When it comes to splitting retirement investments, there are a few key considerations to keep in mind. Firstly, it's important to start saving for retirement as early as possible to take advantage of compound interest and give your investments time to grow. The amount you should aim to save for retirement can vary depending on your age and income, but a common benchmark is to have saved up 11 times your ending salary by the time you retire. This can be achieved by setting aside 15% of your annual income, including any employer contributions.

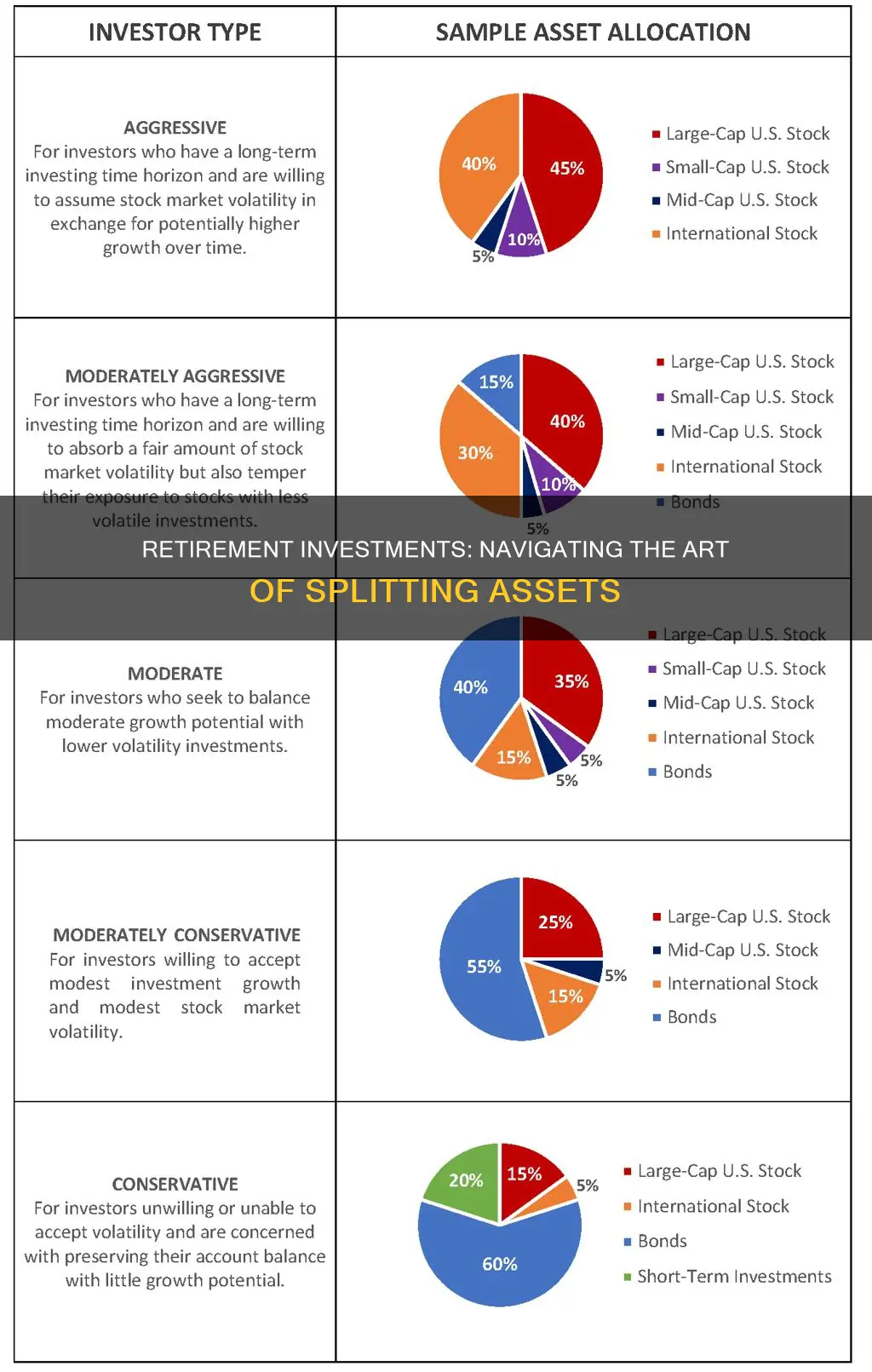

Another important factor to consider is your risk tolerance and the types of assets you invest in. Stocks, for example, tend to be more volatile but offer higher growth potential, while bonds and cash investments are generally considered lower-risk but may provide lower returns. As you get closer to retirement, it's generally recommended to adjust your asset allocation to more conservative investments to preserve your capital.

