The Saudi Stock Exchange, or Tadawul, is the largest stock exchange in the region, with over 150 listed companies. It is one of the three leading emerging market exchanges in the world. Tadawul permits only established institutional foreign investors, not individual investors, to trade. A qualified foreign investor has at least $5 billion in assets under management and has been in business for at least five years. Non-Saudi investors can open a brokerage account with one of the exchange members to buy and sell shares. This article will explore the steps and requirements for an Indian investor to invest in Tadawul.

| Characteristics | Values |

|---|---|

| Number of listed companies | More than 150 |

| Market capitalization | Over 40% of total GCC market capitalization |

| Sectors | Financial services, energy, and others |

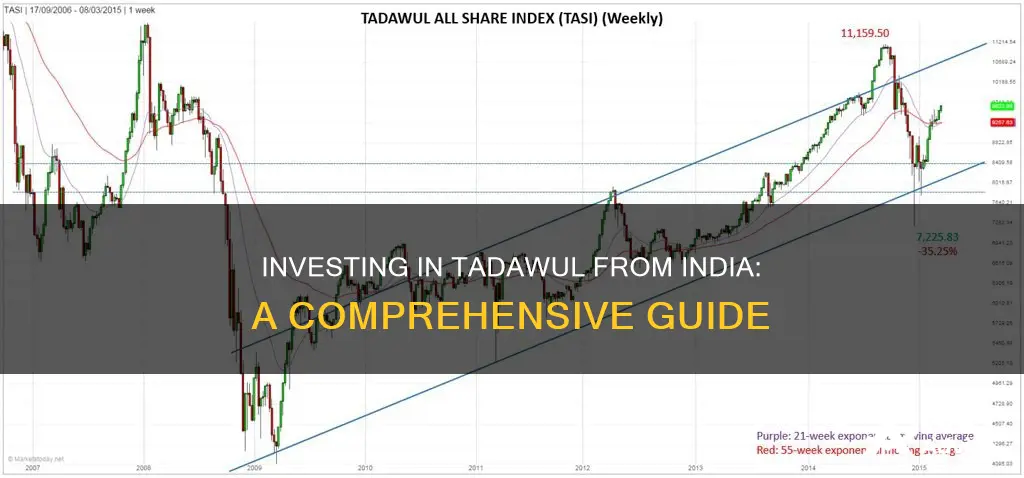

| Main Index | Tadawuhl All Share Index (TASI) |

| Top companies | Saudi Aramco, Arab National Bank, Al Tazaj, Jarir Bookstore |

| Requirements for non-Saudi investors | Open a brokerage account with one of the Exchange members or enter into a swap agreement with an Authorized Person |

| Requirements for individual investors | Open a brokerage account with one of the Exchange members |

What You'll Learn

Eligibility criteria for opening an investment account

To open an investment account in the Saudi Exchange (Tadawul), you must meet the eligibility criteria set out by the Securities Depository Center Company ("Edaa"). The following investors are eligible to open investment portfolios:

Joint Stock and Limited Liability Companies:

- Submit a copy of the commercial register.

- Provide a copy of the company's by-laws, articles of association, annexes, and any amendments.

- Provide a copy of the board of directors' resolution approving the investment portfolio and authorizing signatories.

- List the persons authorized to manage the account and provide copies of their identification cards.

- Provide a list of all company owners included in the memorandum of association and copies of their identification cards.

- If the company requires licenses from other government authorities to operate, provide copies of those licenses.

Charitable and Social Institutions and Associations:

- Submit a copy of the license and by-laws of the charitable or social association or institution.

- Provide a copy of the resolution from the relevant public entity approving the investment.

- Provide a copy of the resolution from the charitable or social association or institution appointing the person who will manage the investment portfolio and cash account, along with their identification card.

- Provide a copy of the Authority's letter of approval for the charitable and social institutions and associations.

- Provide a copy of the title deeds of the endowment and the appointment of the trustee, along with their identification card.

Licensed Mutual Funds:

- Provide a copy of the license to establish the mutual fund.

- Submit a letter from the fund manager stating the name of the person authorized to manage the investment portfolio, along with their identification card.

Public Institutions or Government Funds:

- Provide a copy of the statute or by-laws of the public institution or government fund.

- Submit a copy of the resolution stating the name of the person authorized to manage the investment portfolio, along with their identification card or residence permit (for non-GCC nationals).

- Provide a copy of the Authority's letter of approval for the public institution or government fund.

Additional Requirements for Individuals:

For Saudi/GCC nationals:

Provide a copy of the identification card or family card.

For non-GCC nationals:

Provide a copy of a valid residency permit card (Iqama) and passport.

Additional Requirements for Nonprofit Organizations & Entities:

- Provide a copy of the license issued by the relevant government authority.

