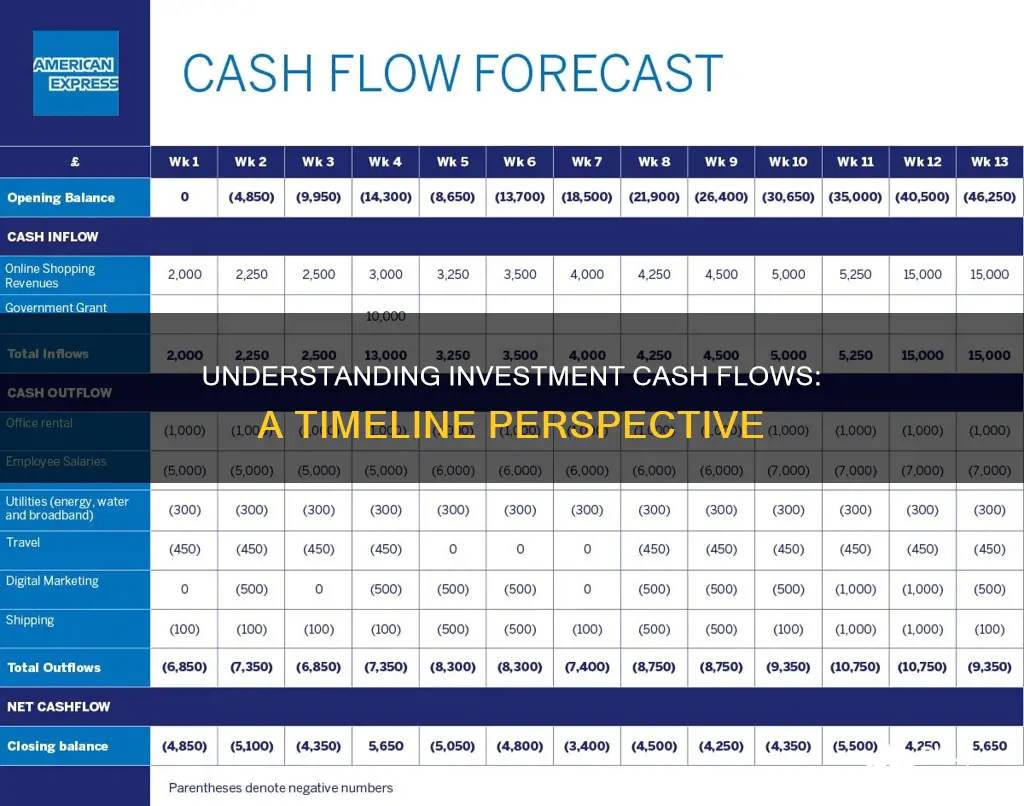

Cash flow is the movement of money into and out of a company over a certain period. A company's cash flow statement is a standard financial statement that reports its sources and use of cash over a certain period. This statement is an indicator of a company's financial health and is of great interest to investors. Cash flow can be categorized into three types: cash flows from operations, from investing, and from financing. Cash flow from investing activities (CFI) is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities. This includes the purchase or sale of non-current assets, such as property, plant, and equipment, as well as investments in marketable securities and other companies.

| Characteristics | Values |

|---|---|

| Definition | Cash flow from investing activities (CFI) |

| Reported on | Cash flow statement |

| Reported by | Public companies |

| Calculated by | Subtracting total cash outflows from total inflows related to investing activities |

| Indicates | A company's investment performance and capital allocation decisions |

| Includes | Transactions like acquiring and disposing of assets, investing in securities, and acquiring other companies |

| Excludes | Short-term investments or cash equivalents, and cash flows from financing activities |

| Positive cash flow indicates | The company is generating more cash from its investing activities than it is spending |

| Negative cash flow indicates | The company is investing in the long-term health of the company |

What You'll Learn

Cash Flow from Operating Activities

The cash flow from operating activities is typically the first section of a company's cash flow statement, which also includes cash flows from investing and financing activities. This statement acts as a corporate checkbook, providing an account of the company's cash sources and usage over a specific period. It is one of the three main financial statements required in standard financial reporting, alongside the income statement and balance sheet.

