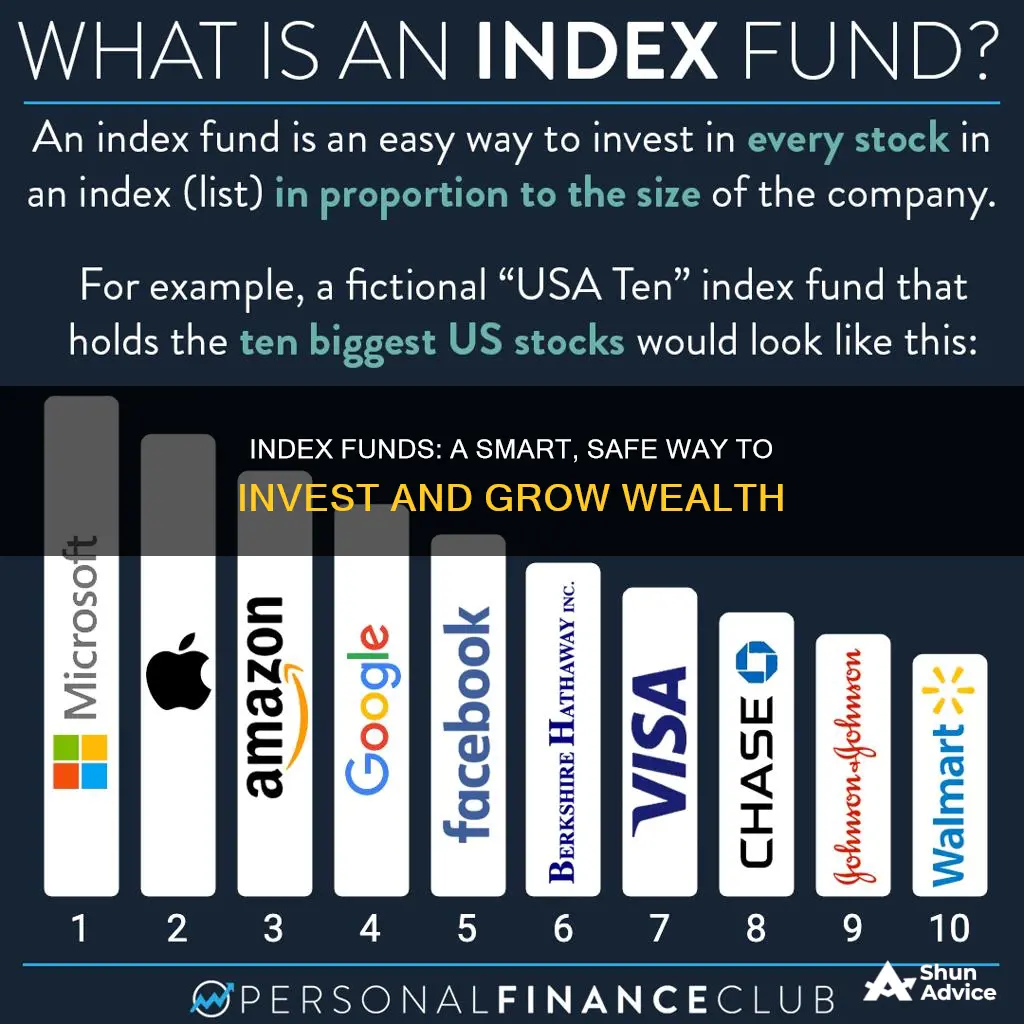

Index funds are a type of investment vehicle that tracks a market index, such as the S&P 500 or the Nasdaq Composite. They are designed to mirror the performance of a specific index by holding a basket of securities in the same or similar proportion to what the index represents. Index funds are passively managed, meaning that investing decisions are based solely on trying to match the index. This makes them a low-cost, low-risk investment option.

When investing in index funds, it is important to have clear goals and to choose the right index fund strategy for your timeline and risk appetite. It is also crucial to research different types of indexes and individual funds, considering factors such as fees, performance, and investment minimums. Investors can purchase index funds directly from a mutual fund company or a brokerage, or through certain investment apps.

Index funds offer several benefits, including diversification, low fees, tax advantages, and low risk due to their diversified nature. However, one drawback is that they rise and fall with the index they track, so they can be vulnerable to market downturns. Overall, index funds are a popular choice for investors seeking low-cost, diversified, and passive investments, and they have consistently outperformed many higher-fee, actively traded funds.

| Characteristics | Values |

|---|---|

| Type of investment vehicle | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive |

| Investment goal | Long-term wealth building |

| Investment costs | Low fees, low risk, low taxes |

| Investment research | Minimal |

| Investment risk | Low |

| Investment return | Matches market performance |

What You'll Learn

Understand the benefits of index funds

Index funds are considered one of the smartest investment moves you can make. Here are the benefits of index funds:

Broad diversification

Investing in index funds instantly diversifies your portfolio, reducing the likelihood of losing money. For example, an index fund tracking the S&P 500 would hold about 500 different stocks. While the performance of each stock fluctuates, investing in a fund that holds all of them matches your portfolio's performance to that of the index. Diversifying your portfolio among so many companies ensures that its value is not overly correlated with the fortunes of any one company listed in the index.

