A revocable trust is a legal entity that can own, buy, sell, hold, and manage assets according to a specific set of instructions. It can be changed or revoked at any time by the grantor, who is the person who creates the trust. The trustee is appointed by the grantor to oversee the management of the assets, and the beneficiary or beneficiaries are those for whom the assets are managed.

A revocable trust can be a useful tool for those who want to manage their assets during their lifetime and ensure they are passed on smoothly to their beneficiaries after their death. It can also help beneficiaries avoid probate court and provide greater privacy over the treatment of assets.

However, revocable trusts have upfront costs and don't offer immediate tax advantages or protection from creditors. They also require careful planning and management to ensure they are properly funded and meet the grantor's objectives.

| Characteristics | Values |

|---|---|

| Purpose | Protecting your assets during your lifetime and creating an avenue to pass your assets with ease after your death |

| Privacy | Records and information about assets remain private after your death |

| Probate | Avoids probate, a lengthy and costly process for your heirs |

| Cost | Initial cost is high but likely offset by savings from probate and legal fees |

| Control | Grantor retains ownership of assets and can easily change beneficiaries |

| Tax | No immediate tax advantages; assets in the trust are still taxable |

| Creditor protection | No creditor protection; assets are reachable by creditors during the grantor's lifetime |

| Complexity | Requires many steps to fund and involves significant upfront costs |

| Will | Does not exempt the owner from needing a will |

Funding a revocable trust

Understanding the Purpose of Funding

Funding your revocable trust involves transferring ownership of your assets and property to the trust. This process ensures that your assets will be managed and distributed according to your wishes upon your death or incapacity. It also helps streamline the distribution process, minimise tax implications, and safeguard your assets from probate and legal challenges.

Transferring Ownership of Assets

To fund your revocable trust, you need to retitle your personal assets so that the trust becomes the legal owner. This can be done by changing the titles of your assets from your individual name to the name of the trust. This includes financial accounts, real estate, investments, and other tangible personal property. It's important to note that some assets, such as retirement accounts and certain qualified annuities, should not be transferred directly into the trust due to tax implications. Instead, you can name the trust as the beneficiary of these accounts.

Working with an Attorney

While it is possible to fund a revocable trust yourself, it is recommended to seek advice from an experienced estate planning or elder law attorney. They can guide you through the process, ensure that documents are properly signed and executed, and advise on any state-specific considerations. Additionally, they can assist in transferring more complex assets, such as real estate, and help you navigate any legal or tax implications.

Common Assets Used for Funding

The most common assets used to fund revocable trusts include real estate, financial accounts (such as bank accounts, brokerage accounts, stocks, bonds), and personal property (such as jewellery, artwork, or family heirlooms). Retirement accounts, life insurance policies, and certain types of business interests can also be included, but it's important to carefully consider the tax implications and seek professional advice.

Timing and Regular Review

Funding your revocable trust is an important step to take as soon as the trust is established. It's also crucial to regularly review and update your trust, especially if there are changes in your financial situation or family dynamics. While it may require some time and effort, funding your revocable trust is essential to ensuring that your wishes are carried out and your beneficiaries are provided for.

Smart Ways to Invest 100K Cash for Maximum Returns

You may want to see also

Choosing a trustee

When choosing a trustee for a revocable trust, it's important to select someone who is trustworthy and capable of managing the trust's assets effectively. Here are some key considerations:

Qualifications and Competency

It is essential to choose a trustee who possesses the necessary skills, knowledge, and qualifications to manage the trust's assets competently. This includes financial acumen, investment expertise, and legal understanding. The trustee should also be mentally competent to make informed decisions and carry out the responsibilities entrusted to them.

Fiduciary Duty

The trustee has a fiduciary duty to act in the best interests of the beneficiaries. They must uphold the highest standards of honesty, integrity, and loyalty in their management of the trust's assets. The trustee should always put the beneficiaries' interests first and avoid any conflicts of interest.

Time Commitment and Availability

Trust management can be a time-consuming task, requiring regular attention and decision-making. It is crucial to select a trustee who has the necessary time and availability to dedicate to this role effectively. They should be able to promptly address any issues that arise and make themselves accessible to the beneficiaries for queries or concerns.

