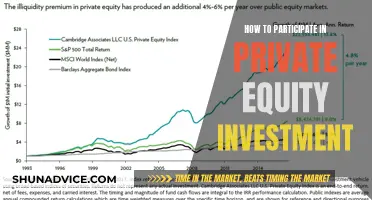

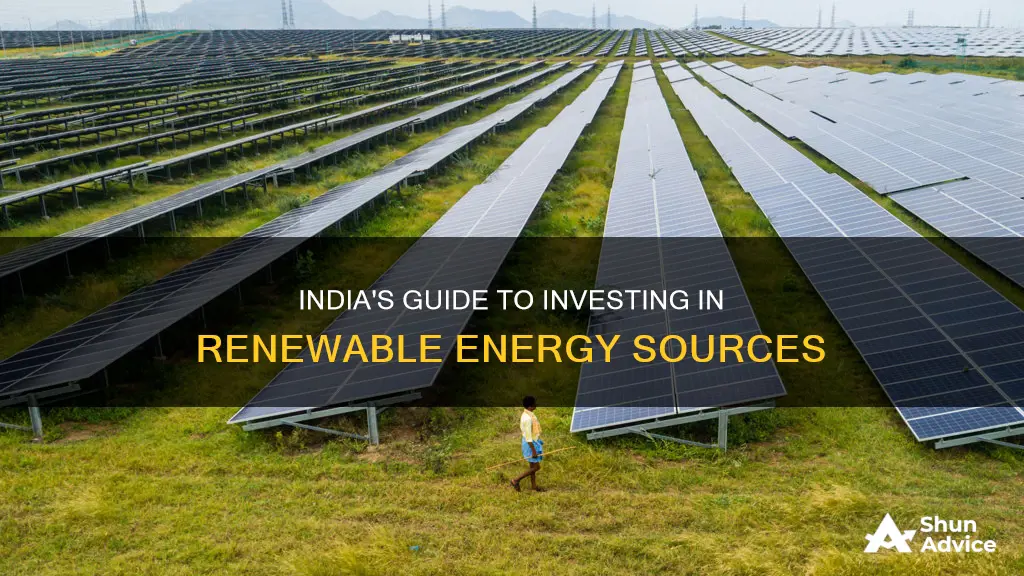

India is rapidly emerging as a global leader in renewable energy. The country has the fourth-largest installed renewable energy capacity in the world and has set ambitious targets for further expansion in this sector. With its abundant solar, wind, and hydropower potential, along with a robust regulatory and policy framework, India offers a favourable business environment for renewable energy projects.

The Indian government has fostered a competitive renewable energy ecosystem, with strong incentives and conducive policies that promote research-led innovation. As a result, the renewable energy sector in India has become highly attractive for investors, with significant inflows of foreign direct investment.

This paragraph introduces the topic of investing in renewable energy in India, highlighting the country's potential and favourable conditions for those looking to explore investment opportunities in this sector.

| Characteristics | Values |

|---|---|

| Global rank in renewable energy capacity | 4th |

| Target renewable energy capacity by 2030 | 450-500 GW |

| Target solar power capacity by 2030 | 280 GW |

| Target wind power capacity by 2030 | 140 GW |

| Target bioenergy capacity by 2030 | 10 GW |

| Current renewable energy capacity | 135-209.63 GW |

| Yearly growth rate in installed renewable power generation capacity | 15.4% |

| Renewable energy investment since 2014 | $70-78 billion |

| Expected renewable energy investment by 2030 | $360 billion |

| Expected solar PV projects investment | $15.5 billion |

| Expected battery manufacturing investment | $2.7 billion |

| Expected electrolyser manufacturing investment | $2.12 billion |

| Expected investment in electricity transmission and storage | $150-170 billion |

What You'll Learn

Solar energy stocks

India has emerged as a global leader in renewable energy, with abundant solar, wind, and hydropower potential, and a robust regulatory framework. The country has set ambitious targets for renewable energy, aiming for 450 GW of renewable energy capacity by 2030, including 280 GW of solar power. This has led to a surge of interest in solar energy stocks.

