The VIX, or the Cboe Volatility Index, is a benchmark index for market volatility based on S&P 500 options. When the market is volatile, the VIX rises, and when it is relatively calm, it falls. The VIX is often called the fear index because it rises when investors are uncertain about market movements and falls when there is more predictability in securities' prices. Investors can use VIX exchange-traded funds (ETFs) to invest based on their feelings about whether the market will become volatile in the near future. However, it is crucial for investors to know that VIX ETFs tend to lose money in the long run, making them suitable only for short-term trades by active investors.

| Characteristics | Values |

|---|---|

| What is VIX? | The VIX, or the Cboe Volatility Index, is a standardized measure of market volatility. It is often called the "fear index" as it rises when investors are uncertain about market movements. |

| How is VIX calculated? | The VIX is calculated using the implied volatility of a basket of options on the S&P 500—both those about to expire and those expiring next month. |

| How to invest in VIX? | VIX ETFs exist but they track VIX futures indexes instead of the index directly. VIX ETFs are highly risky and suitable only for short-term trades by active investors. |

| Examples of VIX ETFs | iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX), ProShares VIX Mid-Term Futures ETF (VIXM), ProShares Ultra VIX Short-Term Futures ETF (UVXY), Simplify Volatility Premium ETF (SVOL) |

What You'll Learn

Understanding the VIX and how it works

The VIX, or the Cboe Volatility Index, is a real-time index that represents the market's expectations for the relative strength of near-term price changes of the S&P 500 Index. It is often referred to as the "fear index" because it rises when investors are uncertain about market movements and falls when there is more predictability in securities' prices. The VIX is a standardised measure of market volatility and is often used to track investor fear.

