The S&P 500 index is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization. It is considered a bellwether for the American stock market and a good indicator of its overall health. The S&P 500 is one of the most popular investments globally, and for good reason. It has returned an average of about 10% annually over time and represents hundreds of America's best companies.

The easiest way to invest in the S&P 500 is through an S&P 500 index fund or an exchange-traded fund (ETF) that tracks the index. Index funds and ETFs are investment funds that aim to replicate the performance of a specific index. They are passively managed, which means they adjust their holdings only when the underlying index changes. This makes them much cheaper than actively managed funds.

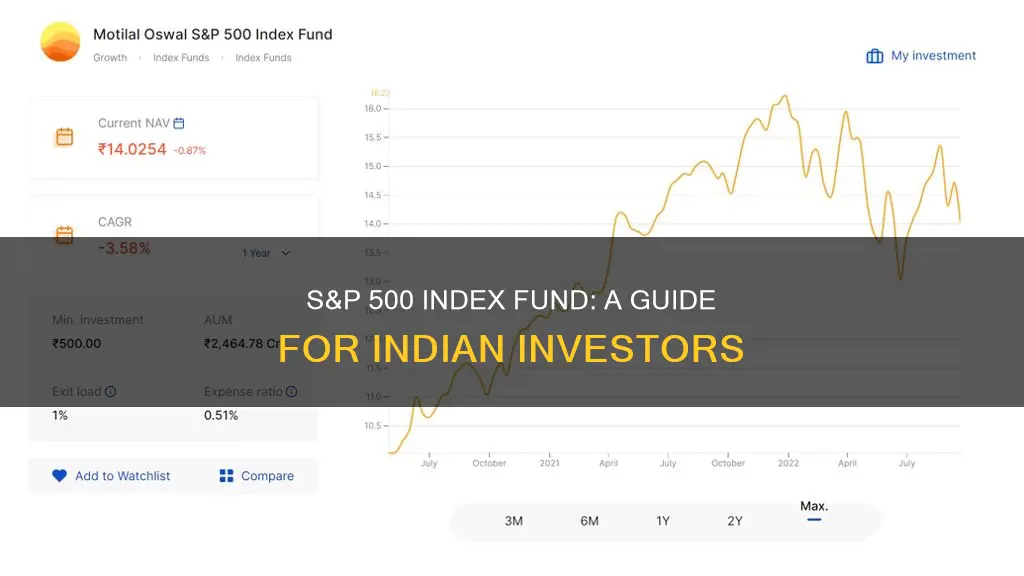

There are a few S&P 500 index funds available to Indian investors, such as the Motilal Oswal S&P 500 Index and the Vanguard S&P 500 ETF Fund. These funds allow investors to gain exposure to the top U.S. companies and benefit from the strong long-term returns of the S&P 500.

When choosing an S&P 500 index fund, it is important to consider the expense ratio, minimum investment, dividend yield, and inception date. The expense ratio is particularly important as it directly impacts your returns.

Overall, investing in the S&P 500 through an index fund or ETF is a great way for Indian investors to gain exposure to U.S. equities and diversify their portfolios.

| Characteristics | Values |

|---|---|

| Index funds or ETFs | Individuals can invest in the S&P 500 through index funds or ETFs that follow the index. |

| Account type | Investors can choose a taxable brokerage account, a 401(k), or an IRA. |

| Number of companies | The S&P 500 index features 500 major US companies. |

| Companies included | The S&P 500 includes the top 500 publicly traded companies in the U.S., such as Apple, Microsoft, Amazon, Google, Facebook, and Johnson & Johnson. |

| Investment options in India | Indian investors can invest in S&P 500 stocks through India's first index fund, Motilal Oswal S&P 500 Index Fund, and Vanguard S&P 500 ETF Fund. |

| Motilal Oswal S&P 500 Index Fund charges | The fund charges an expense ratio of 0.5% on the direct plan and 1% on the regular plan, with a minimum investment of Rs 500. |

What You'll Learn

How to open an S&P 500 brokerage account in India

Since April 2020, regulatory changes have made it easier for Indian investors to invest in S&P 500 stocks through India's first index fund, the Motilal Oswal S&P 500 Index Fund, and the Vanguard S&P 500 ETF Fund.

The Motilal Oswal S&P 500 Index Fund is an open-ended index fund designed to mimic the performance of the S&P 500 index. It is a passive fund, meaning there is no fund manager, and it will generate returns like the S&P index. The fund is available in both regular and direct plan versions, with a growth option only (meaning investors need to redeem their units at a higher price as the fund doesn't pay a dividend). The expense ratio is 0.5% on the direct plan and 1% on the regular plan, with a minimum investment of Rs 500.

The Vanguard S&P 500 ETF Fund was the first exchange-traded fund (ETF) to follow the S&P 500, giving individual investors exposure to the top companies in the index. ETFs are traded like stocks, with values that fluctuate throughout the day, and they tend to have slightly higher fees than index funds.