Impartiality and Objectivity

An ideal trustee should be impartial and objective in their decision-making. They should treat all beneficiaries fairly and equitably, distributing assets according to the grantor's wishes. It is important to choose someone who can remain unbiased and not favour certain beneficiaries over others.

Communication and Transparency

Effective communication and transparency are essential traits for a trustee. They should maintain open lines of communication with the beneficiaries, providing clear and timely updates on the status of the trust and any relevant decisions made. This promotes trust and confidence among the beneficiaries.

Successor Trustee

When choosing a trustee, it is also prudent to consider naming a successor trustee who can step in if the primary trustee becomes unable or unwilling to fulfil their duties. The successor trustee should possess similar qualifications and attributes, ensuring a smooth transition and continuity in trust management.

In conclusion, selecting a trustee for a revocable trust requires careful consideration of the individual's competency, integrity, availability, and ability to act in the best interests of the beneficiaries. It is a role that demands a high level of responsibility and trustworthiness, so choosing someone with strong ethical standards and the necessary skills is of utmost importance.

Cashing in an Investment ISA: A Step-by-Step Guide

You may want to see also

Avoiding probate

A revocable trust is a flexible tool that can help your assets pass smoothly to your beneficiaries while avoiding probate. Here are some key points on how to use a revocable trust to avoid probate:

Understanding Revocable Trusts

A revocable trust, also known as a living trust, is a legal entity that can own, buy, sell, hold, and manage assets according to the grantor's instructions. The grantor is the person who creates and funds the trust by depositing assets. The trustee is appointed to oversee the management of these assets, and the beneficiary or beneficiaries are those for whom the assets are managed. During the grantor's lifetime, they have the ability to revoke, amend, or terminate the trust and take back their assets.

Advantages of Revocable Trusts for Avoiding Probate

The primary advantage of a revocable trust is avoiding probate, which is a lengthy and costly legal process that typically occurs after an individual's death. By having a revocable trust, your assets can be distributed according to your wishes without the need for probate. This not only streamlines the distribution process but also maintains privacy, as probate proceedings are usually public record. Additionally, a revocable trust can help protect your assets in case you become incapacitated. During your lifetime, if you become disabled, the trustee or successor trustee can manage your assets on your behalf, avoiding the need for court-appointed guardianship.

Disadvantages and Considerations

One of the main disadvantages of creating a revocable trust is the initial cost. Setting up a trust can be complex and expensive, especially if your estate plan is complicated. However, the cost may be offset by savings in the long run, such as avoiding probate and associated legal fees. It's important to note that a revocable trust does not provide estate tax benefits since the grantor maintains control of the assets. Additionally, assets in a revocable trust are not protected from creditors, so they can be used to satisfy judgments against the grantor.

Steps to Creating a Revocable Trust

To create a revocable trust, you'll need to follow these steps:

- Create a trust document: List the assets you wish to include, name the trustee, and designate the beneficiaries.

- Sign and notarize the trust agreement: Ensure the grantor signs the document and has it notarized to make it official.

- Transfer assets into the trust: Move assets such as bank accounts, investment accounts, and real estate into the trust by retitling them in the name of the trust.

Fidelity Investments: Sport Clips' Financial Management Partner

You may want to see also

Tax implications

Revocable trusts are considered “grantor” trusts for income tax purposes. This means that any income generated by the trust is taxable to the grantor (the creator of the trust) and must be reported on their personal income tax return. The trust itself does not file a separate tax return. During the grantor's lifetime, the taxpayer identification number of the trust is usually the grantor's Social Security number. All items of income, deductions, and credits are reported on the grantor's personal income tax return.

While the grantor is still alive, a revocable trust is essentially a disregarded entity for tax purposes. The grantor retains full control over the terms of the trust and the assets within it and can modify the terms of the trust at any time. It is easy to transfer ownership of assets into a revocable trust without paying taxes on those items.

However, upon the grantor's death, the assets in the revocable trust are subject to federal and state estate taxes. The trust assets are not shielded from creditors to the same degree as those in an irrevocable trust. If the grantor is sued, trust assets may be used to satisfy a judgment.

In a community property state, the surviving spouse will get a 100% step-up basis on the death of the first spouse. In a non-community property state, the surviving spouse will get a 50% step-up basis.

It is important to note that a revocable trust does not avoid capital gains tax. The grantor is still legally and financially responsible for the assets, and any profits or losses generated by the assets in the trust are taxable to the grantor.