Low costs

The costs of index funds, including taxes and management fees, are often lower than those of other investment funds. Index funds are passively managed, meaning they simply track an index by buying and holding all the stocks in that index. As a result, the holdings of the index fund rarely change, and the expense ratio is comparatively low because there is little work required of the fund manager.

Lower taxes on capital gains

Index funds have lower turnover ratios, which means they accrue capital gains less frequently, resulting in lower taxes owed by investors.

Attractive returns

Index funds tend to generate attractive returns over time, outperforming other types of funds that are actively managed by top investment firms. According to research by Standard & Poor's, only about 23% of actively managed mutual funds outperform the S&P 500 over five years.

Low fees

Index funds are usually far less costly than alternatives like actively managed funds. This is because an index fund manager just has to passively buy the stocks or other investments in an index—you don't have to pay them to make stock picks.

Tax efficiency

Index funds are tax-efficient compared to many other investments. They generally don't have to buy and sell holdings as frequently as actively managed funds, so they avoid generating capital gains that can increase your tax bill.

A Simple Guide to Investing in Fidelity 500 Index Funds

You may want to see also

Know the drawbacks

Index funds are a popular investment choice due to their potential for stable long-term returns, diversification, and low fees. However, they also have some drawbacks that you should be aware of before investing. Here are some of the key disadvantages of investing in index funds:

Lack of Downside Protection

The performance of an index fund is directly linked to the performance of the index it tracks. This means that if the market or sector experiences a downturn, your index fund will likely follow suit. Index funds do not provide the flexibility to quickly respond when the prices of the assets they hold fall. Therefore, it is essential to maintain a long-term perspective when investing in index funds and be prepared for market fluctuations.

Lack of Reactive Ability

Index funds do not allow for advantageous behaviour. If a stock within the index becomes overvalued, it carries more weight in the index. However, this is when investors would typically want to lower their exposure to that stock. Investing solely through an index fund means you cannot act on this knowledge and adjust your portfolio accordingly.

No Control Over Holdings

Indexes are set portfolios, and investors have no control over the individual holdings. You may have specific companies that you want to invest in or avoid for moral or personal reasons, but with an index fund, the components of the portfolio are predetermined and out of your hands.

Limited Exposure to Different Strategies

Index funds provide diversification, but they may not offer access to various successful investing strategies. There are countless strategies that investors have used to generate better risk-adjusted returns. By conducting research and combining different strategies, you may be able to create a more targeted portfolio that aligns better with your personal goals and risk tolerance.

Dampened Personal Satisfaction

Investing can be stressful, and investing in index funds may not alleviate this stress. You may still find yourself constantly checking the market's performance and worrying about the economic landscape. Additionally, you will not experience the same level of satisfaction and excitement from making individual investments and seeing them succeed.

Merrill Lynch Funds: A Guide to Investing Wisely

You may want to see also

Decide on your investment goals

Before investing in index funds, it is important to have clear investment goals. Index funds are a great investment option for those looking to build wealth over time, especially for retirement. They are a low-cost and easy way to invest, mirroring the performance of an existing stock market index, such as the S&P 500.

Index funds are ideal for those looking for a long-term, hands-off investment strategy. They are passively managed, meaning they aim to replicate the performance of a particular market index, rather than trying to beat the market. This passive management strategy means you don't need to actively decide which investments to buy or sell, making it a more straightforward investment option.

Index funds are also a good option for those seeking a more diversified portfolio. By investing in an index fund, you will be investing in a group of stocks or other securities that make up the index. This means you are not putting all your eggs in one basket, so to speak, reducing the risk of losing money. Index funds are less volatile than individual stocks, as they are diversified across a range of companies or assets.

When deciding on your investment goals, it is important to consider the different types of index funds available. Index funds can be mutual funds or exchange-traded funds (ETFs) and can track different indexes, such as the S&P 500, Dow Jones Industrial Average, or Russell 2000. They can also focus on specific sectors, such as technology or healthcare, or target companies with a focus on environmental or social justice causes.

Additionally, it is crucial to understand the costs associated with index funds. While they are generally a low-cost investment option, there can still be management fees, transaction costs, and expense ratios that can eat into your returns. Be sure to compare the costs of different index funds before investing.

Overall, index funds are a great option for those seeking a long-term, diversified investment strategy. They are easy to invest in and provide a hands-off approach to building wealth over time.

