Planning for retirement can be daunting, but it's important to make sure your savings last. Here are some tips to help you invest your retirement funds wisely:

- Calculate your retirement expenses and income to determine how much you'll need to cover with your savings.

- Decide which accounts to withdraw from first, considering tax efficiency and your overall financial picture.

- Set aside one year's worth of cash to supplement your income from annuities, pensions, Social Security, and other sources. Hold this money in a safe, liquid account.

- Create a short-term reserve equivalent to two to four years' worth of living expenses, investing in high-quality, short-term bonds or other fixed-income investments.

- Invest the rest of your portfolio in a mix of stocks, bonds, and cash investments that align with your goals, risk tolerance, age, income needs, and financial goals.

- Consider working with a financial advisor or using a robo-advisor to help you make investment decisions and manage your portfolio.

- Remember that your investment strategy may need to adapt over time as your circumstances change.

| Characteristics | Values |

|---|---|

| Average retirement age | 60-65 |

| Average retirement duration | 20-40 years |

| Average life expectancy for a person who reaches age 65 in the U.S. | 85 years |

| Average inflation rate | 3% |

| Recommended savings rate | 10-15% of income |

| Investment options | Annuities, bonds, total return investment approach, income-producing equities, stocks, cash-value life insurance, mutual funds, index funds, ETFs, individual stocks and bonds |

| Types of retirement plans | Defined contribution plans, traditional pensions, guaranteed income annuities, Federal Thrift Savings Plan, cash-value life insurance plan, nonqualified deferred compensation plans, IRAs, 401(k)s, 403(b)s, 457(b)s, SEP IRAs, SIMPLE IRAs, solo 401(k)s |

What You'll Learn

How much should I save?

Determining how much to save for retirement depends on a variety of factors, including your income, age, financial goals, and risk tolerance. Here are some guidelines and strategies to help you decide how much to set aside for your retirement:

- Recommended Savings Rate: Many financial advisors suggest saving between 10% to 15% of your income for retirement. However, this may vary depending on your individual circumstances, so it's essential to consult a retirement calculator or a financial professional to assess your trajectory and determine a more precise savings target.

- Set Aside Cash Reserves: It is recommended to have one year's worth of cash reserves to supplement your income from other sources, such as annuities, pensions, and Social Security. This cash reserve can be kept in a safe and liquid account, like an interest-bearing bank account or money market fund.

- Create a Short-Term Reserve: In addition to the one-year cash reserve, consider creating a short-term reserve equivalent to two to four years' worth of living expenses. This reserve can be invested in short-term, high-quality bonds, bond funds, or a short-term CD or bond ladder strategy. This reserve can help you avoid tapping into more volatile investments during market downturns.

- Invest the Rest: After setting aside your cash reserves, invest the remaining funds in a mix of stocks, bonds, and cash investments that align with your goals and risk tolerance. The specific allocation will depend on your age, income needs, financial goals, and comfort with risk.

- Adapt Your Strategy Over Time: Your investment strategy may change over time as you approach retirement. For example, you may feel comfortable taking more risks for higher growth potential in the early years of retirement and then shift to a more conservative approach focused on capital preservation and income generation later on.

- Calculate Annual Expenses and Income: Before determining your savings rate, calculate your expected annual expenses during retirement and your anticipated income from various sources, such as Social Security, pensions, or other investments. The difference between these amounts will give you an idea of how much you need to cover with your retirement savings.

- Maximize Employer Matching: If your employer offers a retirement plan with matching contributions, prioritize contributing enough to take full advantage of this benefit. It's essentially free money that provides an immediate return on your savings.

