If you're looking to invest uninvested cash in a VA529 plan, there are a few things you should know. First, VA529 plans offer a tax-advantaged way to save for future education expenses, including higher education, private K-12 tuition, student loan repayment, and registered apprenticeship programs. Earnings on your accounts grow free from federal tax when used for qualified education expenses, and you may be entitled to additional tax advantages depending on your state of residence. There is no online application fee, no annual maintenance fee, and no withdrawal fee for qualified education expenses.

To get started, you'll need to gather some information, including your address, state-issued identification, and social security number. You'll also need similar information for the student and a designated survivor. After entering this information, you can choose from over 20 investment options, including low-cost index portfolios and target enrollment date portfolios. You can then make an initial contribution, with as little as $10 to get started, and set up recurring contributions to grow your savings faster.

It's important to note that VA529 plans may have specific requirements and features that vary by state, so be sure to review the details of the plan before investing.

| Characteristics | Values |

|---|---|

| Initial contribution | $10 |

| Recurring contributions | Yes |

| Investment options | Over 20 |

| Investment types | Low-cost index portfolios, target enrollment date portfolios, principal-protected portfolios, target risk portfolios, specialty portfolios |

| Withdrawal fee | No |

| Withdrawal time | 2-3 business days |

| Withdrawal methods | Bank transfer, check |

| Account owner information | Address, state-issued identification, social security number |

| Student information | Address, social security number, date of birth |

| Designated survivor information | Address, social security number, phone number |

What You'll Learn

How to open a 529 plan account

A 529 plan is a great way to save for future education expenses while also saving on taxes. Here is a step-by-step guide on how to open a 529 plan account:

Choose the Right 529 Plan:

Start by looking into your state's 529 plan to see if it offers a state income tax deduction or tax credit on contributions. Consider the return on investment, costs, fees, and tax benefits when choosing a plan. Direct-sold 529 plans, for example, are approved and monitored by each state and have no sales charges, while advisor-sold 529 plans may incur fees to compensate the advisor.

Choose the Type of 529 Plan:

There are two types of 529 plan account ownership structures: individual accounts and custodial accounts. Individual accounts are usually parent-owned, with the parent having primary ownership and control, while a custodial account is owned by the prospective student, regardless of age, and managed by a custodian.

Complete the 529 Plan Application:

After choosing the right plan, the next step is to apply for the account. This requires specific personal information, including the account owner's and beneficiary's names, social security numbers, dates of birth, addresses, and phone numbers.

Choose 529 Plan Investments:

There are various investments to choose from, depending on your investment objectives. These include age-based portfolios, static portfolios, and individual fund options. Age-based portfolios adjust the investment mix based on the beneficiary's age, becoming more conservative as they approach college age. Static portfolios consistently allocate assets among various investment types, and individual fund options allow for a customizable and flexible approach.

Fund the 529 Plan:

There are several ways to deposit money into a 529 plan, including initial and ongoing contributions. You can start with small initial contributions and increase them later, and you can also set up automatic contributions from your bank account. Friends and family can also contribute directly to the account, but it is important to consider gift contribution limits to avoid a taxable event.

Manage Your 529 Plan:

It is important to monitor your investment performance to ensure it aligns with your goals. You will likely need to adjust your investment strategy over time, and a financial advisor can help guide you through these changes. Additionally, you may need to update beneficiary information, which can be done without triggering tax consequences as long as the new beneficiary is an eligible family member.

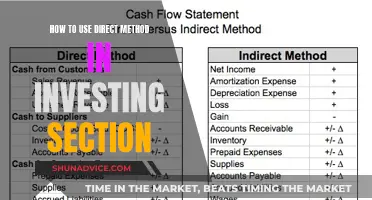

Investment Bankers: Crafting Precise Cash Flow Statements

You may want to see also

Investment options and performance

Virginia529 offers over 20 diverse investment portfolios across five unique categories. These portfolios are designed to help you meet your savings goals and can be customized based on your risk tolerance, time horizon, and investment strategy. Here's an overview of the different types of portfolios available:

- Target Enrollment Portfolios: These portfolios are designed for college savers. You select the expected high school graduation date of your student, and the portfolio adjusts over time, shifting from riskier investments to more conservative options as your child gets closer to enrolling in post-high school education.

- Index Portfolios: These portfolios track the performance of a broad market index and typically offer lower fees than other investment options.

- Principal Protected Portfolios: This option focuses on protecting the security of your investment. Principal Protected Portfolios are designed to safeguard against losses, providing a more stable investment choice.

- Target Risk Portfolios: These portfolios offer a diversified mix of investments, including stocks, bonds, cash, and other assets. They cater to different risk levels, ranging from conservative to aggressive strategies.

- Specialty Portfolios: Specialty Portfolios encompass investment options that don't fall into the other categories. This includes strategies such as the ESG Core Equity Portfolio, which aims for returns while also considering long-term environmental and societal impacts.

The performance charts provided by Virginia529 display the historical performance of these portfolios. The charts represent two values: the daily Unit Price (blue line) and the percent change of the Unit Price based on a selected timeframe (purple line). You can customize the date ranges and zoom into specific periods to analyze performance.

