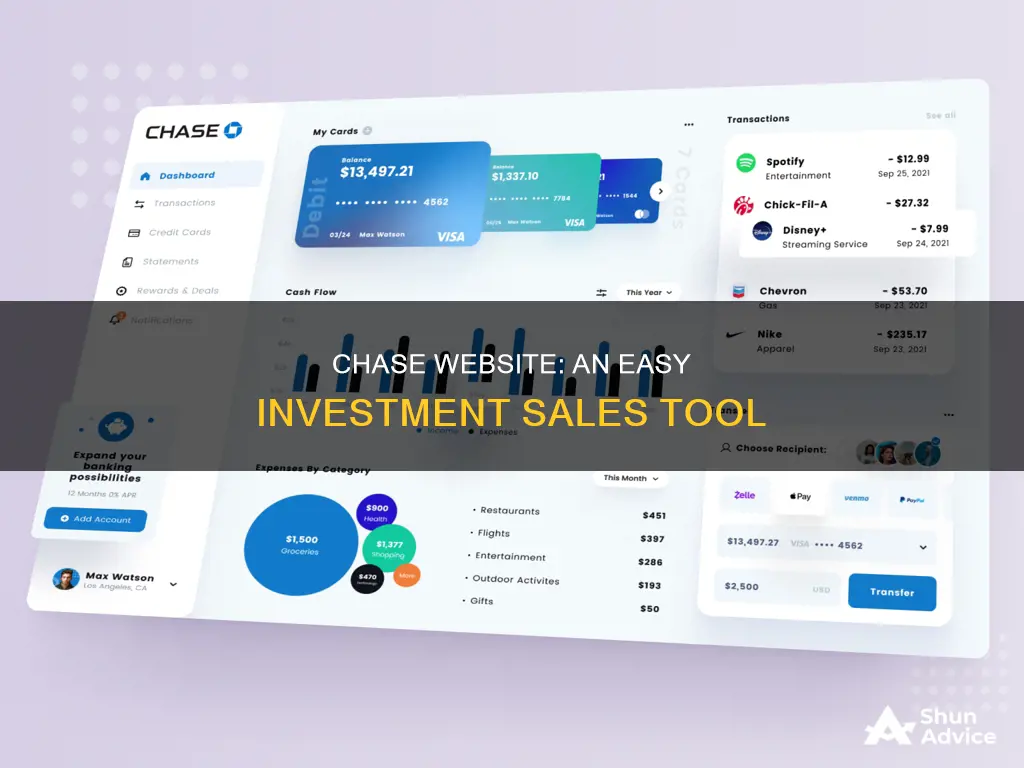

J.P. Morgan Self-Directed Investing is a brokerage account that allows you to trade stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, and fixed-income products online. You can open a J.P. Morgan Self-Directed Investing account with no minimum account balance, and you can start trading with as little as $1. This account provides unlimited commission-free online stock, ETF, and options trades, although options contract and other fees may apply. You can access this account through the Chase website or the Chase Mobile® app.

| Characteristics | Values |

|---|---|

| Account Type | J.P. Morgan Self-Directed Investing |

| Account Features | Trade stocks, bonds, mutual funds, ETFs, options, and fixed-income products online |

| Minimum Account Balance | None |

| Commission Fees | Unlimited commission-free online stock, ETF, and options trades |

| Trading Hours | 6 AM to 2 AM ET |

| Account Value | Current market value of the account in USD |

| Trading Products | Stocks, ETFs, Mutual Funds, Options, Fixed Income |

| Investment Products | S&P 500, Nasdaq 100, ETFs, Stocks, Options, Mutual Funds, Money Market Funds, Treasuries, Fixed Income |

What You'll Learn

How to open a J.P. Morgan Self-Directed Investing account

To open a J.P. Morgan Self-Directed Investing account, you need to be at least 18 years old and have a valid Social Security number and U.S. home address. You will also need a valid driver's license or state-issued ID. You can open a Self-Directed Investing account even if you are not already a Chase bank customer.

There is no minimum account balance to get started, and you can open an account with as little as $1. However, to receive a bonus offer, you will need to open and fund your account with at least $5,000.

You can open a Self-Directed Investing account online or by visiting a Chase branch and speaking with a J.P. Morgan advisor.

Understanding Net Cash Flow: Investing Strategies and Impact

You may want to see also

The benefits of a brokerage account

A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs. There are several benefits to opening a brokerage account:

Wide range of investments

Even if you already have an investment account, a brokerage account is beneficial due to its broad access to investment types and orders.

No contribution limits

There are no annual contribution limits imposed by the IRS or your state on brokerage accounts, unlike other types of investing accounts, including IRAs, 401(k) plans, HSAs, and 529 plans.