To open a brokerage account in India to invest in these funds, you will need to follow the standard process of opening a brokerage account, which can usually be done in 15 minutes or less. You will need to decide which type of account you want (a 401(k), an IRA, or a regular taxable brokerage account), and choose a broker that offers the type of investments you want to make without transaction fees.

Once you have selected your broker and account type, you will need to transfer money into your brokerage account. Then you can place your trade for the S&P 500 fund you want to buy, using the fund's ticker symbol and indicating how many shares you want to buy.

Advantages of Investing in the S&P 500

- Exposure to some of the world's most dynamic companies, such as Apple, Amazon, Microsoft, and Johnson & Johnson.

- Consistent long-term returns.

- No intricate analysis required—you don't need to pick stocks or have any investing expertise.

- Can serve as a core holding due to liquidity and tight bid-ask spreads.

- Low cost, with some of the lowest expense ratios on the market.

Disadvantages of Investing in the S&P 500

- The index is dominated by large-cap companies, with limited exposure to small- and mid-cap stocks.

- It includes only U.S. companies.

- There are inherent risks in equity investing, such as volatility and downside risk, which may not suit newer investors.

Other Considerations

It is important to remember that the S&P 500 should not be the majority of your portfolio. You will also need exposure to other areas of the market, such as small-cap, mid-cap, and international stocks, as well as bond holdings, to build a truly diversified portfolio.

Additionally, while the S&P 500 includes 500 of the largest U.S. companies, it is not a static list. Companies enter and leave the index as they grow and shrink, so it is important to monitor the performance of the fund and the underlying stocks.

Finally, remember that past performance is not a guarantee of future results, and any investment can produce poor returns if purchased at overvalued prices.

Pension Fund Investment: Where to Invest for Maximum Returns

You may want to see also

S&P 500 index funds vs ETFs

S&P 500 index funds and ETFs are both passively managed investment funds that track the performance of the S&P 500 index, a collection of about 500 of the largest companies in the United States. The main difference between the two is that index funds can only be bought and sold at the end of each trading day, while ETFs can be traded throughout the day on a stock exchange like stocks.

S&P 500 Index Funds

S&P 500 index funds are a type of mutual fund that tracks the performance of the S&P 500 index. They are priced once daily after the market closes, and investors can buy or sell shares directly from the fund company. Index funds have lower fees and are more tax-efficient than ETFs. They also tend to have higher investment minimums, ranging from $1 to $3,000.

ETFs

ETFs, or exchange-traded funds, are baskets of securities that trade on stock exchanges like individual stocks. They can be bought and sold throughout the trading day and offer lower fees and higher tax efficiency than index funds. ETFs also tend to have lower investment minimums, and fractional shares are often available.

Both S&P 500 index funds and ETFs are good options for long-term investors looking for low-cost, diversified investments. If you plan on trading frequently, ETFs may be a better option due to their flexibility and lower transaction costs. If you are investing for the long term and don't need to buy or sell throughout the trading day, an index fund could be a better choice. Additionally, if you are investing outside of a retirement plan, ETFs may be preferable as they do not trigger capital gains taxes when other investors cash out.

Finding Mutual Fund Managers: Where Do They Invest?

You may want to see also

Advantages of investing in the S&P 500

Investing in the S&P 500 has many advantages. Here are some of them:

- Exposure to Dynamic Companies: The S&P 500 includes some of the world's most dynamic companies, such as Apple, Amazon, and Microsoft. By investing in the S&P 500, individuals get exposure to these companies and benefit from their growth and performance.

- Consistent Long-Term Returns: Over long periods, the S&P 500 has consistently performed well, providing solid returns for investors. While there may be fluctuations in any given year, the overall trend has been positive.

- No Intricate Analysis Required: When investing in the S&P 500 through an ETF or index fund, individuals do not need to spend time analyzing or picking stocks. The fund automatically tracks the performance of the S&P 500, making it a passive investment strategy.

- Core Holding for Portfolios: S&P 500 index funds and ETFs are highly liquid and trade with tight bid-ask spreads. This makes them ideal as core holdings for most investment portfolios, providing a solid foundation for investors to build upon.

- Broad Market Representation: The S&P 500 includes a diverse range of large-cap companies across various industry sectors in the US. This provides investors with a broad view of the economic health of the country and captures the pulse of the American corporate economy.

- Regular Updates: The components of the S&P 500 are updated on a quarterly basis by a dedicated committee. This ensures that the index accurately reflects the state of the large-cap market and includes companies that meet specific criteria, such as market capitalization, public float, and US headquarters.

DFA Funds: Smart Investment, Diversified Returns

You may want to see also

Disadvantages of investing in the S&P 500

Investing in the S&P 500 index fund can be an attractive option for investors of all experience levels. However, it's important to be aware of the potential disadvantages before making any investment decisions. Here are some key drawbacks to consider:

Market Volatility

The S&P 500 has shown strong long-term growth, but it is not immune to market volatility. There can be periods of significant declines in the index value during market downturns. It's crucial to have a long-term investment horizon and be prepared for short-term fluctuations.