It's important to note that past performance doesn't guarantee future results, and you should carefully review the Invest529 Program Description before making any investment decisions. Additionally, consider seeking advice from a financial advisor to choose the investment strategy that aligns with your goals and risk tolerance.

E*Trade Cash Balance Program: Investing Strategies for Beginners

You may want to see also

Withdrawing from an Invest529 account

Invest529 accounts are flexible and can be used to pay tuition, fees or other qualified higher education expenses. You can also use your Invest529 account for K-12 education, student loan repayment or registered apprenticeship programs. As the Account Owner, you can make a withdrawal request at any time to pay for qualified expenses.

Before making a withdrawal, ensure your account is up-to-date with the correct contact information for you and your student, as well as bank account information. Changing information during the withdrawal process may cause a delay in processing. The fastest way to pay for tuition or other expenses is through your online account.

To make a withdrawal, sign into your online account and select 'Manage My Accounts', then 'Withdraw Funds'. On the Withdraw Funds page, select 'Get Started' and choose the appropriate account. Next, select the purpose of the withdrawal. If you select 'Higher Education' or 'K-12 Education', enter the school name and Student ID (if applicable).

You can then select where you want to send the funds: to the account owner, student, or the school. When sending funds to yourself or your student, you can choose a bank transfer or a check. If sending funds directly to the school, they are sent as an electronic funds transfer (EFT) or a check, depending on the school.

Enter the amount you wish to withdraw and your preferred method to receive the funds. Review the details and submit your request. Withdrawals are typically processed within 2-3 business days. If you request an electronic bank transfer, funds are usually available within 1-2 business days. If you request a check or payment directly to the school, it may take up to 10 business days for the school to receive it.

Keep in mind that a new withdrawal request is needed each time you want to use your Invest529 account. During the process, you can choose where the funds are sent. Remember to consider deadlines when making your withdrawal request.

Apple's Cash: Where Does it Go?

You may want to see also

Tax advantages of a 529 account

A 529 plan is a tax-advantaged account that helps you save for education costs. Earnings on your account grow free from federal tax when used for qualified education expenses. Depending on your state of residence, you may be entitled to additional tax advantages. Here are some of the tax advantages of a 529 account:

Federal Tax Benefits

Earnings in a 529 plan grow tax-deferred, and withdrawals are tax-free when used for qualified education expenses. This includes tuition, fees, books, and room and board. The first $10,000 in distributions per student per year for tuition at an elementary or secondary public, private, or religious school are also considered qualified expenses. Additionally, you can withdraw up to $10,000 for student loan payments per beneficiary, sibling, and step-sibling of the beneficiary, lifetime.

State Tax Benefits

Over 30 states and the District of Columbia offer a full or partial state tax deduction or tax credit for 529 plan contributions. For example, New York residents can receive an annual state income tax deduction of up to $5,000 ($10,000 if married and filing jointly) for 529 plan contributions. In South Carolina, New Mexico, and West Virginia, 529 plan contributions are fully deductible when calculating state income tax. Some states also allow contributions to these plans to be excluded from adjusted gross income for calculating your state tax bill.

Gift Tax Benefits

Grandparents can transfer substantial amounts of cash to their grandchildren's 529 plans without any gift tax complications, making it an excellent estate planning tool. Donors can contribute up to $18,000 per year per designated beneficiary without incurring the gift tax. There is also a way to front-load contributions for up to five years, allowing a one-time contribution of up to $90,000 ($180,000 for married couples) without additional contributions for the next five years.

Rollover Benefits

Thanks to the SECURE 2.0 Act, you can roll over 529 funds into a Roth IRA without penalties or taxes, with a lifetime limit of $35,000. Additionally, 529 savings balances that cannot be used by the beneficiary can be rolled over into a Roth IRA in the beneficiary's name, and plan beneficiaries may exclude up to $10,000 over their lifetime for distributions used to pay student loan principal and interest.

Creating Cash Flow: Investment Strategies for Success

You may want to see also

Transferring funds to another account

If you're considering rolling over funds from another 529 plan, it's important to consult the specific rules and regulations of your current plan. You may need to stop any scheduled contributions, such as bill pay or payroll deductions, before initiating the rollover. Additionally, if you're moving funds to another qualified tuition program, be sure to contact the plan administrator for detailed instructions.

When transferring funds, it's essential to provide the required documentation, which may include a copy of your current 529 plan account statement, separate instruction or forms from your current 529 plan, and a signature guarantee if necessary. You may also need to open a new Invest529 account before initiating the transfer.

It's worth noting that you can also transfer funds to a new account owner. This can be done without any limit on the number of transfers, as long as the new owner is a qualifying family member as defined in IRC Section 529. However, this type of transfer cannot be completed online and requires the signatures of both account owners.

Lastly, starting in 2024, you will be able to roll over unused funds from your Invest529 or Prepaid529 account into a Roth IRA, provided certain requirements are met. These include the account being opened for at least 15 years and the rollover amount not exceeding the eligible balance from five years prior.

Restricted Cash: A Viable Investment Option?

You may want to see also