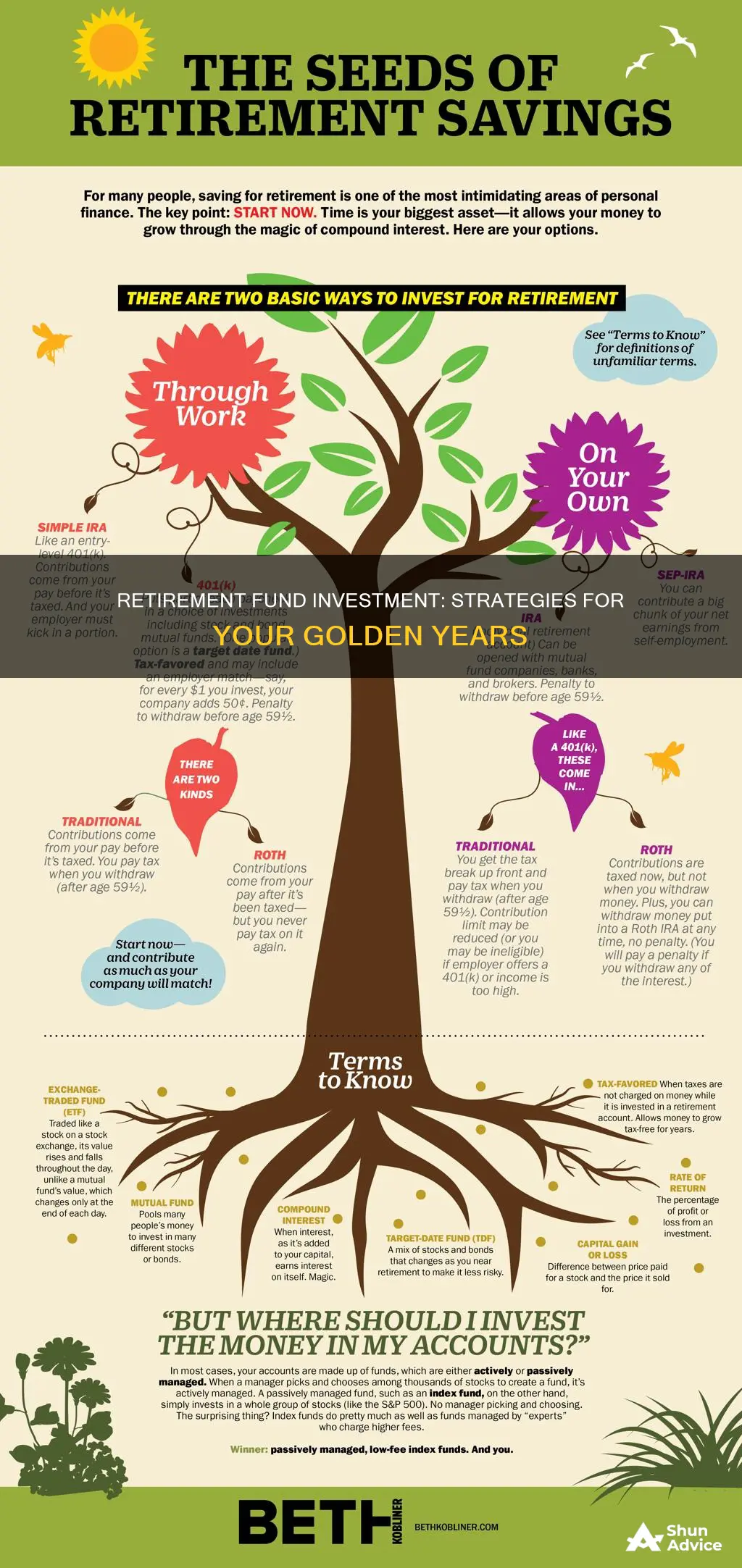

- Utilize Different Account Types: Diversify your retirement savings across different account types, such as a 401(k), IRA (Traditional or Roth), or other employer-sponsored plans. Each type of account has its own contribution limits and tax advantages, so consider utilizing multiple accounts to maximize your savings and minimize your tax burden.

- Save Early and Consistently: The earlier you start saving for retirement, the more time your money has to grow and compound. Consistency in your contributions is also crucial, as it helps build your savings over time.

- Consider Additional Income Sources: If needed, consider part-time work during retirement or generating income from rental properties or other investments. This can help supplement your retirement savings and ensure your income keeps pace with rising living costs.

- Seek Professional Advice: Consult a financial advisor or planner to create a comprehensive retirement plan that takes into account your unique circumstances, goals, and risk tolerance. They can provide personalized guidance on how much to save and invest based on your situation.

Uncover Mutual Fund Investments: PAN Power

You may want to see also

How should I invest?

There are many options for investing your retirement funds, and the best approach will depend on your individual circumstances. Here are some of the most common investment products for retirement:

- Mutual funds: Actively managed by professional fund managers, mutual funds involve teams of analysts and portfolio managers researching, analysing and selecting stocks that are expected to outperform the market. In recent years, passively managed funds (index funds) have gained traction due to their generally lower costs and ease of ownership.

- Index funds: A type of mutual fund that operates more simply by purchasing shares of all the securities in an index, such as the S&P 500. This keeps investors' costs down, and they have been praised by the likes of Warren Buffett.

- Exchange-traded funds (ETFs): Similar to mutual funds, but ETFs can be traded throughout the day on exchanges like individual stocks and bonds. ETF share prices are often lower than comparable mutual funds, making them more accessible to investors.