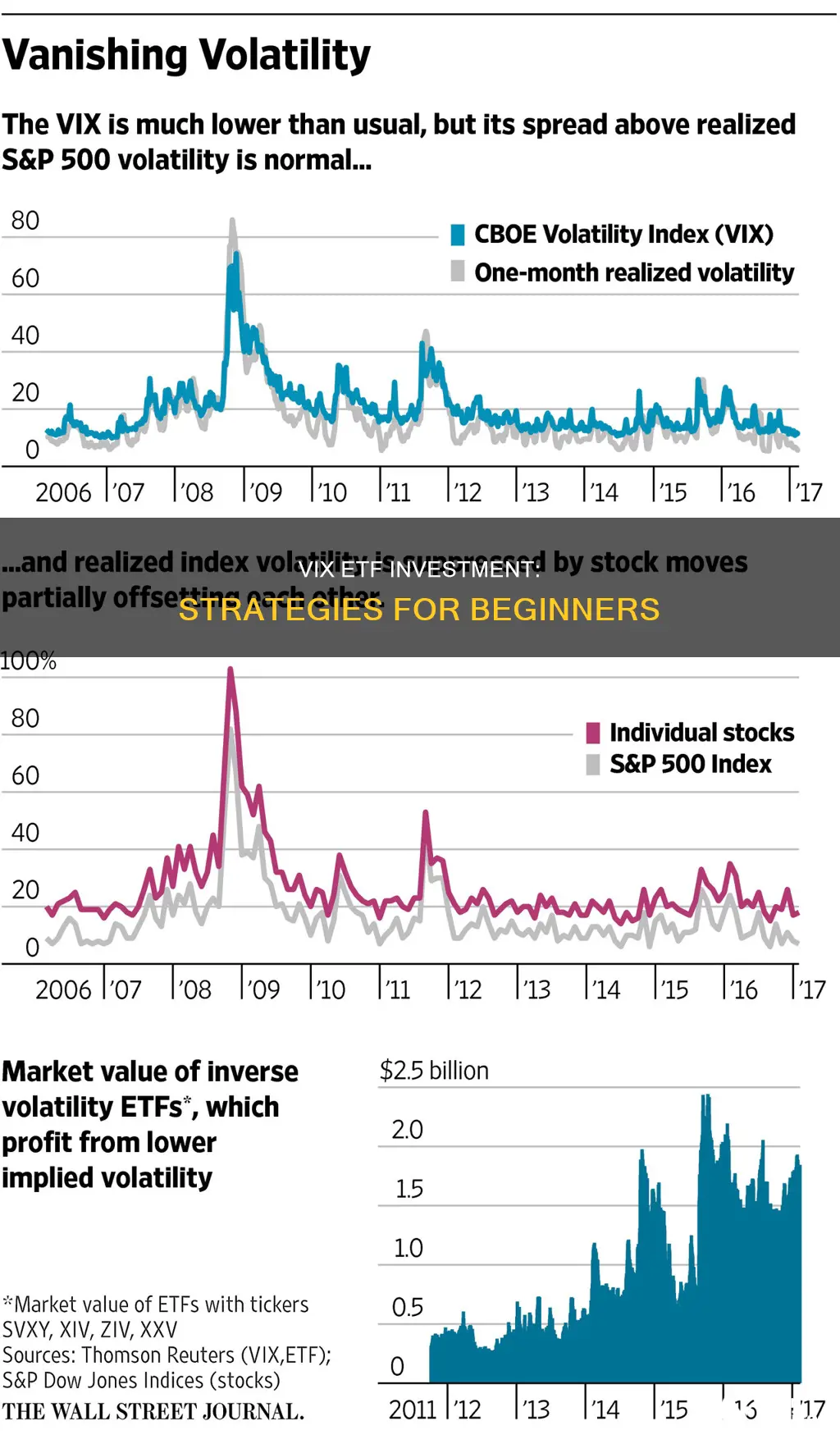

The VIX is calculated using the implied volatilities extracted from the prices of index options on the S&P 500. It is intended to reflect the market's expectation of 30-day volatility. The more dramatic the price swings in the index, the higher the level of volatility, and vice versa. The VIX generally rises when stocks fall and declines when stocks rise.

The VIX is a useful tool for mainstream investors looking to trade stocks directly. Investors can also trade based on the VIX in other ways, such as through VIX options and VIX futures, which allow investors to make wagers based on the volatility index itself. VIX-linked exchange-traded funds (ETFs) are also available, although these are more complex than standard ETFs.

It is important to note that investors cannot buy the VIX index directly. Instead, they can access it through futures contracts, ETFs, and exchange-traded notes (ETNs) that own those futures contracts. The potential issue with VIX ETFs is that they track VIX index futures rather than the index directly, which can lead to a decay in ETF positions over time.

Due to the nature of the VIX and its tendency to spike during market turmoil, VIX ETFs are considered risky and are generally not recommended for long-term investments. They are more suitable for short-term trades by active investors looking to profit from market volatility.

Invest in Vietnam: A Guide to Vietnam-Focused ETFs

You may want to see also

How VIX ETFs work

The VIX, or the Cboe Volatility Index, is a benchmark index for market volatility based on S&P 500 options. When the market is volatile, the VIX rises, and when it is relatively calm, it falls. It is often called the "fear index" because it rises when investors are uncertain about market movements and falls when there is more predictability in securities' prices.

VIX ETFs are exchange-traded funds that track the VIX. They are designed to gain value when the market is volatile and lose value when the market is calm. However, it is important to note that VIX ETFs do not track the VIX directly. Instead, they track VIX futures indexes. This is because the VIX itself is not something that can be bought or sold directly.

VIX ETFs are considered more complex than standard ETFs that track a basket of stocks. They are also known for not being great at mirroring the VIX, with one-month ETN proxies capturing only about 25% to 50% of daily VIX moves. Additionally, VIX ETF positions tend to decay over time as a result of the behaviour of the VIX futures curve.

Due to the nature of the VIX and the complexities of VIX ETFs, these funds are generally not recommended for long-term investing. Instead, they are better suited for short-term trades by active investors.

ETFs: Niche Strategies or Broad Investment Focus?

You may want to see also

Risks of VIX ETFs

VIX ETFs are complex financial products that carry significant risks. Here are some key risks to consider:

Risk of Loss and Volatility

VIX ETFs tend to lose money in the long run, making them suitable only for short-term trades by active investors. They are designed to gain value when the market is volatile and lose value when the market is calm. However, they are highly volatile and can experience massive losses when volatility levels spike. These losses can be so significant that they can virtually annihilate the ETF due to a single period of high volatility. Therefore, VIX ETFs are not suitable for risk-averse investors or long-term investment strategies.

Decay Over Time

VIX ETFs often underperform the VIX index and tend to decay over time due to the behaviour of the VIX futures curve. As VIX ETF positions decay, they have less money to roll into subsequent futures contracts as existing ones expire. This process repeats multiple times, resulting in most VIX ETFs losing money over the long term.

Contango

The potential problem with VIX futures contracts is contango, where the futures price is higher than the current price. In this situation, investors pay a premium each time they buy futures, essentially buying high and selling low, eroding the value of their investment over time. Contango is a common issue with VIX futures, and it can significantly impact the performance of VIX ETFs.

Tracking Issues

VIX ETFs are known for not accurately mirroring the VIX index. One-month Exchange-Traded Notes (ETN) proxies captured only about 25-50% of daily VIX moves, and mid-term products tend to perform even worse. This is because VIX futures indexes, which serve as benchmarks for VIX ETFs, struggle to emulate the VIX index effectively.

