Cash flow from investing activities is a crucial aspect of a company's financial health and growth prospects. It is one of the three primary sections of a company's cash flow statement, alongside cash flow from operations and cash flow from financing activities. This segment specifically tracks the inflows and outflows of cash resulting from investment activities, such as the acquisition or disposal of long-term assets, investments in securities, and mergers or acquisitions. While negative cash flow from investing activities can be concerning, it is not always indicative of poor performance. Instead, it may signal that the company is investing in research, development, or long-term strategic initiatives that will benefit its future health and competitiveness.

What You'll Learn

The purchase of physical assets

Physical assets can include property, plant, and equipment (PPE), also referred to as capital expenditures (CapEx). This category covers a wide range, from buildings and land to machinery and vehicles. These assets are often purchased with the expectation of long-term use and value creation.

When a company invests in physical assets, it typically leads to a negative cash flow in the short term. This is because the acquisition of such assets requires a significant outflow of cash. However, it is important to note that these purchases are not necessarily indicative of poor financial health. In fact, they signal that the company is investing in its future operations and growth.

For example, a company that purchases a new machine may experience a short-term negative cash flow due to the cost of the machine. However, in the long run, this investment is likely to increase the company's output, improve its efficiency, and potentially boost profits. As a result, investing in physical assets can be a strategic decision that contributes to the company's overall success and competitiveness in the market.

Unlocking Cash Flow: Investing Activities for Positive Change

You may want to see also

Investments in securities

Investment securities are a category of securities—tradable financial assets such as stocks, bonds, or fixed-income instruments—that are purchased with the intention of holding them for investment. They are subject to governance under Article 8 of the Uniform Commercial Code (UCC).

Investment securities are often purchased by banks to be held in their portfolios, and they can also be used as collateral. They provide banks with the advantage of liquidity, in addition to the profits from capital gains when sold.

There are three main types of securities: equity, debt, and hybrids. Equity provides ownership rights to holders, debt is essentially loans repaid with periodic payments, and hybrids combine aspects of both debt and equity.

When investing in securities, it is important to understand the different types and their characteristics. Equity securities, for example, offer voting rights and the potential for capital gains but typically do not entitle the holder to regular payments. On the other hand, debt securities represent borrowed money that must be repaid with interest, and they generally entitle the holder to regular interest payments.

When analysing a company's financial health, it is crucial to consider its cash flow statement, which includes information about cash flow from investing activities. This section details the cash generated by or spent on investment activities, such as the purchase or sale of physical assets, investments in securities, or the sale of securities or assets.

Overall, investments in securities involve purchasing tradable financial assets, such as stocks or bonds, with the intention of holding them for the long-term to generate income or support the health and continued operations of the company.

Strategies for Investing in Cash ATMs: A Guide

You may want to see also

The sale of securities or assets

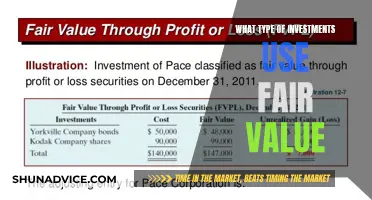

Securities refer to a diverse range of investments, such as stocks, bonds, investment contracts, notes, and derivatives. They are fungible and tradable financial instruments used by municipalities, companies, and other entities to raise capital. The sale of securities can be classified into three main categories: available-for-sale securities, held-to-maturity securities, and held-for-trading securities.

Available-for-sale securities are purchased with the intention of selling them before maturity or holding them long-term if they have no maturity date. These are reported at fair value, and any changes in value are reflected in the "accumulated other comprehensive income" component of the equity section of the balance sheet. Unrealized gains or losses from these securities are not included in net income but are shown in stockholders' equity.

Held-to-maturity securities, on the other hand, are typically debt instruments or equities that a company plans to hold until their maturity date. An example is a certificate of deposit (CD) with a set maturity date.

Held-for-trading securities are purchased for the primary purpose of selling them in the short term to make a quick profit rather than holding them as a long-term investment.

