If you're looking to invest 30 lakhs in India, there are a variety of options to consider. The best choice for you will depend on your financial goals and risk tolerance. For example, if you're looking for a long-term investment, you might consider investing in equity or real estate, both of which have historically offered strong returns over time. Alternatively, if you're seeking regular income, mutual funds could be a good option, with some offering monthly returns. However, it's important to remember that any investment comes with risks, and it's always advisable to seek expert advice before committing your money.

| Characteristics | Values |

|---|---|

| Investment Options | Mutual funds, debt funds, equity funds, Public Provident Fund (PPF), term insurance, health insurance, SIPs, RDs, balanced funds, liquid funds, ultra-short-term funds, large-cap funds, small/mid-cap funds, hybrid mutual funds, money market funds, recurring deposits |

| Investment Horizon | Minimum of 5 years for mutual funds and balanced funds |

| Investment Amount | Rs. 30 Lakh |

| Expected Returns | Rs. 15,000 per month or 6% annually |

| Risk Level | Moderately high |

| Taxation | Short-term capital gains tax of 15% on balanced funds withdrawals within 12 months; gains from liquid/ultra-short-term funds taxed according to income tax slab |

| Investment Advice | Caution advised when investing windfall amounts; consider STP over 3 years or more; invest in debt funds before shifting to equity funds; consult qualified professionals |

What You'll Learn

Mutual funds

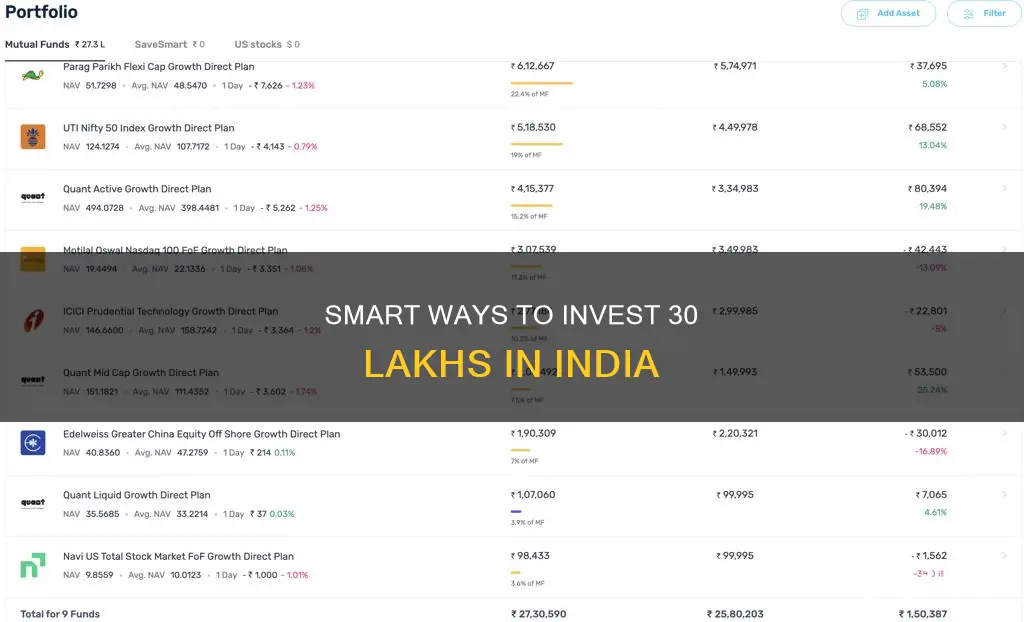

When investing 30 lakhs in mutual funds, it is essential to consider your financial goals and risk tolerance. Diversification is a key strategy to mitigate risk and maximise returns. Spread your investment across different types of mutual funds, such as equity funds, debt funds, and hybrid funds, to balance your portfolio. Additionally, consider investing in mutual funds from different sectors and industries to further diversify your holdings.

For example, you can invest in equity mutual funds that focus on large-cap stocks, mid-cap stocks, or sector-specific stocks, depending on your risk appetite and growth expectations. Debt mutual funds, on the other hand, offer more stable returns with lower risk, making them suitable for more conservative investors. Hybrid funds, as the name suggests, invest in a combination of equity and debt instruments, providing a balance between growth and stability.