Additionally, it's crucial to diversify your retirement investments across different asset classes, such as stocks, bonds, and cash, to minimise risk. This diversification can provide a buffer against losses in any one asset class and help you sleep better at night.

Finally, when it comes to splitting retirement investments in a divorce, it's important to follow the rules and regulations to avoid financial penalties. Retirement accounts are often considered marital property and can be divided between spouses, but the specific laws vary by state and type of retirement account.

| Characteristics | Values |

|---|---|

| Age | The older you are, the less investment risk you can afford to take. |

| Investment timeline | If the timeline is short, market corrections are emotionally and financially problematic. |

| Risk tolerance | Risk tolerance varies from person to person. |

| Innate risk tolerance | Your innate risk tolerance is just as important as your age. |

| Stock market conditions | Don't let stock market conditions dictate your allocation strategy. |

| Diversification | Diversify across stocks, bonds, and cash, and within these asset classes. |

| Target-date funds | Target-date funds manage asset allocation for you. |

| Retirement timeline | The right asset mix should balance your retirement timeline and your comfort with risk. |

| Comfort with risk | Choose a level of risk you know you can live with. |

| Returns | Less-risky investments generally earn a low rate of return, and higher-risk investments generally earn a higher rate of return. |

| Aggressive portfolio | An aggressive portfolio is subject to a relatively high level of investment risk and can expect higher returns. |

| Conservative portfolio | A conservative portfolio is relatively safe from investment risk and can expect lower returns. |

What You'll Learn

Stocks, bonds, and cash

Stocks

Hold 20 or more individual stocks or invest in mutual funds or exchange-traded funds (ETFs). You can diversify your stock holdings by individual company and market sector. Utility companies, consumer staples, and healthcare companies tend to be more stable, while the technology and financial sectors are more reactive to economic cycles. Mutual funds and ETFs are already diversified, which makes them an attractive option when you are working with small dollar amounts.

Bonds

Diversify your bond holdings by investing in bond funds. Or, vary your holdings across bond maturities, sectors, and types. The different types of bonds available are primarily municipal, corporate, and government bonds.

Cash

Cash doesn't lose value like stocks or bonds, so diversifying your cash holdings doesn't need to be a priority. If you have a large amount of cash, you might hold it in separate banks so that all of it is FDIC-insured. For most people, it's more realistic to diversify how you hold your cash to maximize your liquidity and interest earnings. For example, you could hold some cash in a liquid savings account and the rest in a less liquid certificate of deposit (CD) with a higher interest rate than a typical savings account.

Adjusting Your Asset Allocation Over Time

Your asset allocation should change as you get older. When you're younger than 50 and saving for retirement, you can consider investing heavily in stocks since you have plenty of time to ride out any market turbulence. As you reach your 50s, consider allocating 60% of your portfolio to stocks and 40% to bonds, adjusting those numbers according to your risk tolerance. Once you're retired, you may prefer a more conservative allocation of 50% in stocks and 50% in bonds, again modifying this ratio based on your risk tolerance.

Other Considerations

In addition to stocks, bonds, and cash, there are other types of investments to consider for your retirement portfolio. These include real estate, private growth companies, and annuities.

WeFunder Investments: When Do Backers Get Paid?

You may want to see also

Risk tolerance

Factors Affecting Risk Tolerance

Several factors can influence an individual's risk tolerance, including age, financial circumstances, investment goals, and personal characteristics. Younger investors are generally considered to have a higher risk tolerance due to their longer investment horizon, allowing them to recover from potential losses over time. Additionally, individuals with a higher net worth and more liquid capital may have a greater risk tolerance as they can afford to take on more risk without significantly impacting their financial stability.