- Individual stocks and bonds: Some investors prefer to research and purchase individual stocks and bonds to build a diversified portfolio. This can provide a steady stream of income, especially with dividend stocks, and help manage interest rate risk.

- Annuities: Annuities can provide a guaranteed income stream for life or a specified period. They are often considered insurance against the risk of outliving your retirement savings. However, they can be costly and have limited liquidity.

- Income-producing equities: Some equities provide income in the form of dividends. While not all stocks pay dividends, those that do can provide a regular stream of income.

- Target-date funds: An effective and low-maintenance way to maintain an appropriate asset allocation. You simply pick the target date for retirement, and the fund company automatically adjusts the allocation over time.

- Robo-advisors: A low-cost way to access investment help, robo-advisors use computer models and algorithms to customise investments for your portfolio.

When deciding how to invest, it's important to consider your goals, risk tolerance, and time horizon. Retirement accounts can be more aggressive in their investment strategy due to their long time horizon. Additionally, it's crucial to diversify your investments to minimise risk and maximise potential returns. This can be achieved by incorporating a mix of active and passive investments, different industries, company sizes, styles, and geographies.

- Protect your downside: Ensure you have enough cash on hand to supplement your regular income. Hold this cash in a safe, liquid account, such as an interest-bearing bank account or money market fund.

- Balance income and growth: Allocate your portfolio to investments that align with your goals, time horizon, and risk tolerance. A mix of stocks, bonds, and cash investments can provide growth, income, and capital preservation.

- Consider all your income sources: Evaluate the role your savings will play in your overall income plan. If you have sufficient income from guaranteed sources, you may be able to maintain a more aggressive portfolio.

Mutual Funds: Risk Scale Placement and Investor Expectations

You may want to see also

Which retirement account should I use?

When it comes to choosing a retirement account, there are several options available, each with its own advantages and considerations. Here is an overview of some of the most common types of retirement accounts to help you decide which one aligns best with your financial goals:

- Traditional Individual Retirement Account (IRA): This is a popular option for those looking to save for retirement. Contributions to a traditional IRA may be tax-deductible, reducing your taxable income for the year. The funds in your traditional IRA can grow tax-free until you withdraw them in retirement. It's important to note that withdrawals during retirement are typically taxed as regular income.

- Roth IRA: With a Roth IRA, you contribute after-tax dollars, meaning there is no immediate tax benefit. However, the significant advantage comes in retirement when qualified withdrawals, including earnings, are tax-free. This makes a Roth IRA ideal if you expect to be in a higher tax bracket during retirement or if you want tax-free income in retirement.

- 401(k) Plan: If you are employed, you may have access to a 401(k) plan through your employer. This type of retirement account allows you to contribute a portion of your pre-tax salary, lowering your taxable income. Some employers may even match a percentage of your contributions, providing free money for your retirement savings. Similar to a traditional IRA, the funds grow tax-deferred, and you pay taxes on withdrawals in retirement.

- Roth 401(k): Similar to a Roth IRA, a Roth 401(k) allows you to contribute after-tax dollars, and qualified withdrawals in retirement are tax-free. This option is worth considering if your employer offers it and you expect to be in a higher tax bracket later in life.

- Health Savings Account (HSA): While primarily meant for medical expenses, an HSA can also be a powerful retirement savings tool. Contributions are made pre-tax, and the funds grow tax-free. If used for qualified medical expenses, withdrawals are tax-free as well. Unlike other retirement accounts, there is no requirement for minimum distributions at a certain age.

It's important to carefully consider the features and benefits of each retirement account before making a decision. Factors such as tax advantages, contribution limits, employer matching programs, and flexibility in investment choices should all be taken into account when deciding which retirement account is the best fit for your financial journey.

A Beginner's Guide to Scottrade Mutual Funds

You may want to see also

What is the best investment strategy for retirement?

The best investment strategy for retirement will depend on your individual circumstances, but there are some general principles that can help guide your decision-making. Here are some key considerations for choosing the right investment strategy for your retirement:

- Start early: The power of compounding means that starting to save and invest for retirement early in your career can lead to significant growth in your retirement savings over time.

- Understand your options: There are various tax-advantaged and taxable retirement savings accounts available, such as 401(k)s, IRAs, and brokerage accounts. Educate yourself about the different options and choose the ones that best fit your needs and goals.

- Diversification: Diversifying your investments across different asset classes, industries, and geographies can help reduce overall investment risk while increasing the potential for higher returns.

