Investing in equity funds is a great way to gain exposure to a diversified portfolio of stocks. Equity funds pool money from investors to purchase a portfolio of stocks, also known as equity securities. The fund managers aim to generate returns for the investors. While investing in stocks carries more risk than some other investments, equity funds can diversify with stocks from many different companies, thus offering some protection from the risk of one or more stocks underperforming.

There are two primary categories of equity funds: actively managed funds and passive funds. Actively managed funds have portfolio managers who actively research, analyse and select stocks with the goal of outperforming a benchmark index. Passive funds, on the other hand, aim to replicate the performance of a specific market index and do not attempt to outperform the market.

1. Determine your investment goals, risk tolerance and time horizon.

2. Consider the different types of equity funds available, such as actively managed, passive index or sector-specific funds, and choose the one that aligns best with your goals and risk profile.

3. Conduct thorough research and analysis of potential funds by reviewing the fund's prospectus, annual and quarterly reports, and performance data.

4. Open an investment account with the fund company or a brokerage firm that offers access to a wide range of funds.

5. Fund the account by transferring money from a bank account or another investment account.

6. Buy shares of the desired equity fund, keeping in mind the minimum initial investment requirement.

7. Monitor your investments regularly and consider rebalancing your portfolio as needed.

| Characteristics | Values |

|---|---|

| Definition | A type of investment fund that pools money from investors to trade primarily a portfolio of stocks, also known as equity securities. |

| Type of investment | Stocks, bonds, or other securities |

| Benefits | Diversification, professional management, and the potential for superior returns |

| Risks | Stock market volatility and losses |

| Categories | Actively managed funds, passive funds, large-cap funds, mid-cap funds, small-cap funds, growth funds, value funds |

| Investment style | Actively managed funds have portfolio managers who actively research, analyze and select stocks with the goal of outperforming a benchmark index. |

| Investment style | Passively managed funds include index funds, which aim to replicate the performance of a specific market index. |

| Investor suitability | Depends on goals, risk tolerance, and investment philosophy |

| Taxes | Returns are generated through capital gains and dividends, which are taxed differently |

| Investment process | Determine investment goals, risk tolerance, and time horizon; research and analyze potential funds; buy shares |

What You'll Learn

Understand the different types of equity funds

Equity funds are often classified according to the size of the companies they invest in, the investment strategy, and whether they are actively or passively managed.

Actively vs Passively Managed Funds

Actively managed funds have portfolio managers who actively research, analyse and select stocks with the goal of outperforming a benchmark index, such as the S&P 500. The success of these funds depends on the fund manager's skill and decision-making ability. Passively managed funds, on the other hand, include index funds, which aim to replicate the performance of a specific market index. Passive fund managers do not attempt to outperform the market but instead track the index as closely as possible.

Market Capitalisation

Market capitalisation refers to the total market value of a company's outstanding shares. Equity funds are often categorised based on the size of the companies they invest in. Large-cap funds invest in stocks of large companies, usually exceeding $10 billion in market capitalisation. These companies are typically well-established and mature, with a history of stable growth and consistent dividends. Mid-cap funds invest in stocks of mid-size companies, which are still considered to be in the growth phase of their life cycle. Small-cap funds invest in stocks of smaller companies, typically with a market capitalisation of under $2 billion. These companies are often younger and less established but offer the potential for high growth.

Investment Strategies

Equity funds can also be classified based on their investment strategy, with two main categories: growth funds and value funds. Growth funds invest in stocks of companies expected to have rapid earnings growth, while value funds buy stocks that are considered undervalued based on fundamental analysis. Blend equity funds invest in a mix of both growth and value stocks, aiming to balance the two investment strategies.

Sector and Geographic Focus

Equity funds can also be categorised based on their focus on specific sectors or geographic regions. Sector funds invest in stocks of companies operating within a particular industry, such as technology, healthcare or real estate. Geographically focused funds, also known as regional funds, buy stocks of companies based in certain areas of the world.

