TD e-Series funds are a popular investment option in Canada, offering a passive index portfolio with low management expense ratios (MERs). These funds are index mutual funds, meaning they follow a passive investment strategy and replicate the performance of an underlying stock market index. TD e-Series funds were previously only available through TD, but can now be purchased from various discount brokerages, making them more accessible to investors.

One of the main advantages of TD e-Series funds is their low MERs, which can result in significant savings compared to actively traded mutual funds. Additionally, there are no trading fees associated with these funds, making them a cost-effective option for investors.

To invest in TD e-Series funds, individuals can open a TD Direct Investing account or a discount brokerage account with another provider. The funds can then be purchased through the respective platform, with a minimum investment of $100 for initial and subsequent trades. It is important to note that TD e-Series index funds have a 30-day holding period, and selling units within this period will incur an early redemption fee.

Overall, TD e-Series funds offer a simple, low-cost, and diversified investment option for Canadians, making them suitable for both beginners and experienced investors.

| Characteristics | Values |

|---|---|

| Type of fund | Index mutual funds |

| Investment strategy | Passive |

| Underlying stock market index | S&P/TSX index (changing) |

| MER | .33% |

| Brokerages | TD Direct Investing, CIBC Investors Edge, RBC Direct Investing |

| Holding period | 30 days |

| Early redemption fee | 2% |

What You'll Learn

How to open a TD e-Series Funds Account

TD e-Series Funds are an excellent way to invest in a TFSA, RRSP, RESP, or non-registered account. They have one of the lowest Management Expense Ratios (MERs) available on the market and give you the flexibility to manage your investment portfolio.

Step 1: Become a customer of TD Canada Trust (EasyWeb) and get a FREE no-fee savings account with them (no minimum balance required). You can do this online or by visiting a local branch.

Step 2: Deposit money into your TD savings account from your external bank account. You can do this by writing a cheque or linking the two accounts.

Step 3: Open a TD Mutual Funds account (RRSP, TFSA, or Non-Registered). You can do this by speaking to a financial advisor at a local TD branch. They will ask you a series of questions to complete your investor profile and determine your risk tolerance.

Step 4: Ignore the pleas to buy their high MER, low-return mutual funds.

Step 5: Put all your money into your no-fee savings account or a Mutual Fund Bond Index.

Step 6: Convert your TD Mutual Funds account into an e-series Mutual Funds account by filling out and submitting the e-Series Funds Account Conversion Form. You can find this form on the TD Canada Trust website.

Step 7: Wait for the confirmation email that welcomes you to the world of TD Mutual Funds E-Series. This may take up to 2 weeks. If you do not receive an email, check your online account to see if e-Series funds are now available to purchase.

And that's it! You've successfully opened a TD e-Series Funds Account.

It is important to note that TD e-Series Funds have a minimum investment amount of $100, and you can invest as little as $25 per fund per purchase when using a Pre-Authorised Purchase Plan (PPP). There is also a 2% Early Redemption Fee if you sell your funds within 30 days of purchasing them.

BPI Short-Term Fund: A Smart Investment Strategy

You may want to see also

How to buy TD e-Series funds through TD EasyWeb

TD e-Series funds are a popular method for investing in a passive index portfolio in Canada. They are known for having one of the lowest Management Expense Ratios (MERs) available on the market and giving investors the flexibility to manage their investment portfolio.

Step 1: Set up a TD EasyWeb account

If you don't already have a TD EasyWeb account, you will need to set one up. You can do this by visiting the TD Canada Trust website or by calling 1-800-640-2150 for registration information.

Step 2: Open a TD Mutual Funds Account

To purchase TD e-Series funds, you will need to open a TD Mutual Funds account. You can do this by visiting a local TD branch and speaking to a financial advisor or representative. They will ask you a series of questions to complete your investor profile and determine your risk tolerance. Make sure to bring your Social Insurance Number (SIN) card and another piece of government-issued ID.

Step 3: Convert your TD Mutual Funds Account to a TD e-Series Account

After setting up your TD Mutual Funds account, you will need to complete the e-Series fund's account conversion form. You can find this form on the TD website or by requesting it from a TD representative. Mail the completed form to the TD e-Series Funds Administration address on the form. You should receive a confirmation email within 1-2 weeks. If you do not receive an email, check your online account to see if e-Series funds are available for purchase.

