Presenting an investment portfolio can be a daunting task, but with the right preparation, it can be a breeze. Whether you're a seasoned investor or just starting out, knowing how to showcase your investments effectively is crucial. Here are some key steps to help you present your investment portfolio with confidence and make a strong impression:

1. Know Your Audience: Understand the interests and expectations of your audience. Are they potential clients, partners, or investors? Tailor your presentation to their level of financial knowledge and highlight the aspects of your portfolio that align with their goals.

2. Clear Introduction: Start with a strong introduction. Briefly explain your background, expertise, and the type of investments you specialize in. Be clear about what sets you apart from others in the industry.

3. Less is More: Instead of overwhelming your audience with intricate details, provide a concise and simplified version of your investment projects. Focus on the key aspects such as the problem addressed, objectives, execution, and outcomes.

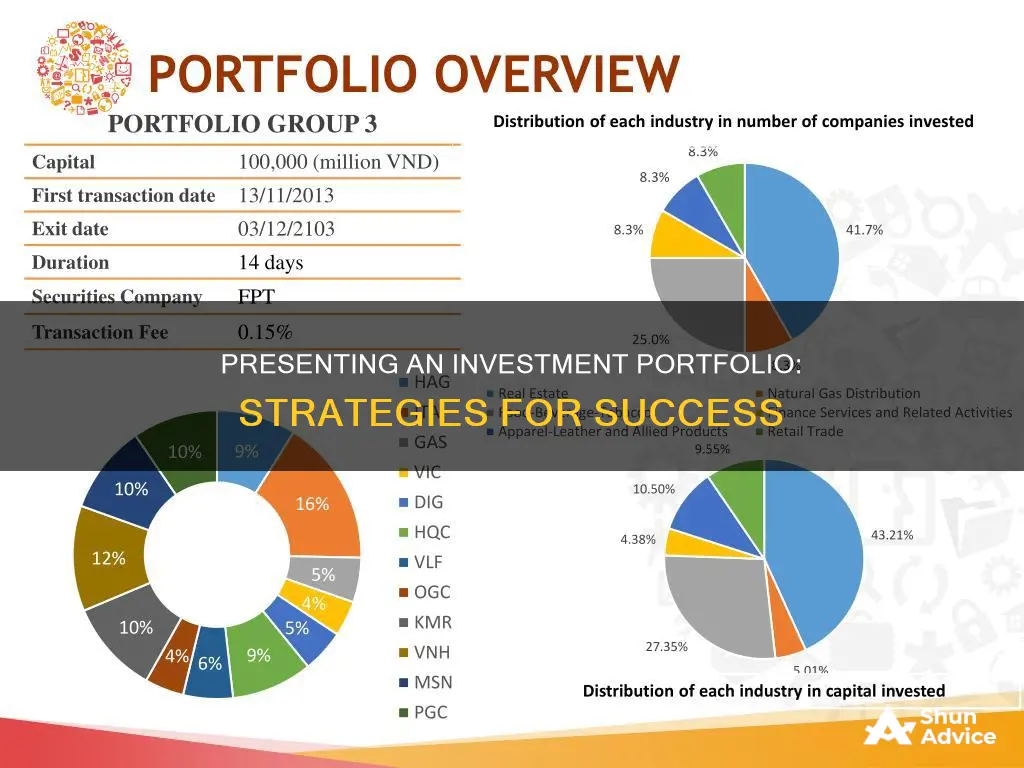

4. Visuals and Data: Utilize visual aids, charts, and graphs to illustrate your investment strategies and performance. Visual representations make complex information more accessible and engaging for your audience.

5. Tell a Story: Storytelling can bring your portfolio to life. Share the rationale and inspiration behind your investment decisions. Connect the dots for your audience by explaining how your investments align with your overall strategy and goals.

6. Practice and Confidence: Rehearse your presentation to refine your delivery. Confidence is key when presenting. Know your material well and be prepared to answer questions. Engage your audience and adapt your presentation to their level of understanding.

