The Internal Rate of Return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. IRR is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. IRR is ideal for analyzing capital budgeting projects to understand and compare potential rates of annual return over time.

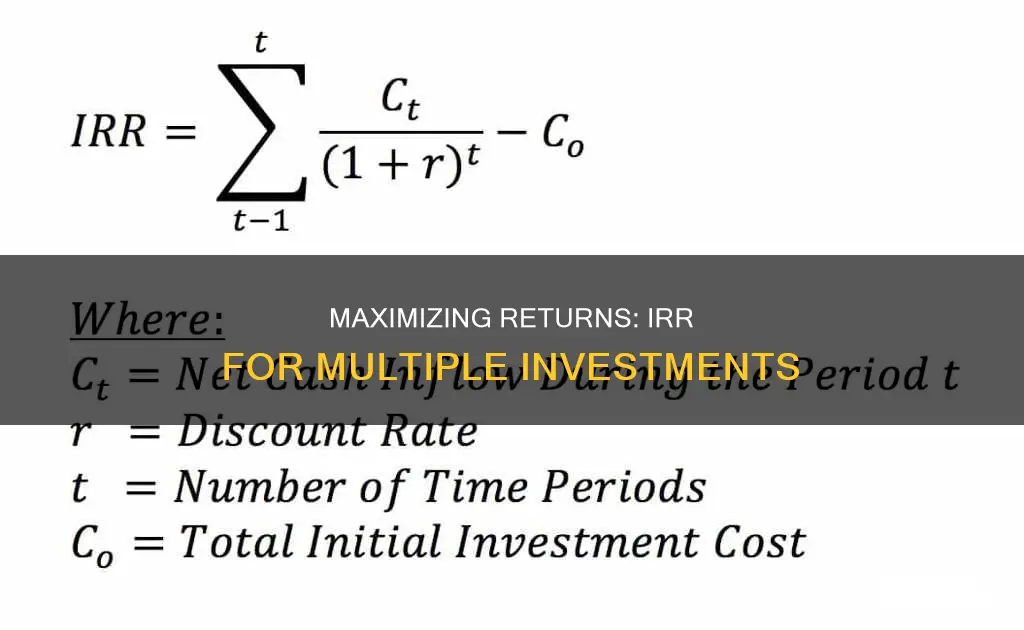

The formula for calculating IRR is:

Net cash inflow during period t

Total initial investment costs

The internal rate of return

The number of time periods

In reality, a firm will undertake several projects simultaneously, and it has to figure out how to budget its capital among them. This issue of concurrent projects is especially prevalent in private equity or venture capital funds that provide capital to several portfolio companies at any given time.

While you can compute separate IRRs for each of these projects, pooled internal rate of return (PIRR) will paint a more cohesive picture while taking into account all of the projects at the same time. PIRR is a method of calculating the overall IRR of a portfolio that consists of several projects by combining their individual cash flows.

| Characteristics | Values |

|---|---|

| Definition | IRR is a metric used in financial analysis to estimate the profitability of potential investments. |

| Formula | IRR = NPV = t=1∑T(1+r)tCt − C0 |

| Use | IRR is used to determine the rate of discount which makes the present value of the sum of annual nominal cash inflows equal to the initial net cash outlay for the investment. |

| Comparison | IRR is used to compare the profitability of different investment options. |

| Limitations | IRR does not account for changing discount rates and is not adequate for longer-term projects with discount rates that are expected to vary. |

| Advantages | IRR is uniform for investments of varying types and can be used to rank multiple prospective investments or projects on a relatively even basis. |

| Disadvantages | IRR does not give the return on the initial investment in terms of real dollars. |

| Alternatives | The modified internal rate of return (MIRR) can be used to arrive at a more accurate measure. |

| Software | IRR can be calculated using software such as Excel. |

What You'll Learn

Using IRR to compare multiple investments

The Internal Rate of Return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. IRR is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.

The IRR is calculated using the same formula as NPV, but it sets the NPV at zero. The formula for IRR is:

$$\displaystyle 0 = \text{NPV} = \sum_{t=1}^{T} \frac{C_t}{(1+IRR)^t} - C_0$$

Where:

- IRR =$ Internal Rate of Return

- NPV =$ Net Present Value

- C_t =$ Net cash inflow during period $t$

- C_0 =$ Total initial investment costs

- T =$ The number of time periods

IRR is a useful tool for comparing multiple investments and projects. It is uniform for investments of varying types, so it can be used to rank multiple prospective investments or projects on a relatively even basis. Generally, when comparing investment options with similar characteristics, the investment with the highest IRR is considered the best.

For example, a company is reviewing two projects with the following cash flow patterns:

- Project A: Initial Outlay = $5,000

- Project B: Initial Outlay = $2,000

The company's cost of capital is 10%. To determine which project to pursue, the company calculates the IRR for each project using the following equation:

$$\displaystyle 0 = (initial\ outlay \times -1) + \frac{CF1}{(1+IRR)^1} + \frac{CF2}{(1+IRR)^2} + ... + \frac{CFX}{(1+IRR)^X}$$

The IRR for Project A is 16.61%, and the IRR for Project B is 5.23%. Given that the company's cost of capital is 10%, management should proceed with Project A and reject Project B.

