The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly-traded U.S. companies, including Apple, Microsoft, Amazon, and Johnson & Johnson. It is considered a bellwether for the American stock market and provides a helpful snapshot of the overall health of the market.

There are several ways to invest in the S&P 500. One way is to buy individual stocks of companies represented in the S&P 500. Another option is to invest in a mutual fund or exchange-traded fund (ETF) that tracks the S&P 500. These funds aim to replicate the performance of the index by investing in the listed companies. This gives investors broad exposure to the leading U.S. companies without having to buy individual stocks.

Most major brokerages, such as Vanguard, Fidelity, and Scottrade, offer S&P 500 funds or ETFs. Investors can also use apps like Robinhood or robo-advisors like Betterment and Wealthfront to invest in these funds.

When choosing an S&P 500 fund or ETF, it is important to consider factors such as the expense ratio, sales load, and dividend yield. The expense ratio represents the annual cost charged by the fund manager, while a sales load refers to a sales commission charged by some mutual funds. By comparing these factors across different funds, investors can make informed decisions about which fund best aligns with their investment goals and strategies.

| Characteristics | Values |

|---|---|

| Number of companies in the index | 500 |

| Type of companies in the index | Leading U.S. companies |

| Investment options | Index funds, ETFs, individual stocks |

| Account options | Taxable brokerage account, 401(k), IRA, HSA, 529 plan, TFSA, RRSP, RESP, FHSA, or a non-registered investment account |

| Index funds vs. ETFs | ETFs can be bought and traded throughout the day; mutual funds are bought and sold once per day |

| Broker options | Ally Invest, E*TRADE, Charles Schwab, SoFi, Robinhood, Betterment, Wealthfront, Vanguard, Fidelity |

What You'll Learn

Understand the S&P 500 index

The S&P 500 Index is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalisation. It is regarded as the leading barometer for judging the performance of the U.S. stock market. The index was launched in 1957 by the credit rating agency Standard and Poor's and is considered the best single gauge of large-cap U.S. equities.

The S&P 500 includes 500 leading U.S. companies, although that number may fluctuate. As of May 2024, there were 503 constituents, with an estimated total market capitalisation of $43.4 trillion. The index represents approximately 80% of the total U.S. market capitalisation.

The S&P 500 is a float-weighted index, meaning that the market capitalisations of the companies in the index are adjusted by the number of shares available for public trading. The index uses a market-cap weighting method, which gives a higher percentage allocation to companies with the largest market capitalisations.

The index features companies from a range of sectors, with the largest concentrations in Information Technology, Financials, and Healthcare. As of April 30, 2024, the top 10 constituents by index weight included Microsoft, Amazon, Alphabet, Meta Platforms, and Berkshire Hathaway.

The S&P 500 is one of the most widely quoted American indexes as it represents the largest publicly traded corporations in the U.S. It is often the institutional investor's preferred index due to its depth and breadth.

While you cannot invest directly in the S&P 500, you can invest in funds that track its composition and performance, such as index funds or exchange-traded funds (ETFs). These funds allow investors to gain exposure to the stocks included in the index and can be purchased through a taxable brokerage account or a tax-advantaged account like a 401(k) or IRA.

Cash App Investing: Free or Fee-Based?

You may want to see also

Choose between an S&P 500 index fund or ETF

Index funds and exchange-traded funds (ETFs) are great ways to invest in the S&P 500. Both options provide investors with broad, diversified exposure to the stock market, making them good long-term investments suitable for most investors. However, there are some key differences between the two that you should be aware of when deciding which option is right for you.

The biggest difference between ETFs and index funds is that ETFs can be traded throughout the day like stocks, whereas index funds can only be bought and sold at the price set at the end of the trading day. This makes ETFs a more attractive option for investors interested in intraday trading. ETFs also typically have lower minimum investments than index funds, and they are more tax-efficient by nature due to the way they are structured.

Despite these differences, index funds and ETFs share many similarities. Both options provide investors with diversification, low costs, and strong long-term returns. They are also both passively managed, meaning that the investments within the fund are based on an index, such as the S&P 500, rather than being actively chosen by a human broker. This passive management results in lower costs for investors compared to actively managed funds.

