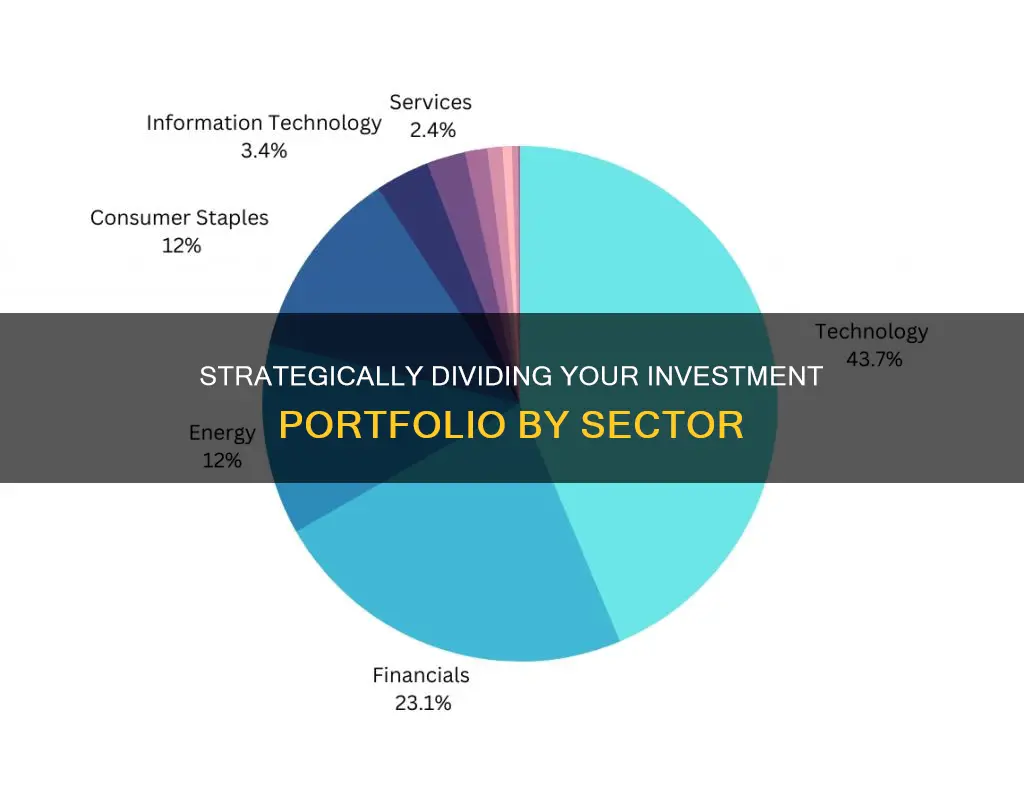

Diversifying your investment portfolio is a crucial step in ensuring the safety of your money. The old saying don't put all your eggs in one basket rings true when it comes to investing. By diversifying your portfolio across different sectors, you reduce the risk of losing all your money if one sector takes a dive. For example, if you had all your money invested in technology stocks and the tech sector suddenly crashed, you would lose everything.

There are many ways to diversify your portfolio, including investing in a variety of asset classes such as stocks, bonds, real estate, commodities, and exchange-traded funds (ETFs). It is also important to invest in companies from various industries, countries, and risk profiles. This ensures that your portfolio is not overly exposed to the performance of one particular sector or industry.

Additionally, investors should consider their risk tolerance and growth goals when deciding how to split their investment portfolio by sector. Younger investors may be more comfortable with a higher-risk portfolio that focuses on aggressive growth, while those closer to retirement may prefer a more conservative approach with fixed-income securities and lower risk.

By diversifying your investment portfolio across different sectors and asset classes, you can rest easy knowing that your money is safe and has the potential to grow over time.

| Characteristics | Values |

|---|---|

| Number of investments | At least 25 different companies |

| Variety of industries | Tech, energy, healthcare, and more |

| Variety of stocks | Large-cap, small-cap, dividend, growth, and value |

| Non-correlated investments | Bonds, bank CDs, gold, cryptocurrencies, and real estate |

| Risk tolerance | Depends on your goals and risk appetite |

| Aggressiveness | Depends on your goals and risk appetite |

| Growth potential | Depends on your goals and risk appetite |

| Fixed-income securities | 55-60% for a moderately conservative portfolio, 35-40% for a moderately aggressive portfolio, 20-25% for an aggressive portfolio |

| Cash and equivalents | 5-10% for all portfolios |

What You'll Learn

- Diversification: Spread your investments across multiple sectors to reduce risk

