The quick ratio is a financial metric used to determine a company's ability to pay off its short-term debts and meet its short-term financial obligations. It is calculated by dividing a company's most liquid assets (cash, cash equivalents, marketable securities, and accounts receivable) by its current liabilities. This ratio provides insight into a company's liquidity and financial health, indicating whether it is using its assets effectively and accruing manageable levels of debt. A key aspect of the quick ratio is that it does not consider a company's inventory or prepaid expenses as liquid assets, making it a more conservative measure than the current ratio. While a high quick ratio generally indicates positive financial health, a very high ratio may suggest inefficient capital allocation.

What You'll Learn

Quick ratio vs. current ratio

The quick ratio and the current ratio are both used to assess a company's liquidity and financial health. However, there are some key differences between the two.

Quick Ratio

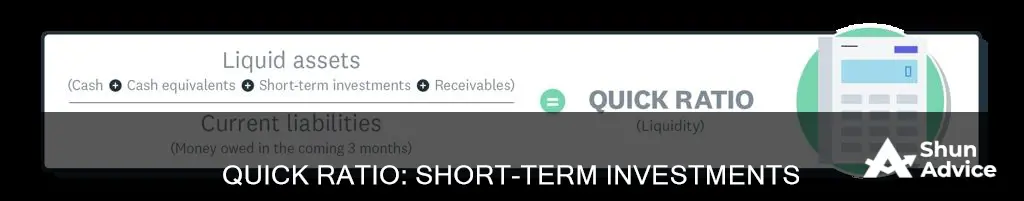

The quick ratio, also known as the acid-test ratio, is a measure of a company's short-term liquidity. It calculates a company's ability to meet its short-term financial obligations using its most liquid assets. These liquid assets include cash and assets that can be converted to cash within a short time, usually 90 days. The quick ratio formula is:

> Quick Ratio = Liquid Assets / Current Liabilities

The quick ratio is considered a conservative measure of liquidity because it excludes inventory and other current assets that are generally more challenging to convert to cash. It focuses on a company's ability to survive a short-term interruption to normal cash flows or a sudden large cash drain.

Current Ratio

The current ratio is another common method to measure business liquidity. Unlike the quick ratio, the current ratio includes all of a company's current assets, even those that may not be as easy to convert into cash, such as inventory. The current ratio formula is:

> Current Ratio = Current Assets / Current Liabilities

The current ratio provides a long-term view of a company's liquidity, considering all assets that can be liquidated and converted into cash within a year. It is often easier to calculate the current ratio as the current assets and current liabilities amounts are typically broken out on external financial statements.

The main difference between the quick ratio and the current ratio is the time frame considered and the definition of current assets. The quick ratio is a more conservative measure as it includes only the most liquid current assets and has a shorter time frame of about three months. On the other hand, the current ratio includes all current assets and offers a longer-term view of a year or more.

The ideal quick ratio is 1:1 or greater, indicating that a company's assets and liabilities are evenly matched. In contrast, the ideal current ratio is 2:1 or greater, suggesting that a company can easily pay off its liabilities without liquidity issues.

While the quick ratio may be more suitable for assessing short-term liquidity and analysing a company over a shorter time frame, the current ratio provides a more comprehensive view of a company's financial health over the subsequent year. Therefore, it is recommended to use both ratios in conjunction to gain a more complete picture of a company's liquidity position.

Investing Cash: How Much and When?

You may want to see also

Quick ratio formula

The quick ratio is a financial metric used to determine a company's ability to pay off its current debts and meet its short-term obligations. It is also referred to as the "acid-test ratio" because it is a quick test of a company's financial health and strength.

The quick ratio formula is:

> Quick Ratio = Quick Assets / Current Liabilities

Quick assets are a company's most liquid assets, which can be easily converted into cash. They include cash, cash equivalents, marketable securities, and accounts receivable.

Current liabilities are a company's short-term debts or obligations that are due within a year.

There are a few different ways to calculate the quick ratio, depending on the specific types of current assets and liabilities a company has. The most common approach is to add up all the quick assets and divide them by the total current liabilities.

> Quick Ratio = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

For instance, if a company has the following:

- Cash and cash equivalents: $20 million

- Marketable securities: $15 million

- Accounts receivable: $25 million

- Current liabilities: $40 million

The calculation would be as follows:

> Quick Ratio = ($20 million + $15 million + $25 million) / $40 million = 1.625

This means the company has $1.625 in quick assets for every $1 of current liabilities, indicating a strong ability to meet its short-term obligations.

It is important to note that the quick ratio is a conservative measure of liquidity as it excludes inventory and prepaid expenses, which may be more difficult to convert into cash quickly.

The quick ratio provides a snapshot of a company's financial health and is often used by accountants, investors, and lenders to assess a company's ability to manage its short-term debts and overall financial stability.

Cashing in on Treasury Investment Growth: Receipt Redemption Guide

You may want to see also

Quick ratio analysis

The quick ratio is calculated by dividing a company's liquid assets by its current liabilities. Liquid assets, or "quick assets", are those that are cash or close to cash, such as cash and savings, marketable securities, and accounts receivable. Current liabilities include accounts payable, employee wages, taxes, and payments towards long-term debts.