No early withdrawal penalties

With a brokerage account, you can withdraw your money at any time without early withdrawal penalties. However, it's important to note that any earnings or gains from selling investments purchased at a lower price will usually be taxed.

No income restrictions

There are no income requirements to open and fund a brokerage account, although some brokerages may require a minimum investment. Additionally, certain types of investments purchased within a brokerage account may have minimum investment requirements.

Potential tax strategies

While brokerage accounts may not offer the same tax advantages as other investment accounts, they still provide opportunities for tax-aware strategies, such as tax-loss harvesting and long-term capital gains tax rates.

Flexibility

The flexibility of brokerage accounts allows you to withdraw funds at any time for short-term goals or larger purchases.

Investment research and tools

Brokerage accounts often provide access to investment research, tools, and strategies to help you make informed investment decisions.

Unlocking Cash Flow Assets: Strategies for Smart Investing

You may want to see also

How to place a trade in your investment account

To place a trade in your investment account, you will need to have opened a J.P. Morgan Self-Directed Investing account. This is a brokerage account that lets you trade stocks, bonds, mutual funds, exchange-traded funds (ETFs), options and fixed-income products online on your own.

There is no minimum account balance to get started, and you can trade with as little as $1. You can also get unlimited commission-free online stock, ETF and options trades.

To place a trade, go to the top menu and choose "Trade", and then select the kind of product you would like to trade: stocks, ETFs, mutual funds, options or fixed income. You can place trades online anytime between 6 am and 2 am ET. Any orders placed outside of normal trading hours (9:30 am-4 pm ET) will be queued for the next trading day.

Finding Investment Balance: Principal as the Key

You may want to see also

How to avoid cash trading violations

When trading in your cash account, it's important to understand the rules to avoid possible violations. Before placing your first trade, you need to decide whether you plan to trade on a cash basis or on margin. A cash account requires you to pay for all purchases in full by the settlement date. For example, if you buy 1,000 shares of stock on Monday for $10,000, you would need to have a $10,000 cash balance available in your account to pay for the trade on the settlement date. According to industry standards, most securities have a settlement date that occurs on the trade date plus one business day (T+1). This means that if you buy a stock on a Monday, the settlement date would be Tuesday.

If you plan to trade strictly on a cash basis, there are three types of potential violations you should aim to avoid: good faith violations, freeriding, and cash liquidations.

A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Only cash or the sales proceeds of fully paid-for securities qualify as "settled funds." Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to the settlement date. If you incur three good faith violations in a 12-month period in a cash account, your brokerage firm will restrict your account. This means you will only be able to buy securities if you have sufficient settled cash in the account before placing a trade. This restriction will be effective for 90 calendar days.

A freeriding violation occurs when you buy securities and then pay for that purchase using the proceeds from a sale of the same securities. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. If you incur one freeriding violation in a 12-month period in a cash account, your brokerage firm will restrict your account. This means you will only be able to buy securities if you have sufficient settled cash in the account before placing a trade. This restriction will be effective for 90 calendar days.

A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on the settlement date. If you incur three cash liquidation violations in a 12-month period in a cash account, your brokerage firm will restrict your account. This means you will only be able to buy securities if you have sufficient settled cash in the account before placing a trade. This restriction will be effective for 90 calendar days.

Investing Cash: Strategies for Smart Money Allocation

You may want to see also

How to access your J.P. Morgan investment and Chase banking accounts

To access your J.P. Morgan investment and Chase banking accounts, you can use the Chase Mobile® app or log in to your accounts on chase.com.

Using the Chase Mobile® App

Download the Chase app for your iPhone or Android.

Using Chase.com

- Go to chase.com.

- Sign in to your account.

Using J.P. Morgan Online

- Go to the J.P. Morgan website.

- Log in to J.P. Morgan Online using your account credentials.

J.P. Morgan Access®

J.P. Morgan Access® is a secure gateway for treasury and investment professionals to access a range of financial transactions and account information, including trust, custody, trade, and cash management services. It offers features such as reporting, transaction services, inquiry and customer service, analytics, and secure email.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Frequently asked questions

In the top menu, choose "Trade" and then select the type of product you want to trade: stocks, ETFs, mutual funds, options, or fixed income.

A brokerage account is a taxable account that allows you to trade securities like stocks, ETFs, mutual funds, bonds, and options. It is separate from savings, checking, IRA, or 401(k) accounts.

You can open a J.P. Morgan Self-Directed Investing account online. You need to be at least 18 years old and have a valid Social Security number and U.S. home address. You may also need to provide a valid driver's license or state-issued ID.