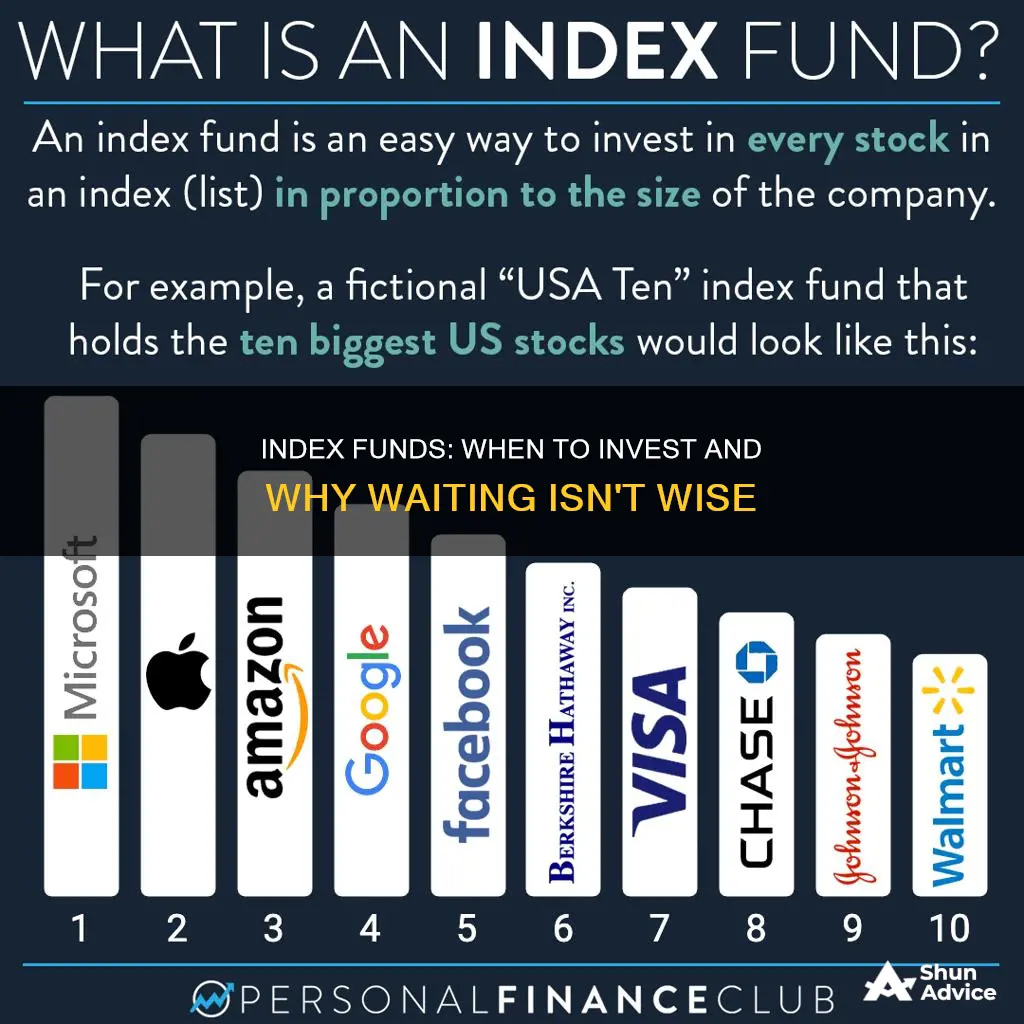

Index funds are a type of investment fund that mirrors the portfolio of a designated stock market index, aiming to match its performance. They are popular with investors because they offer ownership of a wide variety of stocks, greater diversification, lower risk, and solid returns—all at a low cost. When deciding whether to invest in index funds, timing is important. While it is impossible to predict the market, the general consensus is that it is best to invest as soon as possible to take advantage of compounding. However, if you are investing in index funds, it is crucial to adopt a patient approach and avoid trying to time the market.