- Asset Allocation: Divide investments between stocks, bonds, cash, and other assets

- Risk Management: Choose investments with varying risk levels to balance potential returns and losses

- Regular Check-ups: Review your portfolio annually or after significant financial changes

- Rebalancing: Periodically adjust your portfolio to maintain your desired risk level

Diversification: Spread your investments across multiple sectors to reduce risk

Diversification is a crucial aspect of investment, often summarised as "don't put all your eggs in one basket". By spreading your investments across multiple sectors, you can reduce the risk of permanent capital loss and lower the volatility of your portfolio.

A diversified portfolio should include a variety of asset classes, such as stocks, bonds, real estate, commodities, and cash. It should also span different industries, countries, and risk profiles. For instance, you could invest in tech stocks, energy stocks, and healthcare stocks, ensuring that a downturn in one industry doesn't affect your entire portfolio.

It's also important to diversify within each type of investment. For example, when investing in stocks, consider a mix of large-cap, small-cap, dividend, growth, and value stocks. Similarly, with bonds, vary maturities, credit qualities, and durations to reduce sensitivity to interest rate changes.

The key to successful diversification is to ensure your portfolio isn't overly concentrated in any one investment or sector. This way, even if a portion of your portfolio is declining, the rest is likely to be growing or, at the very least, not declining as much.

Remember, diversification is an ongoing process. Regularly review and rebalance your portfolio to maintain your desired risk level and ensure it aligns with your investment goals and time frame.

Saving and Investing: Building Wealth and Security

You may want to see also

Asset Allocation: Divide investments between stocks, bonds, cash, and other assets

When dividing your investment portfolio between stocks, bonds, cash, and other assets, it's important to understand the concept of asset allocation. This is a technique that aims to balance risk and reward by dividing your investments across different asset classes. The three main asset classes are equities (stocks), fixed income (bonds), and cash and cash equivalents.

There is no one-size-fits-all formula for asset allocation, as it depends on various factors such as your financial goals, risk tolerance, investment time horizon, and personal preferences. Younger investors, for example, may opt for more stocks for growth potential, while those closer to retirement may shift their focus to bonds and cash for stability.

- Stocks (Equities): Stocks typically offer higher returns but come with higher risk. If you're comfortable with taking on more risk and have a long investment horizon, you may allocate a larger portion of your portfolio to stocks.

- Bonds (Fixed Income): Bonds are considered less risky than stocks and are often used to reduce the overall volatility of a portfolio. As you approach retirement or if you have a lower risk tolerance, you may consider increasing your allocation to bonds.

- Cash and Cash Equivalents: Cash and cash equivalents, such as money market accounts, are generally low-risk and suitable for short-term financial goals. They are appropriate for goals within a one-year time frame.

- Other Assets: Diversifying your portfolio by including other assets such as real estate, commodities, exchange-traded funds (ETFs), or mutual funds can help further balance your risk.

Moderately Conservative Portfolio:

- 55-60% Fixed-income securities (bonds)

- 25-30% Equities (stocks)

- 5-10% Cash and equivalents

Moderately Aggressive Portfolio:

- 35-40% Fixed-income securities (bonds)

- 45-50% Equities (stocks)

- 5-10% Cash and equivalents

Aggressive Portfolio:

- 20-25% Fixed-income securities (bonds)

- 65-70% Equities (stocks)

- 5-10% Cash and equivalents

Remember, these are just examples, and you should adjust the allocations based on your specific circumstances and goals. It's also important to regularly review and rebalance your portfolio to ensure it aligns with your investment strategy.

Building a Model Investment Portfolio: A Comprehensive Guide

You may want to see also

Risk Management: Choose investments with varying risk levels to balance potential returns and losses

Risk is inherent in any investment, and successful financial risk management requires balancing potential risks with potential rewards. A fundamental idea in finance is the relationship between risk and return: the greater the amount of risk an investor is willing to take, the greater the potential return.

