Mutual funds are a popular investment choice in India, offering solutions for various financial goals and catering to investors from all age groups. However, with thousands of schemes available, selecting the right mutual fund can be challenging. The first step in choosing a mutual fund is defining your financial goals and investment objectives, such as wealth creation, retirement planning, or children's education. Next, assess your risk tolerance and time horizon. Based on these factors, you can shortlist suitable fund categories like equity, debt, or hybrid funds. When evaluating specific schemes, consider factors such as fund performance, consistency of returns, fund manager's experience, expense ratio, and assets under management. It's also important to understand the different types of mutual funds, including growth, income, and tax-saving funds, to build a portfolio aligned with your goals. Remember, there is no one-size-fits-all approach, and the best mutual fund for you will depend on your individual circumstances and objectives.

| Characteristics | Values |

|---|---|

| Investment Objective | Financial goals, such as buying a house, retirement, children's education, etc. |

| Time Horizon | Short-term (less than 1 year) to long-term (more than 5 years) |

| Risk Tolerance | Low, moderately low, moderate, moderately high, high |

| Investment Type | Debt funds, equity funds, hybrid funds, tax-saving funds, liquid funds |

| Performance | Consistency of returns over time and compared to benchmarks and peer groups |

| Fund Manager | Experience and track record of the fund manager |

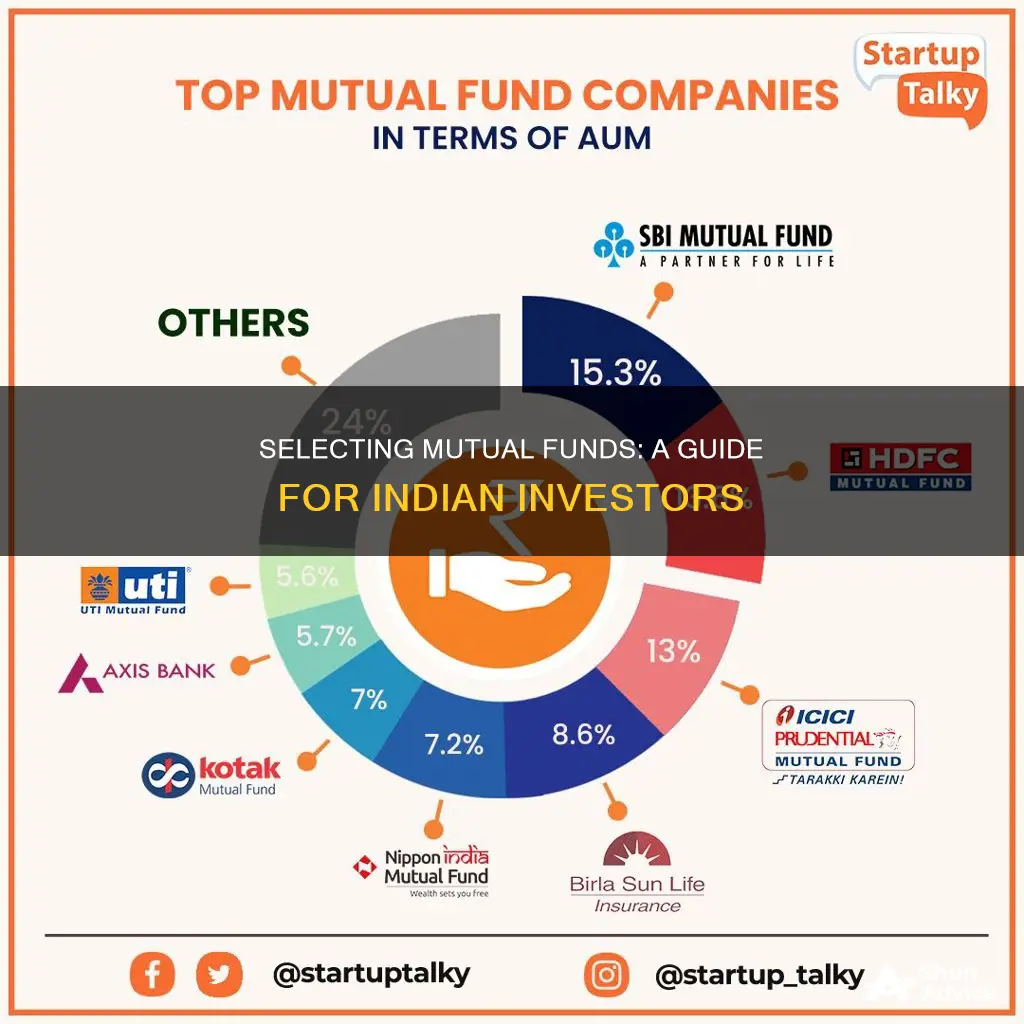

| Assets Under Management (AUM) | Larger AUM is favourable for liquid and short-term debt funds |

| Expense Ratio | Lower expense ratios result in higher net returns |

| Loads | Entry load, exit load, and recurring fees |

| Taxation | Short-term and long-term capital gains taxed differently |

What You'll Learn

Investment objective

When selecting a mutual fund for investment in India, it is important to first define your investment objective. This involves laying out your financial goals, factoring in inflation, and determining how much and where to invest, as well as the investment horizon or time frame.

Wealth Creation or Capital Appreciation

If your goal is long-term wealth creation, maximising returns, or capital appreciation, equity mutual funds are often recommended. These funds invest in stocks and have the potential for high returns, but they also come with higher risks and volatility. They are suitable for investors with a long investment horizon, typically over 5 years, and a higher risk appetite.

Regular Income

If you are seeking regular income from your investments, debt funds or bond funds are a better option. These funds primarily invest in fixed-income instruments like government securities, corporate bonds, and other debt instruments, offering more stable and consistent returns compared to equity funds. They are suitable for investors looking for steady income rather than aggressive capital growth.