- Submit a copy of the board resolution approving the opening of the account.

- Provide a copy of the articles of association.

- Obtain authorization from the board of directors for the persons who will open, deal with, and operate the accounts, along with copies of their identification cards.

- Provide a copy of the Authority's approval to accept the client and open the account.

- Submit copies of all other required documents as per the organization's law and regulations.

It is important to note that these are general guidelines, and for specific instructions on opening a brokerage account, individuals should refer to the requirements of their chosen brokerage firm, such as Emirates NBD Capital. Additionally, regulations limit foreign investment in Saudi stocks to financial institutions and billionaires, with further restrictions on the number of shares a foreigner can buy.

Lucrative Investment Management: A Career Path to Consider

You may want to see also

Steps to open a brokerage account

- Choose a brokerage firm: The first step is to choose a brokerage firm that aligns with your investment goals and preferences. You can opt for an online brokerage account if you want to actively manage your investments or choose a managed brokerage account with a human investment advisor or a robo-advisor.

- Complete the application: You can typically complete the application process online within 15 minutes. Provide the necessary personal and financial information, and review the terms and conditions.

- Fund the account: After opening the account, you will need to deposit funds into your brokerage account. You can transfer money from your bank account or another brokerage account. Some brokers may require you to verify the transaction by depositing a small sum into your bank account first.

- Start investing: Once your brokerage account is funded, you can begin investing in various financial instruments, such as stocks, bonds, mutual funds, or ETFs. Remember to consider your investment goals, risk tolerance, and conduct thorough research before making investment decisions.

- Understand the tax implications: Profits from selling investments in a brokerage account are typically subject to capital gains taxes. Consult with a financial advisor or tax professional to understand the tax implications of your investments.

Building a Minimum Variance Portfolio: Strategies for Investors

You may want to see also

Investment limits on company shares

The Tadawul, or the Saudi Stock Exchange, imposes several restrictions on foreign investment in Saudi stocks. Only established institutional foreign investors are permitted to trade on the exchange, and these investors must have at least $5 billion in assets under management and have been in business for a minimum of five years.

In addition to these requirements, there are several limits to direct investment in Saudi companies that investors should be aware of:

- A foreign investor may own no more than 5% of the shares issued in any one company.

- All foreign investors (resident or non-resident) may collectively own no more than 49% of any company's shares.

- All qualified foreign investors collectively are limited to 20% of a single company's shares and 10% of all the shares of all the companies listed on the exchange.

These limits on foreign ownership prevent foreigners from gaining majority control of Saudi companies.

Rebuilding Your Investment Portfolio: Strategies for Success

You may want to see also

How to trade on the Saudi Exchange

The Saudi Exchange, or Tadawul, is the largest stock exchange in the region, with more than 150 companies listed, commanding over 40% of the total GCC market capitalization. It offers access to financial services and energy industries, among other sectors.

To trade on the Saudi Exchange, eligible investors must be Saudi or GCC nationals or Saudi residents. They should visit a member of the Exchange to open an investment portfolio. The member firm will verify an investor's eligibility. The following investors are eligible to open investment portfolios:

- Joint-stock and limited liability companies

- Charitable and social institutions and associations

- Licensed mutual funds

- Any other person authorized by Capital Market Law and its implementing regulations to own and trade securities

Saudi/GCC nationals and Saudi residents meeting the above criteria will need to provide identification documents to access the depository and settlement system. These include:

- For Saudis and GCC nationals: a copy of the identification card or family card.

- For non-GCC nationals: a copy of a valid residency license card (Iqama) and the passport.

- A copy of the commercial register.

- A copy of the company's by-laws or articles of association, its annexes, and any amendments.

- A copy of the board of directors' resolution approving the opening of an Investment Portfolio for the company and granting power to those who will sign on behalf of the company.

- Copies of the identification cards of members of the board of directors of the listed joint-stock company.

- Copies of the commercial register, license, and letter of engagement in business submitted to the Saudi Exchange.

Additional Requirements for the Parallel Market:

The Saudi Exchange's Nomu-Parallel Market is an alternative platform for companies to go public with lighter listing requirements. As a result, investment in this market is restricted to Qualified Investors who meet at least one of the following criteria:

- Capital Market Institutions trading on their own account.

- Clients of a person authorized by the Authority to conduct managing activities provided that this Authorized Person has been appointed as an investment manager on terms that enable them to make decisions concerning the acceptance of an offer and investment in Nomu-Parallel Market on the client's behalf without obtaining prior approval from the client.

- The Government of the Kingdom, any government body, any supranational authority recognized by the Authority or the Exchange, and any other stock exchange recognized by the Authority or Securities Depository Center Company ("Edaa").

