Recording cash investments in QuickBooks is a straightforward process that offers several advantages, including the ability to keep track of investments using the Equity account and check the investment amount at any time. To begin, users should set up an owner's or partner's equity account by navigating to the Settings or Gear icon, selecting Chart of Accounts, and then choosing New. From the account type drop-down menu, select Owner's Equity or Partner's Equity, depending on your situation. After entering the necessary details, click Save and Close. Once the equity account is set up, users can record owner contributions by navigating to the Accounting section, clicking on Chart of Accounts, and then New. Here, they will select Equity and choose the previously set-up owner's or partner's equity account. They will then enter the owner's contribution or equity in the name or description and type the investment amount in the balance field. Alternatively, if your bank account is connected to QuickBooks, you can simply categorise transactions associated with your deposits.

| Characteristics | Values |

|---|---|

| Step 1 | Click on the +New icon and select the “Bank Deposit” option |

| Step 2 | Select the bank account to which the owner investment needs to be deposited, found under the Accounts drop-down menu |

| Step 3 | Mention the date when the money was deposited |

| Step 4 | Go to the "Add funds to this deposit" section and mention the name of the owner investor or partner in the "Received from" field |

| Step 5 | Click on the drop-down available under the Accounts option and select the equity accounts, which is created earlier |

| Step 6 | Choose the payment method and amount invested in the Amount field |

| Step 7 | Save all the information entered and close |

What You'll Learn

Click the 'Banking' tab

To record a cash investment in QuickBooks, you must first click on the "Banking" tab in the main menu bar at the top of the screen. This is where you'll find the standard "Make Deposits" feature, which is used to add the investment to the relevant owner's equity account.

The "Banking" tab is the central hub for managing all financial transactions in QuickBooks, including deposits, withdrawals, transfers, and reconciliations. It provides a comprehensive overview of the business's financial activities, allowing users to track and record cash investments effectively.

Once you've clicked on the "Banking" tab, you'll be presented with several options to choose from. These options may vary slightly depending on your version of QuickBooks, but the "Make Deposits" feature is typically found within the drop-down menu. This feature is essential for recording cash investments, as it allows you to designate the investment as a deposit into the appropriate owner's equity account.

The "Make Deposits" feature simplifies the process of recording cash investments by providing a user-friendly interface for entering the relevant details. It ensures that the investment is accurately reflected in the business's financial records, helping to maintain the accuracy and integrity of the accounting data.

By selecting the "Make Deposits" option, you can then specify the payment method, amount invested, and other pertinent details. This step-by-step process within the "Banking" tab makes it straightforward for business owners or accountants to record cash investments, ensuring that no crucial steps are missed during the data entry process.

In summary, clicking on the "Banking" tab in QuickBooks is the critical first step in recording a cash investment. It provides access to the necessary tools, such as the "Make Deposits" feature, for accurately reflecting the investment in the business's financial records. This tab serves as a central command centre for all financial transactions, making it easier to manage and track cash flow, including investments made by owners or partners.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Select 'Make Deposits'

To record a cash investment in QuickBooks, you can use the "Make Deposits" feature in the Banking section. Here's a detailed guide on how to do it:

Select "Make Deposits"