Tax Savings

If tax savings is your primary objective, consider investing in Equity-Linked Savings Schemes (ELSS) or tax-saving funds. These funds offer tax benefits under Section 80C of the Income Tax Act, providing deductions of up to Rs. 1.5 lakh in a financial year. ELSS funds also have a lock-in period of 3 years, which can be a consideration for your investment timeline.

Retirement Planning

For those planning for retirement, mutual funds can be a way to grow your wealth over time and generate an income stream during retirement. A mix of equity funds for long-term growth and debt funds for stable income can be considered, depending on your risk appetite and time horizon.

Short-Term Goals

If you have short-term goals, such as purchasing utility goods, a down payment on a house, or an international holiday, liquid funds or overnight funds might be more suitable. These funds are highly liquid and typically invest in short-term instruments with maturities of less than a year, providing easy access to your money when needed.

Education Planning

For goals like saving for your children's higher education, a combination of equity and debt funds can be considered. Equity funds can help with long-term growth, while debt funds can provide a steady income stream for tuition fees and other education-related expenses.

Risk Tolerance

It is important to assess your risk tolerance and ensure it aligns with the risk profile of the mutual fund. Equity funds are generally suitable for investors with a moderately high to high-risk appetite, while debt funds are more appropriate for those with low to moderate risk appetites.

When selecting a mutual fund, it is crucial to analyse the associated risks and ensure they are within your comfort level. Remember that higher returns usually come with higher risks, so carefully consider your investment objectives and risk tolerance before making a decision.

Strategic Investing: Maximizing Returns with Closed-End Funds

You may want to see also

Risk tolerance

In 2015, the Securities and Exchange Board of India (SEBI) mandated that all mutual fund houses display a riskometer, which consists of five levels of risk associated with the invested principal amount. These risk levels are low, moderately low, moderate, moderately high, and high. It's important for investors to assess their risk tolerance and choose funds that align with their comfort level.

Equity mutual funds, for example, are subject to market fluctuations and tend to be more volatile in the short term. However, they can also offer substantially higher returns compared to other types of funds, making them suitable for long-term aggressive investors. On the other hand, debt mutual funds are comparatively more stable but typically provide lower returns, making them a better option for conservative investors.

