Reading an investment portfolio can be a daunting task, but it is a crucial skill for anyone looking to manage their finances effectively. An investment portfolio is a collection of financial investments such as stocks, bonds, commodities, cash, and other assets. The goal of reading and understanding your investment portfolio is to gain insights into the performance of your investments and ensure they are aligned with your financial goals and risk tolerance. By reviewing your portfolio, you can identify the different types of assets you hold, assess their performance over time, and make informed decisions about buying, holding, or selling. It is important to remember that diversification is key to reducing risk and maximizing returns. This involves spreading your investments across various financial instruments, industries, and categories. Additionally, it is essential to regularly monitor your portfolio to stay updated with market conditions and make adjustments as needed to meet your financial objectives.

What You'll Learn

Understanding the summary

Period Covered:

First, determine the time frame covered by the statement. Investment statements are typically provided monthly, quarterly, or annually. Year-end statements, for instance, usually cover both the full year and the last month or quarter. Understanding the period will help you interpret the changes and performance of your investments over that specific time.

Total Account Balance and Changes:

Review your total account balance and any changes since the previous statement. Look for the dollar value and percentage changes in your account value. These changes can result from market movements, dividends, interest earned, or fees. Understanding the sources of these changes is essential for evaluating your investment strategy.

Additions and Withdrawals:

Analyse the summary of money inflows and outflows. This includes deposits, investments, withdrawals, and fees. Understanding these movements will help you identify the sources and amounts, ensuring there are no unexpected or unauthorised transactions.

Investment Holdings and Allocation:

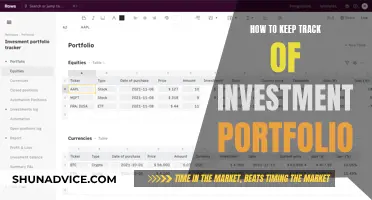

Take a detailed look at what you are investing in. Your statement might include pie charts or graphs to summarise your holdings across different asset classes, such as equities, fixed income, cash, real estate, or exchange-traded funds (ETFs). Drill down into the specific investments within each category to understand their performance and risk exposure.

Transaction History:

Review the list of transactions since your last statement. This includes deposit dates, withdrawal purposes, dividend payments, and other activities. Understanding each transaction helps you identify any discrepancies and evaluate the impact of these activities on your portfolio's performance.

Performance Evaluation:

Assess how your investments are performing. Compare your portfolio's performance with relevant market benchmarks, such as broad market indices. Consider the impact of market movements, fees, and the specific investments you've chosen. Remember that reviewing performance too frequently can lead to overactive investing and anxiety, so focus on long-term trends, especially for retirement accounts.

Risk Assessment:

Understanding your risk tolerance and how it aligns with your portfolio's content is crucial. Evaluate the level of risk you are comfortable with and ensure it matches the risk profile of your investments. Consider your investment objectives, time horizon, and personal circumstances when assessing the risk level of your portfolio.

Maximising Your Account:

Finally, look for opportunities to optimise your account. Review your contributions towards tax-advantaged retirement accounts and ensure you're maximising any available benefits. Also, assess your cash allocation and consider whether it aligns with your investment strategy. Holding too much cash in investment accounts might hinder your potential returns.

Savings-Investment Identity: Understanding the Logical Balance

You may want to see also

Reviewing account activity

Period Covered

Start by identifying the time frame of the statement. Investment statements can be monthly, quarterly, or annual. Year-end statements typically provide information for both the full year and the last month or quarter. Understanding the period covered is essential to grasp the context of the account activity.

Total Account Balance and Changes

Examine your total account balance and any changes since the previous statement. Look for the dollar value of your investments and track how this amount has evolved. Understanding the direction and magnitude of changes in your account balance is a fundamental aspect of reviewing account activity.

Additions and Withdrawals

Analyse the inflows and outflows of funds in your account. Summarise how much money was added through investments or contributions, and identify any withdrawals or fees that reduced your balance. This analysis will help you understand the liquidity and activity of your investments.

Transaction History

Drill down into the details of each transaction during the covered period. Review the dates, descriptions, and specific investments involved in each transaction. This level of analysis will provide insights into the timing and nature of your investment activities. Ask questions about deposits, withdrawals, and dividend payments to ensure a comprehensive understanding of your transaction history.