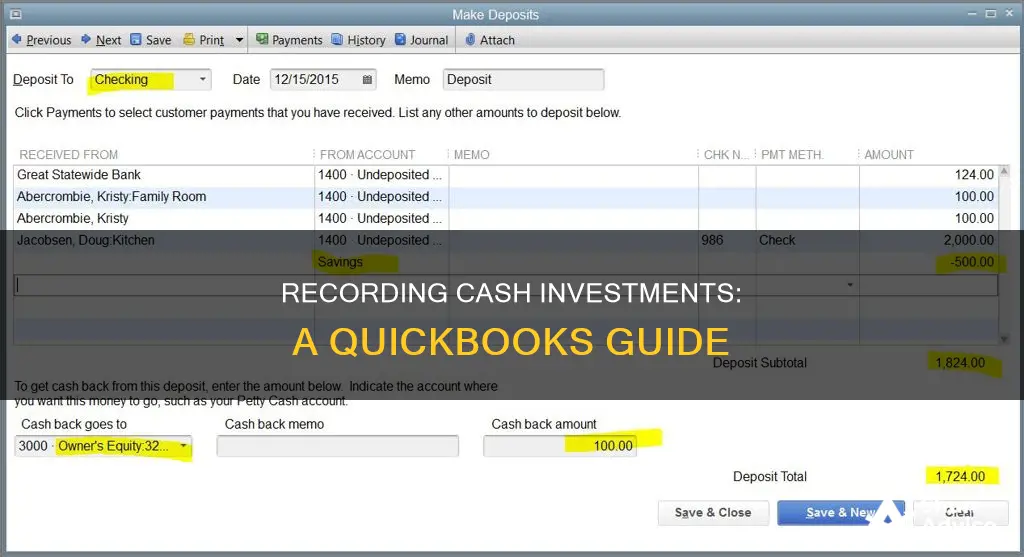

To begin, click on the "Banking" tab in the main menu bar at the top of the QuickBooks screen. From the drop-down menu, select "Make Deposits". If the "Payments to Deposit" window appears, you can select the payment and investment check you want to deposit and click "OK". Alternatively, if you only want to deposit the investment check, click "Cancel". Skip this step if the "Payments to Deposit" window does not open.

Select the Company Bank Account

In the "Make Deposits" window, choose the company bank account in which you want to deposit the investment. This is where the investment funds will be deposited.

Enter Owner or Co-Owner's Name

In the "Detail" area, type your own name or the name of the co-owner who is making the investment. This step helps identify the person associated with the investment transaction.

Enter the Investment Amount

Input the amount of the investment in the "Amount" input box. This represents the value of the cash investment being made.

Select the Applicable Owner Equity Account

Click on the "From" account drop-down menu and select the applicable owner equity account from the list of available accounts. This links the investment to the specific owner or co-owner.

Save and Close

Finally, click on the "Save and Close" button to record the transaction. This will finalise the process and allow you to exit the window.

By following these steps, you can accurately record a cash investment in QuickBooks, keeping your company accounts updated and maintaining a clear overview of capital investments.

Strategies for Investing Cash Reserves: A Guide to Opportunities

You may want to see also

Choose the company bank account

To record a cash investment in QuickBooks, you must first choose the company bank account in which you want to deposit the investment. This is done through the standard "Make Deposits" feature in the Banking section.

- Click the "Banking" tab in the main menu bar at the top of the screen.

- Select "Make Deposits" from the drop-down menu. If QuickBooks displays the Payments to Deposit window, click to select the payment and the investment check that you want to deposit, then click "OK". If you only want to deposit the investment check, click "Cancel" to skip this step.

- In the "Make Deposits" window, select the company bank account in which you want to deposit the investment.

- Type your name or the name of the co-owner who is making the investment in the "Detail" area.

- Enter the amount of the investment in the "Amount" input box.

- Click the "From" account drop-down menu and select the applicable owner equity account from the list of available accounts.

- Click "Save and Close" to record the transaction and exit the window.

It is important to note that you can create multiple owner equity accounts in QuickBooks, allowing you to assign an account to each partner in the business. This helps to keep track of investments from different owners or partners.

Additionally, if your bank account is connected to QuickBooks, you may not need to manually record the owner's investment. Instead, you can simply categorise the transactions associated with your deposits. However, it is always recommended to consult with an accountant to ensure you are handling and tracking investments correctly.

Corporations' Cash Investment Strategies: Unlocking Business Growth

You may want to see also

Type the owner's name

To record an owner's investment in QuickBooks, you must first set up an owner's equity account. This is done by clicking on the Settings (gear icon), then selecting Chart of Accounts on the QuickBooks page. From here, you will click on "New" and then select "Owner's equity" from the Account Type drop-down menu. Next, choose "Owner's equity" or "Partner's equity" from the Detail Type drop-down menu, depending on your situation, and click "Save and Close".

