The nominal interest rate is the rate of interest before adjusting for inflation. It is the rate specified in loan contracts without accounting for compounding. The nominal interest rate is influenced by factors such as the demand and supply of money, federal government actions, and central bank monetary policies. Central banks utilise short-term nominal interest rates as a monetary policy tool, lowering them during economic recessions to encourage economic activity and raising them during inflationary periods. The nominal interest rate is determined by the supply and demand for money in an economy, with the Federal Reserve controlling the money supply. The nominal interest rate is the observed market rate and is often quoted by banks and the financial press.

What You'll Learn

- How nominal interest rates are determined by money supply and demand?

- The nominal interest rate observed in the market

- The relationship between nominal interest rates, real interest rates and inflation

- The role of central banks in setting short-term nominal interest rates

- How nominal interest rates are impacted by economic conditions, such as recession or inflation?

How nominal interest rates are determined by money supply and demand

The nominal interest rate is the rate of interest before adjusting for inflation. It is determined by the supply and demand for money in an economy. The nominal interest rate is also referred to as the rate specified in the loan contract without adjusting for compounding.

The supply of money is determined by the Federal Reserve, or the Fed, and is not directly affected by interest rates. The Fed may choose to alter the money supply to change the nominal interest rate. When the Fed increases the money supply, the line on a graph shifts to the right, and when it decreases the money supply, the line shifts to the left. The Fed controls the supply of money by buying and selling government bonds, which increases or decreases the money supply respectively.

The demand for money is influenced by why households and institutions hold money. Households, businesses, etc., use money to purchase goods and services, so a higher nominal GDP means that more money is demanded. However, as the interest rate increases, the quantity of money demanded decreases, as there is an opportunity cost to holding money.

The equilibrium price and quantity of money are found at the intersection of the supply and demand curves. The interest rate must adjust so that people are willing to hold all the money the Fed is trying to put into the economy.

When the Fed adjusts the supply of money, the nominal interest rate changes. An increase in the money supply results in a surplus of money at the prevailing interest rate, so the interest rate must decrease to encourage people to hold the extra money. A decrease in the money supply creates a shortage of money, so the interest rate must increase to dissuade people from holding money.

Changes in the demand for money can also impact nominal interest rates. An increase in the demand for money can lead to a shortage of money and an increase in the nominal interest rate. On the other hand, a decrease in the demand for money can result in a surplus of money and a decrease in the nominal interest rate.

EM Cash: Investing Strategies for Beginners

You may want to see also

The nominal interest rate observed in the market

The nominal interest rate is the rate that is observed in the market and specified in loan contracts. It is the actual monetary price borrowers pay lenders to use their money, and it is the rate before adjusting for inflation.ın

The nominal interest rate is the rate that lenders and borrowers use as a reference when negotiating loans. It is the interest rate that is often quoted by banks and the financial press. This rate is not adjusted for inflation, and it is usually expressed on an annual basis, such as 5%, 7%, or 10%. Nominal interest rates are determined by the supply and demand for money in an economy.

The nominal interest rate is also referred to as the coupon rate, which is the actual monetary price borrowers pay lenders to use their money. For example, if the nominal rate on a loan is 5%, borrowers can expect to pay $5 of interest for every $100 loaned to them. This rate is often stamped on the coupons redeemed by bondholders, hence the name "coupon rate."

The nominal interest rate is important because it is the rate that is typically stated in loan contracts and other financial agreements. It is the rate that borrowers will see when they sign their loan paperwork, and it is the rate that financial institutions will advertise for their loan or deposit products. This allows customers to quickly understand the rate they will be paying or receiving without the need for adjustments.

However, it is important to note that the nominal interest rate is not the same as the effective interest rate, which takes into account the impact of compounding. The effective interest rate is the rate that borrowers will actually pay, and it is usually higher than the nominal rate. The difference between the nominal and effective rates increases with the number of compounding periods within a specific time period.