The sale of assets, particularly physical assets, is another important aspect of investing activities. This can include the sale of fixed assets, such as property, plant, and equipment (PP&E). The proceeds from these sales are considered an inflow of cash and are listed in the investing activities section of the cash flow statement.

It's worth noting that the purchase of securities or assets can also impact cash flow from investing activities. When a company buys securities or assets, it results in a negative cash flow, indicating an outflow of cash. On the other hand, the sale of securities or assets generates positive cash flow, reflecting an inflow of cash.

In summary, the sale of securities or assets plays a crucial role in a company's investing activities and overall financial strategy. It can involve various types of securities, such as available-for-sale, held-to-maturity, or held-for-trading securities, as well as the sale of physical assets. These transactions are reflected in the cash flow statement and can provide insights into the company's financial health and investment choices.

Cash Advance Investment Strategies: A Guide to Getting Started

You may want to see also

The acquisition of another company

Acquiring another company is an important aspect of a business's growth and capital. It falls under the "Cash Flow from Investing Activities" (CFI) section of a company's cash flow statement. CFI is one of the three sections of a cash flow statement, the other two being "Cash Flow from Operations" (CFO) and "Cash Flow from Financing Activities" (CFF).

CFI tracks the cash inflow and outflow from a company's investing activities, which include the acquisition and disposal of long-term assets, investments in securities, and the acquisition of other companies. The acquisition of another company is a cash outflow activity and is, therefore, a negative cash flow activity. However, it is important for the long-term health and growth of the company.

When a company acquires another company, it is investing in future operations and expansion. This could lead to an increase in output, operating income, and account receivable, as well as a reduction in operating expenses and account payable. This will, in turn, lead to higher revenue and profit margins for the company.

Additionally, acquiring another company can also help a business maintain and improve its operations and techniques. It can also give taxation benefits and help develop an emergency fund.

Overall, the acquisition of another company is a significant investing activity that can have a positive impact on the acquiring company's financial health and growth prospects.

Investing Cash During Inflation: Strategies for Success

You may want to see also

Proceeds from the sale of other business units

The sale of a business unit typically involves the transfer of multiple assets, including capital assets, depreciable property, real property, and inventory. Each of these assets is treated separately for tax purposes, resulting in either a capital gain or loss. The gain or loss on each asset is calculated individually, and the overall proceeds from the sale can have a significant impact on the company's cash flow.

When a company sells a business unit, it is essential to consider the tax implications and seek professional advice. The tax treatment of the sale proceeds can vary depending on the structure of the transaction, such as an asset sale vs. a stock sale, and the applicable tax laws and regulations. Careful planning is necessary to optimise the tax position and ensure compliance with tax authorities.

The proceeds from the sale of a business unit can provide several options for the selling company. One option is to reinvest the proceeds into the business by allocating them to research and development, long-term assets, or other strategic initiatives. This approach can support the company's growth and improve its long-term performance.

Another option is to return the proceeds to shareholders in the form of dividends or share buybacks. This approach can enhance shareholder value and improve the company's financial position in the eyes of investors. Additionally, the selling company may also choose to allocate the proceeds from the sale towards debt reduction, improving their balance sheet and financial health.

In conclusion, proceeds from the sale of other business units can significantly impact a company's cash flow and investing activities. It provides opportunities for reinvestment, growth, and financial optimisation. However, careful consideration of tax implications and seeking professional advice are crucial to ensure compliance and make informed decisions regarding the utilisation of the proceeds.

