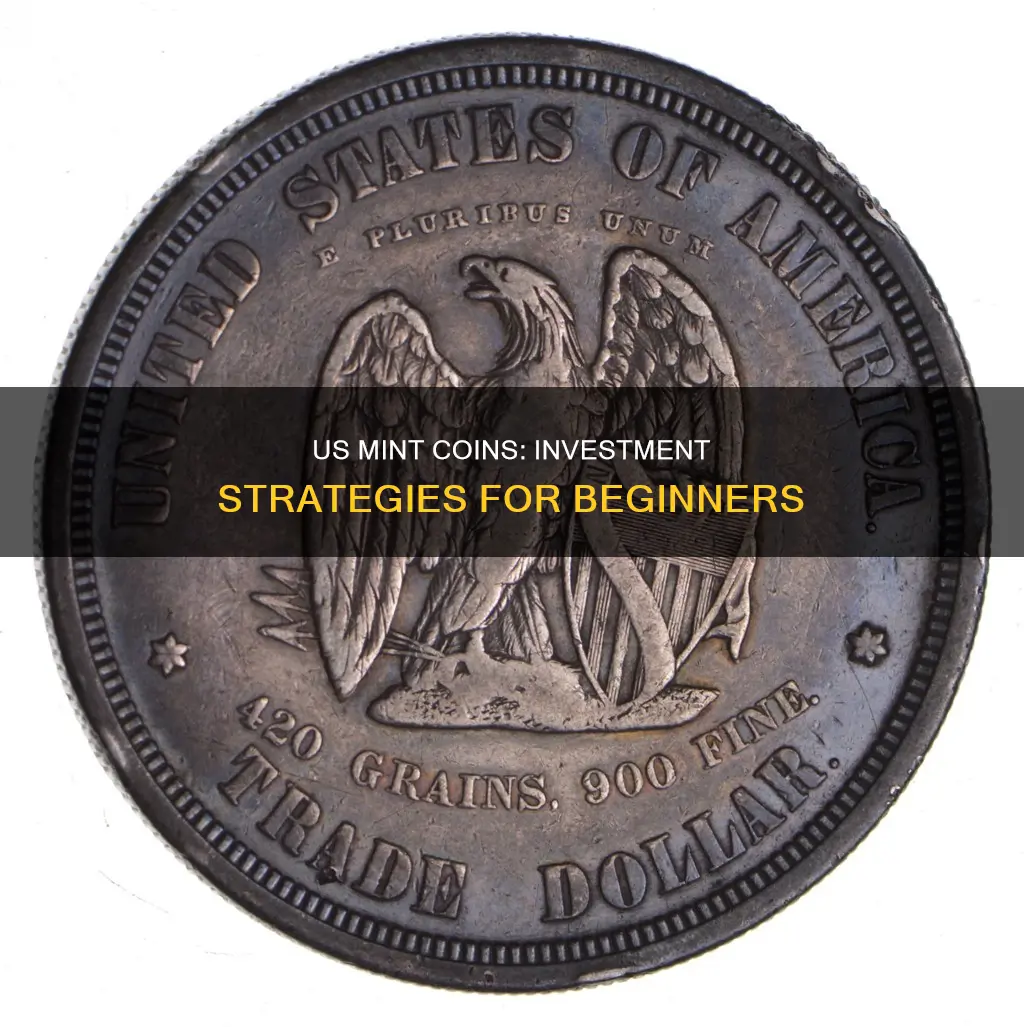

US Mint coins are a popular investment choice, but is it a good idea to invest in them? The answer is subjective and depends on various factors. US Mint silver and gold coins have been around since 1964, so they may not have the same value as they once did. However, US Mint bullion coins are a good investment today due to their high value. The best way to profit from US Mint coins is to capitalise on their rarity, as rare coins are more valuable to collectors and investors. The US Mint website provides an easy way to purchase these coins, with a user-friendly interface and professional customer service. The American Eagle Bullion Coin Program, launched in 1986, offers gold, silver, platinum, and palladium coins. US Mint coins are graded based on factors such as surface preservation, strike quality, errors, and luster, with coins with less wear and tear being more valuable.

| Characteristics | Values |

|---|---|

| Type of Coin | Bullion, Numismatic (collector's), or Commemorative |

| Metals | Gold, Silver, Platinum, Palladium |

| Purchase Options | Authorized purchasers, precious metals wholesalers, private investors, local bullion coin dealers |

| Price | Prevailing market price of the metal + small premium for minting, distribution, and marketing |

| Grading | Based on surface preservation, strike quality, errors, and luster. Graded on a scale from 1 to 70, with 70 being flawless. |

| Rarity | Rare coins with low circulation are more valuable and fetch higher prices. |

| Design | Some coins have commemorative designs encapsulating historically significant moments. |

What You'll Learn

The benefits of collecting US Mint coins

Coin collecting is one of the world's oldest hobbies, historically practised by royalty and the very wealthy. Today, anyone can be a coin collector and there are many benefits to collecting US Mint coins.