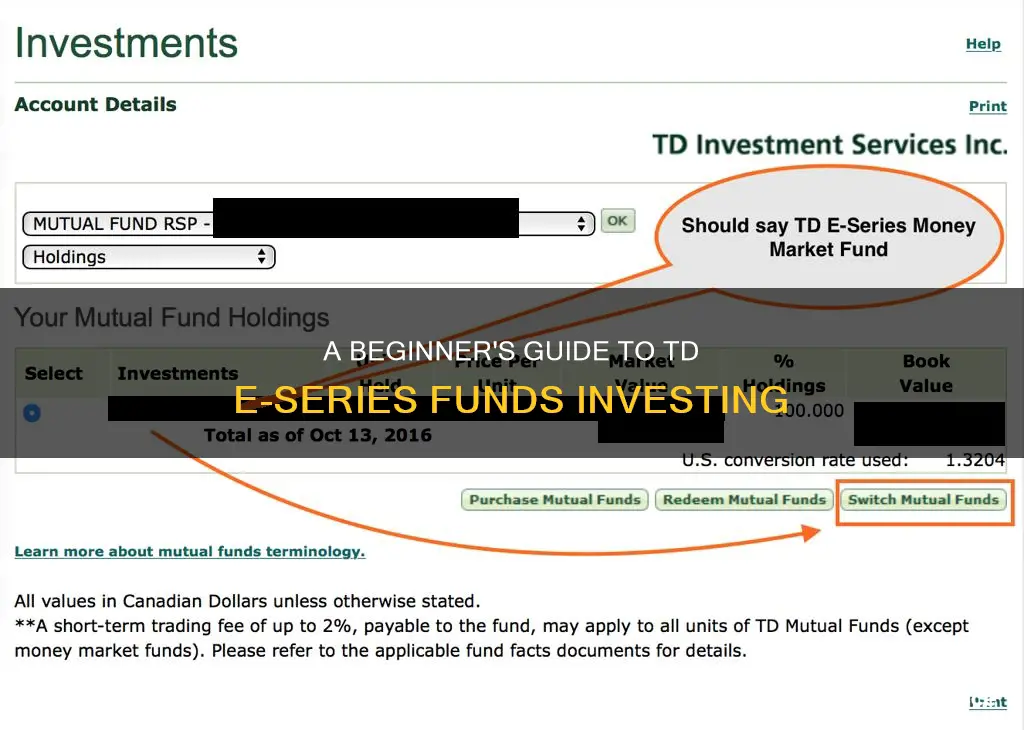

Step 4: Access your TD e-Series Funds Account through TD EasyWeb

Log in to your TD EasyWeb account using your access card code. Once logged in, navigate to the "Investments" section and click on any of the "WebBroker" links. This will take you to the TD Direct Investment portal.

Step 5: Select your desired TD e-Series Fund

Click on the account that you want to make your TD e-Series purchase in. Make sure that you have cash funds in that account to make the purchase. Select the "Buy/Sell" icon at the top of the page and then select the "Mutual Funds" tab. You will need to have funds available to trade, shown as "Cash" in the top right corner of the buy window.

Step 6: Complete the purchase

Select the "Buy" option and search for the symbol name of the TD e-Series fund you want to purchase by typing it in. You can choose to buy in dollars or units. Select whether you want your dividends to be reinvested or paid out in cash into the same account. Review all the details and select the "Agree & Send Order" button to finalize your purchase.

You will receive a confirmation page with the details and a reference number for your purchase. Your order will be placed at the end of the current trading day or the next trading day if the markets are closed.

By following these steps, you can successfully purchase TD e-Series funds through TD EasyWeb. Remember to consider your financial goals and risk tolerance when investing, and consider speaking to a financial advisor for personalized advice.

A Guide to Aditya Birla's Mutual Fund Investment

You may want to see also

How to buy TD e-Series funds through TD Direct Investing

To buy TD e-Series funds through TD Direct Investing, you will need to set up some accounts. This can be done online or in person by setting up a meeting with a TD Direct Investment representative from your local bank. You can also open a Tax-Free Savings account and/or a Self-Directed RSP account for your investments, which are both available in the TD online application.

To access the TD Direct Investment portal, log in to your TD EasyWeb account with your access card code, the same way you would for your day-to-day banking. Once logged in, scroll to your investments section on the main overview page and click on any of the "WebBroker" links. This will take you to the TD Direct Investment portal.

Now, click on the account in which you want to make TD e-Series purchases. Note that you will need to have cash funds in that account to make any purchases. Select the "Buy/Sell" icon at the top of the page and then the "Mutual Funds" tab of the buy window. You will need to make sure you have funds available to trade (shown as "Cash" in the top right corner of the buy window). You will also need to fill in the following fields:

- Like in a TD Mutual Fund Account, you can "Buy", "Sell" or "Switch". If you are buying funds, select the "Buy" option.

- Search and select the symbol name for the TD e-Series fund that you want to purchase. They should show up as you start to type them in. If you are using the Canadian Couch Potato strategy for your e-Series funds, here are the Symbols:

> TDB900 – TD Canadian Index Fund-e

> TDB902 – TD U.S. Index Fund-e

> TDB909 – TD Canadian Bond Index Fund-e

> TDB911 – TD International Index Fund-e

- You can choose to buy in dollars or in the amount of units. It is recommended to choose dollars to make sure you know exactly how much you are buying.

- You can select to either have your dividends reinvested or paid out in cash into the same account. It is recommended to reinvest the dividends – you can always cash them out later.