Adani Green Energy Limited

Adani Green Energy is one of the top solar energy companies in India and is a key player in the renewable energy sector. The company has a large solar power generation capacity and aims to become a significant net exporter of solar energy by 2026. Adani Green Energy is also involved in wind and hybrid power generation.

NTPC Limited

NTPC Limited is India's largest power-generating company, selling electricity to state power utilities. They have a diverse range of power generation sources, including coal, gas, liquid fuel, and renewable sources. NTPC has a significant presence in solar energy, with 15 solar PV power stations and a total installed capacity of 75,418 MW. The company aims to expand further and become a 130 GW firm by 2032.

National Hydroelectric Power Corporation (NHPC) Limited

NHPC Limited is one of India's largest hydropower-generating companies, also dealing with wind and solar energy projects. The company has an installed capacity of around 7,097 MW, including 76 solar-based and 50 wind-based power stations. NHPC provides consultancy services and is actively involved in planning and promoting integrated and efficient hydropower development.

JSW Energy Limited

JSW Energy Limited is an integrated power company with a capacity of around 6,677 MW. Their renewable segment includes solar, hydro, and wind power generation. JSW Energy has manufacturing plants across multiple states in India and is involved in transmitting and trading electricity.

When considering investing in solar energy stocks in India, it is important to evaluate the financial health and performance of the company, stay updated with government policies and incentives, and be aware of global economic factors that may impact the industry.

Investment and Portfolio Management: Strategies for Success

You may want to see also

Wind energy stocks

India is a favourable destination for investing in renewable energy, especially wind energy. The country has set ambitious goals to generate 50% of its electricity from non-fossil fuels by 2030 and achieve net-zero emissions by 2070. Here are some wind energy stocks to consider:

Adani Green Energy Ltd

Adani Green Energy Limited (AGEL) is a prominent green energy company in India, founded in 2015. It operates the Kamuthi Solar Power Project, one of the world's largest solar photovoltaic plants. As of September 20, 2024, AGEL had a market capitalisation of Rs. 310,937.66 crore, and its share price closed at Rs. 1962.95. Over the last five years, the company's revenue has grown at a yearly rate of 38.22%, higher than the industry average. AGEL is one of the top solar power companies in India.

KP Energy Ltd

KP Energy is a key solutions provider for wind energy projects in Gujarat, India. Their services include EPC (Engineering, Procurement and Construction), operation and maintenance, and asset management. KP Energy has a successful track record of over 1 GW of wind energy projects. The company has grown its revenue at a yearly rate of 24.81%, higher than the industry average, and its market share has increased from 0.73% to 1.21%.

BF Utilities Ltd

BF Utilities Ltd is a small-cap wind energy stock established in India in 2000. It generates electricity through windmills and is also involved in infrastructure projects. As of September 20, 2024, the company had a market capitalisation of Rs. 2,817.35 crore, and its share price closed at Rs. 747.95. BF Utilities is showing positive signs of profitability, with a return on equity (ROE) of 42.55% and a net profit margin of 28.35%.

KPI Green Energy Ltd

KPI Green Energy Limited, based in Surat, Gujarat, is a solar power company founded in 2008. It generates and supplies electricity through solar projects under its brand, Solarism. Over the last five years, the company's revenue has grown at a yearly rate of 88.05%, higher than the industry average, and its market share has increased from 0.2% to 2.6%. In the same period, the company's net income has grown at a yearly rate of 78.55%.

Orient Green Power Company Ltd

Orient Green Power Company Ltd focuses on generating electricity through renewable sources, such as wind and biomass energy. The company is key to helping India move towards cleaner, renewable energy alternatives. As of October 29, 2024, Orient Green Power had a market capitalisation of Rs. 2,165.42 crore and a share price of Rs. 18.46. Its PE ratio was 56.39, with a 5-year average return on investment of 7.97%.