Guide to Investing in Mutual Funds: Strategies for Beginners

You may want to see also

Choose a fund strategy

There are many different types of index funds, so it's important to choose the right one for your financial goals and risk tolerance. Here are some key considerations to help you select an index fund strategy that aligns with your investment objectives:

- Time horizon and risk tolerance: Consider your investment horizon and risk tolerance when deciding between more aggressive equity index funds and more conservative bond index funds. If you have a shorter time horizon and lower risk tolerance, bond index funds may be more suitable. On the other hand, if you're investing for the long term, such as for retirement, equity index funds may offer higher potential returns.

- Asset allocation: Determine the appropriate asset allocation for your portfolio based on your timeline and risk appetite. A common rule of thumb is to allocate a higher percentage of stocks for more aggressive or longer-term investments and a higher percentage of bonds for more conservative or shorter-term investments.

- Index selection: Choose the right index to track based on your risk tolerance and investment goals. For example, broad, large-cap stock indexes like the S&P 500 or NASDAQ 100 are generally considered higher risk, while bond indexes like the Bloomberg Barclays U.S. Aggregate Bond Index are lower risk. You can also consider sector-specific indexes or international indexes to tailor your investment strategy further.

- Fund fees and performance: Compare the fees and performance of different index funds before making a selection. Look for funds with low expense ratios, sales loads, and other fees. Additionally, review the fund's historical performance and how closely it tracks its underlying index to ensure it aligns with your expectations.

- Investment minimums and liquidity: Consider the minimum investment required to invest in a particular index fund and ensure it aligns with your budget. Also, evaluate the liquidity of the fund and how easily you can buy or sell shares. Larger funds typically offer more liquidity and lower trading costs.

- Diversification: One of the benefits of index funds is diversification across a wide range of securities. When selecting an index fund, consider how well it diversifies your overall portfolio and helps spread risk.

- Tax implications: Be mindful of the tax implications of investing in index funds, especially if you're investing in a taxable brokerage account. Understand the short-term and long-term capital gains tax rates and consider strategies to minimize your tax burden, such as holding investments for at least a year to qualify for lower long-term capital gains rates.

Remember to review your investment strategy periodically and make adjustments as needed to ensure your index fund choices continue to align with your financial goals and risk tolerance.

Strategies for Investing Like a Hedge Fund Manager

You may want to see also

Research potential funds

Researching potential index funds is a crucial step in the investment process. Here are some key factors to consider:

- Company size and capitalisation: Index funds can track small, medium, or large companies, also known as small-, mid-, or large-cap indexes. This factor will determine the size and scope of the companies you invest in.

- Geography: Consider whether you want to focus on domestic or international markets. Some funds invest in companies that trade on foreign exchanges or a combination of global exchanges.

- Business sector or industry: You can choose funds that concentrate on specific sectors, such as consumer goods, technology, or health-related businesses. This allows you to align your investments with industries you believe in.

- Asset type: Different funds track different asset types, such as bonds, commodities, or cash. Diversifying your portfolio across various asset classes can help manage risk.

- Market opportunities: These funds focus on emerging markets or growing sectors. They can provide exposure to new and potentially lucrative areas of the economy.

- Performance and long-run returns: Evaluate the fund's historical performance and returns over at least five to ten years. This will give you an idea of their potential future returns, although past performance doesn't guarantee future results.

- Fees and expense ratios: Index funds are known for their low fees, but compare the expense ratios of different funds tracking the same index. Even small differences in ratios can impact your returns over time.

- Tax efficiency: Index funds that trade less frequently may be more tax-efficient, as they generate less taxable income. Additionally, consider the tax implications of buying and selling funds.

- Diversification: While index funds are inherently diversified, some funds may provide broader exposure to different sectors or asset classes. Diversification can help reduce risk and smooth out volatility.

- Fund options and accessibility: Not all brokers offer the same funds, so ensure the fund you're interested in is available through your broker. Also, consider the investment minimums and whether you can purchase fractional shares.

Remember to conduct thorough research and carefully evaluate each fund's characteristics before making any investment decisions.

Index Funds: Understanding Their Typical Investment Strategies

You may want to see also

Frequently asked questions

Index funds are a type of investment vehicle that tracks a market index, such as the S&P 500 or the Nasdaq Composite. They aim to match the performance of the index by holding a basket of securities in the same or similar proportion to the index.

Index funds offer broad market exposure and diversification across various sectors and asset classes. They also tend to have lower fees and costs compared to other types of funds, as they are passively managed. Additionally, they are simple to invest in and often perform very well over the long term.

One risk of index funds is that they are designed to mirror a specific market, so they will decline in value when the market does. They also lack the flexibility to pivot away from underperforming securities in the index.

When choosing an index fund, consider factors such as your personal financial situation, life goals, risk tolerance, and budget. Research the fund's fees, performance history, and how closely it tracks its underlying index. Compare different funds to find one that aligns with your investment goals and minimizes costs.

To start investing in index funds, you'll need to decide whether to do it yourself or seek professional help. Then, open an investment account with a brokerage platform or a robo-advisor, and fund the account. Finally, purchase shares of your chosen index fund through the platform.