Net cash provided by financing activities is a crucial metric for understanding a company's financial health and stability. It refers to the difference between incoming and outgoing cash flows, as detailed in a company's cash flow statement. This statement is one of three key financial documents, alongside the balance sheet and income statement, and it offers insight into the management of cash and cash equivalents. Net cash flow from financing activities can be positive or negative, indicating whether a company has cash reserves or needs external funding. Calculating this metric involves analysing transactions related to debt, dividends, equity, and the sale or repurchase of shares and bonds.

What You'll Learn

Cash Flow Statement

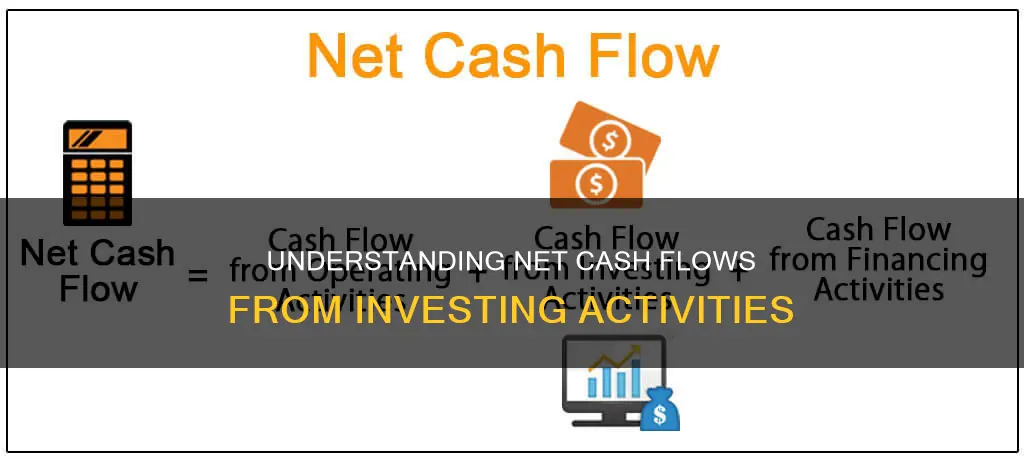

A cash flow statement is one of the three main financial statements a business uses, alongside the balance sheet and income statement. It provides an account of the cash used in operations, including working capital, financing, and investing.

The cash flow statement is divided into three sections:

- Cash Flow from Operating Activities

- Cash Flow from Investing Activities

- Cash Flow from Financing Activities

This response will focus on the second section: Cash Flow from Investing Activities.

Cash Flow from Investing Activities (CFI) is a section of a company's cash flow statement that displays how much money has been used or generated from making investments during a specific time period. It reports the cash inflow and outflow from investing in assets, including intangibles, purchasing assets like property, plant, and equipment, shares, debt, and sale proceeds of assets or disposal of shares/debt/redemption of investments.

Investing activities include a wide range of items and can generate either negative or positive cash flow. Purchases require spending money, which generates negative cash flow, while sales produce income, resulting in positive cash flow. Some examples include:

- Purchase of fixed assets

- Purchase of investments such as stocks or securities

- Sale of fixed assets

- Sale of investment securities

- Collection of loans and insurance proceeds

- Investment in joint ventures and affiliates

- Payments for business acquisitions

- Proceeds from sales of assets

- Investments in marketable securities

Calculating Cash Flow from Investing Activities

To calculate the net cash flow from investing activities, the following steps can be taken:

- Gather the necessary data from the income statement and balance sheet of the business, as well as any other relevant financial documents.

- Make a detailed list of the sources and outflow of cash related to investments.

- Calculate the net cash flow by deducting the total outflow from the total inflow.

- Transfer the calculated value to the cash flow statement, which will also include values from operating and financing activities.

Examples of Cash Flow from Investing Activities

- Apple Inc.: Apple's cash flow from investment activities showed an outflow of $45.977 billion. This includes the purchase of marketable securities and investment in property, plants, and equipment.

- Amazon: Amazon has consistently invested in the purchase of property, equipment, software, and websites, as well as acquiring other businesses and buying marketable securities.

- JPMorgan Chase: As a bank, JPMorgan's cash flow statement includes items specific to financial services, such as loans originated to be held for investment and the investment securities portfolio.

Importance of Cash Flow from Investing Activities

The cash flow from investing activities is important for several reasons:

- It provides a trend analysis of a company's capital expenditures, helping to understand its growth or stability.

- It helps identify why a company may be disposing of assets if the proceeds from the disposal of fixed assets are substantial.

- It allows investors to make more calculated investment decisions by providing a comprehensive view of the company's financial health when analyzed alongside the income statement and balance sheet.

- It helps business owners and managers address any cash flow issues by pinpointing the specific areas where cash flow may be a problem.

In conclusion, the cash flow from investing activities section of the cash flow statement provides valuable insights into a company's investment activities and their impact on cash flow. It includes the cash inflow and outflow from various investment-related transactions and is an essential tool for investors, business owners, and managers to assess the financial health and growth prospects of a company.

