colleges and universities, including renowned institutions such as Duke University, Wake Forest University, North Carolina State University, and the University of North Carolina at Chapel Hill. The presence of these academic institutions contributes to a highly skilled workforce and attracts students and professionals from around the world.

Aerospace and Defence:

North Carolina has a strong aerospace cluster, with industry jobs growing at a rapid pace. The state is home to innovative aerospace companies such as GE Aviation, Honda Aircraft Company, Spirit AeroSystems, and ATI Specialty Materials. This sector adds to the state's economic diversity and technological advancements.

Automotive and Heavy Machinery:

The automotive industry is well-established in North Carolina, with over 230 unique automotive companies, including global suppliers and OEMs. The state's strategic location and strong manufacturing base make it an ideal hub for automotive manufacturing and heavy machinery.

Biotechnology:

North Carolina is a leader in biotechnology, with a focus on research and development. The presence of biotechnology companies and the state's strong collaboration between academia and industry contribute to its diverse economy.

Tourism:

North Carolina's diverse geography, from the Atlantic coastline to the Blue Ridge Mountains, makes it a popular tourist destination. The state's natural attractions, vibrant cities, and cultural offerings contribute to a thriving tourism sector, supporting the local economy and creating diverse investment opportunities.

Other Industries:

In addition to the sectors mentioned above, North Carolina has a strong presence in textiles, food processing, and furniture manufacturing. The state is known as the "Furniture Capital of the World" and hosts the world's largest furniture store and trade shows.

Ally Invest: Portfolio Margin Trading Options Explored

You may want to see also

Population growth and its impact on investment

Population growth can have a significant impact on investment, and this impact can vary depending on the specific context and dynamics of a region. Here are some key paragraphs discussing the impact of population growth on investment:

Impact on Investment Opportunities and Demographic Change:

Population growth can influence investment opportunities and shape demographic change. As the population grows, there is a corresponding rise in demand for various goods and services, which can create new investment avenues. However, if the population growth outpaces economic development, it may result in increased unemployment, declining income levels, and social unrest. Effective population management and family planning policies are crucial to strike a balance and create a conducive environment for private and foreign investments.

Effect on Public and Private Investments:

Population growth often leads to an increase in public investment to cater to the needs of a larger population. This includes investments in social services such as healthcare, education, and infrastructure. On the other hand, private investments may be influenced by the availability of a larger consumer base and a potential increase in demand for goods and services. A growing population can also lead to a larger workforce, impacting labor costs and influencing private investment decisions.

Impact on Specific Industries and Sectors:

Population growth can have varying effects on different industries and sectors. For example, industries such as healthcare, education, and social services may experience increased demand and investment due to a larger population. In contrast, sectors like real estate may see increased demand for rental properties and investment opportunities. Population growth can also impact specific sectors, such as the financial industry, by creating a larger customer base for financial products and services.

Influence on Foreign Direct Investment (FDI):

Population growth can be a factor considered by foreign investors when deciding where to establish their businesses. A larger population may indicate a bigger market for their products or services, making the region more attractive for foreign direct investment. However, other factors, such as the business environment, economic stability, and government policies, also play a significant role in FDI decisions.

Long-Term Effects on Investment Dynamics:

The impact of population growth on investment dynamics can vary in the short and long term. In the short term, population growth may not significantly affect investment decisions. However, in the long term, a growing population can strain public finances and deplete public investment if not adequately managed. This highlights the importance of implementing policies that encourage family planning and create a favorable investment climate to attract private and foreign investments.

Diversification: Managing Risk in Your Investment Portfolio

You may want to see also

Frequently asked questions

North Carolina has a diverse economy, with robust sectors such as technology, banking, healthcare, and education. It offers a business-friendly environment with the lowest corporate income tax rate among all 50 states, affordable business operating costs, and a fast-growing population that supplies a steady pipeline of talent.

Key industries in North Carolina include aerospace & defence, automotive and heavy machinery, biotechnology and pharmaceuticals, information technology, textiles, and tourism. The state is also known as the "Furniture Capital of the World."

Charlotte, Raleigh, Durham, Greensboro, and Winston-Salem are some of the top cities in North Carolina for real estate investment. These cities offer a combination of diverse populations, vibrant cultures, strong economies, and growing job markets.

While North Carolina offers a stable investment environment, there are some risks to consider. These include the lack of liquidity in land investments, market fluctuations, maintenance and management costs, and zoning and land-use regulations. Conducting thorough research and due diligence is essential before making any investment decisions.