| Characteristics | Values |

|---|---|

| Should you wait to invest in index funds? | No, as you will lose money by sitting on the sidelines. |

| Best time to invest | Now, as the market tends to rise over time. |

| Best approach | Consistent investment into simple, low-cost funds. |

| When to avoid investing | If you need the money back in the next few years. |

| When to be cautious | If the fund is narrowly diversified. |

| When to be very cautious | Never try to time the market. |

What You'll Learn

Investing in index funds is a long-term strategy

Index funds are a type of investment fund that tracks the performance of a specific market index, such as the S&P 500. They are typically either mutual funds or exchange-traded funds (ETFs) and are designed to mirror the holdings of the index they are based on. This means that they offer investors a way to gain exposure to a diverse range of securities, such as stocks or bonds, in a single investment vehicle.

One of the key advantages of index funds is their low cost. Because they are passively managed, they generally have much lower management fees than other types of funds. Index funds also tend to have lower transaction costs since they hold investments for the long term, only making changes when the underlying index changes. These lower costs can have a significant impact on investment returns over time.

In addition to their low costs, index funds offer the benefits of diversification and reduced risk. By investing in an index fund, individuals can instantly gain exposure to a broad range of securities, reducing the volatility of their investment portfolio. While individual stocks can be highly volatile, index funds, due to their diversification, tend to experience less extreme fluctuations.

When considering investing in index funds, it is important to remember that they are a long-term investment strategy. Trying to time the market by waiting for dips to buy or highs to sell is generally not a successful strategy. Instead, individuals should focus on consistent, long-term investment, allowing their money to grow over time through compound returns.

By investing a set amount regularly, individuals can take advantage of dollar-cost averaging, whereby their money buys more units when the market is low and fewer units when the market is high. This strategy helps to reduce the impact of short-term market fluctuations and allows investors to benefit from the long-term upward trend of the market.

In summary, investing in index funds is a long-term strategy that offers individuals a low-cost, diversified, and relatively low-risk way to invest in the market. By investing consistently and avoiding the temptation to time the market, individuals can increase their chances of achieving their long-term financial goals.

Municipal Bond Investing: Vanguard Funds for Beginners

You may want to see also

The market is difficult to time

Waiting for the "right time" to invest can result in missed opportunities and higher costs. For example, if you wait five years to invest, you may need to invest twice as much each month to achieve the same returns as someone who started investing immediately. This is because the longer your money is in the market, the more it can benefit from compound interest.

Additionally, the stock market tends to rise over time as the economy grows and corporate profits increase. Therefore, the earlier you invest, the more you can benefit from these long-term gains.

While it is impossible to predict market highs and lows accurately, it is important to remember that even during market corrections, your investments can still grow over time. For example, if you invest in an index fund during a market high, a subsequent market correction of 5-10% can be an opportunity to buy more at a lower price, rather than a cause for panic selling.

Instead of trying to time the market, focus on your investment plan and risk tolerance. If you are investing for the long term (e.g., retirement), choosing a broadly diversified index fund with low fees can be a wise strategy, regardless of short-term market fluctuations.

In summary, trying to time the market is challenging and often unsuccessful. By investing consistently and for the long term, you can increase your chances of achieving your financial goals.

Opportunity Zones: Qualified Fund Investment Benefits and Risks

You may want to see also

Index funds are low-cost

Index funds are a low-cost investment option. They are passively managed, meaning they are designed to replicate the performance of a specific market index, such as the S&P 500, and do not require active fund managers to choose stocks or time trades. As a result, they have much lower management fees and transaction costs than actively managed funds.

Index funds are also more tax-efficient than actively managed funds. They generate less taxable income, and because they buy new lots of securities whenever investors put money into the fund, they can choose from a range of lots when selling a particular security, allowing them to sell those with the lowest capital gains and tax bite.