When deciding between an S&P 500 index fund or ETF, consider factors such as the minimum investment required, capital gains taxes, and the cost of owning the fund. Compare the expense ratios and commissions of different funds to find the most cost-effective option for you. Remember, for long-term investors, the difference between ETFs and index funds may not be as significant, as both options tend to provide strong returns over time.

Apple's Cash: Where Does it Go?

You may want to see also

Open an investment account

Opening an investment account is the first step to investing in the S&P 500. If you don't already have a brokerage account, you'll need one to buy investments. You can use the money you deposit into the brokerage account to purchase S&P 500 stocks or funds, which will then be held within that account.

You can open a brokerage account in 15 minutes or less. You'll want to choose one that matches the kind of investments you plan to make. If you're buying a mutual fund, then try to find a broker that allows you to trade your fund without a transaction fee. If you're buying an ETF, look for a broker that offers ETFs without commissions.

The best brokers offer thousands of ETFs and mutual funds without a trading fee.

If your ultimate goal is investing for retirement, consider investing in the S&P 500 through a 401(k) or IRA, rather than a taxable brokerage account.

Cash Investments: Where Are They Reported?

You may want to see also

Compare S&P 500 ETFs and index funds

When comparing S&P 500 ETFs and index funds, there are several factors to consider. Here are some key differences and similarities between the two:

Similarities:

- Diversification: Both S&P 500 ETFs and index funds provide exposure to a diverse range of stocks within the S&P 500 index, which includes 500 leading U.S. companies across various sectors. This diversification can help reduce investment risk.

- Low Cost: Both options are known for having low expense ratios compared to other types of funds. The focus on passive index replication or tracking keeps costs low for investors.

- Broad Market Exposure: By investing in the S&P 500, you gain access to a large portion of the U.S. stock market, as the index represents nearly 80%-85% of the total capitalization of the U.S. stock market.

Differences:

- Trading Flexibility: ETFs offer more flexibility in trading as they can be bought and sold throughout the trading day, similar to stocks. Index funds, on the other hand, can only be bought and sold at the end of the trading day, based on the fund's net asset value (NAV).

- Minimum Investment: ETFs generally have no minimum investment requirements, allowing investors to purchase as little as one share. Index funds often have minimum investment requirements, although there are some with $0 minimums, especially in workplace retirement plans.

- Liquidity: ETFs are considered more liquid than index funds due to their ability to be traded throughout the day. However, S&P 500 ETFs themselves vary in liquidity, with some having higher trading volumes and tighter bid-ask spreads than others.

- Tax Efficiency: ETFs tend to be more tax-efficient than index funds due to their structure and lower portfolio turnover. ETFs use an "in-kind" creation and redemption process, minimizing capital gains distributions. Mutual funds may generate capital gains when the fund manager sells holdings to meet redemptions, potentially triggering tax events for investors.

- Fees: While both options offer low fees, ETFs typically have slightly lower expense ratios than index funds. This is because index funds have higher operating expenses, as they can only be bought and sold at the end of the day.

- Suitability for Active Traders: ETFs are more suitable for active traders due to their intraday trading flexibility and higher liquidity. Index funds are more commonly used by buy-and-hold investors who are less concerned with short-term trading.

Investing in Cash Balance Plans: Understanding Your Options

You may want to see also

Weigh the benefits and risks of investing in the S&P 500

Weighing the benefits and risks of any investment is a crucial step in financial planning. The S&P 500 is no exception, and while it is a well-known stock market index, it is essential to understand the potential advantages and disadvantages before investing.

Benefits of Investing in the S&P 500:

- Diversification: Investing in the S&P 500 provides instant diversification as it comprises 500 leading U.S. companies across various sectors. This diversification lowers your risk because even if a few stocks underperform, it won't significantly impact your entire portfolio.

- Long-term returns: Historically, the S&P 500 has produced better returns over long-term horizons compared to actively managed portfolios. From 1950 to 2023, the S&P 500 yielded an annualized average return of 11.34%.

- Cost-effectiveness: Index funds and ETFs that track the S&P 500 are generally low-cost investment options. They have low expense ratios, and some popular S&P 500 ETFs trade in the $500 to $650 range.