When selecting mutual funds to invest in, it is crucial to research the fund's performance history, expense ratio, and management team. Consider the fund's track record over the years and compare its returns with relevant benchmarks. Evaluate the fund manager's expertise and their investment strategy to ensure it aligns with your goals. Additionally, consider the expense ratio, as higher fees can eat into your investment returns over time.

To invest 30 lakhs in mutual funds, you can choose between a lump-sum investment or a Systematic Investment Plan (SIP). A lump-sum investment involves investing the entire amount at once, while an SIP allows you to invest a fixed amount regularly. SIPs are a more flexible option, enabling you to invest smaller amounts over time and benefit from rupee-cost averaging.

It is always recommended to consult a financial advisor before making any investment decisions. They can provide personalised advice based on your financial situation, goals, and risk tolerance. Additionally, stay updated with market trends and review your portfolio periodically to ensure your investments align with your goals.

Investment Options for College Savings: What Are Your Choices?

You may want to see also

Short-term debt funds

When choosing a short-term debt fund, it is important to consider the expense ratio, which is the fee charged by the Asset Management Company (AMC) and will impact your returns. You should also assess your risk appetite and the credit rating of the securities held by the fund.

- ICICI Prudential Short Term Fund – Direct Fund – Growth: AUM: ₹14561.49 Crore; NAV: ₹50.52; Expense Ratio: 1.07%

- Aditya Birla Sun Life Short Term Fund – Direct Plan – Growth: AUM: ₹40.10 Crore; NAV: ₹5045.21; Expense Ratio: 1.09%

- Axis Short Term Fund – Direct Plan – Growth: AUM: ₹7096.45 Crore; NAV: ₹26.00; Expense Ratio: 0.99%

- HDFC Short Term Debt Fund – Direct Plan – Growth: AUM: ₹11028.58 Crore; NAV: ₹26.82; Expense Ratio: 0.74%

- Kotak Bond Short Term Plan – Direct Plan – Growth: AUM: ₹12203.28 Crore; NAV: ₹44.11; Expense Ratio: 1.17%

- Nippon India Short Term Fund – Direct Plan – Growth: AUM: ₹4880.44 Crore; NAV: ₹47.13; Expense Ratio: 0.34%

Due Diligence: GRC and Investment Management Explained

You may want to see also

Public Provident Fund (PPF)

The Public Provident Fund (PPF) is a government-mandated, long-term investment scheme that offers guaranteed, risk-free returns. It was introduced in India in 1968 to mobilise small contributions for investment and return. The scheme is ideal for individuals with a low-risk appetite and those seeking to diversify their financial portfolios.

Features of a PPF Account:

- Tenure: PPF accounts have a minimum tenure of 15 years, which can be extended in blocks of 5 years.

- Investment Limits: The minimum investment amount is Rs. 500, while the maximum is Rs. 1.5 lakh per financial year. Investments can be made in a lump sum or in a maximum of 12 instalments.

- Opening Balance: The account can be opened with just Rs. 100 per month, but annual investments above Rs. 1.5 lakh will not earn interest and will not be eligible for tax savings.

- Deposit Frequency: Deposits must be made at least once every year for 15 years.

- Mode of Deposit: Deposits can be made in cash, cheque, demand draft (DD), or through an online fund transfer.

- Nomination: A nominee can be designated for the account at the time of opening or subsequently.

- Joint Accounts: PPF accounts cannot be held jointly.

- Risk Factor: PPF accounts are backed by the Indian government, offering guaranteed returns and complete capital protection.

- Tax Benefit: Interest earned and maturity amounts are tax-free under Section 80C of the Income Tax Act, 1961.

- Partial Withdrawal: Partial withdrawals are permitted from the 5th financial year onwards, with a maximum of one withdrawal per financial year.

Interest on a PPF Account:

The interest rate for 2024 is 7.1% per annum, compounded annually. The interest is calculated on the lowest balance between the close of the 5th day and the last day of every month. To receive interest for a particular month, deposits must be made by the 5th of that month. The interest rate is set by the Finance Ministry and is paid on 31st March.

Opening a PPF Account:

PPF accounts can be opened with either a Post Office or nationalised banks such as the State Bank of India or Punjab National Bank. Certain private banks, including ICICI, HDFC, and Axis Bank, are also authorised to provide this facility. To open an account, individuals must submit the following documents:

- Duly filled account opening application form

- KYC documents (Aadhaar, Voter ID, Driving License, etc.)