7. Interactive Approach: Encourage interaction during your presentation. Create opportunities for dialogue and discussion. This not only keeps your audience engaged but also allows you to address their concerns and showcase your expertise.

8. Risk and Returns: Be transparent about the risks and returns associated with your investments. Provide a balanced view by presenting both the potential gains and the potential drawbacks of your investment strategies.

9. Authenticity: Let your passion and authenticity shine through. Share personal insights and experiences that influenced your investment choices. This adds a human touch to your presentation and helps build trust with your audience.

10. Q&A and Feedback: Anticipate questions and be ready to address them confidently. View the Q&A session as an opportunity to showcase your knowledge and engage further with your audience. After your presentation, seek feedback to continuously improve your delivery and content.

Remember, a well-presented investment portfolio showcases not only your investment choices but also your ability to communicate and connect with your audience.

What You'll Learn

Start with your goals and time horizon

When presenting an investment portfolio, it's important to tailor your message to your goals and time horizon. Here are some key points to consider:

Understanding Time Horizons

The time horizon refers to the amount of time that investors expect to hold onto their investments before needing to access their money. This is a critical factor in determining the level of risk an investor can take on. Generally, the longer the time horizon, the more aggressive and riskier the investment strategy can be.

Short-Term Time Horizon (less than 5 years)

For short-term investments, it's important to preserve the principal amount and ensure liquidity. Suitable investment options include money market funds, savings accounts, certificates of deposit, and short-term bonds, as they can easily be converted to cash. This is suitable for investors approaching retirement or those needing a large sum of cash soon, like a couple saving for a down payment on a house.

Medium-Term Time Horizon (3 to 10 years)

For medium-term investments, a balanced approach is necessary. Investors can handle moderate levels of risk and volatility, so a mix of stocks and bonds is appropriate. This strategy is often used by people saving for college, marriage, or a first home. Towards the end of the time horizon, it's advisable to shift towards more conservative investments to safeguard against potential market downturns.

Long-Term Time Horizon (10 years or more)

With a long-term time horizon, investors can assume more significant risks in pursuit of higher returns. Long-term investors are typically willing to endure greater volatility as their investments have more time to recover from any short-term losses. This strategy is common for retirement savings, with younger investors allocating a higher proportion of their portfolios to stocks and gradually shifting towards fixed-income assets as they age.

Factors Affecting Time Horizon

It's important to note that while age is a significant factor in determining time horizons, other factors come into play, such as income, lifestyle, and individual risk tolerance. Wealthier investors, for instance, may afford to take on more aggressive investments over shorter periods due to their ability to absorb potential losses.

Setting Clear Goals

Before deciding on an investment strategy, it's crucial to outline clear financial goals. Are you saving for retirement, funding a child's education, or purchasing a home? Each goal may have a different time horizon, and understanding these timelines will help shape your investment choices and the level of risk you can take.

In conclusion, when presenting an investment portfolio, a deep understanding of your goals and time horizons is essential. This knowledge will guide your investment strategy, helping you navigate the trade-off between risk and reward to make informed decisions about your financial future.

Savings and Investments: Two Sides of the Same Coin

You may want to see also

Understand your risk tolerance

Understanding your risk tolerance is a crucial aspect of investing. It refers to the degree of risk you, as an investor, are willing to accept given the volatility in the value of an investment. Knowing your risk tolerance will help you plan your investment portfolio, determining how you invest and the types of investments you make.

Your risk tolerance is influenced by several factors, including your age, investment goals, income, and future earning capacity. For example, a young person who doesn't rely on their investments for income can afford to take greater risks than someone nearing retirement. Your personality and mental resilience also play a role. If you can't sleep at night due to short-term drops in your investments, you may prefer lower-risk options despite potentially lower returns.

- What are your investment goals? Common goals include saving for retirement, paying for a child's education, or achieving financial independence. Understanding your goals is the first step in determining how much risk you're willing to take.

- What is your time horizon? Generally, the longer your time horizon, the more risk you can take. For example, if you're saving for retirement, you have a longer time frame for your investments to recover from potential losses. Conversely, shorter-term goals, such as saving for a house down payment, require a more conservative approach.