In addition to comparing projects within a company, IRR can also be used to compare investment options across different companies or industries. For example, an investor can use IRR to compare the potential return of investing in a new startup versus purchasing an established business.

However, it's important to note that IRR has some limitations. It does not account for changing discount rates, so it may not be suitable for longer-term projects with varying discount rates. Additionally, IRR does not consider the actual dollar value of the project or any anomalies in cash flows. It assumes that reinvestments are made at the same internal rate of return, which may not always be accurate.

Investments That Provide Regular Cash Flow

You may want to see also

How to calculate IRR

The Internal Rate of Return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. It is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.

The IRR is calculated using the same formula as NPV, but it sets the NPV equal to zero. The formula for IRR is as follows:

$$\text{0}=\text{NPV}=\sum_{t=1}^{T}\frac{C_t}{\left(1+IRR\right)^t}-C_0$$

Where:

- $C_t$ = Net cash inflow during period $t$

- $C_0$ = Total initial investment costs

- IRR = The internal rate of return

- $t$ = The number of time periods

To calculate the IRR manually, the following steps can be taken:

- Set NPV equal to zero and solve for the discount rate, which is the IRR.

- Note that the initial investment is always negative because it represents an outflow.

- Each subsequent cash flow could be positive or negative, depending on the estimates of what the project delivers or requires as a capital injection in the future.

- Due to the nature of the formula, IRR cannot be easily calculated analytically and instead must be calculated iteratively through trial and error or by using software such as Excel.

Using Excel makes calculating the IRR easy. The steps are as follows:

- Enter Cash Flows: List all the cash flows associated with the investment or project in an Excel spreadsheet. These cash flows can be both positive (inflows) and negative (outflows).

- Arrange Cash Flows: Organize the cash flows in chronological order, with the initial investment (usually a negative value) at the beginning and subsequent cash flows listed in the order they occur.

- Use IRR Function: In a cell where you want the IRR value to appear, use the IRR function. The syntax for the IRR function is: =IRR(values). The "values" are the range of cells containing the cash flows, including the initial investment.

For example, if your cash flows are in cells A1 through A5, where A1 represents the initial investment and A2 through A5 represent subsequent cash flows, you would input the following formula in a cell where you want the IRR displayed: =IRR(A1:A5)

It is important to note that IRR is not the actual dollar value of the project. It is the annual return that makes the NPV equal to zero. The higher the IRR, the more desirable an investment is to undertake. IRR is uniform for investments of varying types and can be used to rank multiple prospective investments or projects on a relatively even basis.

Pooled Internal Rate of Return (PIRR)

When dealing with multiple investments, the Pooled Internal Rate of Return (PIRR) can be used to calculate the overall IRR of a portfolio consisting of several projects by combining their individual cash flows. The PIRR formula is as follows:

$$\begin{aligned}

&IRR\ =\ NPV\ =\ \sum^T_{t=1}\frac{C_t}{(1+r)^t}\ -\ C_0\ =\ 0\\

&\textbf{where:}\\

&IRR\ =\ \text{internal rate of return}\\

&NPV\ =\ \text{net present value}\\

&C_t\ =\ \text{the pooled cash flows expected at time }t\\

&r\ =\ \text{the risk-free rate of return}

\end{aligned}$$

The PIRR can provide a more cohesive picture of the overall performance of an entity running multiple projects or a portfolio of funds, compared to analysing each project separately.

Fidelity Investments: Are They Right for Your SMB?

You may want to see also

The limitations of IRR

The Internal Rate of Return (IRR) is a popular method for evaluating the profitability of investments. However, it has several limitations that must be considered:

- Not considering the size of the investment: IRR does not take into account the size of the investment. A smaller investment with a lower IRR may still result in a higher return on investment (ROI) than a larger investment with a higher IRR.

- Assuming reinvestment at the same rate: IRR assumes that all cash flows generated by the investment are reinvested at the same rate, which may not be realistic. This assumption can lead to an overestimation or underestimation of the actual return.

- Not accounting for the timing of cash flows: IRR assumes that all cash flows occur at the midpoint of the investment period. If cash flows occur earlier or later than expected, the IRR may not accurately reflect the actual return.

- Ignoring the risk of the investment: IRR does not take into account the risk associated with the investment. Two investments with the same IRR may have different levels of risk.

- Not accounting for inflation: IRR does not consider the impact of inflation on the actual return on investment.

- Multiple IRRs: In complex projects with non-conventional cash flows, there can be multiple IRRs, making it challenging to interpret the results accurately.

- Ignoring the scale of investments: IRR focuses on the percentage return and does not consider the absolute value of cash flows. A project with a high IRR but a substantial initial investment may not be as attractive as a project with a lower IRR and a lower capital requirement.