The quick ratio is considered a conservative measure of liquidity because it excludes the value of inventory and focuses on a company's ability to pay short-term obligations with its most liquid assets. A positive quick ratio indicates that a company is more likely to survive emergencies or other events that create temporary cash flow problems.

Lenders and investors use the quick ratio to decide whether to provide a loan or investment to a business. A quick ratio of 1 or above indicates that a company has enough liquid assets to meet its short-term obligations. However, an extremely high quick ratio may indicate that a company is sitting on a large surplus of cash that could be better invested elsewhere.

The quick ratio is an important tool for business managers, investors, and lenders to assess a company's financial health and resilience. It is one of several liquidity measures that can be used in conjunction with other metrics such as the current ratio and the cash ratio to gain a comprehensive understanding of a company's financial position.

Cashing Out Your SoFi Investment: A Step-by-Step Guide

You may want to see also

Quick ratio limitations

The quick ratio is a financial metric used to determine a company's ability to pay off its current debts. While it is a useful tool, it does have some limitations.

Firstly, the quick ratio assumes that a company will meet its obligations using its quick or liquid assets, such as cash, cash equivalents, and marketable securities. However, companies typically aim to meet their obligations from operating cash flow rather than using their assets. As such, the quick ratio does not reflect a company's ability to meet obligations from its operating cash flows; it only measures the company's ability to survive a short-term cash crunch.

Secondly, the quick ratio does not consider other factors that affect a company's liquidity, such as payment terms, negotiation strength, and current credit facilities. As a result, it does not provide a complete picture of a company's liquidity. For a more comprehensive understanding of a company's financial health, it is recommended to use the quick ratio in conjunction with other metrics, such as the current ratio and the cash ratio.

Thirdly, the quick ratio ignores supplier and customer credit terms, which can give a misleading impression of asset liquidity. It also does not take into account the time frame of payments. For example, some accounts receivable included in current assets may become bad debts that will never be recovered, or they may be recovered after a longer period, negatively impacting the company's liquidity.

Additionally, the quick ratio is not suitable for comparing companies across different industries. It is only useful as a metric for comparison between similar companies.

Lastly, the quick ratio does not consider a company's future cash flow capabilities and long-term liabilities. It is important to note that a company with a high quick ratio today may not be selling a profitable product and may struggle to maintain its cash balance in the future.

Smart Ways to Invest Your Extra Cash

You may want to see also

Quick ratio in practice

The quick ratio is a financial metric that assesses a company's ability to pay off its current debts and meet short-term obligations. It is calculated by dividing a company's liquid assets (cash, cash equivalents, marketable securities, and accounts receivable) by its current liabilities. This ratio provides insight into a company's financial health and liquidity position, indicating whether it can easily convert short-term assets into cash.

In practice, the quick ratio is used by investors, suppliers, and lenders to evaluate a company's financial stability and competence. A well-defined liquidity ratio, or a ratio greater than 1, signals that a company has sufficient cash to meet its short-term liabilities and is less likely to struggle financially. This can lead to sustainable growth and make the company more attractive to investors.

For example, consider two companies, A and B, with different balance sheets. Company A has current assets of $165,000, consisting entirely of quick assets, and current liabilities of $137,500. Its quick ratio is 1.2, indicating a strong financial position. On the other hand, Company B has current assets of $25,000, including inventory and prepaid expenses, and current liabilities of $37,500. Its quick ratio is 0.67, suggesting that it may not be in a favourable position to receive funding for short-term obligations.

The quick ratio is also useful for businesses themselves to assess their financial health and make informed decisions. For instance, if a company's quick ratio is below the industry average, it can take steps to improve it, such as cutting operating expenses or refinancing short-term loans with longer-term debt. Conversely, if the quick ratio is significantly above average, the company may consider investing excess cash in business expansion or acquiring new assets.

While the quick ratio is a valuable tool, it has some limitations. It assumes that a company will meet its obligations using its quick assets, which may not always be the case as companies typically aim to meet obligations from operating cash flow. Additionally, the quick ratio does not consider other factors affecting liquidity, such as payment terms and existing credit facilities. Therefore, it should be used in conjunction with other metrics like the current ratio and cash ratio to gain a comprehensive understanding of a company's financial health.

Derivatives in Investment Banking: A Common Practice?

You may want to see also

Frequently asked questions

The quick ratio is a financial metric used to determine a company's ability to pay off its current debts and meet short-term financial obligations. It measures a company's short-term liquidity against its short-term obligations.

The quick ratio is calculated by dividing a company's liquid assets (cash, marketable securities, and accounts receivable) by its current liabilities. It assesses whether a company's liquid assets outnumber its liabilities.

The quick ratio focuses on highly liquid assets and is considered more conservative than the current ratio. It excludes inventory and prepaid expenses, which may be more difficult to convert into cash. The current ratio includes all current assets, even those that may not be as easily converted to cash.