- How comfortable are you with short-term losses? Investments can fluctuate, and you may need to sell at a loss if you need the money in the near term. A longer time horizon gives you the flexibility to hold onto investments, hoping they will recover and increase in value.

- Do you have non-invested savings? It's important to have savings in liquid accounts for emergencies, regardless of your risk tolerance. However, if you're keeping a large portion of your savings in cash due to investment anxiety, it's a sign you're risk-averse.

- How often will you track your investments? If the idea of daily market fluctuations makes you anxious, a diversified portfolio and a long-term focus may be more suitable. Conversely, if you actively seek out new investing opportunities and are willing to take on more risk, be sure to research your investments thoroughly.

Based on your risk tolerance, you can be classified as an aggressive, moderate, or conservative investor. Aggressive investors are willing to risk losing money to achieve potentially better results. They tend to focus on capital appreciation and primarily invest in stocks. Moderate investors aim for a balance between growth and risk mitigation, often investing in a mix of stocks and bonds. Conservative investors seek little to no volatility in their portfolios and prefer guaranteed and highly liquid investments, such as bank certificates of deposit, money markets, or U.S. Treasuries.

Savings, Investment, Employment, and GDP: A Balancing Act

You may want to see also

Match your account type with your goals

When choosing an investment account, it's important to consider your goals and risk tolerance. Here are some tips to help you match your account type with your investment goals:

- Determine your financial situation and goals: Consider your age, the time horizon for your investments, the amount of capital you have to invest, and your future income needs. For example, a young college graduate starting their career will have different investment needs than someone nearing retirement.

- Assess your risk tolerance: Are you comfortable with taking on more risk for potentially higher returns, or do you prefer a more conservative approach to protect your capital? Remember that higher returns usually come with higher risk.

- Choose the right account type: If you're investing for retirement, a retirement account like an IRA might be suitable as it offers tax advantages. For non-retirement goals, a standard brokerage account could be a better option. You can also open a joint account with a spouse or another person.

- Consider tax implications: Understand the tax implications of different account types. For example, with a standard brokerage account, any interest, dividends, or gains are typically subject to taxes in the year they are received. With a retirement account like an IRA, there may be upfront tax breaks or tax-free withdrawals in retirement.

- Evaluate investment choices: Different account types offer access to various investments, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Choose an account that aligns with your investment preferences and provides the level of diversification you desire.

- Rebalance your portfolio: Remember to periodically reassess your portfolio and make adjustments as needed. This may involve buying or selling certain assets to return your portfolio to its original allocation.

Building a Portfolio: Investing Strategies for Beginners

You may want to see also

Select your investments

Selecting your investments is a crucial step in building a profitable and well-diversified investment portfolio. Here are some detailed instructions and considerations to help you make informed choices:

Determine Your Risk Tolerance:

Before choosing specific investments, it is essential to assess your risk tolerance. Your risk tolerance reflects your ability to withstand investment losses while aiming for higher returns. It is influenced by your financial goals, time horizon, and emotional comfort with market volatility. Young investors with a long investment horizon can typically tolerate more risk, as they have more time to recover from potential losses. In contrast, older investors nearing retirement may opt for more conservative strategies to protect their assets.

Choose the Right Asset Classes:

Diversification across different asset classes is a key strategy to manage risk and optimise returns. Traditional asset classes include stocks, bonds, and cash. Stocks offer higher long-term appreciation potential but come with higher risk. Bonds are generally considered safer and provide fixed-income returns. Diversification can be achieved by allocating your investment capital across these asset classes based on your risk tolerance. For example, a balanced portfolio might allocate half of its funds to stocks and the other half to bonds.

Diversify Within Asset Classes:

Breaking down asset classes into subclasses allows for further diversification. For stocks, you can diversify across industrial sectors, market capitalisations, and domestic or foreign companies. Within the bond asset class, you can diversify by considering factors such as coupon rate, maturity, bond type, and credit rating. Diversification within asset classes helps to reduce the impact of specific risks associated with particular sectors or company sizes.

