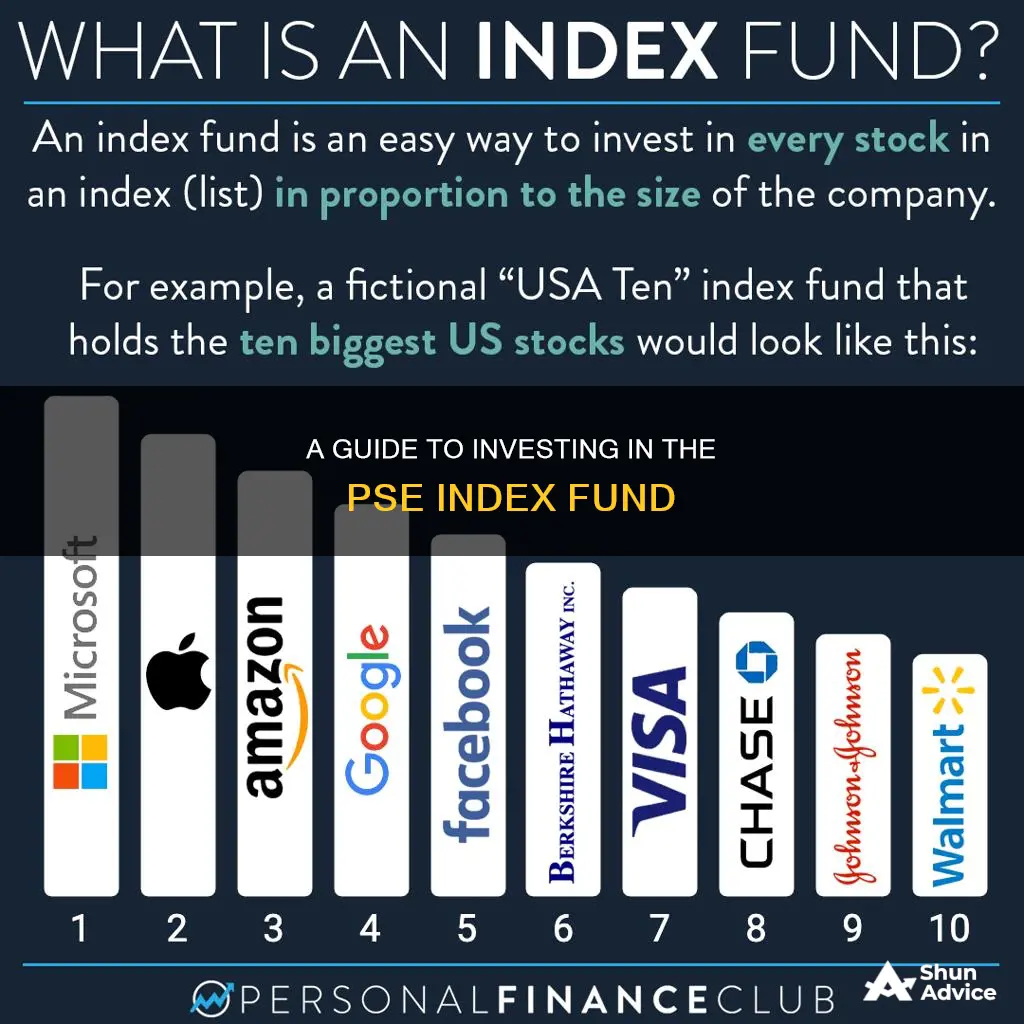

Index funds are a type of fund that tracks the performance and returns of a particular market or industry index. They are a low-cost, efficient, and hassle-free way of investing in the stock market, particularly in the Philippines' top 30 companies, also known as blue-chip companies, whose shares are traded on the Philippine Stock Exchange (PSE).

Index funds are an attractive investment option because they offer instant diversification, low management fees, consistency, and low initial capital. They are also passively managed, meaning investors don't need to actively monitor their investments.

There are several types of index funds available in the Philippines, including Unit Investment Trust Funds (UITF), First Metro Philippine Equity Exchange-Traded Funds (FMETF), and Variable Universal Life (VUL) plans.

To invest in index funds in the Philippines, individuals can follow these general steps:

1. Decide on the type of index fund that aligns with their investment goals and strategies.

2. Compare fees and charges across different index funds to identify the most cost-effective option.

3. Conduct due diligence by researching the tracking error, which indicates how closely the fund mirrors the index it is tracking.

4. Consider convenience by choosing a platform that makes investing easy and accessible.

5. Open an account with a stockbrokerage firm or trading participant (TP) accredited by the PSE, either traditional or online, based on factors like minimum investment requirements, services offered, and client feedback.

