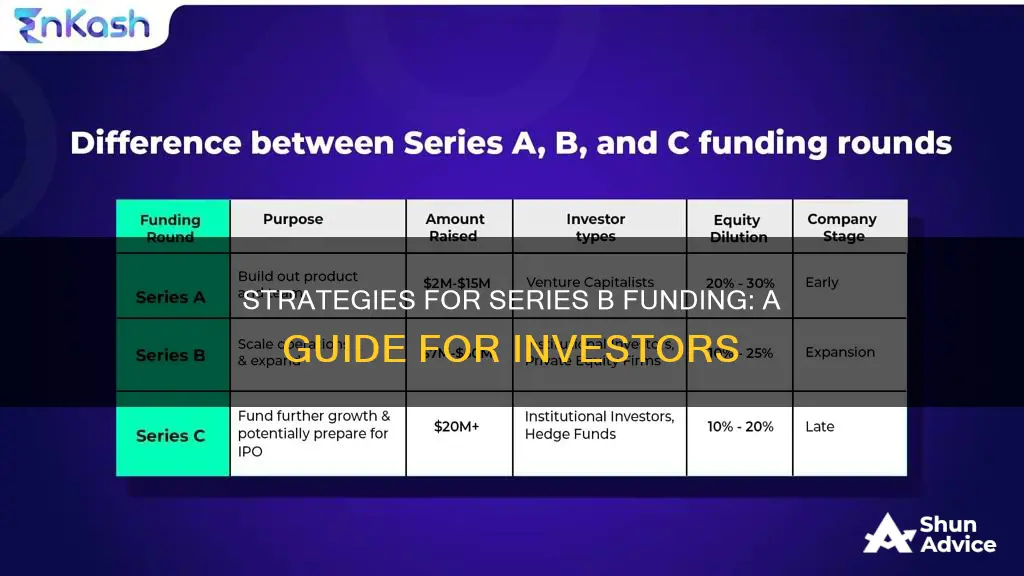

Series B funding is the third stage of startup financing and the second stage of venture capital financing. It is a priced round that usually follows a Series A round of funding, and companies typically raise this funding from institutional investors, such as venture capital firms, in order to increase their customer base, find new markets, and scale operations. Companies that have completed seed and Series A investment rounds previously demonstrate to investors that they are ready for larger-scale success. Series B funding is used to help the company expand to meet these high demand levels.

| Characteristics | Values |

|---|---|

| Funding type | Equity-based financing |

| Funding stage | Third stage of startup financing and the second stage of venture capital financing |

| Investors | Institutional investors, such as venture capital firms, private equity firms, and the general public (e.g. via equity crowdfunding platforms) |

| Investment size | $7-10 million on average; $15.1 million median size for US companies in Q3 2023 |

| Company valuation | Solid valuations of more than $10 million; $35 million median valuation in 2022 |

| Company stage | Beyond the early startup stage, with stable revenues and some profits |

| Funding purpose | Scaling operations, increasing customer base, finding new markets, business expansion, talent acquisition, developing new technologies |

What You'll Learn

How to prepare a Series B fundraising pitch

Series B funding is a crucial step for any startup, and preparing a compelling pitch is essential for securing the investment needed to take your business to the next level. Here are some guidelines on how to craft a persuasive Series B fundraising pitch:

- Understand the purpose of Series B funding: Series B funding is typically about taking your business beyond the development stage and scaling operations. It's the time to expand your customer base, enter new markets, and grow your team to meet the demands of a larger-scale operation.

- Know your audience: Series B funding usually comes from institutional investors such as venture capital firms and private equity firms. These investors have likely provided funding for previous rounds, but there may also be new investors joining at this stage. Understand their expectations and what they are looking for in a potential investment.

- Determine your funding needs: Before approaching investors, decide on the amount of capital you want to raise and the terms of the investment. Consider your cash runway, burn rate, and specific goals you want to achieve with the funding, such as expanding internationally or launching new products.

