Private equity funds are an attractive investment option for many investors, offering access to lucrative opportunities in the financial markets. These funds typically purchase entire companies and aim to generate substantial returns. However, investing in private equity comes with certain requirements and considerations. Firstly, individuals need to meet the Securities and Exchange Commission's (SEC) definition of an accredited investor, which includes income and net worth thresholds. Even then, finding a suitable private equity fund that is accepting new investors can be challenging. An alternative approach is to invest indirectly by purchasing shares of private equity management companies or through funds of funds, exchange-traded funds (ETFs), or special purpose acquisition companies (SPACs). Private equity investments also carry higher risks due to their illiquid nature, long investment horizons, and concentration in a limited number of portfolio companies.

| Characteristics | Values |

|---|---|

| Minimum Investment Requirement | $25 million, but can be as low as $250,000 or even $25,000 |

| Investor Type | Institutional investors and wealthy individuals such as large university endowments, pension plans, and family offices |

| Investment Type | Early-stage, high-risk ventures in sectors such as software, healthcare, telecommunications, hardware, and biotechnology |

| Investment Period | 10 years |

| Diversification | Low; a typical private equity fund will have 10-20 portfolio companies |

| Fees | Management fee (1.5-2% of the commitment amount) and a share of the total profits ("carried interest", typically 20%) |

| Access | Only available to qualified investors who meet the SEC's definition of an accredited investor |

What You'll Learn

Meet the SEC's definition of an accredited investor

To meet the SEC's definition of an accredited investor, an individual or entity must satisfy at least one requirement regarding income, net worth, asset size, governance status, or professional experience. The SEC defines accredited investors as those who are financially sophisticated and have a reduced need for regulatory protection.

Firstly, to be an accredited investor, a person must have an annual income exceeding $200,000 ($300,000 for joint income) for the last two years, with the expectation of earning the same or a higher income in the current year. This criterion cannot be met by showing a mix of individual and joint income with a spouse.

Secondly, an accredited investor should have a net worth exceeding $1 million, either individually or jointly with a spouse. This amount cannot include the value of a primary residence, which means that any mortgages or loans associated with the primary residence must be subtracted from its value.

Thirdly, the SEC considers applicants to be accredited investors if they are general partners, executive officers, or directors of a company issuing unregistered securities. Additionally, an entity is considered an accredited investor if it is a private business development company or an organisation with assets exceeding $5 million.

It is important to note that there is no formal process or certification for becoming an accredited investor. The responsibility falls on the company offering unregistered securities to ensure that all investors meet the SEC's criteria.