6. Submit the required documents and identification cards to open the account.

7. Place buy orders through the assigned trader or online trading account.

8. Make payments before the settlement deadline, which is typically two clearing days after the transaction date (T+2).

9. Receive proceeds or shares from the TP, along with confirmation receipts and invoices.

It's important to note that investing in index funds, like any other investment, carries risks. Stock market investing doesn't guarantee returns, and individuals should familiarize themselves with potential risks, such as company and economic developments, before investing.

What You'll Learn

What is the PSE Index?

The Philippine Stock Exchange Index (PSEi) is the benchmark for the overall performance of the local stock market in the Philippines. It is composed of the top 30 companies (although one source states 35) whose shares are publicly traded on the stock market. These companies are also called blue-chip companies, and include the likes of Jollibee Foods Corp, Puregold, and San Miguel Corp.

The PSEi is carefully selected as the companies represent the entire market. When the prices of their stocks fall, the market is said to be in decline, and when they increase, the market is said to be on the rise.

The PSEi is made up of the following companies:

- Aboitiz Equity Ventures, Inc.

- Alliance Global Group, Inc.

- Bloomberry Resorts Corporation

- Bank of the Philippine Islands

- Converge Information and Communications Technology Solutions, Inc.

- GT Capital Holdings, Inc.

- International Container Terminal Services, Inc.

- Jollibee Foods Corporation

- JG Summit Holdings, Inc.

- Metropolitan Bank & Trust Company

- Megaworld Corporation

- Manila Electric Company

- Metro Pacific Investments Corporation

- Puregold Price Club, Inc.

- Robinsons Land Corporation

- Robinsons Retail Holdings, Inc.

- Security Bank Corporation

- SM Investments Corporation

- San Miguel Corporation

- SM Prime Holdings, Inc.

- Universal Robina Corporation

ETFs and Mutual Funds: Key Investment Considerations

You may want to see also

How to invest in the PSE Index Fund?

The Philippine Stock Exchange Index (PSEi) is composed of the top 30 companies whose shares are traded on the Philippine Stock Exchange (PSE). These are called blue-chip companies, and you may know some of them, such as Jollibee Foods Corp, Puregold, and San Miguel Corp.

Index funds are a hassle-free, low-cost, and diversified way of investing in the stock market. They are investment funds that mirror the stock index by buying all 30 companies and buying them according to their weight in the index.

- Choose a broker: There are two types of brokers in the PSE: traditional and online. Traditional brokers will assign a trader or agent to execute your transactions, while online brokers allow you to trade on your own through their platform. Some factors to consider when choosing a broker include minimum investment requirements, types of services offered, commissions and fees, and client feedback.

- Open an account: Contact your chosen broker and find out their account opening requirements. Submit the required documents and identification cards, and proceed with the account opening process, which will include a Know Your Customer (KYC) procedure.

- Give your order: Place a buy order through your assigned trader or online trading account. For online accounts, ensure that your account is pre-funded before entering buying orders.

- Pay before the settlement date: Payment for shares bought should be made before the settlement deadline, which is two clearing days from the transaction date (T+2).

- Receive your proceeds/shares: You will receive either the proceeds of the sale of your stocks or proof of ownership of the stocks bought after the settlement processing on T+2.

There are several types of index funds available in the Philippines, including Unit Investment Trust Funds (UITF), First Metro Philippine Equity Exchange Traded Fund (FMETF), and Variable Universal Life (VUL) plans.

When choosing an index fund to invest in, consider the following:

- Tracking error: This is the difference between how closely the fund performed compared to the index it is tracking. A lower tracking error indicates better performance.

- Management fees: Compare the cost of running the fund, including trustee fees, custodianship fees, external auditor fees, and other fees.

- Low capital requirement: Some index funds have a minimum investment requirement as low as PHP 1,000.

- Convenience: Consider factors such as the ease of account opening and customer service.

- EastWest PSEI Tracker Fund

- BPI Philippine Equity Index Fund

- Philequity PSE Index Fund Inc.

- First Metro Philippine Equity Exchange Traded Fund

- PAMI Equity Index Fund, Inc.

Obtaining Your Mutual Fund Investment Statement: A Guide

You may want to see also

Advantages of the PSE Index Fund

The PSE Index Fund is a great investment option for those looking to mirror the performance of the Philippine Stock Exchange Index (PSEi). Here are some advantages of investing in the PSE Index Fund:

Instant Diversification

The PSE Index Fund offers instant diversification as it is composed of the top 30 companies in the Philippines, also known as blue-chip companies. By investing in the fund, you automatically invest in all 30 companies, reducing the risk associated with investing in individual stocks.

Low Management Fees

The PSE Index Fund has lower management fees compared to other investment options. The fund's main goal is to mirror the PSEi, which requires minimal effort from fund managers, resulting in lower fees for investors.

Consistency

The objective of the PSE Index Fund is to mirror the PSEi. Therefore, as long as the PSEi is performing well, you can expect consistent returns on your investment.