- Sensitivity to assumptions: IRR relies on certain assumptions, such as cash flow projections and discount rates. If these assumptions are incorrect or change over time, the IRR calculation may no longer be accurate.

While IRR is a valuable tool for evaluating investments, it is important to be aware of its limitations. Investors should consider using additional metrics, such as Net Present Value (NPV) and Return on Investment (ROI), and conduct sensitivity analysis to make more informed investment decisions.

Computing Net Proceeds: Investing Cash Flow Explained

You may want to see also

When to use MIRR instead of IRR

The Modified Internal Rate of Return (MIRR) is a variation of the traditional Internal Rate of Return (IRR) calculation. MIRR is considered to be more realistic and accurate than IRR, especially for investments with multiple cash flows. MIRR is also more conservative, while IRR can sometimes overinflate potential investment returns. Here are some scenarios where MIRR is a more suitable metric than IRR:

- When you want a more accurate reflection of an investment's profitability: MIRR provides a more realistic assessment of the time value of cash flows. It recognises that cash awaiting investment and cash distributed by the investment may have different rates of return than the return generated while in the investment.

- When you want to consider the realistic reinvestment of cash flows and the cost of financing: MIRR allows for adjusting the assumed rate of reinvested growth for different stages of a project. It assumes that positive cash flows are reinvested at the firm's cost of capital and that the initial outlays are financed at the firm's financing cost.

- When you are dealing with unconventional cash flows: MIRR is more suitable when cash flows are unconventional, incorporating a mix of positive and negative values. It is also a more prudent choice when a project's cash flows are significant and are reinvested at a rate different from the cost of capital.

- When you want to avoid overstating the potential profitability of a project: IRR tends to overstate the potential profitability of a project, which can lead to capital budgeting mistakes. MIRR compensates for this flaw and gives a more conservative estimate.

- When you are dealing with long-term projects: MIRR is particularly valuable when evaluating long-term projects, as it takes into account both financing and reinvestment considerations, providing a more reliable measure of a project's long-term profitability.

- When you want to avoid the issue of multiple IRRs: MIRR is designed to generate one solution, eliminating the issue of multiple IRRs, which can cause uncertainty and confusion.

- When you want to consider the impact of inflation: MIRR incorporates external costs like inflation due to the incorporation of the cost of capital.

- When you want a single, easily analysable result: MIRR will always return a single result, regardless of the sequence and direction of cash flows. In contrast, IRR may be harder to analyse when reporting multiple valid calculations for an irregular set of cash flows.

Cash App's Investing Tile: What's the Deal?

You may want to see also

When to use XIRR instead of IRR

XIRR (Extended Internal Rate of Return) and IRR (Internal Rate of Return) are both financial metrics used to determine the profitability of an investment. However, there are some key differences between the two.

The IRR is a metric used in financial analysis to estimate the profitability of potential investments. It is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. IRR is ideal for comparing investments with different holding periods or cash flow patterns.

The XIRR, on the other hand, is used to measure the profitability of investments with irregular cash flows. It is a more accurate measure when cash flows are not evenly spaced over time. It allows for the entry of different cash flow dates and the interpolation of the internal rate of return.

When to use XIRR:

- Use XIRR when dealing with irregular cash flows, such as real estate investments with variable rental incomes.

- Use XIRR when you need to consider specific transaction dates to get an accurate return rate, such as with a portfolio of stocks bought and sold at different times.

- Use XIRR when cash flows are not all at the same time period. For example, when there is an initial investment upfront that is not on December 31.

When to use IRR:

- Use IRR when dealing with regular cash flows, such as bonds, annuities, or other investments with consistent, periodic payments.

- Use IRR when the project or investment has conventional cash flows at set intervals.

It is important to note that both IRR and XIRR can be easily calculated in Excel, and it is recommended to run the numbers for each to better forecast and make informed investment decisions.

Cash Reserves Investments: A Safe Haven for Your Money

You may want to see also

Frequently asked questions

IRR, or Internal Rate of Return, is a metric used in financial analysis to estimate the profitability of potential investments. It is a discount rate that makes the Net Present Value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.

IRR calculations rely on the same formula as NPV, but with IRR, the NPV is set to zero. The formula for IRR is:

Net cash inflow during period t

Total initial investment costs

The internal rate of return

The number of time periods

ROI, or Return on Investment, tells an investor about the total growth of an investment, whereas IRR provides the annual growth rate. While the two numbers would be the same over a one-year period, they will differ for longer periods.

To use IRR with multiple investments, you need to calculate the overall IRR of the portfolio by combining the individual cash flows of each investment. This involves knowing both the cash flows received and the timing of those cash flows.

Pooled Internal Rate of Return (PIRR) is a method of calculating the overall IRR of a portfolio consisting of several projects. It provides a more cohesive picture by taking into account all the projects simultaneously.