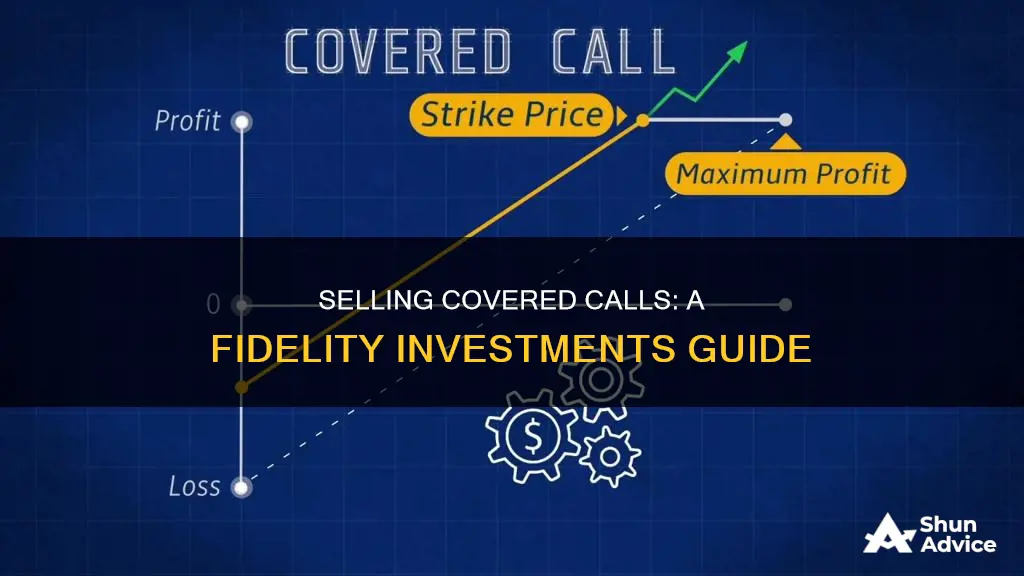

A covered call is an income-generating options strategy. It involves two components: owning an investment, typically a stock, and selling a call option on that same investment. The shares that are owned cover the obligation created by selling to open the options contract. This way, the shares are ready to be delivered to the option buyer if the contract is exercised.

Selling covered calls is a strategy in which an investor writes a call option contract while simultaneously owning an equivalent number of shares of the underlying stock. The intent of a covered call strategy is to generate income on an owned stock, which the seller expects will not rise significantly during the life of the options contract.

To sell covered calls, you need to open a brokerage account with options trading and apply to trade options. Once approved, you can research investment options and execute trades.

What You'll Learn

Selling covered calls through the Fidelity app

A covered call is an income-generating options strategy. It involves two components: owning an investment (usually a stock) and selling a call option on that same investment. The shares that are owned cover the obligation created by selling to open the options contract.

To sell covered calls through the Fidelity app, you must first ensure that the underlying stock is settled. This usually takes two business days after purchase or one business day after assignment.

Once the underlying shares have settled, follow these steps to place your trade:

- Pull up a quote for the desired security and select "Option Chain".

- Choose your desired strike price.

- Enter the number of contracts you want to sell and select "Sell to Open".

- Fill out the remaining applicable fields on the trade ticket.

It's important to note that selling covered calls involves significant risk and is not appropriate for all investors. Before trading options, please read the "Characteristics and Risks of Standardized Options" document.

Suppose you own 400 shares of a stock (XYZ), which are currently worth $39.30 per share. You don't think the stock will increase much or at all over the next couple of months. In the options chain, you find that 1 call option covering 100 shares of XYZ stock with a strike price of $40 is selling for $0.90 per contract. Here, the buyer has the right to exercise the contract to buy the XYZ shares at $40 a share before the contract expires. By selling 1 XYZ contract, you would receive $90.

If the price stays below the strike price during the life of the contract, you keep the $90 premium if the buyer does not exercise the option. However, if the price of the underlying stock rises above the strike price before expiration, the option buyer has the right to exercise the contract and buy the shares from you at the strike price. This is one of the risks of executing a covered call – you get income for selling the call, but you may lose out on further gains if the stock price rises above the strike price.

Vanguard Index Funds: Best Investment Options for 2023

You may want to see also

The risks of selling covered calls

While a covered call is often considered a low-risk options strategy, it does come with certain risks that investors should be aware of:

- Missing out on stock appreciation: The main risk of selling covered calls is the potential to miss out on stock appreciation. If the stock price rises significantly above the strike price, the writer of the covered call will only benefit from the stock appreciation up to the strike price and will not participate in any further gains. In strong upward moves, it would have been more favourable to hold the stock and not write the call.

- Limited upside potential: Covered calls limit the upside potential of the underlying stock during the life of the contract. The writer of the call option gives up the opportunity to benefit from any increase in the stock price above the call exercise price.

- Downside risk: While the risk on the option is capped because the writer owns shares, those shares can still drop in value, causing a significant loss. The premium income received from selling the call can help offset this loss to some extent.

- Increased complexity: Writing the option adds another layer of complexity to a stock trade, involving more transactions and commissions.

- Tax liability: If the covered call results in the sale of the underlying stock, it may trigger a taxable event, especially if the investment has large unrealized gains.

- Assignment risk: If a contract is "in the money" (i.e., the price of the underlying stock is higher than the strike price), it can be assigned at any time before expiration, which could force the writer to sell their position.