Firstly, US Mint coins offer a rich history, making collecting a rewarding hobby. People collect coins for various reasons, including historic or artistic value, or as a long-term investment. For example, the US Mint's annual coin sets are the staple of coin collecting and include uncirculated coins, proof sets, and commemorative coins. These coins often feature rich symbolism and artistry to commemorate important aspects of American history, making them valuable collectibles.

Secondly, coin collecting can be a good way to diversify an investment portfolio. Rare coins, in particular, can provide significant profits over time, although it is important to note that earning money from rare coins can take time. The value of a rare coin is typically influenced by factors such as demand and the condition of the coin. For example, a coin with scratches, bag marks, or corrosion will have a lower value than one in pristine condition.

Additionally, coin collecting can be a fun and educational hobby. Collectors can learn about the history of US Mint coins, the coin-making process, and the artists behind the coin designs. The US Mint also offers resources for kids to learn about coins, such as coin-related games and activities.

Lastly, coin collecting can be a social hobby. Collectors can connect with other numismatists (coin collectors) through coin clubs, shows, and auctions. These social aspects of coin collecting can provide opportunities to learn from more experienced collectors, as well as to buy, trade, and sell coins.

Jasmy Coin: A Smart Investment Move?

You may want to see also

How to buy and sell US Mint coins

The United States Mint does not sell its bullion coins directly to the public. Instead, it distributes the coins through a network of official distributors called "Authorized Purchasers", who then sell to wholesalers, financial institutions, and other secondary retailers. To become an Authorized Purchaser, your firm must meet certain financial and professional criteria.

The US Mint also provides consumer alerts and guidelines for businesses interested in manufacturing, advertising, and selling numismatic items that incorporate genuine US coins. For example, it is prohibited to alter US coins with the intent to defraud, and the US Mint owns the copyright to several coin designs.

If you are looking to buy US Mint coins, you can find Authorized Purchasers online. Some Authorized Purchasers advertise what they are buying on their websites and even offer virtual quote cards with the prices they will pay for certain coins.

When selling US Mint coins, there are several options. You can sell them in-person at a traditional storefront coin dealer or sell them online. Selling in-person allows you to talk to a dealer face-to-face and get a check immediately, while selling online may result in a higher offer from a dealer who needs the specific coins you are selling.

- Do not clean your coins, as this can reduce their value by up to half and may be a deal-breaker for some dealers.

- Know what type of coins you have, such as slabbed or graded coins, and research their approximate value. Keep in mind that coin price guides typically list retail values, and you may receive 20-50% less when selling to a dealer.

- If selling gold or silver coins, find out the current bullion prices to get a sense of what offer to expect.

- Take precautions to keep yourself and your coins safe, such as avoiding flaunting your coins and being discreet when shipping them.

Bitcoin Investment: A Reliable Bet?

You may want to see also

Grading systems for US Mint coins

The condition or state of wear of a coin, or its "grade", is a major factor in determining its value. Learning how to grade coins is essential when buying, selling, or investing.

In the early days of coin collecting, dealers relied on their individual experiences, observations, and opinions to grade coins, resulting in a lack of standardisation. Over time, discussions were held by the American Numismatic Association (A.N.A.) to create a universal grading system. This culminated in the publication of the "Official A.N.A. Grading Standards for United States Coins" in 1978, which represented a consensus among professional numismatists.

The two main grading services in the industry, Numismatic Guaranty Corporation (NGC) and Professional Coin Grading Service (PCGS), use the Sheldon Scale, invented by Dr. William H. Sheldon in 1949. The Sheldon Scale assigns grades from "1" to "70" to coins, with "70" being the best grade possible and indicating a perfect coin with zero marks and no ill-toning.

The NGC's grading process is unique as it involves two leading numismatic experts grading any one coin, ensuring that no factor in the coin's condition is overlooked. Additionally, NGC's graders are anonymous and prohibited from being involved in the commercial coin-selling business, preventing bias in the grading process.

The following sections provide an overview of the grading scales for circulated and uncirculated coins, as well as a description of the factors considered during the grading process.

Circulated Coins

Circulated coins have been used to some extent in daily commerce and exhibit varying degrees of wear. The grades for circulated coins are determined based on factors such as the amount of wear, the visibility of the design, the condition of the rims, and the clarity of the legends and numerals.

The circulated grades range from About Good (AG-3) to Choice About Uncirculated (AU-58). An About Good coin is heavily worn, with portions of the lettering, date, and legends being worn smooth, while a Choice About Uncirculated coin exhibits only slight traces of wear on the highest points of the design, retaining almost full luster.