- Check the "Amount (including commission)" box. Don't let the word "commission" scare you – there are no commissions when purchasing TD e-Series funds.

- You will need to fill in a Trading password (this option can be turned off in your settings). If you didn't receive one when you opened the accounts, you will have to call the TD Direct Investment phone line and get them to assign you a temporary one.

- Select the "Preview Order" button on the bottom right to continue.

- Make sure to confirm all of your details in this window. The preview screen also shows that you will be charged $0 for your commission and provides some additional warnings about minimum holding periods and long-term fees charged by TD Direct Investing – the usual fees associated with holding the investment. Select the "Agree & Send Order" button to finalize your purchase.

- You will now be given a confirmation page that your order was received, with the details and a reference number. Your purchase is now complete.

You can now repeat the above process for all of the funds you want to include in your TD e-Series portfolio.

Fidelity Mutual Funds: Investing in Corporate Debt

You may want to see also

How to move from TD Mutual Funds to TD Direct Investing

To move from TD Mutual Funds to TD Direct Investment, you'll need to physically go to the bank. Here's a step-by-step guide:

- Call ahead and make an appointment. Mention that you want to open a TD Direct Investment account.

- Bring a void cheque from the bank you want to withdraw investment funds from. The representative will be able to use this as your default withdrawal account.

- Ask to open a TFSA and/or RRSP account and tell the TD Direct Investment representative that you want to transfer funds from your current TD Mutual Fund account to the new TD Direct Investment account. Specify that you want the funds to be transferred directly and that you want the same funds you currently have.

- Don't be bullied or swayed by the representative. You can answer honestly that you prefer the low fees and personal management of the TD e-Series funds.

- Sign the papers they provide to open your new TD Direct Investment account.

- Wait a week or two for your new account to be opened. You should receive an email confirmation when it's ready. Your money will not have been transferred yet.

- Sign the transfer payments paperwork to authorize the switch in funds from your TD Mutual Fund account to your TD Direct Investment account. This will take another week or two for the funds to transfer.

- Confirm your transfer. You should receive another email from TD confirming your purchases in your new TD Direct Investment account.

Now you can take advantage of the TD Direct Investment platform's features, contribute to your TFSA and RRSP through bill payments, and access a wider range of investment options.

Explore Top Funds for Payment Company Investors

You may want to see also

How to rebalance your portfolio

Even if you're investing in index funds, your portfolio can begin to drift. Because of the way that funds operate, not to mention shifting market conditions, you might end up with more shares of one fund than another. This can bring your portfolio out of balance and result in sub-par performance.

In order to get back on track, you should rebalance your portfolio back to its original asset mix at least once per year.

Determine Your Target Allocations

Firstly, you need to determine your target allocations based on your risk level. This can be done by filling out a questionnaire, such as the Customer Information Profile (CIP) provided by TD. This will help you understand your risk tolerance and determine the appropriate asset mix for your portfolio.

Calculate How Much Your Portfolio May Be Skewed

Next, you need to calculate how much your portfolio has strayed from your target allocations. This can be done by comparing the current value of your investments to your target allocations.

Make Trades to Switch Funds

Once you know which funds are over or underweighted, you can make trades to switch funds instead of selling and buying. This can be done through your TD Direct Investing account.

Use New Money to Rebalance

If you have new money available to invest, you can put it into the underperforming funds to bring them back up to the proper allocation.

Sell Shares of Better-Performing Funds

If you don't have enough funds to rebalance, you can sell some shares of the better-performing funds and then put the proceeds into the underperforming funds. This forces you to buy low and sell high, which is a preferred strategy when investing.

Use a Robo-Advisor

If you would rather not rebalance your portfolio yourself, you can consider using a robo-advisor service, such as Wealthsimple, which will automatically rebalance your portfolio for you.

Market Downturn: Mutual Fund Investment Strategies and Tips

You may want to see also

Frequently asked questions

TD e-Series funds are index mutual funds, meaning that they follow a passive investment strategy and are designed to replicate the performance of an underlying stock market index.

The major advantage of the TD e-Series is its low Management Expense Ratio (MER). The TD Canadian Index (tdb900) has a current MER of .33%. When compared with your typical actively traded equity mutual fund at over 2.00%, it represents huge savings in investment fees.

The easiest way to buy TD e-Series funds is with a discount brokerage account, either through TD or another provider. If you already have an account, it’s as easy as selecting the fund and making the purchase, with no trading fees. Depending on where you hold your account, there may be a minimum purchase amount.

Unlike ETFs, you do not need to be very concerned about the time of day or day of the week that you buy/sell the TD e-series funds. Just like mutual funds, the TD e-series funds are only bought and sold once per day and are bought at the 'end of day' price. If you order your TD e-series funds before 3 pm, then you will get that day's 'end of day' price. If you order the TD e-series funds after 3 pm, then you will get the 'end of day' price for the next business day.