TD Ameritrade is an online broker that offers commission-free trading of stocks, options, and ETFs. It provides a wide range of investment options, including stocks, bonds, mutual funds, ETFs, options, futures, annuities, IPOs, and foreign investments. The platform offers various account types, such as individual and joint brokerage accounts, retirement plans, education savings accounts, and trust accounts. TD Ameritrade also provides multiple trading platforms, such as the classic web platform, the next-generation web platform, and the thinkorswim trading platform. The platform is suitable for both beginner and advanced investors, offering educational resources and advanced trading tools. While TD Ameritrade was acquired by Charles Schwab in 2019, existing clients can continue to access similar features and services through Schwab, including the thinkorswim platform.

| Characteristics | Values |

|---|---|

| Account minimum | $2,000 for margin or options trading; $1,000 for TD Automated Investing; $25,000 for TD Automated Plus; $25,000 for day trading |

| Stock trading costs | Commission-free |

| Options trading costs | No base commission; $0.65 per contract |

| Account fees | $75 full account transfer fee; no partial transfer fee; no annual or inactivity fee |

| Number of no-transaction-fee mutual funds | 1,600 |

| Tradable securities | Stocks, ETFs, mutual funds, futures, forex, IPOs, bitcoin futures, bonds, annuities, foreign investments, fixed-income securities |

| Crypto availability | No direct access; crypto-based products available over-the-counter; qualified clients can trade Bitcoin futures |

| Trading platform | Two main platforms: TD Ameritrade web and thinkorswim; virtual trading simulator paperMoney |

| Mobile app | TD Ameritrade Mobile and thinkorswim app |

| Research and data | Research, analysis, commentary, and news from 15 providers, including FRED, Argus, CFRA, Reuters, Vickers, and Morningstar |

| Customer support | 24/7 support via phone, text, fax, live chat, email, social media, and in-person at over 250 branches |

What You'll Learn

How to open a TD Ameritrade account

TD Ameritrade was acquired by Charles Schwab in 2019, and all accounts have been moved to Schwab. If you are a new client, you will need to set up a Schwab Login ID and password to access your account.

To open a TD Ameritrade account, you will need:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your employer name and address (if applicable)

TD Ameritrade does not require a minimum cash deposit to get started, but if you want to do options or margin trading, you'll need to have at least $2,000 in the account. The company charges a flat $6.95 fee per trade.

Step 1: Start your application

Navigate to TD Ameritrade's account application page and fill out some basic information about yourself (name, email, etc.). You will also select which type of account you want to open.

Step 2: Enter personal information

Enter more personal information, such as your Social Security number, mailing address, date of birth, and employment information. You will also be asked whether you or someone in your household works for any stock exchange or if an immediate family member is a director or 10% shareholder of a publicly held company.

Step 3: Review and edit information

Review the information you have entered and make any necessary corrections.

Step 4: Agree to terms

Review and agree to the technical information provided, including PDFs of the client agreement, account handbook, a business continuity plan statement, and an IRA account agreement disclosure. You will also select what will happen to the cash in your account when it is not invested in an asset.

Step 5: Set up your online login

Set your username, password, and security questions. TD Ameritrade states that the account will then be opened, and you can fund it, choose trading features, and edit your account preferences.

And that's it! You've set up your TD Ameritrade brokerage account.

How Much Cash Flowed from 2010 Investments?

You may want to see also

How to fund your TD Ameritrade account

To fund your TD Ameritrade account, you can transfer money from another brokerage account or deposit funds from your bank account. Here's a step-by-step guide:

- Log in to your TD Ameritrade account: Go to the TD Ameritrade website and enter your login credentials. If you don't already have an account, you'll need to create one.

- Navigate to the funding section: Once you are logged in, look for a section titled "Funding," "Transfers," or "Deposits." This is where you will initiate the process of adding funds to your account.

- Choose the type of transfer or deposit: You will likely have options to transfer funds from a linked bank account or to transfer securities from another brokerage firm. Select the option that applies to you.

- Follow the prompts: TD Ameritrade will guide you through the process of entering the necessary information for your transfer or deposit. This may include the amount you wish to add, the account from which the funds will be drawn, and the account details for the transfer.

- Confirm the details and complete the transfer: Review all the information you have entered to ensure it is correct. Once you are sure everything is accurate, submit your request.

- Allow time for processing: Transfers may take several business days to complete, so be sure to plan ahead if you have a specific investment timeline in mind.