Uncirculated and Proof Coins

Uncirculated coins are new coins that have never been in circulation and exhibit no wear from general circulation. Depending on their storage conditions and contact with other coins, they may have blemishes, bag marks, or toning. Uncirculated coins are graded from Mint State (MS-60) to Mint State (MS-70), with higher grades reflecting sharper details and fewer bag marks.

Proof coins, on the other hand, are made by a special process using carefully selected coin blanks and dies. They are struck at slow speed and with extra pressure, resulting in high-relief features and deep mirror-like surfaces. Proof coins are graded in a separate category, from Proof (PR-60) to Proof (PR-70), based primarily on eye appeal, quality of luster, and the presence of contact marks, hairlines, etc.

Bitcoin: Dumb Investment or Smart Bet?

You may want to see also

Investing in rare US Mint coins

US Mint coins are a good investment option for those looking to diversify their portfolios away from stocks and bonds. The value of these coins is not tied to market trends but is influenced by factors such as demand, rarity, and the condition of the coin. Rare US Mint coins have the potential to provide significant profits, especially over the long term.

US Mint coins have been around since 1964, so they may not have as much value as they did in the past. However, the introduction of US Mint bullion coins has made them a good investment option today due to their high value.

The most profitable way to make money from US Mint coins is to capitalise on their rarity. Rare coins are more likely to fetch higher prices among collectors and investors. These rare coins can be purchased from the US Mint website, which provides an easy-to-use interface for purchases.

When it comes to investing in rare US Mint coins, it is important to look for those with historical and aesthetic value. The best coins to purchase are those with less wear and tear as they tend to fetch higher prices. The grading of the coin before purchase ranges from 1 to 70, with the highest value coins graded at 70. These are considered flawless and of museum quality.

Additionally, proof coins, which have a shiny, mirror-like finish, are struck twice instead of once, making them rarer and more valuable.

Overall, investing in rare US Mint coins can be a profitable strategy, especially for long-term investors. However, it is important to do adequate research and only purchase coins from reputable dealers to avoid counterfeits or doctored coins.

Hero Coin: A Good Investment Option?

You may want to see also

Storing and protecting your collection of US Mint coins

Tools and Supplies:

- A high-quality magnifying glass is useful for inspecting your coins.

- Use a soft cloth or pad when handling and viewing your coins to prevent scratches and damage.

- A plastic ruler is recommended as metal rulers may scratch the coins.

- Invest in a reference book that includes information on dates, mint marks, varieties, grading guidelines, and prices to help you identify and value your coins.

- Consider purchasing coin holders, folders, albums, gloves, and a soft pad for storing and handling your coins safely.

- For more advanced collectors, additional supplies such as a digital scale, a digital caliper, a stereo microscope, a natural daylight lamp, a high-quality digital camera, and coin cataloguing software may be beneficial for authenticating and cataloguing your collection.

Handling and Storage:

- Always handle coins with care. Hold them by their edges between your thumb and forefinger over a soft surface to avoid fingerprints and natural oils from your skin, which can be corrosive.

- Wash your hands before handling your coins to minimise the possibility of damage.

- Avoid the temptation to polish your coins, as this can reduce their value. Older coins with deep age coloration are often more desirable than coins that have been polished or cleaned.

- If you need to clean a coin, use only mild soap and water, and pat it dry with a soft towel. Brushing or rubbing can scratch the delicate surface.

- Keep coins in a cool, dry place, as sharp changes in temperature and moisture can cause discolouration and reduce their value.

- Use original holders and cases provided by the US Mint whenever possible. Modern coin sets and coins are typically packaged in protective plastic cases, folders, capsules, or boxes.

- For high-value coins, consider using hard plastic holders or sealed holders (slabs) provided by professional coin grading services for added protection and authentication.

- Ensure that the cardboard and plastic holders you use are acid-free and free from polyvinyl chloride (PVC), as acid and PVC can damage the surface of your coins over time.

- Consider storing your coins in a safe-deposit box at a bank for added security. If you choose to store them at home, ensure that your home insurance covers full replacement costs in case of theft or damage.

- Take precautions to maintain a certain level of anonymity and privacy regarding your collection, as sharing too many details outside the coin-collecting community may attract unwanted attention.

Shiba Inu Coin: Worthy Investment or Risky Gamble?

You may want to see also

Frequently asked questions

The United States Mint does not sell its bullion coins directly to the public. Instead, it distributes its coins through a network of official distributors called “authorized purchasers”. You can find a local bullion dealer on the US Mint website.

The types of US Mint coins to consider depend on your investment goals and available funding. You can choose from bullion coins or numismatic coins. Bullion coins are valued by their weight and fineness of a specific precious metal. Numismatic coins have a certain inherent and intangible value determined by the coin’s condition, rarity, and precious metal content.

Precious metals are a resilient asset class. They have an intrinsic value that stocks, bonds, and mutual funds lack. US Mint coins provide risk management and act as a hedge against inflation through strategic diversification. US-minted coins as investments also attract premium values.