Recording investments in foreign subsidiaries is a crucial aspect of financial reporting for multinational corporations. When a company invests in a foreign entity, it must carefully navigate the complexities of accounting for these transactions to ensure compliance with international financial standards. This process involves recognizing the investment at fair value and subsequently accounting for any changes in the investment's value over time. Proper documentation and a clear understanding of the accounting standards are essential to accurately reflect the financial impact of these foreign investments in the company's financial statements.

What You'll Learn

- Legal Considerations: Understand tax laws and regulations for foreign investments

- Financial Reporting: Implement consistent accounting methods for subsidiary investments

- Currency Fluctuations: Monitor exchange rates to manage investment value

- Local Compliance: Adhere to foreign regulations and reporting standards

- Transfer Pricing: Establish fair pricing policies for intercompany transactions

Legal Considerations: Understand tax laws and regulations for foreign investments

When investing in a foreign subsidiary, it is crucial to navigate the complex web of legal and tax considerations to ensure compliance and optimize your financial strategy. One of the primary steps is to thoroughly research and understand the tax laws and regulations of the country where your investment will be made. Each country has its own unique tax system, and these laws can significantly impact your investment's profitability and your overall financial planning. For instance, some countries may offer tax incentives for foreign investors, such as reduced tax rates or tax credits, while others might impose strict regulations on foreign ownership or have specific reporting requirements.

Familiarize yourself with the tax residency rules of the host country. These rules determine where a company's profits are taxed. Understanding these rules is essential because it can affect how you record and report your investment. In some cases, you might need to establish a permanent establishment in the foreign country to be subject to their tax laws, which could have implications for your investment structure.

The process of transferring funds across borders also requires careful attention. International transfer pricing regulations must be followed to avoid potential tax disputes. These regulations dictate how much a company can charge for goods or services transferred between related entities in different countries. Proper documentation and justifiable transfer pricing methods are essential to ensure compliance and prevent penalties.

Additionally, consider the legal structure of your investment. Will you be acquiring shares, assets, or a direct ownership stake? Each option has different tax implications and reporting requirements. For instance, acquiring shares might trigger different tax consequences compared to purchasing assets, and these differences can impact how you record the investment on your financial statements.

Seeking professional advice from legal and tax experts is highly recommended. They can provide tailored guidance based on your specific investment scenario, helping you navigate the legal and tax complexities of foreign investments. These professionals can assist in structuring your investment to minimize tax liabilities, ensure compliance with local laws, and provide ongoing support to adapt to any changes in legislation.

Recession-Proof Cash Investments: Where to Park Your Money

You may want to see also

Financial Reporting: Implement consistent accounting methods for subsidiary investments

When dealing with investments in foreign subsidiaries, it is crucial to establish consistent accounting methods to ensure accurate financial reporting. This consistency is essential for maintaining transparency, comparability, and reliability in financial statements, especially when dealing with multiple subsidiaries across different countries. Here's a step-by-step guide to implementing consistent accounting practices:

- Choose an Accounting Method: Decide on the appropriate accounting method for your investments in foreign subsidiaries. The most common approaches are the equity method and the proportional consolidation method. The equity method is suitable when you have significant influence over the subsidiary but not control. It involves measuring the investment at cost and then adjusting for any changes in the subsidiary's net assets. On the other hand, proportional consolidation is used when you own a significant portion of the subsidiary's shares and have control over its operations. This method requires consolidating the subsidiary's financial statements with your own.

- Establish a Consistent Basis of Measurement: Determine the basis on which you will measure the subsidiary's financial performance. This could be historical cost, fair value, or another relevant measurement basis. Consistency in measurement is key to ensuring that financial statements reflect the true and fair view of the investment. For instance, if you choose to measure the investment at fair value, ensure that you apply the same valuation techniques consistently across all subsidiaries.

- Develop a Standardized Chart of Accounts: Create a uniform chart of accounts for all subsidiaries to ensure consistency in financial reporting. This chart should include all relevant accounts related to the investment, such as equity, receivables, payables, and any specific accounts related to the subsidiary's operations. A standardized chart of accounts simplifies the consolidation process and reduces the risk of errors.

- Implement Consistent Accounting Policies: Establish and document consistent accounting policies for the group, including those specific to foreign subsidiaries. These policies should cover areas such as revenue recognition, depreciation, inventory valuation, and treatment of foreign currency transactions. Consistency in accounting policies ensures that financial statements are comparable and reliable over time and across different subsidiaries.