Select Individual Investments:

When selecting individual investments within your chosen asset classes, conduct thorough research and analysis. For stocks, use stock screeners to shortlist potential picks, and then perform in-depth analysis to evaluate opportunities and risks. Consider factors such as dividends, price-to-earnings (P/E) ratio, beta, and earnings per share (EPS). For bonds, assess factors like coupon rate, maturity, bond type, credit rating, and the prevailing interest rate environment.

Consider Mutual Funds and ETFs:

Mutual funds and exchange-traded funds (ETFs) offer instant diversification and professional management. Mutual funds pool your money with other investors to purchase a diverse range of stocks, bonds, or other assets. ETFs are similar but trade on stock exchanges and passively track an index. While these options provide diversification benefits, they also come with management fees that will reduce your overall returns.

Monitor and Rebalance:

Regularly monitor your portfolio's performance and weightings. Over time, price movements can cause your initial weightings to change, leading to an imbalance in your portfolio. Periodically rebalance your portfolio by buying or selling securities to return it to your desired asset allocation. When rebalancing, consider the tax implications of selling certain assets, and always keep diversification across subclasses and sectors in mind.

Building a Minimum Variance Portfolio: Strategies for Investors

You may want to see also

Create your asset allocation and diversify

Diversification is a crucial aspect of investment portfolio management, and it begins with determining the appropriate asset allocation for your investment goals and risk tolerance. Here are some detailed instructions on how to create your asset allocation and diversify your investment portfolio:

Determine Your Risk Tolerance:

Your risk tolerance is a key factor in deciding your asset allocation. Consider your personality and how much risk you are willing to take. Can you tolerate short-term losses in pursuit of potentially higher returns? A younger investor with a longer time horizon can typically afford to take on more risk, while someone closer to retirement may need to focus on protecting their assets.

Choose Your Asset Allocation:

Allocate your capital between different asset classes such as stocks, bonds, cash, and alternative investments. Stocks offer the potential for high returns but come with higher risk. Bonds are generally less volatile and provide more modest returns. Cash and cash equivalents are the safest but offer lower returns. You can also explore other asset classes like real estate, precious metals, and commodities.

Diversify Within Each Asset Class:

Spread your investments within each asset class to reduce risk. For example, diversify your stock holdings by investing in a range of companies across different sectors and market capitalizations. You can also invest in mutual funds or exchange-traded funds (ETFs) that provide instant diversification by pooling money from multiple investors.

Monitor and Rebalance:

Regularly monitor your portfolio to assess its performance and diversification. Over time, your asset allocation may get out of balance due to market fluctuations. Rebalancing involves adjusting your portfolio to return to your desired asset allocation. This may involve selling overweighted assets or investing more in underweighted assets.

Consider Dollar-Cost Averaging:

This strategy involves investing a fixed amount at regular intervals, helping to smooth out market volatility. By investing the same amount over time, you buy more shares when prices are low and fewer when prices are high.

Remember, diversification is a long-term strategy, and it's important to stay disciplined and avoid making impulsive decisions based on short-term market movements. By creating a diversified portfolio and regularly monitoring and rebalancing it, you can improve your investment returns while managing risk effectively.

The Emotional Rewards of Saving and Investing

You may want to see also

Frequently asked questions

A job presentation is a performance, so take time to properly introduce yourself. State your name and the type of design you specialise in. Be clear about what sets you apart from other candidates. Pick a project you loved working on, rather than one you spent the most time on, and give a simple overview of the process. Be prepared for an onslaught of questions at the end.

Your portfolio should include a list of everything you own, such as cars, stocks, bonds, mutual funds, cash and bank accounts. You should also list everything you owe, such as student loan or credit card debts. This will create a "balance sheet", allowing you to see everything about your finances.

First, start with your financial goals and time horizon. Then, understand your risk tolerance and match your account type with your goals. Next, select your investments and create your asset allocation, before diversifying your investments. Finally, monitor, rebalance and adjust your portfolio regularly.