Inox Wind Limited

Inox Wind is a major maker of wind turbine engines and a provider of complete solutions for wind power projects. The company has a strong foothold in the Indian market and is expanding its global reach. Inox Wind has a robust order book and is well-positioned to benefit from the growing demand for wind energy options.

Suzlon Energy Limited

Suzlon Energy is a world leader in the wind energy business and is based in India. The company manufactures and provides wind blades and offers end-to-end solutions for wind farm development and operation. Suzlon Energy has a strong presence in both local and foreign markets and continuously invests in research and development to enhance its product lines.

Waaree Energies Limited

Waaree Energies is a major maker of solar photovoltaic panels and a provider of solar power options. The company has a strong foothold in the Indian market and is expanding globally through intelligent partnerships and deals. Waaree Energies focuses on research and development, aiming to create new and cost-effective solar solutions.

Tata Power Company Limited

Tata Power is one of India's most prominent integrated power companies, actively growing its green energy fleet. With a strong focus on solar and wind power projects, the company aims to achieve a production capacity of 25% from green sources by 2025. Tata Power has a diverse footprint across multiple states in India and explores possibilities in foreign markets.

ReNew Power Private Limited

ReNew Power is a significant player in the Indian green energy field, with a diverse collection of wind and solar power projects. The company has ambitious growth plans and is well-positioned to capitalise on the growing demand for clean energy. ReNew Power has a strong focus on technological innovation and has collaborated with top foreign companies to create cutting-edge green energy solutions.

Greenko Energy Holdings

Greenko Energy Holdings is a significant owner and user of green energy assets in India, with a diverse fleet that includes wind, solar, and hydropower projects. The company has a strong track record of completing large-scale projects and has worked with top foreign partners to fund its growth plans.

Azure Power Global Limited

Azure Power is a major independent solar power company in India with a collection of operating and under-construction solar projects. The company has a good track record of completing large-scale solar projects and is well-positioned for future growth. Azure Power has made innovative agreements with top foreign companies to maximise their knowledge and resources.

Energy Development Company Ltd

Energy Development Company Ltd operates hydroelectric power plants and engages in renewable energy production. The company is active in India's hydropower sector, providing sustainable energy solutions. As of October 29, 2024, Energy Development Company had a market capitalisation of Rs. 106.35 crore and a share price of Rs. 22.39.

WAA Solar Ltd

WAA Solar Ltd develops solar power projects in India, contributing to the country's renewable energy targets. The company focuses on solar photovoltaic projects. As of October 29, 2024, WAA Solar had a market capitalisation of Rs. 161.06 crore and a share price of Rs. 121.40.

Savings, Investment, and Their Intricate Balance Sheet Equation

You may want to see also

Green hydrogen production

Green hydrogen is produced using electrolysis, where renewable energy sources such as solar and wind power are used to split water into hydrogen and oxygen. This process creates a clean fuel that can replace fossil fuels in industry, clean transportation, aviation, marine transport, and potentially also for decentralised power generation.

India has recognised the potential of green hydrogen and launched the National Green Hydrogen Mission in 2022, with the aim of becoming a leading producer and supplier. The country has set a target of producing 5 million metric tonnes of green hydrogen annually by 2030, supported by 125 GW of renewable energy capacity.

The production of green hydrogen in India offers several investment opportunities, including:

Government Policies and Incentives

Monitor government policies and incentives related to renewable energy, such as the National Green Hydrogen Projects. The Indian government has shown strong commitment in this area, with initiatives like the National Solar Mission and the Green Energy Open Access Rules.

Technological Advancements

Companies in the green hydrogen sector often invest in advanced technologies, such as improved electrolysis techniques, effective storage solutions, and scalable production methods. These innovations reflect the commitment of hydrogen fuel companies to drive progress in the industry.

Market Demand and Growth Potential

The demand for green hydrogen is expected to grow rapidly due to its potential to decarbonise sectors like transportation, shipping, and steel production. With India's ambitious renewable energy targets, the market demand for green hydrogen stocks and their growth potential is significant.