Cashing in on Fidelity: Investment Check Options

You may want to see also

Frequently asked questions

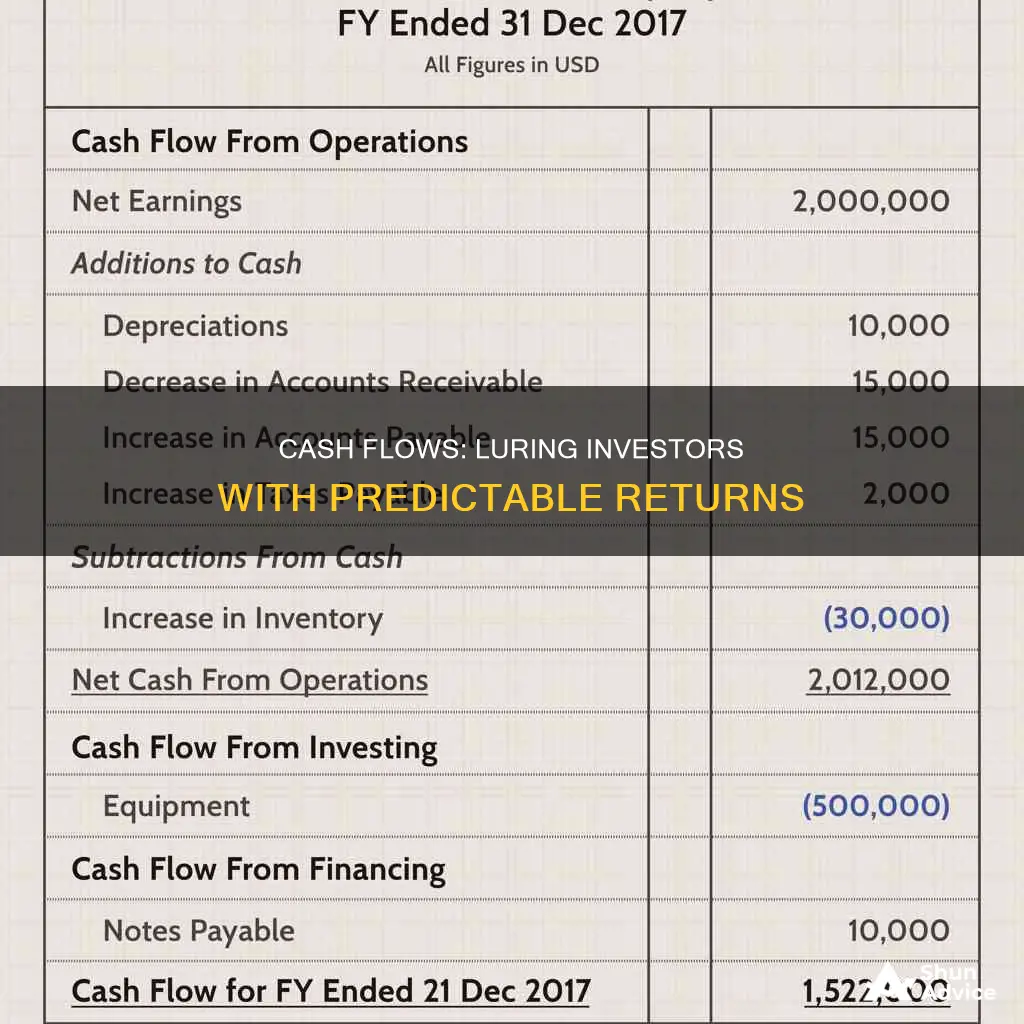

Cash flow from investing activities (CFI) is a section of a company's cash flow statement that reports the cash inflows and outflows resulting from investment activities. These activities include the acquisition and disposal of long-term assets, such as property, plant, and equipment, as well as investments in marketable securities.

Cash flow from investing activities includes transactions such as the purchase or sale of long-term assets, investments in securities, acquisitions of other businesses, and proceeds from the sale of investments.

Cash flow from investing activities is calculated by adding up all the cash inflows from the sale of non-current assets and marketable securities, and then subtracting the costs of purchasing these assets. The formula is: Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments).

Cash flow from investing activities is important because it provides insights into a company's capital expenditure and investment strategies. It helps stakeholders understand how the company is allocating cash for future growth and assesses its ability to invest in opportunities, acquire assets, and manage its long-term financial health.

A positive net cash flow from investing activities indicates that a company is generating more cash from its investing activities than it is spending. This suggests effective management of investments and potential strategic investments to enhance future growth. On the other hand, a negative cash flow does not always indicate poor performance. It may mean that the company is investing in the long-term health of the business, such as research and development, which can lead to significant gains in the long term.