Municipal Bond Funds: A Smart Investment Strategy

You may want to see also

Know the benefits and risks of investing in equity funds

Benefits of Investing in Equity Funds

Equity funds offer investors a professionally managed, diversified approach to investing in stocks, with the potential for attractive long-term returns. Here are some key benefits:

- Diversification: Equity funds invest in a wide range of stocks across different sectors and industries, helping to spread investment risk. This risk management strategy minimises the impact of any single investment's performance on the overall portfolio.

- Professional Management: Fund managers bring experience and expertise to investing in stock markets, aiming to outperform market benchmarks and generate superior returns for investors.

- Attractive Returns: Historically, stocks have offered the potential for higher returns than other asset classes like bonds and cash. Equity funds aim to provide long-term wealth creation, making them attractive to those building wealth over time.

- Liquidity: Open-ended equity mutual funds offer high liquidity, allowing investors to redeem units partially or fully at any time.

- Tax Efficiency: Equity mutual funds are considered one of the most tax-efficient investment options. Taxation arises only on redemption or dividend payout, and long-term capital gains below a certain threshold are often tax-exempt.

- Regulation: Equity funds are regulated by securities authorities, such as the Securities Exchange Board of India (SEBI), which protects investors' interests and ensures safer investments.

Risks of Investing in Equity Funds

While equity funds offer potential benefits, it's crucial to understand the associated risks:

- Market Risk: Economic downturns, geopolitical events, or shifts in investor sentiment can cause stock prices to decline, leading to potential short-term losses for investors.

- Volatility: The stock market experiences fluctuations and periods of volatility, which can impact the performance of equity funds.

- Management Fees: Actively managed funds often come with higher management fees, eating into overall returns.

- Tax Implications: Equity funds generate returns through capital gains and dividends, which are taxed differently. Short-term capital gains are typically taxed at a higher rate than long-term gains.

- Credit Risk: This is the risk of a company being unable to pay its debts, which could impact the performance of equity funds holding its stocks.

- Foreign Currency Risk: Changes in international currency values can affect a company's worth and, consequently, the performance of equity funds holding its stocks.

- Liquidity Risk: If a company fails to meet its short-term debt obligations, it can impact the liquidity of equity funds holding its stocks.

- Political Risk: Political changes or instability in a company's operating region can affect its returns and, by extension, the performance of associated equity funds.

- Economic Concentration Risk: If a company's value is heavily concentrated in a single entity, sector, or country, its worth can be disproportionately impacted by declines in that specific area.

Mutual Fund Investment Guide for Filipinos

You may want to see also

Learn how to invest in equity funds

Equity funds are a type of investment fund that pools money from multiple investors to purchase a portfolio of stocks, also known as equity securities. The fund managers then aim to generate returns for the investors. Equity funds are also known as stock funds due to their focus on stocks.

Equity funds offer investors a professionally managed, diversified approach to investing in stocks, with the potential for attractive long-term returns. While investing in stocks carries more risk than some other investments, equity funds diversify with stocks from many different companies, thus offering some protection from the risk of one or more stocks underperforming.

There are two primary categories of equity funds: actively managed funds and passive funds. Actively managed funds involve portfolio managers actively researching, analysing, and selecting stocks with the goal of outperforming a benchmark index, such as the S&P 500. The success of these funds largely depends on the fund manager's skill and decision-making ability. Passive funds, on the other hand, include index funds, which aim to replicate the performance of a specific market index, such as the S&P 500. Passive fund managers do not aim to outperform the market but instead try to track the index as closely as possible.

- Investment Objectives and Select the Fund Style: Determine your investment goals, risk tolerance, and time horizon. Consider the different types of equity funds available, such as actively managed, passive index, or sector-specific funds, and choose the one that aligns best with your goals and risk profile.

- Research and Analyse Potential Funds: Review the fund's prospectus, annual and quarterly reports, and financial news and research platforms to gather information about the fund's performance, holdings, management style, and decision-making process.