Strategizing Initial Investment: Deciding Your First Cash Flow

You may want to see also

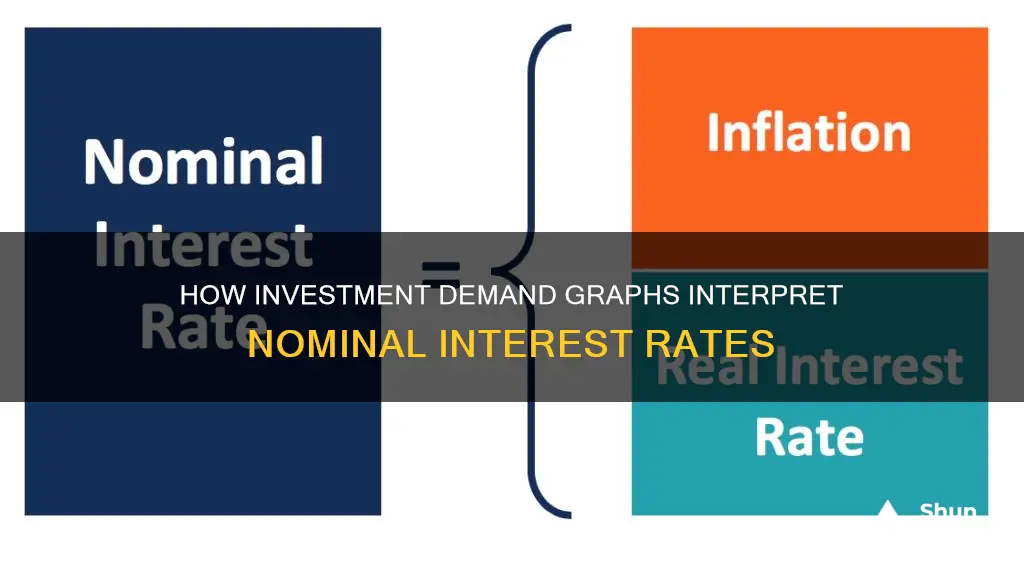

The relationship between nominal interest rates, real interest rates and inflation

The nominal interest rate is the rate of interest before adjusting for inflation. It is the rate actually observed in the market and is often quoted by banks and the financial press. Nominal interest rates are determined by the supply and demand for money in an economy. The nominal interest rate is the stated interest rate of a bond or loan, which signifies the actual monetary price borrowers pay lenders to use their money.

The real interest rate, on the other hand, accounts for inflation, giving a more precise reading of a borrower's buying power after the position has been redeemed. It is calculated by subtracting the expected inflation rate from the nominal interest rate. The real interest rate is crucial for making informed financial decisions, especially in the context of investments and loans.

The relationship between nominal and real interest rates can be understood using the Fisher effect, an economic theory created by Irving Fisher. The Fisher effect states that the nominal interest rate will tend to incorporate inflation expectations to provide lenders with a real return. The equation for the Fisher effect is:

Nominal Interest Rate = Real Interest Rate + Expected Inflation Rate

This means that an increase in expected inflation will tend to increase the nominal interest rate. For example, if the nominal interest rate on a savings account is 4% and the expected inflation rate is 3%, then the money in the savings account is actually only growing at 1%.

In terms of the relationship between nominal interest rates and inflation, an increase in inflation will lead to an increase in the nominal interest rate. This is because the nominal rate will adjust to reflect changes in the inflation rate to remain competitive. As a result, countries with higher nominal interest rates will also tend to have higher inflation rates.

The relationship between real interest rates and inflation is inverse: as inflation increases, real interest rates fall, unless nominal rates increase at the same pace as inflation. When the real interest rate is positive, it means that the lender or investor is able to beat inflation, whereas a negative real interest rate means that the rate being charged or paid is not keeping up with inflation.