Dividends and Interest

In addition to your transactions, pay attention to dividends and interest payments received. These automatic additions to your account can impact your overall returns and may even be reinvested to purchase more of the investment that paid out the earnings. Understanding these dividends and interest can help explain changes in your portfolio composition.

Investment Changes

Review your portfolio statement for any changes in your investments, such as mergers or maturities. Investment funds may merge with others, bonds may mature and convert into cash, or there may be other adjustments. Reading your statement carefully will help you stay informed about these changes and their potential impact on your portfolio.

Building a Minimum Variance Portfolio: Strategies for Investors

You may want to see also

Performance evaluation

Performance Measurement

Performance measurement provides an overall indication of the portfolio's performance. It involves calculating the portfolio's total return over a specific period, including income (such as dividends and interest) and capital gains or losses. This provides a snapshot of the portfolio's absolute performance.

Performance Attribution

Performance attribution builds on performance measurement by explaining how the performance was achieved. It involves analyzing the individual assets within the portfolio to identify which investments contribute positively or negatively to the overall performance. This granular analysis helps in making informed decisions about rebalancing the portfolio.

Performance Appraisal

Performance appraisal uses both returns and attribution to infer the quality of the investment process. It includes comparing the portfolio's performance to relevant benchmarks, such as market indices, to gauge how it stacks up against the broader market. It also involves assessing the risk associated with the portfolio using metrics like the Sharpe Ratio, which measures the risk-adjusted returns.

Returns-based Attribution

Returns-based attribution focuses on the returns generated by the portfolio to identify the factors that contributed to those returns. It helps investors understand the impact of market movements and their investment decisions on the overall performance.

Holdings-based Attribution

Holdings-based attribution evaluates the performance of the portfolio over time by analyzing the holdings and their contribution to the returns. It helps investors understand the impact of their investment decisions and asset allocation on the portfolio's performance.

Transactions-based Attribution

Transactions-based attribution uses both holdings and transactions to explain the portfolio's performance over the evaluation period. It provides a comprehensive view of the portfolio by considering the impact of investment decisions, asset allocation, and market movements.

Benchmarks and Performance Appraisal Ratios

Benchmarks, such as market indices, are used to compare the portfolio's performance to a relevant reference point. This helps investors assess if their strategy is on track to meet their financial objectives. Performance appraisal ratios, such as the Sharpe Ratio and the Sortino Ratio, are used to measure the risk-adjusted returns and evaluate the efficiency of the portfolio.

Evaluating Investment Manager Skill

The evaluation of investment manager skill requires a broad range of analysis tools and an understanding of how these tools work together. Appraisal ratios, such as the Sortino ratio and upside/downside capture ratios, help identify manager skill by measuring investment skill and evaluating the impact of investment decisions.

Tips for Effective Performance Evaluation

- Set clear investment goals and select appropriate benchmarks that reflect your investment style and objectives.

- Track both risk and return to understand the overall growth and volatility of your portfolio.

- Calculate risk-adjusted returns to assess the efficiency of your portfolio in terms of returns per unit of risk.

- Evaluate individual assets within the portfolio to identify their contribution to overall performance.

- Consider the impact of fees and expenses on your net returns.

- Regularly review and adjust your portfolio to ensure it remains aligned with your evolving goals and market conditions.

Mastering Investment Projections with Spreadsheets: A Comprehensive Guide

You may want to see also

Confirming risk level

Confirming your risk level is an important step in understanding your investment portfolio. It is a key factor in deciding on an investment strategy and will determine how much risk you are willing to accept.

Your risk level will be influenced by two main factors: your risk tolerance and your risk capacity. Your risk tolerance is your comfort level in taking on risk under current conditions, while your risk capacity is the amount of financial risk you are able to take on, given your current financial situation.

To confirm your risk level, consider the following:

Time Horizon

The amount of time you plan to invest your money for is crucial. If you are investing for a short period, choosing highly volatile investments such as stocks may not be wise. In this case, safer options like bonds or other secure securities are preferable. Conversely, if you have a longer time horizon, you can opt for more volatile investments as you have more time to recoup any losses. For example, a 60:40 investment strategy (60% stocks, 40% bonds) may be suitable for a high-risk investor with a long time horizon.