Note: TD Ameritrade, Inc. has been acquired by Charles Schwab, so you may need to set up a new Schwab account and transfer your funds there. You can contact Schwab customer support for guidance on this process.

Warren Buffett's Cash Investment Strategies Revealed

You may want to see also

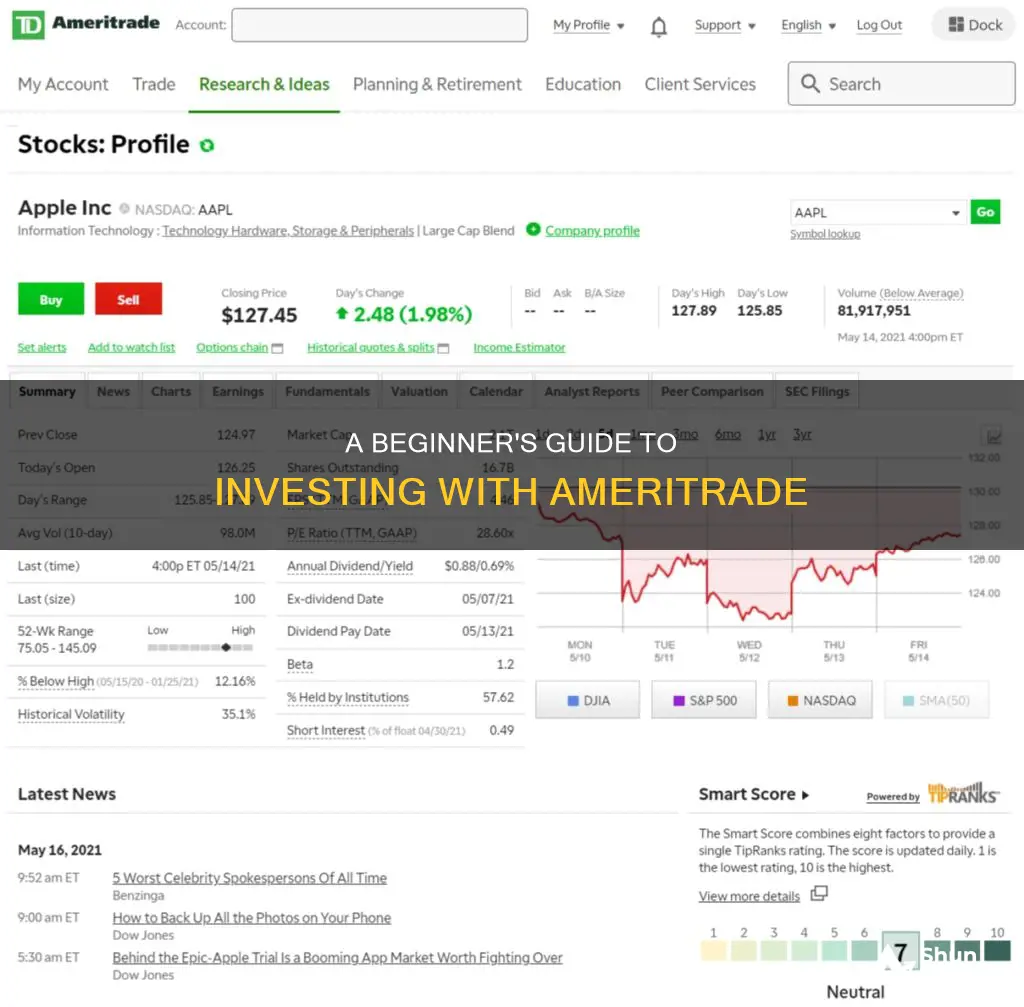

How to research stocks to buy

Before buying stocks, it is important to do your research. Here are some key steps to help you get started:

- Understand your risk tolerance: Investing in stocks carries more risk than other types of investments, such as bonds or index funds. Determine how much risk you are comfortable with and only invest money that you can afford to lose.

- Evaluate the company's performance and finances: Look beyond the products and services offered by the company. Understand how the company makes money and assess its financial health by reviewing its annual reports and financial statements.

- Consider the price and valuation of stocks: Aim to identify undervalued stocks by analysing the price-to-earnings ratio. This will help you determine if the stock is a good investment opportunity.

- Utilise TD Ameritrade's resources: TD Ameritrade offers a wide range of educational resources, including immersive articles, podcasts, webcasts, videos, and in-person events. Take advantage of these tools to improve your investment knowledge and make more informed decisions.