Capital Investment Project: Cash Flows Strategy

You may want to see also

The role of central banks in setting short-term nominal interest rates

Central banks play a crucial role in setting short-term nominal interest rates, which serve as the foundation for other interest rates levied by banks and financial institutions. Nominal interest rates are the rates observed in the market and specified in loan contracts, without adjusting for inflation or compounding. Central banks utilise these rates as a tool for implementing monetary policy, with the aim of maintaining economic stability and achieving price stability.

During economic recessions, central banks typically lower the nominal interest rate to encourage economic activities. This makes borrowing more affordable for banks, allowing them to pass on the savings to their customers through reduced interest rates on loans. Consequently, consumers are incentivised to borrow and spend more, providing a stimulus to the economy.

On the other hand, during inflationary periods, central banks tend to raise the nominal interest rate to combat rising prices. Increasing the nominal rate makes borrowing costlier, which, in turn, makes purchasing goods and services on credit more expensive. As a result, consumers curb their spending, leading to a slowdown in economic growth.

The Federal Reserve (Fed) in the United States, for instance, has the mandate to maintain stability within the country's financial system. The Fed accomplishes this by adjusting the federal funds rate, which is the interest rate at which banks lend to each other overnight to maintain their reserve requirements. Additionally, the Fed sets the discount rate, which is the rate at which banks can borrow directly from the central bank.

It is worth noting that central banks do not directly mandate interest rates. Instead, they influence the supply of money in the economy, typically through the buying and selling of securities in the open market. These actions affect short-term interest rates, which then have a ripple effect on longer-term rates and overall economic activity.

Robo-Advisers: Investment Advisers' Future or Fad?

You may want to see also

How nominal interest rates are impacted by economic conditions, such as recession or inflation

Nominal interest rates are impacted by economic conditions such as recession and inflation. During a recession, interest rates typically decline as loan demand slows, investors seek safety, and consumers reduce their spending. A central bank can lower short-term interest rates and buy assets during an economic downturn to stimulate spending.

On the other hand, nominal interest rates tend to be high during periods of high inflation. Central banks tend to set nominal rates high during inflationary times, but they may overestimate the inflation level and keep nominal interest rates too high. The resulting elevated level of interest rates may have serious economic repercussions as they tend to stall spending.

The nominal interest rate is the rate of interest before adjusting for inflation. It is determined by the supply and demand for money in an economy. The supply of money is set at the discretion of the Federal Reserve and is not directly affected by interest rates. The demand for money is influenced by the dollar value of aggregate output, meaning the nominal GDP. As the dollar value of aggregate output increases, the demand for money also increases.

Changes in the supply and demand for money can impact nominal interest rates. When the Federal Reserve increases the money supply, there is a surplus of money at the prevailing interest rate, and the interest rate must decrease. Conversely, when the Fed decreases the money supply, there is a shortage of money at the prevailing interest rate, and the interest rate must increase.

Attracting Cash Investments: Strategies to Engage Shareholders

You may want to see also

Frequently asked questions

The nominal interest rate is the rate of interest before adjusting for inflation. It is the rate observed in the market and specified in loan contracts, which is usually the rate advertised or stated by banks and financial institutions.

The real interest rate is the rate after taking inflation into account. The nominal rate contains two parts: the real interest rate and an inflation premium. As inflation erodes the purchasing power of money over time, the real interest rate reflects the lender's actual return.

The nominal interest rate (n) for a specified period can be calculated using the formula: n = m × [(1 + e)¹/m - 1], where m is the number of compounding periods and e is the effective interest rate.

Central banks use the short-term nominal interest rate as a tool for monetary policy. During a recession, the nominal rate is lowered to stimulate economic activity, while during inflationary periods, the rate is raised to curb spending and control inflation.

The nominal interest rate affects investment demand by influencing the cost of investment. A higher nominal interest rate increases the cost of borrowing funds, reducing the amount of investment. Conversely, a lower nominal interest rate makes borrowing cheaper, encouraging more investment.

These questions and answers provide a basic understanding of the role of nominal interest rates in investment demand graphs and their impact on economic decisions.