Vanguard is a popular choice for investors due to its low-cost approach and wide range of investment options. When it comes to investment minimums, Vanguard offers flexibility with varying minimum requirements depending on the type of account and fund. For example, most Vanguard mutual funds require a minimum investment of $3,000, while you can invest in a Vanguard Target Retirement Fund or Vanguard STAR® Fund with just $1,000. Additionally, Vanguard ETFs are accessible with a minimum investment of only $1 through their fractional share program. It's important to note that some funds have higher minimums, typically ranging from $50,000 to $100,000, to protect against short-term trading activity. Aside from investment minimums, Vanguard also has account service fees, which are typically $25 annually for brokerage and mutual fund accounts, but these fees can be waived or avoided through various means.

What You'll Learn

Vanguard's minimum investment requirements

Vanguard offers a range of investment options with different minimum investment requirements. Here is a detailed overview of Vanguard's minimum investment requirements:

Mutual Funds:

Most Vanguard mutual funds have a minimum investment requirement of $3,000. However, there are some funds with lower minimums, such as the Vanguard Target Retirement Funds and the Vanguard STAR® Fund, which only require a minimum investment of $1,000.

ETFs (Exchange-Traded Funds):

Vanguard ETFs have a very low minimum investment requirement. You can invest in a Vanguard ETF for as little as $1 through their fractional share program. This means that you can buy a fraction of a share, rather than purchasing a whole share at the market price.

Stocks and Non-Vanguard ETFs:

When purchasing stocks or non-vanguard ETFs through Vanguard, there is no minimum investment requirement. However, you must buy and sell these investments at the market price.

Admiral Shares and Institutional Shares:

Vanguard also offers Admiral Shares and Institutional Shares for certain funds, which have their own minimum investment requirements. For example, the Emerging Markets Government Bond Index Fund Admiral™ Shares (VGAVX) and the Emerging Markets Government Bond Index Fund Institutional Shares (VGIVX) are two such funds with specific share classes and their own minimum investment thresholds.

529 Plan Accounts:

Vanguard 529 Plan accounts, which are used for saving for education, have special account service fees and minimum investment requirements that vary depending on the state in which the account is opened.

Brokerage and Mutual-Fund-Only Accounts:

There is no fee to open an account at Vanguard. However, there is a $20 or $25 annual fee for each brokerage and mutual-fund-only account, which can be waived under certain conditions, such as having a total of $5 million in qualifying Vanguard assets or signing up for e-delivery of account documents.

It is important to note that Vanguard's minimum investment requirements may change over time, and there may be additional fees and expenses associated with their investment products. It is always a good idea to review the prospectus and the most up-to-date information on their website before investing.

Fixed Income Funds: Where Are Your Investments Going?

You may want to see also

Vanguard's brokerage account fees

Vanguard Brokerage Account Fees

Vanguard charges an annual fee of $25 for each of your brokerage and mutual-fund-only accounts. However, there are several ways to avoid this fee. Firstly, if you are the primary account owner, you can opt for e-delivery of statements, confirmations, reports, notices, and other important account updates. Additionally, Vanguard does not charge this fee to clients with an organisation or trust account registered under an employee identification number (EIN) or those enrolled in an advisory program serviced by a Vanguard affiliate. Finally, the fee is waived if your total qualifying Vanguard assets amount to at least $5 million.

Vanguard also offers a range of investment advice services, each with its own advisory fee schedules. These services vary in terms of management, fees, eligibility, and access to an advisor.

When it comes to trading fees, Vanguard clients do not pay a commission to buy or sell Vanguard mutual funds and ETFs online. In fact, Vanguard offers over 160 of its own mutual funds and more than 3,000 funds from other companies, all with no transaction fees. It's important to note that while Vanguard ETFs are offered commission-free through Vanguard Brokerage Services, another broker may charge commissions.

While most Vanguard mutual funds require a minimum investment of $3,000, you can invest in any Vanguard Target Retirement Fund or the Vanguard STAR® Fund with a minimum of $1,000. The minimum investment for a Vanguard ETF is $1 through their fractional share program, and for a non-Vanguard ETF, it is the price of one share.

Vanguard also charges certain fees for other services, such as account closure, deposit of physical certificates, foreign securities transactions, and restricted security legend removal. These fees vary and are outlined in detail on the Vanguard website.

It's important to review the Vanguard Brokerage Services commission and fee schedules for comprehensive information on all applicable fees.

Best Tracker Funds: Where to Invest Your Money

You may want to see also

Vanguard's ETF fees and minimums

Vanguard ETF Fees and Minimums

Vanguard is known for its low fees, which can help investors make the most of their money. When it comes to ETFs (exchange-traded funds), Vanguard offers a range of options with competitive fees and minimum investment requirements.

Fees

Vanguard's average ETF expense ratio is 77% less than the industry average. The expense ratio covers the cost of portfolio management, administration, marketing, and distribution, and is expressed as a percentage of the fund's average net assets. While the expense ratio varies by ETF, they generally range from 0.05% to 0.22%. In addition, Vanguard offers commission-free trades when buying or selling ETFs online. However, if you use another broker to buy or sell Vanguard ETFs, they may charge commissions.

Minimums

One of the advantages of investing in Vanguard ETFs is the low minimum investment requirement. You can buy a Vanguard ETF for as little as $1 through their fractional share program, regardless of the ETF's share price. There is also no minimum account balance requirement. You only need enough money in your settlement fund to cover the cost of the ETFs you want to purchase. This makes Vanguard ETFs accessible to a wide range of investors, even those just starting with a small amount of money.