Hedging Mutual Fund Investments: Strategies for Risk Mitigation

You may want to see also

Find a private equity fund accepting new investors

Finding a Private Equity Fund Accepting New Investors

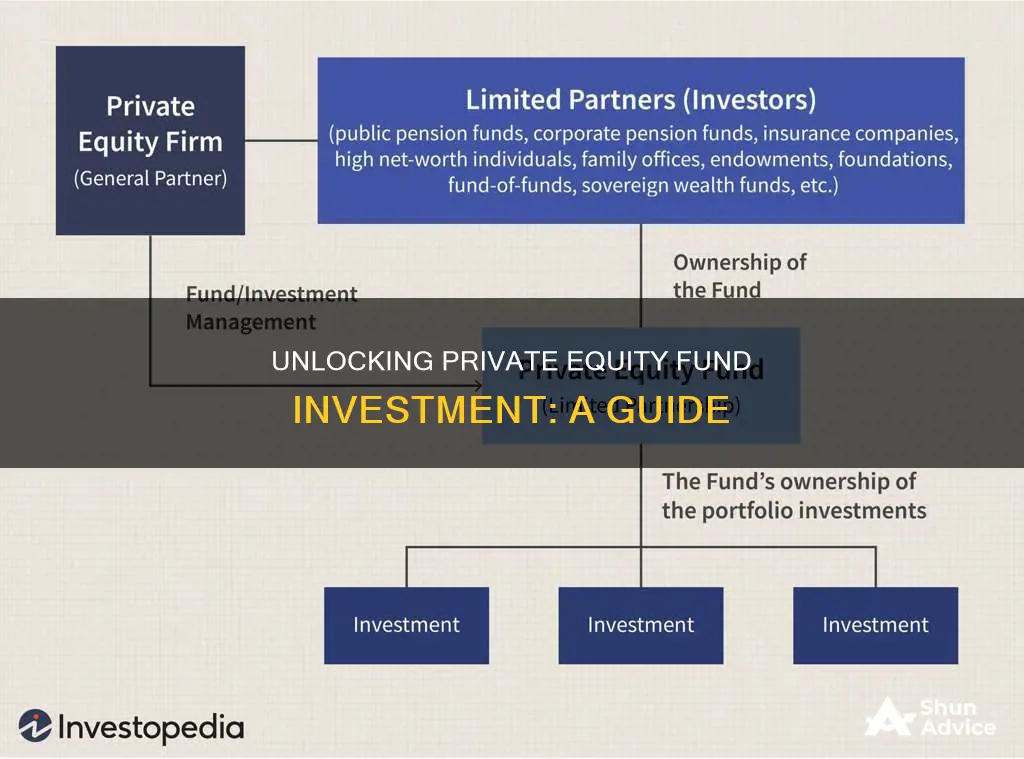

Private equity funds are a form of investment that takes place outside of the public stock market. Investors gain an ownership stake in private companies. Private equity firms manage these funds and invest the pooled capital in various private equity instruments.

Private equity funds are not registered with the Securities and Exchange Commission (SEC) and are therefore not subject to regular public disclosure requirements. As such, it can be challenging to find a private equity fund that is accepting new investors. Here are some ways to find one:

- Research top private equity firms: Start by researching the top private equity firms in the world, focusing on those that align with your investment goals and strategies. As of 2024, the largest private equity firms in terms of capital raised include CVC Capital Partners and Advent International. These firms may be more likely to accept new investors due to their size and scope.

- Look for private equity exchange-traded funds (ETFs): Private equity ETFs offer exposure to publicly listed private equity companies. This option may be more accessible for those who are not accredited investors or who cannot meet the minimum investment requirements of traditional private equity funds.

- Consider deal-by-deal investing: In recent years, there has been a shift towards deal-by-deal investing, where investors have more control over where their capital goes. This structure may be more open to new investors as it allows for more flexibility and discretion.

- Network within the industry: Building relationships within the private equity industry can provide access to information about funds that may be accepting new investors. Consider attending industry conferences, networking events, and meetings with private equity professionals to learn about potential investment opportunities.

- Work with an intermediary: Intermediaries, such as fund placement agents or investment banks, often have relationships with private equity firms and can facilitate introductions and provide information about investment opportunities. They may have insights into funds that are actively seeking new investors.

- Explore online platforms: There are online platforms and marketplaces that connect investors with private equity fund opportunities. These platforms typically provide information about various funds, their investment strategies, and their performance. They may also offer the ability to directly invest in private equity funds or provide a way to indicate your interest in specific funds.

When evaluating private equity funds, it is essential to consider factors such as the fund's investment strategy, performance track record, fees and expenses, and the reputation and experience of the fund managers. It is also crucial to ensure that you meet the accreditation and minimum investment requirements of the fund.

Invest in Nifty Total Market Index Fund: A Comprehensive Guide

You may want to see also

Indirectly invest by investing in a private equity management company

One way to gain exposure to private equity is to invest in a private equity management company. These are companies that manage private equity funds and are compensated through a management fee (often 2% of fund assets) and a share of the fund's profits.

Private equity management companies are often not registered with the SEC and are therefore not subject to public disclosure requirements. As a result, investors considering this option should be aware of the higher risks involved. Some of these risks include conflicts of interest, as these companies may be managing multiple funds and portfolio companies, and a lack of transparency due to the private nature of the investments.

Additionally, investing in a private equity management company may require a high initial investment amount and a long-term commitment, typically of 10 or more years. Investors should carefully review the offering documents and agreements provided by the company to understand the terms of the investment, including any fees and expenses.

It is also important to note that the success of private equity management companies is largely dependent on their ability to identify undervalued or under-managed companies, implement improvements, and sell them for a profit. This "buying to sell" strategy is a key differentiator from public companies, which typically "buy to keep".