- Asset allocation: The mix of stocks, bonds, and cash in your portfolio should be aligned with your age, risk tolerance, and investment goals. Generally, younger investors can allocate more towards stocks, while older investors may want to increase their allocation to bonds and cash.

- Minimize fees: Investment fees can eat into your returns over time, so pay attention to the fees associated with different investment options and choose low-cost options whenever possible.

- Seek professional advice: If you're unsure about how to invest for retirement, consider consulting a financial advisor or using a robo-advisor service, which can provide personalized investment recommendations based on your goals and risk tolerance.

- Tax-advantaged accounts: Contributing to tax-advantaged accounts like 401(k)s and IRAs can provide tax benefits, such as tax-deductible contributions or tax-free withdrawals in retirement.

- Stocks and bonds: Investing in a combination of stocks and bonds can provide a balance of income and growth in your retirement portfolio. Dividend-paying stocks and municipal bonds can be particularly attractive for retirees.

- Real estate: Investing in real estate, either directly or through real estate investment trusts (REITs), can provide consistent income and diversification to your retirement portfolio.

- Annuities: Annuities can provide a guaranteed income stream during retirement, but they can be complex and costly, so carefully consider the features and fees before purchasing.

- Robo-advisors and target-date funds: These automated investment services can handle the asset allocation and rebalancing of your portfolio for you, taking the guesswork out of retirement investing.

Diversified Equity Funds: Smart Investment, Smart Returns

You may want to see also

How do I create income in retirement?

Creating an income in retirement requires careful planning and consideration of your financial situation, goals, and risk tolerance. Here are some strategies to help you create income during your retirement years:

- Calculate your expenses and income: Determine your expected expenses and income sources during retirement. This includes considering your desired lifestyle, healthcare costs, and any other financial obligations. Calculate the difference between your expenses and income to understand how much you need to cover with your retirement savings.

- Assess your risk tolerance: Understand how much risk you are comfortable taking with your investments. Generally, as you approach retirement age, it is advisable to adopt a more conservative investment strategy to preserve your savings.

- Consider different investment options:

- Annuities: Annuities provide a guaranteed income stream, either for a fixed period or your entire life. They offer predictability and are often seen as insurance against outliving your retirement savings. However, they may have limited liquidity and are subject to the claims-paying ability of the insurance company.

- Bonds: A diversified bond portfolio can offer a steady stream of income. Bonds are available in various forms, such as U.S. Treasury securities, corporate debt instruments, and government-offered bonds.

- Income-producing equities: Some stocks provide income through dividend payments. While dividend payouts may vary, investing in companies with a history of consistent dividend payouts can provide a regular income stream.

- Total return investment approach: This strategy involves investing in a diversified portfolio of stocks and bonds and taking systematic withdrawals. It can provide immediate cash flow while continuing to build savings for the future. However, there is no guarantee that your funds will last throughout retirement.

- Utilize tax-advantaged accounts: Take advantage of tax-deferred or tax-free growth offered by accounts like 401(k)s and Individual Retirement Accounts (IRAs). Traditional accounts may allow you to deduct contributions from your taxes now, while Roth accounts allow you to withdraw money tax-free during retirement.

- Consult a financial advisor: Consider seeking advice from a financial professional who can help you understand your options and develop a retirement income strategy tailored to your specific circumstances.

- Start early: The earlier you start saving and investing for retirement, the more time your money has to grow. Starting early also allows you to take advantage of the power of compounding, increasing your chances of a comfortable retirement.

- Increase your income and reduce debts: Focus on increasing your income and reducing any debts you have. This will give you more financial flexibility to contribute to your retirement savings.

Roth IRA vs. Mutual Funds: Why Choose the Former?

You may want to see also

Frequently asked questions

Many advisors recommend saving 10% to 15% of your income, but this can vary depending on your individual circumstances.

There are various options available, including stocks, bonds, annuities, income-producing equities, and retirement plans such as 401(k)s, 403(b)s, and IRAs.

A 401(k) is offered by private companies, while a 403(b) is typically offered by public schools, charities, and some churches. Both allow you to contribute pre-tax money and offer tax advantages.

A Roth IRA is a type of retirement account that allows you to contribute after-tax money, which then grows tax-free. Withdrawals in retirement are also tax-free.

It is recommended to have a balanced portfolio of stocks, bonds, and cash investments. The specific allocation will depend on your timeline, risk tolerance, and income needs. Diversification is important to minimize risk and maximize returns.