- Regularly Review and Update Accounting Methods: Financial reporting standards and regulations evolve, and so should your accounting methods. Regularly review and update your policies to ensure compliance with the latest accounting standards, such as IFRS or GAAP. This may involve re-evaluating the choice of accounting method, adjusting for any changes in the subsidiary's operations, or adapting to new interpretations of accounting standards.

By implementing these consistent accounting methods, you can ensure that your financial statements provide a clear and accurate representation of your investments in foreign subsidiaries. This consistency is vital for stakeholders, investors, and regulatory bodies to make informed decisions and maintain confidence in your financial reporting.

Unlocking Global Growth: Navigating the Foreign Investment Decision

You may want to see also

Currency Fluctuations: Monitor exchange rates to manage investment value

Currency fluctuations can significantly impact the value of your investment in a foreign subsidiary, and monitoring exchange rates is a crucial step in managing this risk. Here's a detailed guide on how to approach this aspect:

Understanding Exchange Rates: Begin by familiarizing yourself with the concept of exchange rates. Exchange rates represent the value of one country's currency in relation to another. These rates fluctuate constantly due to various economic factors, such as interest rates, inflation, and geopolitical events. Understanding these factors is essential for predicting exchange rate movements. You can access real-time exchange rate data from reliable financial websites or use specialized software that provides currency conversion tools.

Setting Up Exchange Rate Alerts: To ensure you stay informed, set up alerts for the currency pair relevant to your investment. Many financial institutions and currency exchange platforms offer email or mobile notifications when exchange rates reach a certain threshold. This proactive approach allows you to take timely action to protect your investment. For instance, if your subsidiary's currency depreciates rapidly, you can consider strategies to mitigate potential losses.

Regular Monitoring: Make it a habit to regularly monitor exchange rates. Set a schedule, such as weekly or bi-weekly, to review the currency's performance. Consistency is key to identifying trends and potential opportunities. Keep a record of the exchange rates you observe, along with any significant economic events that occurred during that period. This documentation will help you analyze the relationship between currency fluctuations and your investment's performance.

Risk Management Strategies: Based on your monitoring, develop a risk management strategy. If the exchange rate moves unfavorably, consider the following: hedging your investment by entering into forward or option contracts to lock in an exchange rate; diversifying your investment portfolio across multiple currencies to reduce currency-specific risk; or adjusting the pricing strategy of your subsidiary to account for currency fluctuations. Each of these strategies has its own advantages and should be tailored to your specific investment and risk tolerance.

Local Expertise: Engage with local financial advisors or consultants who have expertise in the region where your subsidiary operates. They can provide valuable insights into the local market, including currency trends and potential economic factors that may influence exchange rates. Local knowledge can help you make more informed decisions and adapt your investment strategy accordingly.

Investing in the S&P 500: A Guide for Scotrage Traders

You may want to see also

Local Compliance: Adhere to foreign regulations and reporting standards

When investing in a foreign subsidiary, it's crucial to navigate the complex web of local regulations and reporting standards to ensure compliance and avoid legal pitfalls. Here's a comprehensive guide to help you through this process:

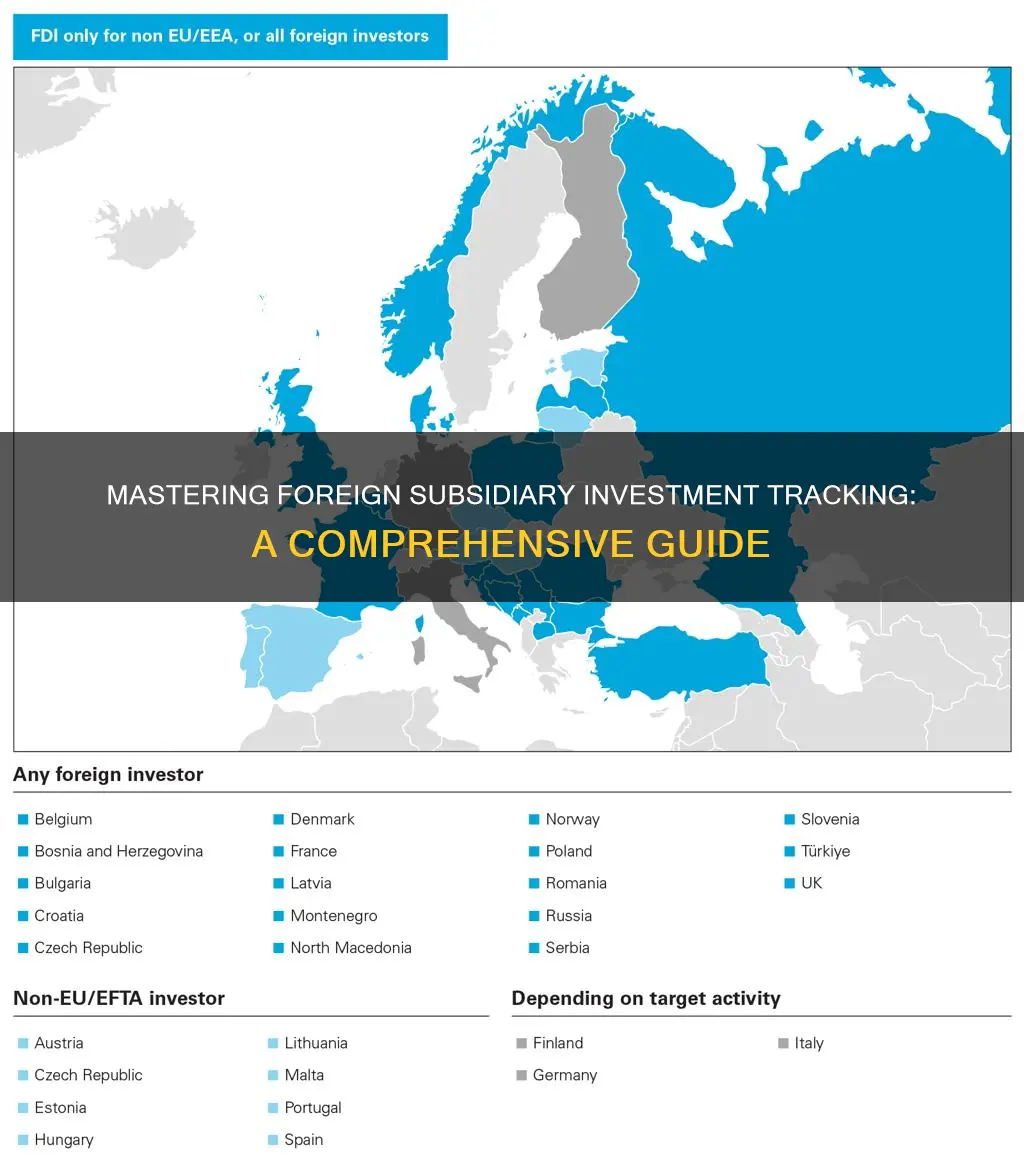

Research and Understand Local Laws: Begin by thoroughly researching the legal framework of the country where your subsidiary operates. Each country has its own set of rules and regulations governing foreign investments, ownership structures, and financial reporting. Familiarize yourself with the specific laws related to your industry and the nature of your investment. This includes understanding the legal entity requirements, such as whether you need to establish a branch office, a subsidiary, or a joint venture, and the associated registration processes.

Compliance with Accounting Standards: Adhering to local accounting standards is essential for accurate financial reporting. Different countries have their own accounting frameworks, such as International Financial Reporting Standards (IFRS) or country-specific standards. Ensure that your subsidiary's financial statements are prepared according to these standards, as this will impact how you record and report your investment. For instance, you might need to adjust your financial statements to comply with local currency requirements, tax regulations, or specific reporting deadlines.

Tax Obligations: Tax compliance is a critical aspect of local compliance. Research the tax laws and regulations of the host country to understand your tax obligations as an investor. This includes knowing the tax treatment of your investment, any withholding tax requirements, and the timing of tax payments. Each country has its own tax authorities and rules, so it's essential to consult with tax professionals to ensure you meet all obligations. Proper tax planning and record-keeping will help you avoid penalties and ensure a smooth investment process.

Reporting and Disclosure Requirements: Foreign subsidiaries are often subject to various reporting and disclosure obligations. These may include regular financial reports, tax returns, and other statutory filings. Understand the specific reporting requirements, including the frequency and format of reports. Stay updated on any changes in regulations that might impact your reporting obligations. Timely and accurate reporting is vital to maintaining a good relationship with local authorities and ensuring your investment remains compliant.

Engage Local Professionals: Navigating local regulations can be complex, so consider engaging local legal and accounting professionals. These experts can provide valuable guidance on compliance, tax planning, and financial reporting. They can help you understand the nuances of local laws and ensure your subsidiary operates within the legal framework. Local professionals can also assist with the necessary documentation, filings, and any ongoing compliance requirements.