Financial Performance

Assessing the financial health of green hydrogen companies is crucial before investing. Examine financial statements, revenue growth, profit margins, and cash flow to make informed investment decisions.

Infrastructure Development

The infrastructure for storing, transporting, and distributing green hydrogen is still underdeveloped in India, presenting an investment opportunity. This gap can lead to job creation and economic growth, making it an attractive prospect for investors.

Leading Companies in Green Hydrogen Production

Some of the leading companies in India's green hydrogen sector include:

- National Thermal Power Corporation (NTPC)

- Oil & Natural Gas Corporation (ONGC)

- Reliance Industries

- Larsen & Toubro Limited

These companies are contributing significantly to the country's green hydrogen production and the transition to cleaner energy sources.

With India's focus on renewable energy and the growing demand for green hydrogen, investing in this sector offers a lucrative opportunity for foreign investors. By staying informed, conducting thorough research, and tailoring investments to their risk appetite, investors can contribute to India's energy transition while also enjoying significant returns.

Diversity Investments: Managers' Role in Creating Inclusive Spaces

You may want to see also

Foreign investment opportunities

India is a favourable investment destination for renewable energy, with abundant solar, wind, and hydropower potential, and a robust regulatory and policy framework. The country has set ambitious targets for renewable energy expansion, aiming for 450 GW of renewable energy capacity by 2030. This includes 280 GW of solar power, 140 GW of wind power, and 10 GW of bioenergy.

Foreign companies have a variety of avenues to explore when investing in India's renewable energy sector. Here are some key opportunities:

Direct Project Development

Foreign investors can identify viable renewable energy projects and invest in their development, construction, and operation. This approach allows for greater control and the potential for higher returns. India's favourable policies and incentives, such as tax benefits and long-term power purchase agreements, further enhance the investment potential.

Competitive Bidding for Government Tenders

Participating in competitive bidding processes for government tenders and auctions is a strategic way to secure projects. Foreign companies can benefit from the Indian government's supportive policies and incentives, making it easier to navigate the regulatory landscape.

Partnerships or Joint Ventures with Local Companies

Foreign entities can form partnerships or joint ventures with local Indian companies. This approach leverages local expertise and market knowledge, fosters technology transfer, and facilitates skill development. It can also help foreign investors navigate regulatory complexities.

Acquisition of Existing Renewable Energy Projects or Companies

Foreign investors can acquire existing renewable energy projects or companies in India to gain immediate market entry and take advantage of existing infrastructure and operational efficiencies.

Financing Options and Collaborations with Indian Financial Institutions

Foreign investors can explore financing options and collaborations with Indian financial institutions, which have been actively supporting the growth of the renewable energy sector. These institutions can provide access to capital and facilitate investments.

Relationships with Government Agencies and Industry Associations

Fostering strong relationships with government agencies and industry associations can be beneficial. It can facilitate networking, provide access to the latest market trends and opportunities, and create a supportive environment for foreign investors.

India's renewable energy sector has attracted significant foreign investment, with Foreign Direct Investment (FDI) reaching around $1.5 billion in the financial year 2021-22. The total investment in the sector reached a record $14.5 billion during the same period, a substantial increase from previous years. This highlights the growing appeal of India as a destination for foreign investment in renewable energy.

Home Investment: A Smart Portfolio Move?

You may want to see also

Government initiatives

The Indian government has undertaken several initiatives to promote renewable energy in the country, reflecting its commitment to achieving its renewable energy targets, reducing greenhouse gas emissions, and transitioning to a more sustainable and cleaner energy future. Here are some key government initiatives in this sector:

National Solar Mission (NSM): Launched in 2010, NSM aims to promote the development and use of solar energy for both grid-connected and off-grid applications. It sets ambitious targets for solar capacity addition and provides financial incentives, subsidies, and policy support to boost solar energy adoption.

Wind Energy Promotion: India has one of the world's largest wind energy capacities. The government offers incentives such as generation-based incentives (GBIs) and accelerated depreciation benefits to encourage wind power development.