Your financial circumstances also play a role in determining your risk tolerance. If you anticipate significant income growth in the coming years, you may be more inclined to take on more risk. On the other hand, if you have concerns about the stock market or prefer a more stable investment approach, you might opt for lower-risk options like bonds, precious metals, or slow-growth companies.

Assessing Your Risk Tolerance

To assess your risk tolerance, it's essential to consider your investment goals, time horizon, and comfort with risk. Ask yourself questions such as how much risk you are willing to take, your anxiety level about losing money in the stock market, and your planned retirement age. These questions can help you understand your tolerance for risk and guide your investment decisions.

Investment Options Based on Risk Tolerance

Once you have assessed your risk tolerance, you can choose investment options that align with your comfort level. Individuals with a high risk tolerance may opt for lesser-proven stocks or other investments with the potential for significant gains but also carry a higher risk of loss. On the other hand, those with a low risk tolerance may prefer more conservative investments, such as blue-chip stocks, consumer goods stocks, utilities, and bonds, which typically generate moderate gains with a lower risk of substantial losses.

Diversification and Risk Management

It's important to remember that diversification is a key aspect of risk management in investing. Diversifying your portfolio across various asset classes and risk levels can help reduce the impact of market downturns and protect your savings. Even within a high-risk portfolio, spreading your investments across different assets can decrease your overall exposure to risk.

Adjusting Risk Tolerance Over Time

It's worth noting that your risk tolerance may change over time as your financial situation, goals, and market conditions evolve. Younger investors might start with a higher risk tolerance, taking advantage of the power of compounding over several decades. However, as they approach retirement, they may gradually shift towards more conservative investment options to preserve their capital and generate stable income.

Retirement Investments: Assessing Your Success

You may want to see also

Time until retirement

The time until your retirement is a major factor in determining how to split your investments. The closer you are to retirement, the less time you have to recover from any losses, but the more money you may have to invest.

If you are in your 20s, you should begin investing, even if it is a small amount. You can take advantage of compound interest, and you have the time to ride out any market volatility. A common strategy is to invest 80% in stock funds and 20% in bond funds.

In your 30s, it is crucial to make a habit of putting money away. You can still benefit from compound interest, and investing 10% to 15% of your income can be beneficial. If you can only save a little, make sure to contribute enough to get any company match on a 401(k).

In your 40s, you need to get serious about your retirement funds. By this stage, you should commit to saving 15% of your annual income and continue to max out contributions to your 401(k) and IRA. You may also want to consider reducing or avoiding debt to have more money to save. You can choose aggressive assets like stock funds to give your funds the best chance to grow, but be careful to stick with investments that have a track record of producing returns.

In your 50s, you may want to switch some of your investments from more aggressive stocks to more stable, low-earning funds like bonds and money markets. The IRS allows those approaching retirement to put more of their income into investment accounts. For 2024, workers aged 50 and older can contribute an additional $7,500 per year to a 401(k) and $8,000 to a traditional or Roth IRA.

In your 60s, retirees commonly shift their focus from growth to income and stocks that provide dividend income or fixed-income bonds. When retirees turn 73 (for those born between 1951 and 1959) or 75 (for those born in 1960 or later), they will need to start taking required minimum distributions (RMDs) from their retirement accounts. A Roth IRA doesn't require RMDs and can continue to grow.

In general, the older you are, the less investment risk you can afford to take. As you get closer to retirement, your risk tolerance decreases, and you can't afford any wild swings in the stock market.

Amazon: A Worthy Investment

You may want to see also

Emergency funds

The amount you should save for your emergency fund depends on your personal situation, such as your income, expenses, and lifestyle. A common recommendation is to save three to six months' worth of living expenses during your working years. This can be adjusted based on your household income—for dual-income households, three months' worth of expenses might be sufficient, while single-income households may want to aim for six months.

As you approach retirement, some advisors suggest increasing your emergency fund to cover 12 to 18 months of expenses, or even three to four years' worth in case of significant financial emergencies. This is because, during retirement, your income will likely decrease, and unexpected expenses could put a strain on your finances.