- Government-owned companies either directly or through a portfolio managed by a person authorized to carry out managing activities.

- Companies and funds established in a GCC member state.

- Investment Funds.

- Non-resident foreigners permitted to invest in the Parallel Market and who meet the requirements stipulated in the Guidance Note for the investment of Non-Resident Foreigners in the Parallel Market.

- Qualified foreign financial institutions.

- Any other legal persons allowed to open an investment account in the Kingdom and an account at the Securities Depository Center Company ("Edaa").

- Natural persons allowed to open an investment account in the Kingdom and an account at the Securities Depository Center Company ("Edaa"), and who fulfill any of the following criteria:

- Have conducted transactions in security markets of not less than 40 million Saudi Riyals in total, and not less than ten transactions in each quarter during the last twelve months.

- Have net assets of not less than 5 million Saudi Riyals.

- Have worked for at least three years in the financial sector.

- Hold the General Securities Qualification Certificate, recognized by the Authority ("CME-1").

- Hold a professional certificate related to securities business and accredited by an internationally recognized entity.

Any other persons prescribed by the Authority.

Additional Requirements for the Derivatives Market:

Before opening a derivatives account, investors should be aware of the risks and returns associated with trading derivatives. To trade, the investor should open an account through a broker who is a Derivatives member of the Exchange. Additional eligibility requirements apply to investors looking to trade derivatives, including:

- Institutions: All institutional and corporate clients, as well as Individual DPMs.

- Individual DPMs: Saudi individual investment accounts where the manager (Authorized Person) makes buy/sell decisions for the client without referring to the account owner.

- Level 1 Individuals: Individual Qualified Clients who fulfill any of the following criteria:

- Have conducted transactions of not less than SAR 40 million, and not less than 10 transactions in each quarter during the last 12 months.

- Have an average portfolio size of SAR 5 million for the preceding 12 months.

- Have worked for at least three years in financial sectors in jobs related to securities investments.

- Hold General Securities Qualification Certificates recognized by the Authority.

- Hold professional certificates related to securities business and accredited by an internationally recognized entity.

- Level 2 Individuals: Clients who are not under any of the other categories defined above.

Saving and Investing: Your Guide to Financial Freedom

You may want to see also

Additional eligibility requirements for trading derivatives

To trade on the Saudi Exchange, eligible investors must meet specific criteria. The following investors are permitted to open investment portfolios:

- Joint-stock and limited liability companies

- Charitable and social institutions and associations

- Licensed mutual funds

- Any other persons authorised by Capital Market Law to own and trade securities

To open a derivatives account, investors should be aware of the associated risks and returns. Additional eligibility requirements apply to investors looking to trade derivatives:

Institutions: All institutional and corporate clients, as well as Individual DPMs (a Saudi individual investment account where the manager makes buy/sell decisions without referring to the account owner).

Level 1 Individuals: Individual Qualified Clients who meet any of the following criteria:

- Conducted transactions of not less than SAR 40 million, with a minimum of 10 transactions per quarter over the last 12 months.

- Maintained an average portfolio size of SAR 5 million over the preceding 12 months.

- Worked for at least three years in the financial sector in a role related to securities investments.

- Hold the General Securities Qualification Certificate recognised by the Authority.

- Hold a professional certificate related to the securities business and accredited by an internationally recognised entity.

Level 2 Individuals: Clients who do not fall under any of the other categories.

To trade derivatives, investors should open an account through a broker who is a Derivatives member of the Exchange. If an investor already has an equities trading account, they may need to sign an additional agreement with their broker.

In India, there are three key prerequisites to trading in derivatives:

- Possess an active demat account.

- Open a trading account in India.

- Maintain a specific percentage of cash, known as 'margin money', in your trading account.

Creating a Compelling Investment Portfolio for Clients

You may want to see also

Frequently asked questions

Non-Saudi investors can buy and sell shares on the Tadawul by opening a brokerage account with one of the exchange members.

The requirements vary depending on whether you are a Saudi national, an individual expatriate, or a legal person. For example, Saudi nationals need to provide their National Identification Card or family record, as well as their residential address, place of work, and work address. Individual expatriates need to provide a residence permit or a passport if they are a Gulf Cooperation Council (GCC) national. Legal persons must provide documentation about the nature of their business, ownership, and control structure.

Yes, regulations limit foreign investment in Saudi stocks to financial institutions and billionaires. There are also limits to the number of shares any foreigner can buy and the collective ownership of foreign investors in any company.

To trade on the Tadawul, eligible investors should visit a member of the exchange to open an investment portfolio. The member firm will verify the investor's eligibility, including their nationality or residency status, and ensure they meet the conditions set out by the Securities Depository Center Company ("Edaa").