When considering risk tolerance, it's important to understand the relationship between risk and return. Asset allocation aims to balance risk and return to achieve financial goals. Investors with a higher risk appetite can allocate more of their portfolio to equities, while those with a lower risk tolerance may opt for a larger allocation to debt instruments.

Additionally, it's worth noting that risk tolerance is closely tied to investment objectives and time horizons. For instance, if an investor is seeking capital appreciation and has a long-term investment horizon, they may be comfortable taking on more risk. Conversely, those with shorter investment horizons or seeking regular income may prefer lower-risk options to protect their capital.

In conclusion, understanding one's risk tolerance is essential when selecting a mutual fund for investment in India. By assessing their risk capacity and aligning it with their investment goals and time horizon, investors can make more informed decisions and choose funds that match their risk profile.

Mutual Fund Investment: Strategies, Risks, and Rewards

You may want to see also

Investment horizon

When selecting a mutual fund for investment in India, one of the most important factors to consider is the investment horizon, or the length of time that an investor expects to hold a security or a portfolio. This is crucial because the investment horizon determines an investor's desired exposure to risk and income needs, which in turn contribute to the selection of securities.

The investment horizon is one of the first steps an investor must take when creating a portfolio. It is also one of the crucial factors in determining the type of mutual fund to invest in. Mutual funds can be classified as short-term, medium-term, or long-term, depending on their investment horizon.

Short-Term Mutual Funds

Short-term mutual funds have an investment horizon of 1 to 3 years. For debt funds, a period of fewer than 36 months is considered short-term, while for equity and balanced funds, a period of less than 12 months is defined as a short-term investment horizon. Money market funds, savings accounts, certificates of deposit, and short-term bonds are good choices for short-term investments as they can be easily liquidated for cash.

Medium-Term Mutual Funds

Medium-term mutual funds have a longer investment horizon of more than 36 months (3 years), with investors typically staying invested for 5 to 7 years. This category includes debt funds with an investment horizon of 1 to 5 years and equity funds with a tenure of 3 to 7 years. Medium-term investment strategies tend to balance between high- and low-risk assets, so a mix of stocks and bonds is often recommended to protect wealth without losing value to inflation.

Long-Term Mutual Funds

Long-term mutual funds have the longest investment horizon, which can last up to 10 years or more. Debt funds with tenures between 5 and 20 years and equity funds with an investment horizon of 7 to 20 years fall under this category. Retirement savings are the most common type of long-term investment, and long-term investors are typically willing to take greater risks in exchange for greater rewards.

Choosing the Right Investment Horizon

The choice between short-term, medium-term, and long-term investment horizons depends on the investor's financial goals and risk appetite. For example, if an investor is nearing retirement or needs a large sum of cash in the near future, a short-term investment horizon is more suitable. On the other hand, if an investor has a long-term goal such as saving for retirement or a child's education, a longer investment horizon may be preferred.

It is important to note that the length of the investment horizon also affects the level of risk an investor is willing to take. Generally, investors with longer investment horizons can take on more risk since the market has more time to recover in case of a pullback. As a result, portfolios with longer investment horizons tend to have a larger portion dedicated to equities, while those with shorter horizons may move more towards fixed-income investments.

Philam Life Mutual Funds: Your Guide to Investing

You may want to see also

Fund manager's experience

When selecting a mutual fund for investment in India, one of the key considerations is the experience of the fund manager. Fund managers play a crucial role in the success of a mutual fund and are responsible for steering the fund strategy and implementing it. They are professionally qualified individuals who closely monitor the market, economic trends, policies, and other factors influencing the stock market. The performance of a fund is significantly influenced by the decisions made by the fund manager. Hence, it is essential to evaluate the fund manager's experience and track record when selecting a mutual fund for investment.

- Past performance and track record: Evaluating the past performance of a fund managed by the fund manager provides insights into their ability to generate returns. While past performance does not guarantee future results, it indicates the manager's investment approach and whether they have consistently outperformed the benchmark.