The low costs of index funds can make a big difference to investment returns, especially over the long term. This is why Warren Buffett, one of the most successful investors of all time, has recommended low-cost index funds as the smartest investment most people can make.

However, it is worth noting that the fees of index mutual funds can vary, so it is important to compare costs before investing. While index funds are usually cheaper than actively managed funds, some are cheaper than others.

Hedge Funds: Pooled Investment Vehicles Explained

You may want to see also

They are a passive investment

Index funds are passive investments that track major indexes, making them a low-cost investment option. They are designed to replicate the performance of a specific market index, such as the S&P 500, without active management. This passive management approach offers several benefits to investors.

Firstly, index funds have consistently outperformed actively managed funds in terms of total return over the long term. This is mainly due to their lower management fees. Instead of having a fund manager actively trading and analysing securities, index funds simply duplicate the portfolio of their designated index, which changes infrequently. As a result, index funds have much lower transaction costs, which can make a significant difference in returns over time.

Secondly, index funds offer broad diversification. By investing in an index fund, you gain exposure to a diversified selection of securities in a single investment. For example, an S&P 500 index fund provides ownership in hundreds of companies, reducing the risk associated with owning just a few individual stocks. This diversification smooths out volatility and lowers the overall risk of the investment.

Additionally, index funds have lower fees compared to actively managed funds. The passive nature of index funds eliminates the need for high-fee managers, consultants, and research teams. These cost savings are passed on to investors, resulting in lower expense ratios and higher returns. Warren Buffett, one of the most successful investors of all time, has recommended low-cost index funds as the smartest investment most people can make.

Finally, index funds offer tax advantages. By trading less frequently, index funds generate less taxable income that must be passed on to shareholders. Additionally, they can choose from various lots with different capital gains tax implications when selling a particular security, allowing them to minimise the tax bite.

In summary, index funds are passive investments that offer broad diversification, low fees, and tax advantages. They are an attractive option for investors seeking a low-cost, low-risk way to participate in the overall growth of the economy.

A Beginner's Guide to REIT Funds in India

You may want to see also

They are highly diversified

Index funds are highly diversified, meaning they offer immediate diversification. With one purchase, investors can own a wide range of companies. For example, a share of an S&P 500 index fund provides ownership in hundreds of companies, while a share of a Nasdaq-100 fund offers exposure to about 100 companies. This diversification smooths out volatility and reduces risk.

Index funds are passively managed, meaning they are not actively traded by a fund manager. Instead, they hold investments until the index itself changes, which doesn't happen very often. This passive management leads to lower management fees and transaction costs, which can make a big difference in returns over time.

Index funds are also tax-efficient. They generate less taxable income than other types of funds because they trade less frequently. Additionally, they can choose from hundreds or thousands of lots when selling a particular security, allowing them to sell the lots with the lowest capital gains and the lowest tax bite.

While diversification is generally a good thing, it can also limit the upside. The broad-based basket of stocks in an index fund may be dragged down by some underperformers, and the fund will be vulnerable to any drops in the market. However, the odds that an index fund will lose everything are very low.

Index funds are a good option for investors looking for a low-cost, diversified investment that can provide solid returns over the long term.

Fidelity Funds: Exploring AMD Investment Opportunities

You may want to see also

Frequently asked questions

Index funds are easy to invest in, have low fees, and often perform very well. They are also highly diversified and tax-efficient, making them a good option for beginners.

No, it is generally not advisable to try to time the market. If you are investing for the long term (over 5-10 years), it is better to invest as soon as you are able to rather than waiting for a dip that may or may not happen.

The amount of money you need will depend on the specific fund and your financial situation. Some funds have minimum investment amounts, while others allow you to buy fractional shares with just a few dollars. It is important to do your research and choose a fund that aligns with your investment goals and risk tolerance.

While index funds are generally considered lower risk due to their diversification, they are still subject to market volatility and can lose money. It is important to remember that past performance is not a guarantee of future results and that all investments carry some degree of risk.