Overall, investing in a private equity management company can be a viable option for those looking for indirect exposure to private equity, but it comes with higher risks, longer time horizons, and less transparency compared to other types of investments.

Retirement Planning: Where Your 401(k) Funds Are Invested

You may want to see also

Understand the long investment horizon

When considering investing in private equity, it's important to understand the long investment horizon associated with this type of investment. Private equity funds typically have a long-term investment horizon, often spanning 10 to 12 years, and in some cases, extending to 16 years or more. This long duration is due to the complex and illiquid nature of private equity investments.

The long investment horizon in private equity is characterised by periods of illiquidity, which means that investors' capital will be tied up for several years. This is an important consideration, as it affects the accessibility of funds during the investment period. Private equity investments are generally not suitable for those who may need access to their funds in the near term. Therefore, it's crucial to assess your financial situation and goals before committing to private equity.

The long investment horizon in private equity is influenced by various factors, including the type of investment strategy employed and market conditions. For example, a buyout fund that has already identified its target company may have a shorter horizon, while a venture capital fund may require additional years to find suitable investments. Market conditions can also impact the investment horizon, as private equity managers may have fewer exit options during difficult market cycles, potentially extending the investment period.

The long-term nature of private equity investments provides advantages for investors. Longer time horizons allow investors to access more complex and unique investment strategies that may not be available to public equity investors. Additionally, the long-term horizon enables investors to diversify their portfolios across a wider range of asset classes, which can help mitigate risks.

It's important to note that the long investment horizon in private equity is a key factor in achieving higher returns. Private equity managers employ long-term strategies that have historically resulted in higher returns compared to public equities. The longer duration provides the opportunity for investments to grow and maximise returns over time.

Mutual Funds: Best International Investment Opportunities

You may want to see also

Be aware of the high minimum investment requirements

Private equity investments are not easily accessible for the average investor. The high minimum investment requirements, ranging from $250,000 to as much as $25 million, make it difficult for most people to even consider investing in this asset class. These high minimums are instituted by high-quality private equity fund managers who are highly sought-after and can easily raise the desired capital even with such high minimum requirements. Given these minimum investment requirements, an investor would need a substantial pool of assets to devote to this space to achieve appropriate diversification within a private equity portfolio.

The high minimum investment requirements of private equity funds also make it challenging to diversify across multiple funds. One way to overcome this hurdle is to use a private equity fund-of-funds vehicle, which provides access to multiple private equity manager funds within a single investment vehicle. While this approach offers benefits such as professional manager selection and access to top-quality managers, it also comes with additional fees that can impact overall returns.

For those who cannot meet the high minimum investment requirements of private equity funds, there are alternative ways to gain exposure to the private equity market. One option is to invest in the companies that manage the funds. These fund management companies are often publicly listed on major stock exchanges, allowing investors to buy shares and participate in the performance of the private equity funds without directly investing in them. However, investing in a manager doesn't allow for focus on specific fund strategies, and investors are exposed to the overall success or failure of the management company.

Another option for investors who want to avoid the high minimum investment requirements of private equity funds is to invest through exchange-traded funds (ETFs). ETFs provide exposure to a group of publicly traded private equity companies and can be purchased over a stock exchange without worrying about minimum investment requirements. However, ETFs also add an extra layer of management expenses that may not be encountered with direct private equity investments.

In summary, the high minimum investment requirements of private equity funds can be a significant barrier for many investors. Those who can meet these requirements can gain access to exclusive investment opportunities, but it's important to carefully consider the level of diversification and the associated fees. For those who cannot meet the minimum requirements, alternative investment vehicles such as fund-of-funds, ETFs, and investing in fund management companies provide indirect ways to gain exposure to the private equity market.

Luxembourg Funds: Why Investors Should Consider This Option

You may want to see also

Frequently asked questions

Private equity funds typically require a minimum investment of $25 million, though this can be as low as $250,000 or even $25,000 in some cases.

Private equity funds are generally only available to qualified purchasers, i.e. investors with $5 million or more in investable assets.

Private equity investing is very speculative and therefore risky. There is no guarantee that the companies you invest in will succeed, and few protections if they fail. Private equity funds are also illiquid and typically have a 10-year investment horizon.