Bioenergy Promotion: The government promotes the use of biofuels and biomass-based power generation. Initiatives include the Ethanol Blending Program, which mandates blending ethanol with petrol, and the National Policy on Biofuels.

Hydropower Development: India aims to harness its hydropower potential while addressing environmental concerns. Various policies and incentives support the development of small and large hydropower projects.

Geothermal and Ocean Energy: While still in the early stages, the government is exploring opportunities for geothermal and ocean energy projects. Research and development initiatives are underway to harness these resources effectively.

Renewable Purchase Obligations (RPO): Under the Electricity Act, 2003, state electricity regulatory commissions enforce RPOs, mandating distribution companies and open access consumers to procure a specific percentage of their power from renewable sources.

Tax Incentives: To promote investments in renewable energy projects, the government offers tax benefits, including accelerated depreciation and income tax exemptions.

Green Energy Corridors: The government is developing dedicated transmission lines for renewable power, known as Green Energy Corridors, to improve grid infrastructure and facilitate the integration of renewable energy.

International Collaboration: India actively collaborates with various countries and international organizations on renewable energy projects, technology transfer, and capacity building, demonstrating its commitment to global cooperation in this sector.

Research and Development: The Ministry of New and Renewable Energy (MNRE) funds research and development initiatives to enhance renewable energy technologies, making them more accessible and cost-effective.

Net Metering and Feed-in Tariffs: Various states have introduced net metering policies and feed-in tariffs to encourage rooftop solar installations, allowing consumers to sell excess electricity back to the grid.

Production Linked Incentive (PLI) Scheme: The government has introduced the PLI scheme to enhance India's manufacturing capabilities and exports in high-efficiency solar PV modules. This scheme aims to build 65 GW of annual manufacturing capacity and create direct and indirect employment opportunities.

National Green Hydrogen Mission: With a total initial outlay of INR 19,744 Cr, this mission aims to make India a market leader in adopting green hydrogen. It targets 5 MMT annual green hydrogen/ammonia production and 125 GW of renewable energy capacity by 2030.

Ultra Mega Renewable Energy Parks: The government has implemented policies to establish Ultra Mega Renewable Energy Parks, contributing to the expansion of the renewable energy sector.

PM KUSUM Scheme: The PM KUSUM scheme is one of the ecosystem enablers in India, promoting the adoption of renewable energy sources.

Solar Rooftop Scheme: The government provides financial incentives for off-grid solar installations, encouraging the utilization of solar energy.

Green Term Ahead Market (GTAM): The launch of GTAM has facilitated the sale of renewable energy power through exchanges, making it easier for renewable energy producers to sell their power.

These initiatives demonstrate the Indian government's strong commitment to fostering a competitive and sustainable renewable energy sector, attracting investments, and driving the country towards a greener and more sustainable future.

A Secure Guide to EPF India Investments

You may want to see also

Frequently asked questions

Renewable energy is energy that comes from sources that are naturally replenished, such as solar, wind, geothermal, hydropower, and bioenergy.

Renewable energy is important because it offers a cleaner and more sustainable alternative to fossil fuels, helping to reduce carbon emissions and combat climate change.

There are several ways to invest in renewable energy in India. You can invest directly by buying stocks in renewable energy companies, or through exchange-traded funds (ETFs) that focus on clean energy or specific types of renewable energy, such as solar or wind. You can also invest in renewable energy projects or companies through direct project development, competitive bidding for government tenders, or by forming partnerships or joint ventures with local Indian companies.

Investing in renewable energy in India offers several benefits, including favourable government policies, incentives, and financial support, as well as a growing market and increasing demand for renewable energy sources. India is also committed to reducing carbon emissions and has set ambitious targets for renewable energy capacity by 2030 and 2070.

Some risks to consider when investing in renewable energy in India include the country's heavy reliance on thermal energy, particularly coal-based power, as well as challenges related to the production, distribution, and storage of renewable energy. There may also be intermittent availability of solar and wind energy due to natural conditions.