- Craft a compelling narrative: Your pitch deck should tell a clear and engaging story about your company's journey and future prospects. Focus on data and evidence that demonstrate traction, a sustainable growth trajectory, and the potential for scalability. Use narrative elements to make your pitch memorable and help investors connect with your vision.

- Keep it concise: A typical Series B pitch deck should have around 10-12 slides. Make sure your presentation is clear and concise, with minimal text and engaging visuals. If you're sending a "teaser" deck via email, provide a high-level overview rather than diving into excessive detail.

- Highlight problem-solving and market fit: Investors want to see that you have identified a problem or gap in the market and that your product or service effectively addresses this need. Demonstrate a deep understanding of your target market and how your solution fits within the competitive landscape.

- Showcase traction and growth: Provide evidence of a stable and growing customer base, revenue growth, and user engagement. Highlight key milestones and achievements, and communicate your long-term goals and expansion strategies.

- Demonstrate a viable business model: Investors will be looking for a solid revenue model and a credible path to profitability. Showcase your unit economics, growth statistics, sales proficiency, client retention, and burn rate to illustrate the potential for sustainable financial performance.

- Prepare your management team: Investors will not only be investing in your idea but also in your team's ability to execute. Ensure your management team is well-prepared to answer questions and address any concerns. They should demonstrate a thorough understanding of the market, the competition, and the growth strategy.

- Address risks and challenges: Be prepared to address any potential risks or challenges that investors may raise. This could include competition, market fluctuations, or operational hurdles. Show that you have a robust plan in place to navigate these challenges effectively.

- Build relationships with investors: Fundraising is not just about securing investment; it's also about building long-term relationships with investors. Cultivate these relationships by maintaining open communication, seeking feedback, and demonstrating your commitment to creating a successful and sustainable business.

Remember, a successful Series B fundraising pitch is about demonstrating the potential for growth, scalability, and profitability. By effectively communicating your vision, traction, and business acumen, you'll be well on your way to securing the funding needed to take your startup to new heights.

Vanguard Funds: Best Investment Options for Your Portfolio

You may want to see also

What investors are looking for at the Series B stage

Series B funding is a crucial stage for startups as it helps them move beyond the development stage and expand their operations. At this stage, investors are looking for a few key things:

- Strong user and customer traction: Investors will be looking for proof of a stable and growing customer base. Startups need to demonstrate that they have a solid user base and are expanding rapidly. This includes showcasing not just income but also subscriber growth and engagement data.

- Revenue and profitability: Investors will be looking for evidence of a viable revenue model and a path to profitability. They will want to see that the startup is generating revenue and preferably some profits. It is important to note that the focus has shifted from the goal and the team to the financial performance of the company.

- Scalability: Investors will want to see the potential for the startup to scale and expand its operations. This includes having a plan to generate revenue with low costs and a larger profit margin. The company's expansion strategy must also align with its original mission and products.

- Team and leadership: Investors will be looking for a capable and experienced team leading the startup. This includes key positions in the C-suite and sales leadership. They will want to see that the team has a track record of success in their respective fields.

- Clear milestones and goals: Investors will want to see that the startup has achieved important milestones and has a clear plan for the future. This includes specific goals and milestones that will be achieved with the additional funding.

- Sustainable growth trajectory: While investors are looking for strong growth, they also want to see efficient growth. This means focusing on growing sustainably rather than at all costs. Startups with a low burn rate and a plan to break even quickly will be more attractive to investors.

- Commercialization progress: Investors will want to see that the startup has a solid understanding of the market and a plan to disrupt it successfully. This includes having a niche for their products or services and a clear path to commercialization.

Overall, investors at the Series B stage are looking for startups that have moved beyond the initial development stage and are ready to expand their operations. They want to see strong user traction, revenue growth, a viable path to profitability, and a capable team leading the company. Startups that can demonstrate these factors will be well-positioned to attract Series B funding.