- Ability to identify investment opportunities: Experienced fund managers possess comprehensive knowledge and insights into the market. They analyse shifts in the stock market, assess the competition within industries, and conduct thorough reviews of companies' annual results to identify attractive investment opportunities.

- Risk management and decision-making: Fund managers must balance risk and return to protect investors' wealth. They employ risk management techniques and ensure adequate diversification in asset portfolios to mitigate risks. Their decisions are based on extensive research and due diligence, considering both macro and sector-related information.

- Compliance and reporting: Fund managers are responsible for ensuring compliance with regulatory authorities, such as the Securities and Exchange Board of India. They must also meet reporting requirements, keeping investors informed about the fund's objectives, strategies, risks, expenses, and policies.

- Experience and qualifications: Consider the fund manager's educational background, certifications, and years of experience in the industry. Experienced fund managers have a deeper understanding of market dynamics and are better equipped to make informed investment decisions.

- Performance of other funds managed: Look at the performance of other funds managed by the same fund manager. This can provide a broader perspective on their investment strategy and ability to generate returns across different funds.

- Stability of the fund management team: A stable and experienced fund management team can provide better support to the fund manager and contribute to more consistent performance over time.

When selecting a mutual fund for investment in India, it is beneficial to consider the fund manager's experience and track record as one of the key criteria. By evaluating the factors mentioned above, investors can make more informed decisions and select funds with higher potential for success.

Finding Investment Funds: A Comprehensive Guide to Sources

You may want to see also

Expense ratio

When selecting a mutual fund for investment in India, one of the most important factors to consider is the expense ratio. This is the fee charged by investors for the management of their investments and is levied on all investors to ensure profits. The expense ratio is a derivative of Assets Under Management (AUM) and is usually expressed as a percentage of the fund's average net assets. For example, an expense ratio of 0.30% means you will pay $30 per year for every $10,000 invested.

As an investor, you should aim for mutual funds with a lower expense ratio. While the percentage may seem small, it will have a larger impact when calculated across your total investment portfolio. A reasonable expense ratio for an actively managed portfolio is about 0.5% to 0.75%, while an expense ratio above 1.5% is generally considered high. Actively managed funds tend to have higher expense ratios than passively managed funds because they require a team of portfolio managers to constantly monitor and change the assets to maximise performance.

The expense ratio is calculated by dividing a mutual fund's operating expenses by the average total dollar value of all the assets in the fund. It includes management fees, marketing and distribution costs, and other operational expenses such as taxes, legal fees, accounting, auditing, and record-keeping.

When evaluating mutual funds, it is important to consider the fund's expense ratio in addition to other factors such as fund performance, fund manager experience, and investment objectives. By comparing the expense ratios of different funds, you can identify those that offer the best value for your investment.

Growth and Income Funds: Smart Investment Strategies

You may want to see also

Frequently asked questions

The parameters for selecting a mutual fund are return expectation, risk tolerance, investment horizon, expense ratio, past performance, fund manager experience, and assets under management.

The three main types of mutual funds are debt mutual funds, equity mutual funds, and hybrid mutual funds. Debt funds are more stable and suitable for conservative investors, while equity funds offer higher returns but are more volatile. Hybrid funds are a combination of debt and equity funds.

Your investment objective depends on your financial goals and time horizon. Common financial goals include purchasing a house, retirement planning, children's education, vacation planning, etc. The time horizon can be short-term (less than 1 year), medium-term (1-5 years), or long-term (more than 5 years).

Your risk tolerance depends on your age, life stage, and financial situation. Different asset classes have different risk profiles. For example, debt funds have lower risk than equity funds. You should assess your risk appetite and choose a mutual fund that aligns with your risk tolerance.

The tax consequences of investing in mutual funds depend on the type of fund and the holding period. For example, short-term capital gains (less than 12 months) in equity funds are taxed at 15%, while long-term capital gains (more than 12 months) are tax-exempt up to a certain threshold and taxed at a higher rate thereafter.