Lack of Individual Stock Selection

Investing in the S&P 500 means giving up control over individual stock selection. While this provides diversification benefits, it may also mean missing out on potential gains from specific stocks that outperform the broader market. Investors seeking more control over their portfolio may prefer strategies that allow them to select individual stocks.

Concentration in US Stocks

The S&P 500 Index primarily focuses on US-based companies, which can result in limited exposure to international markets. This concentration may not provide the same level of diversification benefits that could be gained from global investments. Investors seeking broader international exposure may need to explore additional investment options.

Inclusion of Underperforming Stocks

While the S&P 500 committee periodically reviews the index constituents, there may be instances where underperforming stocks remain in the index for a certain period. This can impact the overall performance of the index during those periods.

Currency and Geopolitical Risks

For investors outside the US, such as those in India, currency fluctuations between the Indian Rupee and the US Dollar can impact returns. Additionally, the performance of the S&P 500 is influenced by economic and political events in the US, which may not align with the performance of other markets, such as India.

Limited Potential for Outperformance

Index funds that track the S&P 500 aim to replicate the performance of the index, so they generally do not outperform the market. If you're seeking higher returns, you may need to consider other investment strategies or actively managed funds.

Tax Considerations

Investing in international mutual funds, such as those tracking the S&P 500, may have different tax implications compared to domestic funds. For Indian investors, gains from these funds may be taxed differently, which could affect net returns. It's important to understand the specific tax rules that apply to your situation.

While the S&P 500 index fund offers diversification and accessibility, it's important to carefully consider these disadvantages and consult with a financial advisor to determine if this investment aligns with your goals and risk tolerance.

Invest in Fidelity: New Millennium Fund for Future Growth

You may want to see also

How to select the right S&P 500 fund

When selecting the right S&P 500 fund, there are a few key things to keep in mind. Here are some detailed instructions on how to choose the right S&P 500 fund for your investment goals:

Understand the S&P 500 Index:

The S&P 500 Index is a stock market index that tracks the performance of 500 large public U.S. companies, representing about 80% of the total U.S. stock market's value. It is considered a bellwether for the American stock market and provides a diverse range of companies across industries.

Evaluate Investment Options:

You can invest in the S&P 500 through index funds or exchange-traded funds (ETFs) that follow the index. Index funds are passively managed, aiming to replicate the index's performance. ETFs trade like stocks and offer intraday liquidity, while index funds are bought and sold at the end of each trading day.

Compare Expenses:

When selecting an S&P 500 fund, consider the expense ratio, which is the annual fee charged by the fund manager. S&P 500 index funds typically have slightly higher expense ratios than ETFs due to higher operating expenses. However, both options are generally low-cost compared to other types of investments.

Analyze Performance:

Review the historical performance of the S&P 500 funds you are considering. Look at their fact sheets, returns over time, and how closely they track the underlying index. Remember that past performance does not guarantee future results, but it can give you an idea of how the fund has performed in different market conditions.

Consider Your Investment Goals:

Different S&P 500 funds may have varying levels of diversification and risk. Consider your investment goals, risk tolerance, and time horizon. If you are investing for the long term, focus on funds with a strong track record of performance and low fees. If you are more risk-averse, look for funds with a more diversified portfolio that includes mid-cap and small-cap stocks.

Research Brokerage Options:

You will need a brokerage account to purchase S&P 500 funds. Compare brokers that offer a wide range of ETFs and mutual funds without trading fees. Also, consider the ease of use, customer support, and any additional features that align with your investment needs.

Monitor and Review:

Once you've selected and invested in an S&P 500 fund, remember to regularly monitor its performance and review your investment strategy. Stay informed about any changes in the underlying index, the fund's management, and how it aligns with your financial goals.

Remember that investing in the S&P 500 through index funds or ETFs offers broad exposure to the U.S. stock market and provides a relatively low-cost and diversified investment option. Always do your research, consider your financial situation and goals, and seek professional advice when needed.

India's Best Investment Funds: Where to Invest?

You may want to see also

Frequently asked questions

The S&P 500 is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization. It is considered a bellwether for the American stock market and offers a diversified pool of stocks for investors.

Indian investors can invest in the S&P 500 through index funds or exchange-traded funds (ETFs) that track the index. Some options include the Motilal Oswal S&P 500 Index Fund and the Vanguard S&P 500 ETF Fund. These funds allow you to gain exposure to U.S. companies and diversify your portfolio.

Investing in the S&P 500 offers several advantages, including ownership of many companies, diversification, low costs, solid historical performance, and ease of buying. It provides exposure to some of the world's most dynamic companies and has consistently generated strong returns over the long term.