In addition to the low minimum investment, Vanguard also offers a range of account types to suit different investment goals. Whether you're saving for retirement, education, a dream home, or any other financial goal, Vanguard has options available.

With their low fees, accessible minimum investments, and variety of account types, Vanguard ETFs provide a flexible and cost-effective option for investors.

Trust Fund Investment Strategies: Where to Begin?

You may want to see also

Vanguard's mutual fund fees and minimums

Vanguard is known for its low-cost approach to investing, with fees and minimums that are often lower than those of its competitors. Here's a breakdown of the fees and minimums associated with Vanguard mutual funds:

Account Service Fees

Vanguard charges an annual fee of $25 for each brokerage and mutual fund-only account. However, there are ways to avoid this fee, such as by signing up for e-delivery of account documents or by having at least $5 million in qualifying Vanguard assets.

Purchase and Redemption Fees

While most Vanguard funds do not charge purchase and redemption fees, a few funds with multiple share classes may charge one or both of these fees to help cover higher transaction costs and discourage short-term trading. These fees vary from 0.25% to 1.00% of the transaction amount.

Minimum Investment Requirements

The minimum investment required to open a Vanguard mutual fund account varies depending on the type of fund and account. Here are the minimums for some common types of accounts:

- Vanguard Target Retirement Funds and Vanguard STAR® Fund: $1,000

- Most actively managed Vanguard funds: $3,000

- Most Vanguard index funds: $3,000

- Most actively managed funds: $50,000

- Certain sector-specific index funds: $100,000

It's important to note that some funds have higher minimums to protect against short-term trading activity, and fund-specific details can be found in each fund's profile.

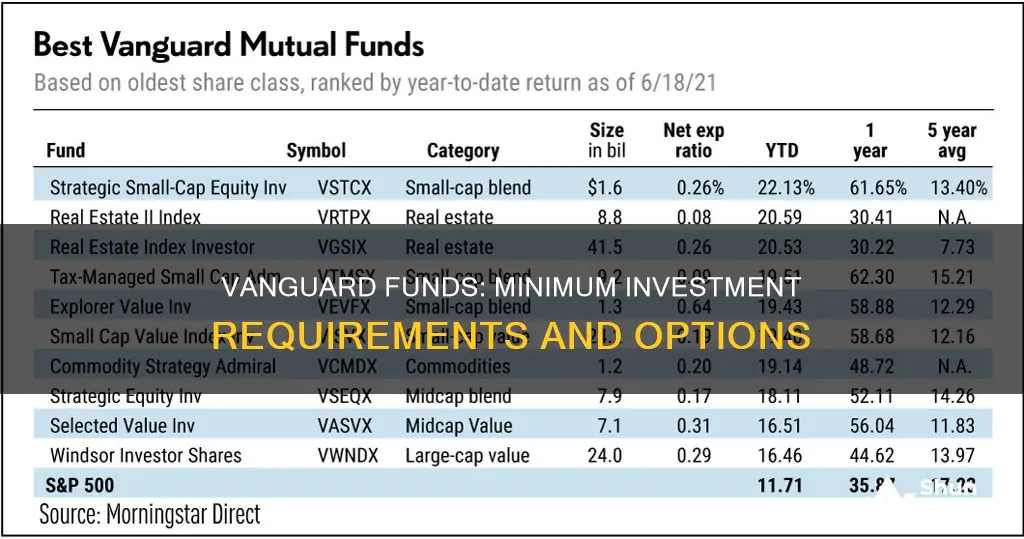

Fund Expense Ratios

The average Vanguard mutual fund and ETF (exchange-traded fund) expense ratio is 82% lower than the industry average. This expense ratio includes management, administrative, marketing, and distribution fees, and it is calculated annually, directly reducing investors' returns. While Vanguard's low-cost approach may not offer the highest returns, it can help investors make the most of their money by keeping costs under control.

Smart Mutual Fund Investments: 16K Options

You may want to see also

Vanguard's advisory fees

Vanguard offers four investment advice services, each with its own advisory fee schedules. Here is an overview of the advisory fees for Vanguard's services:

Personal Advisor Select

The annual fee for Vanguard Personal Advisor Select™ is 0.30% of the assets you invest, which equates to a maximum of $30 for every $10,000 in your portfolio. This fee covers access to a financial advisor, a customised goals-based financial plan, and ongoing investment advice. The minimum amount required to invest in this service is $500,000, and Vanguard will waive any fund minimums.

Personal Advisor

Personal Advisor is available for an approximate 0.3% advisory fee, which is a maximum of $35 per $10,000 annually. This service provides access to an advisor when you need it and automated investment management. The minimum assets required to enrol are $50,000 in eligible Vanguard Brokerage Accounts.

Active/Index Investment Option

The advisory fee for this option is a maximum of $40 per $10,000 annually. This option combines Vanguard ETFs and mutual funds, offering the potential for higher returns from actively managed funds with the broad diversification of index funds.

ESG Investment Option

The advisory fee for the ESG Investment Option is a maximum of $35 per $10,000 annually. This option helps align your investments with your values by using Vanguard ETFs that apply pre-screened ESG criteria.

Crowdfunding: Investing for All, Without Barriers

You may want to see also

Frequently asked questions

You can buy a Vanguard ETF for as little as $1.

Most Vanguard mutual funds require a minimum investment of $3,000. However, you can invest in any Vanguard Target Retirement Fund or Vanguard STAR® Fund with just $1,000.

The minimum investment for a non-Vanguard ETF is the price of one share.

The minimum investment for individual securities is the price of one share.