Pension Funds: Choosing the Right Investment for Your Future

You may want to see also

How to create a Series B pitch deck

A Series B pitch deck is a crucial component of your fundraising strategy. Here are some tips on how to create an effective and compelling pitch deck:

Understand the Purpose of Series B Funding

Series B funding is typically sought by companies that have moved beyond the early startup stage and are ready to scale their operations. This funding round is about taking your company to the next level, expanding your customer base, entering new markets, and increasing your team to meet the demands of growth. Understanding the purpose of Series B funding will help you tailor your pitch deck accordingly.

Know Your Audience

Series B funding usually comes from institutional investors such as venture capital firms and private equity firms. These investors have specific criteria and expectations, so it's important to understand their perspective. They are looking for companies with strong growth potential, a solid business model, and a capable management team. Keep your audience in mind as you craft your pitch deck to ensure it resonates with them.

Structure and Content

Most pitch decks follow a standard structure, but it's the design and details that set them apart. Your deck should typically include the following:

- Problem and Solution: Clearly articulate the problem your company is solving and how your product or service addresses it.

- Evidence of Traction: Demonstrate that you have a stable customer base, strong user engagement, and a sustainable business model that is generating revenue.

- Growth and Scalability: Show that your company has the potential to scale and that you have a plan to manage this growth effectively.

- Competitive Advantage: Highlight what sets your company apart from your competitors and why you will be successful in the market.

- Financials and Projections: Provide an overview of your financial situation, including revenue, expenses, and future projections. Be prepared to discuss milestones and key performance indicators (KPIs).

- Team and Management: Introduce your management team and highlight their relevant experience and expertise. Investors want to see capable leaders in place.

Keep it Concise and Visual

As a general guideline, aim for around 10-12 slides for your Series B pitch deck. Make sure your deck is visually appealing and easy to follow. Use charts, graphs, and other visuals to support your message. Avoid overwhelming your audience with excessive text—keep your messaging concise and to the point.

Tell a Compelling Story

Storytelling is a powerful tool in your pitch deck. Weave a narrative that showcases your company's journey, including the problems you've overcome, the milestones you've achieved, and your vision for the future. Connect the dots between your company's past, present, and future to create a compelling story that resonates with investors.

Practice and Refine

Don't underestimate the importance of practice. Rehearse your pitch, seek feedback, and make adjustments as needed. Practice delivering your pitch to people outside your industry to ensure your message is clear and understandable. Refine your deck based on feedback and be open to iterating as you receive input from potential investors.

Remember, your pitch deck is a living document that may evolve as you engage with investors and receive feedback. Stay flexible, be prepared to adapt, and always focus on highlighting the strengths and potential of your company.

American Funds: The Investment Agent's Favorite Choice Explained

You may want to see also

How much funding to raise at Series B

Raising the right amount of funding is crucial for a startup's success. The amount of funding to raise at Series B depends on several factors, including the company's growth plans, market conditions, and investor expectations. Here are some key considerations for determining how much funding to raise:

Growth Plans and Runway

The amount of funding raised should be aligned with the company's growth plans and milestones. Consider your burn rate, headcount expansion, international expansion, product development, and the desired cash runway. For instance, if you aim to increase headcount, expand globally, or launch new products, you will need a larger Series B round.

Market Conditions

The state of the market significantly impacts the amount venture capitalists are willing to invest. In a competitive funding landscape with high valuations and low interest rates, investors may be more cautious. On the other hand, in a downturn, they may seek safer, more established investments. As of Q3 2023, the median size of Series B rounds for U.S. companies was $15.1 million, a decrease from previous quarters.

Investor Expectations

Investors in Series B rounds typically expect to see strong achievements and progress since the Series A round. They look for companies with solid valuations, stable revenues, and profitable growth strategies. Demonstrating traction, a sustainable growth trajectory, and a clear path to profitability will enhance your chances of securing funding.

Dilution and Share Capital

When determining the amount to raise, consider the impact on share capital and dilution. Raising too little may require additional funding rounds sooner, leading to further dilution, while raising too much may result in unnecessary dilution and reduced control for founders. It is crucial to strike a balance and raise what you need to reach your next milestone, with a reasonable buffer.

Comparable Rounds

Analyze how much other startups at a similar stage and in your industry have raised in their Series B rounds. This will give you a sense of the current market standards and investor expectations.

