Knowing how much interest you've made on your investments is important for investors who want to understand their income and estimate how much they might receive in the future. There are a few ways to see how much interest you've made on your investments, including using digital banking, investment income tools, or calculating it manually.

| Characteristics | Values |

|---|---|

| Investment income | Interest and dividends are two different types of investment income |

| Investment income tool | Schwab.com has an Investment Income tool that allows investors to see how much income they have received and estimate how much they might receive in the future |

| Interest earned | Interest earned statements are known as 1099-INT forms and are issued when $10 or more in interest is earned on a deposit account or when a U.S. Saving Bond is redeemed |

| Original account balance | The original amount of your investment, which can be found by subtracting the interest paid from the current balance |

| Interest paid | The difference between your original account balance and its current balance |

What You'll Learn

Using digital banking

You can use digital banking to see the interest made on your investment. If you have a Maya Digital Bank account, you can view your interest earned on your Personal Goal accounts, which is credited monthly. You can also use a compound interest calculator to see how your savings have grown over time. Simply enter the amount you have in savings and the calculator will show you your final balance, total contributions, and interest earned.

If you are unsure about how to access this information on your digital banking platform, you can contact your bank's customer service team for guidance.

Low Interest Rates: Friend or Foe of Investment?

You may want to see also

Using the Investment Income tool on Schwab.com

If you're interested in seeing how much investment income you've received, including dividends, consider using the Investment Income tool on Schwab.com. Many investors like to have an idea of how much income they receive from investments, as well as an estimate of how much they might receive in the coming year.

Using the Investment Income Summary on Schwab.com, investors can see how much income they have received, as well as estimate how much they might expect in the future. The Investment Income Summary shows interest and dividends as two different types of investment income. Under the summary of estimated investment income is a bar chart that displays estimated income by month. It's possible to adjust the view of the chart to show the previous year's received investment income as well as estimated income for the current year rather than estimated income for the next 12 months.

To access the Investment Income Summary, select Investment Income under the Accounts drop-down menu. You can also find out what your interest rate is and how much interest was earned this year and last year by using digital banking. Log in to your account and select your checking or savings account. Then, select 'Manage' at the top of the screen and choose 'Interest' within the 'Account details' section. Interest earned statements are known as 1099-INT forms. These are issued when $10 or more in interest is earned on a deposit account or when a U.S. Saving Bond is redeemed.

Keynesian Theory: Interest Rates and Investment Insights

You may want to see also

Using the Investment Income Summary on Schwab.com

If you want to see how much interest you've made on your investments, you can use the Investment Income Summary on Schwab.com. This tool allows investors to see how much income they have received and estimate how much they might expect in the future. To access the Investment Income Summary, select Investment Income under the Accounts drop-down menu.

The Investment Income Summary provides a detailed breakdown of your investment income, including interest and dividends. It also offers a visual representation of your estimated income with a bar chart that displays income by month. You can adjust the view of the chart to show the previous year's received investment income, as well as estimated income for the current or next year. This flexibility allows you to compare your investment income over different periods.

Additionally, the Investment Income Summary provides transparency by listing all the accounts included in the estimate. This includes retirement, managed, and uncategorized accounts, ensuring you have a comprehensive overview of your investment income across all your accounts.

To further understand your investment income, you can also refer to your digital banking platform or mobile banking app. These platforms often provide information about your interest rate and the interest earned on your deposit accounts. Interest earned statements, also known as 1099-INT forms, are issued when certain criteria are met, such as earning $10 or more in interest. By utilising both the Investment Income Summary on Schwab.com and your digital banking resources, you can effectively track and estimate your investment income.

Investing: My Journey and Interest Explained

You may want to see also

Subtracting the interest paid from the current balance

To see the interest made on an investment, you can use digital banking or a mobile app. Select your account and then choose 'Account details' or 'Manage'. You can then view your interest earned. This information is also available on a 1099-INT form, which is issued when $10 or more in interest is earned on a deposit account or when a US Saving Bond is redeemed.

You can also use an Investment Income tool, such as the one on Schwab.com, to see how much investment income you've received, including dividends. You can also use the Investment Income Summary to see how much income you've received and estimate how much you might expect in the future.

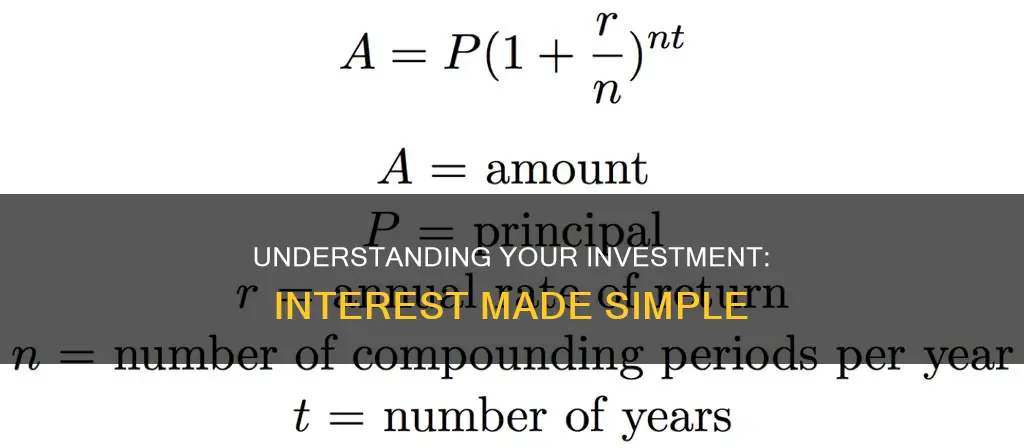

If you want to calculate the interest rate or rate of return on your investment, you can subtract the interest paid from the current balance. This will give you the original account balance, or the original amount of your investment. Once you have this information, you can use a formula to compute your interest rate. To express the rate as a percentage, multiply this amount by 100.

It's important to note that the interest rate is usually easy to find with a deposit account, like a savings account or CD. However, past performance does not guarantee future results, so it's always a good idea to do your research and understand the risks involved.

GDP Growth and Low Interest Rates: A Recipe for Investment?

You may want to see also

Viewing interest earned statements (1099-INT forms)

If you want to see how much interest you've made on an investment, you can use digital banking. You can select your checking or savings account, then select 'Account details' and 'Interest' within the 'Account details' section. Interest earned statements are known as 1099-INT forms. These are issued when $10 or more in interest is earned on a deposit account or when a US Saving Bond is redeemed. You can also use the Investment Income tool on Schwab.com to see how much investment income you've received, including dividends. You can also use the Investment Income Summary on schwab.com to see how much income you've received and estimate how much you might expect in the future.

If you're not sure of your original account balance, you can subtract the interest paid from the current balance. The interest paid is the difference between your original account balance and its current balance. Once you have this information, you can use a formula to compute your interest rate, or rate of return.

Invest Wisely: Strategies for the Uninterested

You may want to see also

Frequently asked questions

You can use digital banking to see how much interest you've earned this year and last year. You can also use investment tools such as the Investment Income Summary on Schwab.com.

You can calculate your interest rate by subtracting the interest paid from your current balance.

Interest earned statements are known as 1099-INT forms. These are issued when $10 or more in interest is earned on a deposit account or when a U.S. Saving Bond is redeemed.