How Investment Demand Graphs Interpret Nominal Interest Rates

You may want to see also

Privacy

Probate Avoidance

Probate is a public process that can be expensive and lengthy for your heirs. It can extend from a couple of months for a simple estate to a couple of years for a more complex one. A revocable trust allows your assets to bypass probate, keeping the details of your estate private.

A revocable trust can also preserve the privacy of information shared about your estate. The probate process that wills are subject to makes your estate a public record for anyone to access. In contrast, a revocable trust keeps your records and information about your assets private, even after your death.

Protection Against Challenges

The standard will may create family disputes and be challenged for alteration by any member of your family. By using a revocable trust, you can specifically disinherit anyone who contests your wishes upon your death.

Continuous Management

A revocable trust can also help ensure the continuous management of your wealth. By appointing a professional trustee to manage your property, your accumulated wealth can grow for multiple generations.

Estate Tax Minimization

While a revocable living trust does not minimize taxes on its own, provisions can be included in the trust documentation to establish a credit shelter trust (CST) upon your death. This can help reduce estate taxes for large estates exceeding the combined tax exclusion amounts.

Understanding Net Cash Flows from Investing Activities

You may want to see also

Frequently asked questions

A revocable trust is a legal entity that can own, buy, sell, hold, and manage assets according to a specific set of instructions. The grantor, who sets up the trust, can change or revoke the trust at any time. The trustee oversees the management of the assets, and the beneficiary or beneficiaries receive the assets.

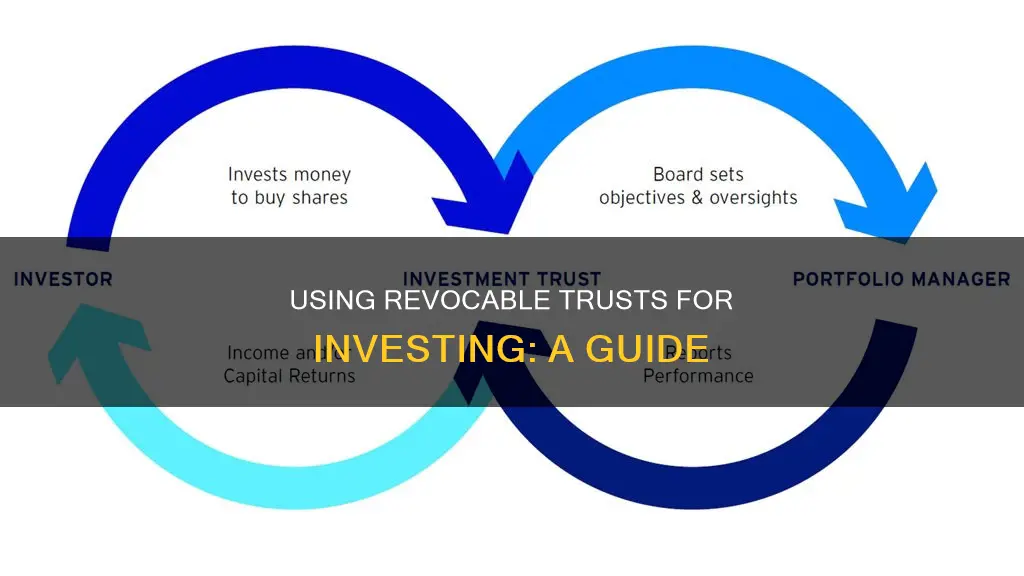

The grantor creates a trust document that appoints a trustee to manage their property. The trustee can be a competent adult, bank, or trust company, or the grantor themselves. The grantor's assets, such as investments, bank accounts, and real estate, are then transferred into the trust. The grantor retains control of the assets while alive and can amend or change the trust at any time. Upon the grantor's death, the assets are distributed to the beneficiaries.

A revocable trust helps avoid probate, protects the privacy of the trust owner and beneficiaries, and minimizes estate taxes. It also allows the grantor to maintain control over their assets and provides flexibility in distributing the assets.

Revocable trusts have upfront costs and involve many steps to fund. They do not offer tax advantages or protection from creditors. Additionally, the grantor must continuously monitor and maintain the trust, and there may be administrative expenses and difficulties for unique assets.