Timing and Interval

There is no fixed rule for the timing and interval between funding rounds. Typically, startups wait around two years after closing a Series A round before raising Series B. However, this interval may vary depending on market conditions and the company's specific circumstances.

In conclusion, the decision on how much funding to raise at Series B should be carefully calibrated to the company's growth plans, market conditions, and investor expectations. It is essential to strike a balance between raising enough capital to achieve milestones and avoiding unnecessary dilution.

International Index Funds: Diversify Your Portfolio, Maximize Returns

You may want to see also

When to raise a Series B round

There is no one-size-fits-all answer to the question of when to raise Series B funding. It depends on the specific circumstances and needs of the company, as well as market conditions. However, there are some general guidelines and considerations to keep in mind.

Timing Considerations

- Typically, startups wait for around two years after closing a Series A round before raising their Series B. This allows them to optimize cash flow and extend their runway while waiting for more favourable market conditions.

- It is important to continuously cultivate relationships with investors and always be fundraising. This approach makes the funding process more efficient and helps secure investments for future rounds.

- Series B funding is generally raised when a company has moved beyond the early startup stage and achieved specific milestones in its business development. This could include demonstrating stable revenue streams, generating profits, and reaching a solid valuation (often over $10 million).

- Series B funding is particularly relevant for companies that are ready for the development stage and need support to expand their operations and customer base.

- Series B funding can also help a company to scale its team, sales, marketing, and technology to meet the demands of its growing customer base.

- It is important to consider the amount of capital needed, the terms of the funding, and the company's goals for using the cash within a particular timeframe. This will help determine the appropriate size of the Series B round.

- The state of the market will also impact the amount venture capitalists are willing to invest. In Q3 2023, for example, the median size of Series B rounds for US companies decreased by 39.8% from Q1 2021 due to market conditions.

Investor Considerations

- Series B funding usually involves institutional investors, such as venture capital firms, and sometimes private equity firms. These investors often specialize in later-stage company investments.

- Previous investors from Series A funding rounds may also participate in Series B and can help attract new investors.

- New investors in Series B funding typically purchase shares at a higher price than earlier investors, resulting in lower returns but also lower risk.

- Series B investors will look for a credible path to profitability and a solid revenue model. They will also want to see that the company has filled important positions, such as those in the C-suite and sales leadership.

- It is important to demonstrate strong user and customer traction, as well as the ability to generate profits using a sustainable business plan.

- Series B funding can be challenging to secure as investors' focus has shifted from the goal and personnel to the profits the company is generating.

In summary, the decision to raise Series B funding depends on a combination of factors, including the company's stage of development, financial health, market conditions, and the availability and interests of potential investors. By carefully considering these factors and making a compelling case for investment, companies can increase their chances of securing the funding they need to scale and expand their operations.

UK Pension Funds: Where Is Your Money Invested?

You may want to see also

Frequently asked questions

Series B funding is the third stage of startup financing and the second stage of venture capital financing. It usually follows a Series A round of funding and is used to help companies expand their customer base, find new markets, and scale operations.

The amount of funding raised in Series B depends on the company's goals and needs. It is crucial to consider the burn rate, cash runway, and specific objectives, such as increasing headcount or launching new products. Allowing for some headroom above the anticipated round size is generally recommended.

Series A funding is about proving product-market fit and crafting a go-to-market strategy. In contrast, Series B funding focuses on demonstrating go-to-market fit and investing more heavily in strategies that are already working. Series B funding also involves expanding the customer base and scaling operations.

There is no right or wrong time, and the decision should be based on the company's specific circumstances and market conditions. Typically, startups wait for about two years after closing a Series A round before raising Series B. However, in a challenging economic climate, founders may opt to extend the time between funding rounds to optimise cash flow.

Investors in Series B funding typically seek evidence of a solid revenue model and a credible path to profitability. They focus on efficient growth rather than growth at all costs. They also look for companies with a low burn multiple and a plan to break even within a shorter timeframe.