- Residential address proof

- Nominee declaration form

- Passport-size photograph

Withdrawing from a PPF Account:

Partial or complete withdrawals from a PPF account are typically permitted only upon maturity, i.e., after the completion of 15 years. However, in special circumstances, such as life-threatening illnesses, higher education, or a change in residential status, premature withdrawals of up to 50% of the account balance are allowed after completing 5 years. To withdraw funds, individuals must submit Form 3/Form C to the bank or post office where the account was opened.

Investment Managers: Are They Regulated?

You may want to see also

Equity funds

Risk and Return

Investment Horizon

Types of Equity Funds

- Sector and Theme Funds: These funds focus on a particular industry or theme, such as FMCG, pharma, or technology. While they can provide specialised exposure, they are also riskier due to their concentration in a specific sector.

- Large-Cap Equity Funds: These funds invest in well-established, large-cap companies, offering more stable returns with a lower risk level.

- Mid-Cap Equity Funds: Mid-cap funds invest in medium-sized companies and are considered less stable than large-cap funds.

- Mid-and-Small-Cap Funds: By investing in both mid-cap and small-cap companies, these funds have the potential to offer high returns but come with increased risk and volatility.

- Small-Cap Funds: Investing in shares of small-cap companies, these funds are highly prone to market volatility and risk.

- Multi-Cap Funds: Multi-cap funds provide diversification by investing across stocks of all market capitalisations, allowing the fund manager to adjust the allocation based on market conditions.

- Index Funds: These are passively managed funds that follow a specific index, such as Sensex, and invest in the same companies that make up the index in the same proportions. Index funds have lower costs as they don't require active management.

Taxation

The taxation of equity funds in India depends on the holding period. Short-term capital gains, realised within one year of the holding period, are taxed at a rate of 15%. Long-term capital gains, realised after a holding period of one year, are tax-free up to Rs 1 lakh per year. Any gains exceeding this limit are taxed at 10%.

Systematic Investment Plan (SIP)

Choosing the Right Equity Fund

When selecting an equity fund, it is essential to consider the fund's performance, the fund manager's expertise and historical returns, the expense ratio, and the fund's risk-adjusted returns. It is also crucial to ensure that the investment style and risk profile of the fund align with your own financial goals and risk tolerance.

JPMorgan's Emerging Manager Program: Investment Opportunities?

You may want to see also

Liquid or ultra-short-term funds

Ultra-short-term funds are fixed-income debt fund schemes that invest in debt and money market assets for a period of a week to 18 months. They lend to companies for a period of 3 to 6 months and are considered low-risk due to their low lending duration. The risk is slightly higher than that of liquid funds but still one of the lowest-risk categories of schemes available.

Some of the top ultra-short-term funds in India include:

- Nippon India Ultra Short Duration Fund

- UTI Ultra Short Duration Fund

- ICICI Prudential Ultra Short Term Fund

- Tata Ultra Short Term Fund

- Axis Ultra Short Duration Fund

- Mahindra Manulife Ultra Short Duration Fund

- HDFC Ultra Short Term Fund

- Baroda BNP Paribas Ultra Short Duration Fund

- DSP Ultra Short Fund

When investing in ultra-short-term funds, it is important to consider factors such as risk, return, costs, and investment horizon. While these funds offer high liquidity and sufficient returns, they are not entirely risk-free and are subject to capital gains taxes in India.

Strategies for Landing Investment Portfolio Leads

You may want to see also

Frequently asked questions

You can invest in mutual funds with a minimum 5-year investment horizon. You can draw a regular return from your mutual fund investments through a Systematic Withdrawal Plan (SWP). You can invest a lump sum in a balanced fund and start withdrawing a fixed amount every month on a fixed date. However, profits made on SWP withdrawals from balanced funds within 12 months from the date of investment will attract short-term capital gains tax. To avoid this, you can start the SWP after 12 months, and capital gains will be tax-free.

You can consider investing in ICICI Prudential Balanced Fund, DSP BlackRock Balanced Fund, HDFC Balanced Fund, and L&T Prudence Fund.

You can put your money in short-term debt funds and systematically shift to equity over five years. You can also invest in a Public Provident Fund (PPF) account, which offers triple tax benefits and is one of the best retirement tools. The maximum investment is Rs 1.5 lakh per year, and you can save Rs 46.75 lakhs over 15 years.