Where to Invest Your Emergency Funds

When investing your emergency fund, look for options that are low-risk, easily accessible, and offer a reasonable rate of return. Here are some options to consider:

- Savings Accounts: These are generally considered low-risk and offer FDIC insurance up to $250,000 per account. However, the interest rates are typically low and may not keep up with inflation.

- High-Yield Savings Accounts: These online savings accounts offer higher interest rates than traditional savings accounts but may have higher minimum balance requirements and transaction limits.

- Certificates of Deposit (CDs) and CD Ladders: CDs offer higher interest rates and FDIC insurance but require locking up your money for a set period. CD Ladders invest in CDs with varying maturity dates to balance liquidity and higher interest rates.

- Money Market Mutual Funds: These are a higher-yield alternative to high-yield savings accounts, offering higher interest rates and extreme liquidity. However, they may require higher minimum balances and do not offer FDIC insurance.

- Treasury Bills and Bonds: Backed by the US government, these are considered one of the safest investments. They provide a reliable source of income and a predictable cash flow. You can create a laddered portfolio with varying maturity dates to ensure a steady stream of income and accessibility.

- Short-Term Bond Funds and Short-Term Municipal Bond Funds: These provide a higher rate of return than traditional savings or money market accounts while being relatively low-risk. They invest in short-term debt securities, offering a balance between risk and reward. However, they are not FDIC-insured and may fluctuate in value.

C-Corp: Why Investors Choose This Structure

You may want to see also

Tax diversification

Tax-advantaged investment accounts

Retirement accounts such as 401(k)s, 403(b)s, and traditional IRAs are considered tax-advantaged investment accounts. They are funded with pre-tax or tax-deductible money and have defined contribution limits. Earnings are tax-deferred, and withdrawals are taxed as ordinary income when you withdraw them in retirement. Withdrawals made before age 59½ may face an additional 10% penalty tax.

Fully taxable investment accounts

A traditional brokerage account is fully taxable and is funded with after-tax money. You pay taxes on yearly dividends and interest earnings, as well as capital gains when you make a profit by selling stock. The tax amount depends on your tax bracket, how long you held an investment, and whether dividends are qualified or non-qualified. You may be able to deduct investment losses through tax-loss harvesting.

Tax-free investment accounts

Roth IRAs, Roth 401(k)s, municipal bonds, 529 savings plans, and health savings accounts (HSAs) are considered tax-free investment accounts. Most are funded with after-tax money. Earnings are generally tax-deferred, and withdrawals are tax-free if certain conditions are met. For example, Roth IRA or Roth 401(k) earnings are generally tax-free if distributions are taken after age 59½ and the accounts are at least five years old. Municipal bonds are generally tax-exempt at the federal and state level. HSA and 529 withdrawals are only tax-free if the money is used for qualified medical or education expenses, respectively.

- Create different tax 'buckets' for retirement: Putting some of your savings into tax-advantaged and some into tax-free accounts can provide an even bigger benefit. When you reach age 59½, consider withdrawing just enough from your tax-advantaged accounts to keep you in a lower tax bracket, and then tap your tax-free accounts for any remaining needs.

- Anticipate your tax bracket later in life: If you're earlier in your working life and expect your income to increase, you may want to prioritise Roth accounts. Your contributions will be taxed at the lower rate you're paying today, but you'll be able to access that money tax-free when you retire. If you've already reached your peak earning years, you may want to shift toward traditional accounts that allow you to make pre-tax contributions.

- Make sure you have liquidity for short-term needs: Fully taxable investments, including interest-bearing bank accounts and brokerage accounts, can be valuable as they can be tapped at any time without penalty.

Should I Liquidate My Investments to Pay Off Debt?

You may want to see also

Frequently asked questions

If you're in your 20s, you can consider investing heavily in stocks as you have plenty of time until retirement and can ride out any market turbulence. You can also take advantage of compound interest by investing early.

In your 40s, you should get serious about your retirement funds and commit to saving 15% of your annual income. You can also consider investing in aggressive assets like stock funds to give your funds the best chance to grow.

In your 60s, you may want to shift your focus from growth to income and stocks that provide dividend income or fixed-income bonds. You will also need to start taking required minimum distributions (RMDs) from your retirement accounts.