Low Initial Capital

Investing in the PSE Index Fund requires a much lower initial capital compared to investing directly in the stock market. With just one share of the PSE Index Fund, you gain access to a portfolio of all 30 blue-chip companies, which would be much more expensive if purchased individually.

Passive Income

The PSE Index Fund is a passive investment option. A fund manager handles the investments, so you don't need to be skilled in stock trading to enjoy potential earnings. This makes it a convenient option for those who want to invest without actively managing their portfolio.

Long-Term Results

The PSE Index Fund is designed for long-term investing. Historically, the stock index has proven hard to beat, and experts like Warren Buffet suggest that ordinary people are better off investing in it.

Investing in Funds: Diversification, Expertise, and Access

You may want to see also

Disadvantages of the PSE Index Fund

Index funds are a popular investment choice as they offer the potential for stable returns over time, a diversified portfolio of holdings, and low fees. However, there are some disadvantages to be aware of before investing in the PSE Index Fund. Here are some of the disadvantages of investing in the PSE Index Fund:

- Management fees — While index funds typically have lower management fees than actively managed funds, the fees charged by index funds in the Philippines are relatively high compared to those in other countries. This is partly due to the licensing fee imposed by the PSE, which is 0.03% of the total assets under management (AUM) for PSEi-tracking funds. These fees can range from 0.50% to 1.50% per year, which is a significant expense for investors.

- Limited control — Index funds are passively managed, which means that fund managers take a hands-off approach and invest passively in companies in the market index it follows. This lack of active management may be a disadvantage for investors who prefer to have more control over their investments and want the ability to make quick adjustments to their portfolio.

- Potential for capital loss — Like any investment in the stock market, there is a potential for capital loss when investing in index funds. While index funds are considered safer than investing in individual stocks, there is no guarantee that you will not lose money. The returns of index funds are not guaranteed, and you may still experience losses if the market or sector performs poorly.

- Lack of diversification — While index funds offer instant diversification across a range of stocks, this diversification may not be sufficient for some investors. Additionally, some indexes are not diversified and only invest in a specific industry or sector, which can increase the risk of loss.

- Tracking error — Index funds aim to mirror the performance of a particular stock market index, but they may not always be able to do so perfectly. The difference between the return of the index fund and the stock index it tracks is known as the tracking error. A high tracking error indicates that the fund is not able to closely follow the index, which may lead to lower returns for investors.

Equity Funds: Where to Invest and Why

You may want to see also

How to choose the best PSE Index Fund

When choosing the best PSE Index Fund, there are several factors to consider. Firstly, it is important to understand the different types of index funds available, such as Mutual Funds, Exchange-Traded Funds (ETFs), and Unit Investment Trust Funds (UITFs). Each type has its own advantages and disadvantages, so it is crucial to weigh them according to your investment preferences and strategies.

Fees and charges play a significant role in determining the overall gains or losses of your investment. Even small differences in fees between index funds can lead to substantial variances in returns, especially when dealing with a large investment portfolio. Therefore, it is essential to study the prospectus of the funds and calculate the total fees, including any hidden or third-party charges. Generally, selecting index funds with lower overall fees can give you a significant advantage over those with higher charges.

Another critical factor to consider is the "tracking error," which refers to the difference between the fund's performance and the index it is tracking. Ideally, you want to choose a fund with a lower tracking error, as it indicates that the fund is closely mirroring the index it is based on. However, it is worth noting that fees are often a significant contributor to this discrepancy.

Convenience is also an important aspect when choosing an index fund. Opt for a platform that offers ease of access, user-friendly interfaces, and a seamless process for checking investments, funding, and making trades. Additionally, consider the minimum initial capital required, the facility for regular auto-invest, customer service, and other factors that align with your personal preferences and investment goals.

Lastly, remember that no single index fund is inherently superior to another. The best PSE Index Fund for you will depend on your unique circumstances, risk tolerance, investment horizon, and financial objectives. Diversification across different types of funds can also be beneficial, as it leverages the advantages of each while mitigating risks.

Understanding Investment Funds: What Are They?

You may want to see also

Frequently asked questions

A PSE Index Fund is a type of fund that tracks the performance of the Philippine Stock Exchange Index (PSEi), which is made up of the top 30 companies publicly traded on the stock market. By investing in a PSE Index Fund, you are investing in all 30 of these companies, with the fund mirroring the performance of the PSEi.

There are a few ways to invest in a PSE Index Fund, including through Unit Investment Trust Funds (UITF), Mutual Funds, and Exchange-Traded Funds (ETF). The steps to invest will vary depending on the type of fund and the specific fund provider, but generally, you will need to open an account and fund your investment.

Investing in a PSE Index Fund offers instant diversification, as you are investing in a basket of the top 30 companies in the Philippines. It is also a low-cost and hassle-free way to invest in the stock market, as the fund is managed by professionals, and you don't need to buy each stock individually. Additionally, PSE Index Funds have low management fees and low initial capital requirements.