Complexity and High Costs

VIX ETFs are more complex than standard ETFs that track a basket of stocks. They use derivatives and are often structured as Exchange-Traded Notes (ETNs), introducing counterparty risk. Additionally, VIX ETFs can be expensive to invest in, with relatively high expense ratios compared to other investment options.

Mexico ETF: A Smart Investment Strategy

You may want to see also

How to buy VIX ETFs

VIX ETFs are complex and risky, and they are not suitable for long-term investors. They are designed for traders who want to make short-term, tactical trades. If you believe that market volatility is about to rise, or you want to hedge another investment against volatility, a short-term VIX position could be a good idea.

You can buy VIX ETFs through your brokerage account. You can submit a buy order to designate the number of shares to buy, or a buy-limit order, which lets you set both the number of shares to buy and the maximum price you’re willing to pay per share.

It's important to remember that VIX ETFs don't reflect the VIX index. They track VIX futures indexes, which means that over periods of a month or a year, the return pattern of VIX ETFs will differ radically from that of the VIX index.

- ProShares VIX Mid-Term Futures ETF (VIXM)

- IPath Series B S&P 500 VIX Short-Term Futures ETN (VXX)

- ProShares Ultra VIX Short-Term Futures ETF (UVXY)

- Simplify Volatility Premium ETF (SVOL)

ETFs: A Smart Investment Strategy for Your Money?

You may want to see also

Best VIX ETFs to buy

The VIX, or the Cboe Volatility Index, is a benchmark index for market volatility based on S&P 500 options. When the market is volatile, the VIX rises, and when it is calm, it falls. It is often called the "fear index" because it rises when investors are uncertain about market movements and falls when there is more predictability in securities' prices.

VIX ETFs are exchange-traded funds that investors can use to invest based on their feelings about whether the market will become volatile in the near future. However, VIX ETFs tend to lose money in the long run, making them suitable only for short-term trades by active investors.

- ProShares VIX Mid-Term Futures ETF (VIXM): This fund tracks an index that measures the return of VIX futures contracts with roughly five months until expiration. It has a three-year return of 58% and an expense ratio of 0.85%.

- IPath Series B S&P 500 VIX Short-Term Futures ETN (VXX): This fund uses VIX futures contracts with one or two months until expiration. It has a three-year return of -36.64% and an expense ratio of 0.89%.

- ProShares Ultra VIX Short-Term Futures ETF (UVXY): This fund offers exposure to short-term volatility in the S&P 500 and is leveraged to produce a return equal to 1.5 times the movement in its benchmark each day. It has a three-year return of -67.40% and an expense ratio of 0.95%.

- Simplify Volatility Premium ETF (SVOL): This fund sells VIX derivatives to other investors and buys VIX call options to limit the negative impact of spikes in volatility. It has a quarterly return of 6.41% and an expense ratio of 0.54%.

- Short VIX Short-Term Futures ETF (SVXY): This ETF targets half of the inverse (-0.5X) of the daily returns of the S&P 500 VIX Short-Term Futures Index. It is suitable for experienced investors looking to profit from declines in the expected volatility of the S&P 500 over one month.

- IPath S&P 500 VIX Mid-Term Futures ETN (VXZ): This exchange-traded note provides investors with exposure to the S&P 500 VIX Mid-Term Futures Total Return Index. It is designed for sophisticated investors looking to take tactical, short-term positions on expected market volatility in the medium term.

Things to Consider

Before investing in VIX ETFs, it is important to keep the following in mind:

- VIX ETFs are short-term investments: VIX ETFs are designed for short-term tactical trades and are not suitable for long-term investors. They tend to lose value over time due to their use of derivatives.

- VIX ETFs can be expensive: The expense ratios of VIX ETFs can be high, ranging from 0.54% to 0.95%.

- VIX ETFs are risky: VIX ETFs can be extremely volatile and are considered high-risk investments. They are not suitable for all investors.

- Do your research: Understand how the VIX and VIX ETFs work, including their unique risks, before adding them to your portfolio.

Africa ETF: A Guide to Investing in the Continent's Future

You may want to see also

Frequently asked questions

The VIX, or the Cboe Volatility Index, is a benchmark index for market volatility based on S&P 500 options. When the market is volatile, the VIX rises. When the market is relatively calm, it falls.

You can buy VIX ETFs through your brokerage account. You can submit a buy order to designate the number of shares to buy, or a buy-limit order, which lets you set both the number of shares to buy and the maximum price you’re willing to pay per share.

VIX ETFs tend to gain value when the VIX rises, so you should buy VIX ETFs when you expect market volatility to increase. This can be very difficult to predict, so it’s important to only invest amounts you’re willing to lose.

VIX ETFs can profit from market volatility and are easier to understand and use than derivatives. They are best for short-term trading. However, they can be expensive, tend to lose value over time, and are not recommended as a long-term holding.