Financial Standing

Your financial standing in terms of available balance will affect your risk tolerance. The more money you have, the riskier your investments can be. This is because the amount of capital you can afford to lose is directly proportional to your risk tolerance. It is important to only invest money that will not affect your financial stability or cause liquidity problems in the future.

Risk Pyramid

The investment risk pyramid is an asset allocation strategy that can help you balance risk and reward. At the bottom of the pyramid are low-risk assets like cash and treasuries, while the middle represents moderately risky assets like corporate bonds and blue-chip stocks. The top of the pyramid consists of smaller allocations to riskier assets like growth stocks. The pyramid structure should be customised according to your time horizon, assets, and risk tolerance.

Risk-Reward Trade-Off

The risk-reward trade-off states that the higher the risk, the higher the potential return. However, it's important to remember that while taking on more risk may lead to higher returns, it also increases the possibility of significant losses.

By considering these factors, you can confirm your risk level and make more informed investment decisions that align with your financial goals and tolerance for risk.

Investment Surpassing Savings: A Recipe for Economic Growth or Debt?

You may want to see also

Getting the most from your account

Checking in on your accounts regularly can help you discover opportunities to maximise your investments. For example, retirement account statements often tell you how much you've contributed for each tax year. Since the IRS sets maximum annual contribution limits, it's often smart to be sure and maximise your contributions. Look for a section on your statements called "Retirement Summary" or something similar, and see if you're contributing enough to reach the maximum limit.

You might also be surprised by how much cash you're holding. If you actually want to invest in your investment accounts, holding cash there might not make sense, especially if your investment provider doesn't pay much interest on your account balance. When investments mature or pay out earnings, you may build up a substantial amount of cash. If you find a cash allocation that's higher than you want, you could consider moving it to an online bank account or investing it elsewhere.

Your statements may also tell you about your cost basis in taxable accounts. With that information, you might learn several things. While you need to review strategies with a professional before doing anything, a few ideas you might discuss are:

- If you have losses in your account, you can potentially harvest those losses to reduce your taxable income.

- You can see which investments have long-term capital gains, as those might generate less of a tax burden than short-term gains if you need to sell and generate cash.

If your money is in an annuity, you may see several additional pieces of information. If you decide to cash out, the surrender value is the amount you would receive from the insurance company after they charge surrender fees. These fees often decline over time, so it may be worth waiting—or taking a partial withdrawal—to reduce those charges. Call the insurance company and a financial professional for help understanding how to avoid those fees.

Annuities can be complicated and have a variety of "hypothetical" account values. These account values don't necessarily tell you how much money you can walk away with if you cash out. Instead, they may be linked to income guarantees in your annuity. The amount of income you receive may be calculated from those balances, but you may have a different account value that would be available for withdrawal.

Comparing Portfolio Investments: Strategies for Success

You may want to see also

Frequently asked questions

The purpose of an investment portfolio summary is to understand where your investments are and if you are on track to meet your financial goals. It provides an overview of your current asset allocation and the factors impacting any changes in its value.

An investment portfolio summary will include a breakdown of your portfolio by major asset classes, such as equities, fixed income, and others, as well as by sectors within those classes, such as small-, mid-, and large-cap stocks. It will show the quantities and dollar values of the various assets and how they contribute to your overall asset allocation.

Investment providers typically create monthly or quarterly statements. While it's important to monitor your investments, reviewing performance too frequently can lead to overactive investing and anxiety. For long-term investors, reviewing quarterly statements is generally sufficient. As you approach your financial goals or retirement, more frequent monitoring may be beneficial.

When reviewing your statement, consider the period covered, your total account balance and any changes since the last statement, the performance of your investments, additions and withdrawals, and the total change resulting from these factors. Pay attention to your risk level and ensure your investments align with your financial goals and risk tolerance.

Broad market movements often significantly impact your investment portfolio's performance, especially if you are well-diversified. Compare your account balance changes with the performance of the broader stock market during the same period. Additionally, consider the impact of specific events on individual stocks or sectors.