Once the owner's equity account is set up, you can record the owner's contribution or equity by clicking on "Accounting" on the QuickBooks page, then selecting "Chart of Accounts", and then "New". Under the Account Type, select "Equity" and choose the Owner's equity account you set up earlier from the Detail Type drop-down menu.

Now, type the owner's name and their contribution or equity in the name or description field. This is where you will input the owner's name and any other relevant details.

After that, enter the owner's investment amount in the balance field and click "Save and Close" to finish the process.

If your bank account is connected to QuickBooks, you don't need to manually record the owner's investment. Instead, you can simply categorise the transactions associated with your deposits. To do this, click on the "New" button and then select "Bank Deposit". From the Account Type drop-down menu, select the relevant bank account that is connected, and enter the date of the deposited money. In the "Received From" box under the "Add Funds to This Deposit" section, enter the name of the investor. Choose the appropriate equity account in the Account field and specify the payment method. Finally, enter the owner's investment amount in the Amount field and click "Save and Close".

Understanding Proceeds From Equipment Sales: Cash From Investing?

You may want to see also

Enter the investment amount

Recording the owner's investment amount is a crucial step in keeping your business accounts accurate and up-to-date. Here is a detailed guide on how to enter the investment amount when recording a cash investment in QuickBooks:

Step 1: Access the "Make Deposits" Feature

To begin, navigate to the “Banking” tab in the main menu bar at the top of the QuickBooks screen. From the drop-down menu, select "Make Deposits". If the "Payments to Deposit" window appears, choose the payment and investment check you want to deposit and click "OK". Alternatively, if you only want to deposit the investment check, click "Cancel". Skip this step if the "Payments to Deposit" window does not appear.

Step 2: Select the Company Bank Account

In the "Make Deposits" window, choose the company bank account into which you want to deposit the investment. This step ensures that the investment is deposited into the correct account.

Step 3: Enter Owner Information

In the "Detail" area, type your name or the name of the co-owner who is making the investment. This step helps identify the owner associated with the investment amount.

Step 4: Input the Investment Amount

Enter the amount of the investment in the "Amount" input box. Ensure that the amount is accurate and matches the investment you are making.

Step 5: Select the Applicable Owner Equity Account

Click on the "From" account drop-down menu and select the applicable owner equity account from the list of available accounts. This step associates the investment with the correct owner equity account.

Step 6: Save and Close

Finally, click on the "Save and Close" button to record the transaction and exit the window. This step ensures that the investment amount is saved and properly entered into QuickBooks.

By following these steps, you can accurately enter the investment amount when recording a cash investment in QuickBooks, keeping your business accounts up-to-date and maintaining proper financial records.

Enhancing Cash Flow: Investing Strategies for Positive Returns

You may want to see also

Frequently asked questions

To record owner investment in QuickBooks, click on the "+New" icon and select "Bank Deposit". Then, select the bank account to which the owner investment needs to be deposited, and mention the date when the money was deposited. Next, go to the "'Add funds to this deposit' section and mention the name of the owner investor or partner in the 'Received from' field. After that, select the equity account from the drop-down under the "Accounts" option, choose the payment method, and enter the amount in the "Amount" field. Finally, save and close.

You can record investor money as other current assets. To create your other current assets account, go to the Lists menu bar and select "Chart of Accounts". Then, click "Account", choose "New", and select "Other Current Assets" from the "Account Types" menu. Enter the necessary account information and click "Enter Opening Balance". Enter the amount of the investment money and the date.

No, it is not necessary to connect your bank account to record owner investment in QuickBooks. If your bank account is not connected, you will need to make an account for the owner investment. If your bank account is connected, you only need to categorize the transactions.