- Opportunity risk: If the stock price rises above the effective selling price of the covered call, there is an opportunity cost associated with missing out on potential gains.

Credit Investment Funds: Understanding the Basics

You may want to see also

The benefits of selling covered calls

Covered call writing (CCW) is a popular option strategy for individual investors, and for good reason. Here are some of the benefits of selling covered calls:

- Income: When you sell a covered call, you immediately generate income by receiving the option premium from the buyer. This cash is yours to keep, regardless of what happens next with the stock price.

- Safety: The premium you collect provides some protection against losses if the stock price declines. For example, if you buy a stock at $50 per share and sell a call option with a $2 premium, you are effectively buying the stock at $48 per share. This reduces your risk of loss if the stock price falls.

- Increased probability of profit: By selling covered calls, you can lower your break-even price, which increases the likelihood of earning a profit. If you own a stock at $48 per share, you make a profit as long as the stock price is above $48 at expiration.

- Limited risk: Covered calls can help you control risk and improve returns. If the stock price drops, the premium you received provides some protection against losses.

- Hedging risk: Selling covered calls can hedge risk on your stock holdings. If the stock price rises, you can still profit by selling at the strike price, but if it drops, you keep the premium as a form of downside protection.

- Dividends: By selling covered calls, you can earn dividends as long as you continue holding the stock and own it before the ex-dividend date.

- Locking in a higher price: If you're looking to sell your investment but want to wait for the price to rise, a covered call can help. It ensures your investment will be sold if the target price is reached, and you also receive a premium.

While selling covered calls offers these benefits, it's important to remember that there are also risks involved, such as the potential for reduced profits if the stock price increases significantly and the possibility of losing out on dividends.

Social Security Funds: Where Does the Money Go?

You may want to see also

How to sell covered calls

A covered call is an income-generating options strategy. It involves two components: owning an investment (usually a stock) and selling a call option on that same investment. The shares that are owned cover the obligation created by selling to open the options contract. This way, the shares are ready to be delivered to the option buyer if the contract is exercised.

- Open a brokerage account with options trading: Look for an account with low fees, as well as the research, investing, and trading capabilities that align with your strategy before opening the account.

- Apply to trade options: Depending on your financial institution, you may need permission to trade options. For example, at Fidelity, you must first complete an options application.

- Research investment options and execute trades: Your brokerage may have resources to help you research and plan an options strategy. Once you have a stock or ETF in mind, log into your brokerage account. The options chain will show you contracts at different strike prices and for different durations. Once you've found a combination that you like, you can start selling covered calls right from the options chain.

When selling a covered call, it's important to remember that you are obligating yourself to sell your shares at the strike price if the buyer exercises their option. This strategy is suitable for investors who think the price of the underlying stock or investment will remain steady or have a slight increase.

Assume an investor owns shares of XYZ Company and wants to maintain ownership as of February 1. The trader expects the price of the stock to remain unchanged, rise slightly, or decline slightly over the next three months. To benefit from this expectation, a trader could sell April call options to collect income, anticipating that the stock will close below the call strike at expiration, and the option will expire worthless. This strategy is considered "covered" because the two positions (owning the stock and selling calls) are offsetting.

Super Funds: Where Your Money is Invested

You may want to see also

Using covered calls for other investment strategies

Covered calls can be used in a variety of investment strategies, each with its own advantages and disadvantages. Here are some ways to use covered calls for other investment strategies:

- Income Generation: Covered calls are often used to generate additional income from existing stock holdings. By selling call options, investors can collect premiums, providing a steady income stream without having to sell their shares. This strategy is particularly attractive for investors who plan to hold a stock for the long term but want to boost their income during that period.

- Target Price Selling: Covered calls can be used when an investor wants to sell their stock at a specific target price. By setting the strike price at or near the desired selling price, the investor collects the premium upfront and is prepared to sell their shares when the market reaches that level. This approach allows for a gradual exit from a position or taking advantage of a particular price target.

- Improving Portfolio Yield: Covered calls can be employed to enhance the yield on a portfolio by collecting premiums from selling call options. This extra income can supplement dividends or other income streams generated by stock holdings.

- Downside Protection: Covered calls can act as a form of protection against potential losses. By receiving the premium from selling the call option, investors lower their cost basis in the underlying stock. This premium can offset potential losses or provide a cushion against downside risks if the stock price remains flat or decreases slightly.

- Leveraged Investing: Covered calls can be used as a basis for leveraged investment strategies due to their low-volatility returns. Investors can borrow money at a lower interest rate to invest in covered calls, potentially increasing their overall returns. However, it's important to ensure that the returns from the covered call strategy are higher than the cost of borrowed capital.

- IRA Strategy: Covered calls can be a good strategy for traditional or Roth IRAs. Investors can buy back stock without worrying about immediate tax consequences and generate additional income that can be distributed or reinvested.

While covered calls offer various benefits, it's important to consider the risks and potential downsides. These strategies may limit upside potential, and investors must be comfortable with selling their underlying position if the call option is exercised. Additionally, in volatile markets, the accumulated premiums may not be sufficient to cover losses. Therefore, it's crucial to carefully assess the investment outlook and market conditions before employing covered call strategies.

A Beginner's Guide to Index Fund Investment on E-Trade

You may want to see also