- Open an Investment Account: You can typically open an account directly with the fund company or through a brokerage firm that offers access to a wide range of funds from multiple providers. Provide personal information, such as your name, address, and date of birth, and fund the account by transferring money from a bank account.

- Buy Shares of the Equity Fund: Once your account is open and funded, you can buy shares of the desired equity fund. Many funds have a minimum initial investment requirement, ranging from a few hundred to several thousand dollars. Monitor your investments regularly and consider rebalancing your portfolio as needed.

It is important to note that investing in equity funds carries risks, primarily due to the volatility of the stock market. Before investing, carefully consider the fund's investment objectives, risk factors, and charges. Understand the fees associated with the fund, as these will impact your overall investment returns.

A Guide to Investing in SBI Nifty Index Fund

You may want to see also

Compare equity funds with other types of funds

Equity funds are a type of investment fund that pools money from investors to primarily buy a portfolio of stocks, also known as equity securities. They are also known as stock funds.

Equity Funds vs. Income Funds

Equity funds are often compared with income funds. The former is considered to carry higher risk and offer potentially higher returns, while the latter focuses on generating regular income through investments in fixed-income securities like bonds or the money market, and are used to mitigate risk.

However, the distinction between the two is not as clear-cut as it once was, and many investors choose funds that offer both equity growth potential and income generation.

Equity Funds vs. Debt Funds

Equity funds are also compared with debt funds, with the former typically offering higher returns over the long term, but with greater risk. Debt funds, on the other hand, invest in debt instruments and offer fixed returns. They are considered less risky and are favoured by investors with lower risk tolerance.

Equity Funds vs. Mutual Funds

Equity funds are a type of mutual fund, which pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Mutual funds are known by the kinds of securities they invest in, their investment objectives, and the type of returns they seek.

Types of Mutual Funds

Mutual funds fall into four main categories: stock, money market, bond, and target-date funds.

Advantages of Mutual Funds

Mutual funds offer diversification, professional management, and the potential for superior returns. They are also highly liquid and are subject to industry regulations.

Disadvantages of Mutual Funds

Mutual funds often carry high fees, commissions, and other expenses. They may also suffer from a "cash drag", where a significant part of their portfolios must be held in cash to satisfy share redemptions.

The Social Security Trust Fund: Where is it Invested?

You may want to see also

Explore alternative investments to equity funds

Equity funds are a type of investment fund that pools money from investors to primarily trade a portfolio of stocks, also known as equity securities. They are also known as stock funds due to their focus on stocks.

There are alternative investments to equity funds that you can consider. These alternative investments are financial assets that do not fall into conventional investment categories such as stocks, bonds, or cash. Here are some alternative investment options to consider:

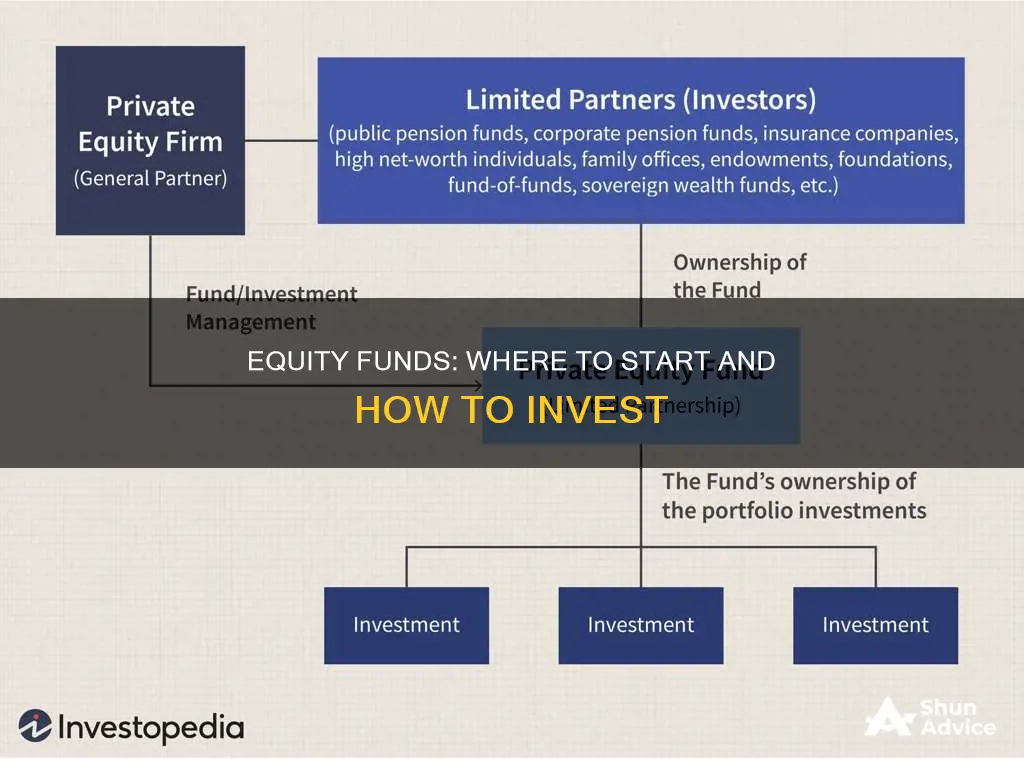

- Private equity or venture capital: This involves investing in private companies or startups, often through private equity firms, venture capital funds, or crowdfunding platforms. Private equity companies often provide more than just capital; they may also offer industry expertise, talent sourcing assistance, and mentorship to founders.

- Hedge funds: Hedge funds are investment funds that trade liquid assets using various strategies to achieve high returns. They are typically exclusive to institutional investors or high-net-worth individuals.

- Real estate: Real estate is a common alternative investment that includes investing in physical properties, property-based securities, real estate crowdfunding platforms, or real estate investment trusts (REITs). It offers the potential for capital appreciation and ongoing cash flow through rent.

- Commodities: Commodities are tangible assets such as gold, silver, oil, agricultural products, or other natural resources. They are considered a hedge against inflation and can be traded on commodity platforms, exchange-traded funds (ETFs), or mutual funds.

- Art and collectibles: These investments may include art, sports memorabilia, entertainment memorabilia, high-end watches, or other collectibles. Their value may increase over time due to historical worth or the success of associated parties.

- Cryptocurrency: Cryptocurrency is a form of digital currency that exists outside the traditional scope of stocks and bonds. It offers the potential for capital appreciation or passive income through staking rewards.

- Peer-to-peer lending: Peer-to-peer lending involves making loans to individuals or businesses through online platforms that connect borrowers and investors. It is similar to investing in bonds but often entails transacting with riskier clients.

These alternative investments offer benefits such as portfolio diversification, higher potential returns, and protection against inflation. However, they also come with higher fees, complexity, and risk compared to traditional investments. It is important to conduct thorough research and due diligence before investing in any alternative investment opportunities.

Index Funds: Investing Basics for Beginners

You may want to see also

Frequently asked questions

An equity fund is a type of investment fund that pools money from multiple investors to buy a portfolio of stocks, also known as equity securities. The fund managers aim to generate returns for the investors. Equity funds are also known as stock funds.

Equity funds offer investors a professionally managed, diversified approach to investing in stocks, with the potential for attractive long-term returns. They also provide benefits such as diversification, professional management, and the potential for superior returns.

Equity funds carry risks associated with stock market volatility and losses. The main risk is market risk, which refers to the potential decline in stock prices due to economic downturns, geopolitical events, or changes in investor sentiment.

When choosing an equity fund, consider your investment goals, risk tolerance, and time horizon. Different types of equity funds include actively managed funds, passive index funds, and sector-specific funds. Select a fund that aligns with your goals and risk profile.

To invest in equity funds, you need to determine your investment objectives, risk tolerance, and time horizon. Then, research and analyse potential funds, considering factors such as fund performance, fees, and investment strategies. Finally, open an investment account and purchase shares of the desired equity fund.