The cash flow from operating activities can be calculated using two methods: the indirect method and the direct method. The indirect method, preferred by many accountants, starts with the net income from the income statement and then adds back non-cash items to arrive at a cash basis figure. The direct method, on the other hand, tracks all transactions in a period on a cash basis and uses actual cash inflows and outflows on the cash flow statement.

The generic formula for calculating cash flow from operating activities is:

> Cash Flow from Operations = Net Income + Non-Cash Items + Changes in Working Capital

However, the exact formula may vary for each company, depending on the items on their income statement and balance sheet.

The cash flow from operating activities is an important benchmark for assessing the financial success and profitability of a company's core business activities. It helps business owners and investors make informed decisions, maintain sufficient cash for operational efficiency, and meet financial obligations. Positive cash flow from operating activities indicates that the company's core operations are thriving, while negative cash flow may suggest that additional cash is required to sustain the business.

Overall, the cash flow from operating activities provides valuable insights into a company's ability to generate cash from its day-to-day activities and is a key metric for analysts and investors when evaluating a company's financial health and potential.

Unlocking Investment Opportunities with Cash-Out Refinancing

You may want to see also

Cash Flow from Financing Activities

Financing activities include transactions involving debt, equity, and dividends. This includes the issuance of debt or equity, and paying dividends.

The formula for CFF is:

CFF = Cash inflows from issuing equity or debt – (Cash outflows from stock repurchases + dividend payments + debt repayment)

A positive CFF means more money is flowing into the company than out, increasing the company's assets. However, this could be a warning sign if the company is already in debt. Conversely, negative CFF could indicate that a company is servicing or retiring debt, or making dividend payments and stock repurchases, which can be a positive sign for investors.

Overall, cash flow from financing activities is an important indicator of a company's financial health and stability, and its ability to manage its capital structure.

Unlocking the Power of Idle Cash: Smart Investment Strategies

You may want to see also

Cash Flow from Investing Activities

Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets. These investments can be made to generate income or as long-term investments in the health or performance of the company.

Positive net cash flow from investing activities indicates that a company is generating more cash from its investing activities than it is spending, suggesting effective management of investments and potential future growth.

Negative cash flow from investing activities is not always a warning sign. It can indicate that management is investing in the long-term health of the company, such as research and development.

To calculate cash flow from investing activities, you add the purchases or sales of property, equipment, other businesses, and marketable securities.

Lenders and investors analyse cash flow statements to assess a company's ability to manage its operating expenses and debts.

Cash Payments for Trading Securities: An Investment Activity?

You may want to see also

Negative Cash Flow

However, if negative cash flow becomes a persistent issue across multiple quarters, it may indicate a flawed business plan, a lack of growth opportunities, or missed opportunities. It can also lead to challenges such as cash crunch, increased bank charges and interest rate risks, and equity dilution. Therefore, it is important for investors to carefully assess the reasons behind negative cash flow and make informed decisions accordingly.

To calculate negative cash flow, you can use the formula: Cash Flow = Cash Inflows - Cash Outflows. If the resulting number is negative, it indicates a deficit and is termed negative cash flow.

Temporary Investments: Are They Really Cash?

You may want to see also

Positive Cash Flow

A company with positive cash flow is in a position to cover its obligations, such as paying expenses, salaries, and vendor fees, while also being able to reinvest in its business, pay dividends to shareholders, and attract outside investment. Positive cash flow also serves as a buffer against future financial challenges, allowing companies to better navigate economic downturns and avoid the costs of financial distress.

- Operating cash flow: This reflects the day-to-day operations of a company, including income from sales and outflows from salaries, lease payments, taxes, and interest payments.

- Investing cash flow: This relates to long-term investments, such as purchasing or selling securities, assets, or investments in other companies.

- Financing cash flow: This refers to the net cash linked to financing activities, such as issuing debt or equity, paying dividends, or selling ownership shares to investors.

While positive cash flow is generally a positive sign, it is important to note that it does not always equate to profitability. A company can have a positive cash flow without making a profit, and vice versa, as cash flow focuses on the movement of money rather than accounting terms like profit, which exist on paper.

Understanding Non-Cash Investment Gains: What You Need to Know

You may want to see also