- Practise with PaperMoney: If you are new to trading, consider using PaperMoney, a virtual trading simulator offered by TD Ameritrade. This platform provides you with $100,000 in virtual money to practice trading without risking your own capital.

- Diversify your portfolio: It is generally recommended that individual stock picks comprise only about 5% to 10% of your overall investment portfolio. Diversifying your portfolio helps to reduce risk and maximise long-term returns.

By following these steps and conducting thorough research, you can make more informed decisions when buying stocks through TD Ameritrade or any other investment platform. Remember, investing carries inherent risks, and past performance does not guarantee future results.

Borrowing to Invest: A Guide to Getting Started

You may want to see also

How to buy stock on TD Ameritrade

TD Ameritrade has been acquired by Charles Schwab, so to buy stocks on TD Ameritrade, you will need to set up a Schwab Login ID and password to access your account. If you are new to Schwab, you will need to set up a new login. If you are already a Schwab client, you can use your existing login details.

Once you have your login details, you can access your account through the Schwab website or mobile app.

To buy stocks, you can use one of two trading platforms offered by TD Ameritrade, or the mobile app. The first option is to place a stock order on the company's website. To do this, you will need to fund your account, search for the stock's ticker symbol, and fill in an order ticket with your trade request.

The second option is to use the thinkorswim desktop platform, which is aimed at more advanced stock traders. This platform is high-powered and has a variety of tools to help you analyze and plan your trades.

TD Ameritrade also offers a virtual trading simulator called paperMoney, which is a desktop-based platform that provides $100,000 in practice money and access to a margin account. This platform is available for free for 60 days, after which you will need to set up a real-money account.

Where the Ultra-Wealthy Put Their Money

You may want to see also

How to short a stock on TD Ameritrade

To short a stock on TD Ameritrade, you'll need a margin account with at least \$2,000 in cash or eligible securities. Margin accounts allow traders to borrow money or shares from the brokerage to leverage their trades. TD Ameritrade's margin accounts also require that you keep at least 30% of your account value as equity at all times.

- Enable Your Account for Margin Trading: Go into your account options to enable margin trading. TD Ameritrade will provide you with documentation and a form to acknowledge the risks of short selling. You may also need to answer questions about your investment strategy, goals, and liquidity.

- Place a Sell Order: Once your account is enabled for margin trading, place a sell order on a stock you don't own. Specify that you plan to short this particular stock.

- Account Minimum: You must have a minimum of \$2,000 in capital in your TD Ameritrade margin account. This requirement protects the broker if your short sale goes against you and you have to cover your losses.

- Stocks That Can't Be Traded: Shorting stocks on TD Ameritrade is limited by the availability of shares to borrow. You can short sell just about any stocks except for penny stocks without shares offered for borrowing, OTC stocks, and pink sheet stocks.

- Account Approval Time: When you initially fund your account and enable margin trading, you'll need to wait up to three business days for approval. During this time, TD Ameritrade may ask for additional information to ensure your account qualifies for margin trading.

- No Share Reservation: Unlike some other platforms, TD Ameritrade does not allow you to reserve shares for shorting later. If you place a short sale order and no shares are available, the transaction won't go through.

- Short Selling Fees: As of June 2023, margin rates at TD Ameritrade range from 12.5% to 14.5%, with a base rate of 13.25%. Short selling on TD Ameritrade is subject to margin interest and borrow fees.

Remember that short selling is a risky strategy and not suitable for everyone. It involves borrowing and selling shares, expecting to buy them back at a lower price later. While it can be profitable in a declining market, it can also result in unlimited losses if the stock price rises.

Understanding Investment Cash Flows: A Timeline Perspective

You may want to see also

Frequently asked questions

To open a TD Ameritrade account, you need to fill out an application form with basic personal information, such as your name, email, date of birth, mailing address, and Social Security number. You will also need to provide your Individual Taxpayer Identification Number or Social Security number, as well as your employer's name and address, if applicable.

TD Ameritrade offers commission-free trading of stocks, options, and ETFs, and there are no inactivity or annual fees. However, there is a $75 fee for transferring out your full balance, and options trades incur a per-contract fee of $0.65. Additionally, mutual funds and ETFs traded on a short-term basis may be subject to fees.

TD Ameritrade offers a wide range of investment options, including stocks, bonds, mutual funds, ETFs, options, futures, annuities, IPOs, foreign investments (Forex), and other fixed-income securities.