Cashing in on Investments: A Meryl Lynch Guide

You may want to see also

Long-term Investments

The nature and intent of long-term investments play a crucial role in determining the applicable accounting methods. For instance, investments may be acquired for their cash flow yields, to establish influence or control, or for other strategic reasons. When a company acquires a controlling ownership interest in another company, their financial statements must be "consolidated" into a single set of financial statements, reflecting goodwill and revised values for the subsidiary's assets and liabilities.

The percentage of ownership in another company also determines the accounting method. If a purchasing company owns less than 20% of the outstanding stock of the investee company and does not exert significant influence, the cost method is used. However, if the purchasing company owns between 20% and 50% or exercises significant influence, the equity method is employed. In this case, the investor company must recognise its share of the investee company's income, regardless of whether dividends are received.

Recording Cash Investments: A Quickbooks Guide

You may want to see also

Business Acquisitions

Net cash provided by investing activities is a financial indicator that shows the net amount of cash inflows and outflows resulting from a company's investment activities over a specific period. It takes into account the cash spent or received from buying or selling long-term assets, as well as other investments such as securities or bonds.

For example, Amazon's 2017 financial statements show outflows from the acquisition of other businesses, net of cash acquired. This indicates that Amazon's strategy involves investing in the acquisition of other companies to support its long-term growth.

The purchase of another company is considered an investing activity and is accounted for under cash from investing activities. This is separate from financing activities, which include debt and equity financing, and operating activities, which include day-to-day business operations.

A positive net cash flow from investing activities indicates that a company has generated cash from its investments, while a negative number indicates that the company has spent more on investments than it has earned. However, a negative cash flow from investing activities is not always a bad sign, as it can indicate that a company is investing in its long-term health, such as through research and development or the acquisition of other businesses.

Understanding the Relationship Between Cash and Investments

You may want to see also

Cash Flow from Operating Activities

CFO can be calculated using either the direct or indirect method. The direct method tracks all transactions in a period on a cash basis, including cash inflows and outflows such as salaries paid, cash paid to vendors and suppliers, cash collected from customers, interest income, dividends received, income tax paid, and interest paid. On the other hand, the indirect method starts with net income from the income statement and then adds back non-cash items to arrive at a cash basis figure. This method is simpler to prepare and is more commonly used, as it relies on information from the income statement and balance sheet.

The formula for calculating CFO using the indirect method is:

> Cash Flow from Operating Activities = Net Income + Depreciation, Depletion, & Amortization + Adjustments To Net Income + Changes In Accounts Receivables + Changes In Liabilities + Changes In Inventories + Changes In Other Operating Activities

CFO is an essential tool for evaluating a company's performance and liquidity. It helps stakeholders understand how much cash is generated from day-to-day operations and provides a metric to compare current performance against historical results. Positive cash flow from operating activities indicates that a company's core business activities are thriving, while negative cash flow suggests that additional cash is needed to sustain operations.

Selling Investments on Cash App: A Step-by-Step Guide

You may want to see also

Cash Flow from Financing Activities

The cash flow statement is one of the three main financial statements that give an overview of a company's financial health. The other two are the balance sheet and the income statement.

The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Financing activities include transactions involving debt, equity, and dividends. Debt and equity financing are reflected in the cash flow from financing section, which varies with the different capital structures, dividend policies, or debt terms that companies may have.

The formula for calculating cash flow from financing activities is:

> CFF = CED − (CD + RP)

>

> where:

> CED = Cash inflows from issuing equity or debt

> CD = Cash paid as dividends

> RP = Repurchase of debt and equity

For example, if a company has the following information in the financing activities section of its cash flow statement:

- Repurchase stock: $1,000,000 (cash outflow)

- Proceeds from long-term debt: $3,000,000 (cash inflow)

- Payments to long-term debt: $500,000 (cash outflow)

- Payments of dividends: $400,000 (cash outflow)

The CFF would be:

> $3,000,000 - ($1,000,000 + $500,000 + $400,000) = $1,100,000

Positive cash flow from financing activities means more money is flowing into the company than flowing out, increasing the company's assets. Conversely, negative CFF numbers can mean the company is servicing debt or retiring debt, making dividend payments, or undertaking stock repurchases.

It is important to note that a positive cash flow from financing activities may not always be a good thing, especially if a company is already saddled with a large amount of debt. Conversely, negative CFF may not be cause for concern if a company is repurchasing stock and issuing dividends while maintaining healthy earnings.

Any significant changes in cash flow from financing activities should prompt investors to investigate the transactions further.

Understanding Your Cash Available to Invest

You may want to see also

Frequently asked questions

Net cash provided by investing activities is the net amount of cash generated by or used in a company's investment activities over a specific period.

Investing activities include the purchase or sale of physical assets, investments in securities, or the sale of securities or assets.

The formula for calculating net cash provided by investing activities is:

Net Cash Flow from Investing Activities = Total Inflow (Cash Received) – Total Outflow (Cash Spent)

Examples of investing activities include the purchase or sale of property, plant, and equipment (PP&E), acquisitions or sales of other businesses, and purchases or sales of marketable securities such as stocks or bonds.

Understanding net cash provided by investing activities is important because it provides insights into a company's financial health and investment strategies. It helps investors and analysts evaluate the company's cash position and its ability to generate cash from its investments.