By diligently researching and adhering to local regulations, you can ensure that your investment in a foreign subsidiary is well-managed and compliant. This approach minimizes legal and financial risks, fosters a positive relationship with local authorities, and contributes to the long-term success of your international venture.

Cashing in on Fidelity: Investment Check Options

You may want to see also

Transfer Pricing: Establish fair pricing policies for intercompany transactions

Transfer pricing is a critical aspect of international business, especially when dealing with intercompany transactions between a parent company and its foreign subsidiaries. It involves setting prices for goods, services, or intangibles exchanged between these entities to ensure compliance with tax regulations and to maintain a fair and transparent financial structure. Establishing fair pricing policies is essential to avoid potential tax disputes and to optimize the financial performance of the entire group. Here's a comprehensive guide on how to navigate this process:

Understand Transfer Pricing Rules: Begin by familiarizing yourself with the transfer pricing regulations in the countries involved. Tax authorities often have specific guidelines and standards for determining arm's-length prices, which serve as a benchmark for fair pricing. These rules may vary across jurisdictions, so it's crucial to research and understand the legal framework in each relevant market. For instance, the United States uses the 'Section 482' method, while the European Union has established the 'Arm's Length Principle' as a guiding principle for transfer pricing.

Determine the Appropriate Method: Transfer pricing methods can be complex and may include the comparable unadjusted profit method, the profit-split method, or the cost-plus method. The choice of method depends on the nature of the transaction and the specific circumstances of the group. For instance, the comparable unadjusted profit method is often used when there is a lack of comparable market data. It involves analyzing the financial performance of similar companies in the same industry. The profit-split method, on the other hand, allocates profits based on various factors like risk, return, and contribution to the overall group's success.

Conduct a Thorough Analysis: To establish fair pricing, a comprehensive analysis is required. This includes studying the functional and economic characteristics of the intercompany transactions. Evaluate the roles and contributions of each subsidiary, considering factors such as the level of risk, the use of assets, and the provision of services. For example, if a parent company provides a unique service to its subsidiary, the pricing should reflect the value of that service while also considering the subsidiary's overall profitability.

Document and Justify Decisions: Transparency and proper documentation are key. Clearly document the transfer pricing policies, the methods used, and the rationale behind the chosen approach. Justify your decisions by providing detailed explanations of the analysis, including any adjustments made to market prices. This documentation will be crucial in case of tax audits or disputes, ensuring that your pricing policies can withstand scrutiny.

Regularly Review and Adjust: Transfer pricing is not a one-time task but an ongoing process. Regularly review and update your pricing policies to reflect changes in market conditions, business operations, and legal requirements. Stay informed about any amendments to transfer pricing regulations and adapt your strategies accordingly. This proactive approach ensures that your intercompany transactions remain compliant and aligned with the best interests of the entire group.

A Beginner's Guide to Sofi Invest

You may want to see also

Frequently asked questions

When you make an initial investment in a foreign subsidiary, you should recognize it as a long-term asset on your balance sheet. The investment is typically recorded at fair value, and any differences between the investment amount and the fair value are treated as a revaluation reserve. This ensures that your financial statements reflect the true value of your investment.

Subsequent investments in the same foreign subsidiary should be accounted for using the equity method. This means that you will recognize your share of the subsidiary's profits or losses in your financial statements. The investment is initially recorded at cost, and any adjustments are made to reflect the change in ownership interest. This method provides a more accurate representation of the financial relationship between the parent company and the subsidiary.

Exchange rate fluctuations can impact the value of your foreign investments. You should revalue your investment periodically to reflect the current market exchange rate. Any gains or losses due to exchange rate changes are treated as foreign currency translation adjustments and are reported in the income statement. This ensures that your financial statements accurately represent the investment's value in the parent company's currency.

Yes, tax considerations are crucial when dealing with foreign investments. You should consult tax professionals to understand the tax implications in both the parent company's and the subsidiary's jurisdictions. Tax laws may vary, and proper planning is essential to optimize tax efficiency. This may include structuring the investment to take advantage of tax treaties, deferral of tax payments, or other tax strategies.

Proper documentation is essential to support the recording of foreign investments. You should maintain detailed records, including investment agreements, financial statements of the subsidiary, exchange rate information, and any relevant correspondence. These documents provide evidence of the investment's terms, conditions, and value, ensuring compliance with accounting standards and facilitating audit purposes.