- Simplicity and passive investing: S&P 500 index funds or ETFs are simple investment options as they aim to replicate the returns of the S&P 500. This passive investing approach does not require intricate analysis or stock-picking, making it ideal for those who prefer a hands-off approach.

- Exposure to large U.S. companies: The S&P 500 provides exposure to some of the largest and most dynamic U.S. companies, such as Apple, Amazon, Microsoft, and Walmart. These companies represent about 80% of the total U.S. stock market's value.

Risks of Investing in the S&P 500:

- Concentration and diversification: The S&P 500 is dominated by large-cap companies, particularly in the technology sector. This concentration in a specific sector and large companies may limit exposure to small-cap and mid-cap stocks, which could have higher growth potential.

- Volatility and downside risk: As with any stock investment, there is inherent volatility and the risk of losses. The S&P 500 has experienced significant declines in the past, and newer or risk-averse investors may find it challenging to tolerate such fluctuations.

- Limited to U.S. companies: The S&P 500 only includes U.S. companies, which means investors seeking international diversification may need to consider other options or additional investments.

- Inability to beat the market: By design, S&P 500 index funds aim to replicate the market's performance. Therefore, they are not suitable for investors seeking to outperform the market. If you are looking to beat the market, you may need to consider individual stocks or actively managed funds.

- Lack of customization: Investors who are particular about the companies they invest in may find S&P 500 index funds limiting as they cannot choose which companies are included in the index.

In conclusion, the S&P 500 can be a solid investment option, especially for those seeking long-term, cost-effective, and diversified exposure to the U.S. stock market. However, it is essential to understand the potential risks, including concentration in specific sectors and large-cap companies, inherent volatility, and the inability to beat the market.

Chipper Cash Investment: A Guide to Getting Started

You may want to see also

Frequently asked questions

The S&P 500 is a stock market index that tracks the performance of 500 large, publicly-traded U.S. companies. It is considered a bellwether for the American stock market.

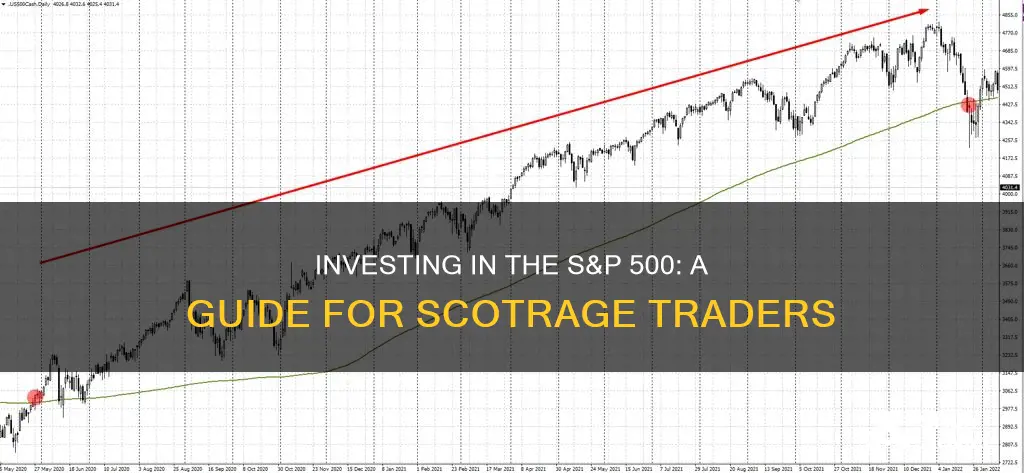

Scottrade was acquired by TD Ameritrade in 2017. You can invest in the S&P 500 through TD Ameritrade by purchasing an S&P 500 index fund or an ETF that tracks the index.

An S&P 500 index fund is a type of investment fund, either a mutual fund or an ETF, that is based on the S&P 500 index. It aims to replicate the performance of the index by investing in the companies listed on it.

Investing in an S&P 500 index fund or ETF offers benefits such as diversification, ease and convenience, and solid long-term performance.

Some risks and downsides of investing in the S&P 500 include concentration in a small number of companies, underexposure to international markets and smaller companies, and limited returns during economic downturns.