One of the most common ways to measure risk is by determining standard deviation, which is a statistical measure of dispersion around a central tendency. A high standard deviation indicates a lot of value volatility and therefore a high degree of risk.

When deciding on an investment strategy, it is important to consider your risk tolerance, or how much risk you are willing to accept. Your risk capacity, on the other hand, is the amount of financial risk you are able to take on given your current financial situation.

- Avoidance: This involves choosing the safest assets with little to no risk.

- Retention: This strategy entails accepting any risks as the price for the chance of high returns.

- Sharing: Risk can be distributed among two or more parties. For example, insurance companies pay reinsurers to cover potential losses above a certain level.

- Transferring: Risks can be passed on from one party to another. For instance, health insurance allows individuals to transfer the risk of costly medical expenses to an insurance company in exchange for regular premium payments.

- Loss prevention and reduction: Instead of eliminating risk, many investors mitigate it by balancing volatile investments with more conservative choices.

Additionally, diversification is a crucial strategy for minimising risk. A well-diversified portfolio consists of different types of securities from diverse industries, with varying degrees of risk and correlation with each other's returns. By spreading your investments across multiple asset classes and market sectors, you can reduce the overall risk of your portfolio.

- Spread your portfolio: Invest in a range of different vehicles, such as cash, stocks, bonds, mutual funds, ETFs, and other funds. Look for assets whose returns have historically moved independently of each other.

- Stay diversified within each type of investment: Include securities that vary by sector, industry, region, and market capitalization. Mix styles, such as growth, income, and value. For bonds, consider varying maturities and credit qualities.

- Include securities with different risk levels: You are not limited to choosing only low-risk investments. By selecting a range of investments with different rates of return, you can ensure that large gains offset losses in other areas.

Remember, risk management is an ongoing process as risks can change over time. It is important to regularly assess and diversify your portfolio to ensure it aligns with your financial strategy and goals.

Building a Diverse Investment Portfolio: Strategies for Success

You may want to see also

Regular Check-ups: Review your portfolio annually or after significant financial changes

It is important to review your investment portfolio regularly, but how often you do this depends on your financial situation and how much time you want to spend managing your investments. Financial advisors recommend checking in at least once a year. This gives you an opportunity to review your position, ask questions, and discuss your options.

You should also monitor significant changes in your life and adjust your portfolio accordingly. For example, a change in marital status, an unexpected inheritance, or a sudden change in your health should prompt a review of your asset allocation.

Additionally, keep an eye on your portfolio's balance. If the balance shifts by 5% or more, this is a signal to take a look at your allocations and consider making adjustments.

Remember, investing is not an exact science and there is no "right" answer to how often you should check your portfolio. It is a good idea to avoid micromanaging your investments and focus on the long-term.

Kids' Guide to Saving and Investing Wisely

You may want to see also

Rebalancing: Periodically adjust your portfolio to maintain your desired risk level

Rebalancing is an important way to help minimise volatility in your portfolio and may improve long-term returns. It is a way to maintain your desired risk level and ensure your portfolio is in line with its allocation target.

There are several rebalancing strategies, but the key is to set up a schedule that works for you and stick to it. Here are some factors to consider:

- How much has your portfolio deviated from your original asset allocation?

- Are you still comfortable with your current asset allocation, or has your situation changed, suggesting you amend the mix?

- Have your goals or risk tolerance changed?

You can set a percentage range for rebalancing, such as 5% or a window of 1-2%. The wider the band, the fewer rebalancing events will be triggered, allowing you to capitalise on positive momentum in stock investments. You can also set a time to rebalance—annually, quarterly, or twice a year. Less frequent rebalancing may lead to greater stock allocations, higher overall returns, and greater volatility.

When rebalancing, you can add new money to an underweighted asset class or use withdrawals to decrease the weight of an overweight asset. For example, if your portfolio has drifted from an 80% stock and 20% bond mix to an 85%/15% split, you can sell 5% of your stock assets and use the proceeds to buy bonds.

Remember that the goal of rebalancing is not perfection, as asset values will always deviate from their predetermined percentages. It is about ensuring your portfolio remains suitable for your goals and risk tolerance.

Strategizing Dividend Investment: Balancing Your Portfolio

You may want to see also

Frequently asked questions

Splitting your investment portfolio by sector, or diversifying your portfolio, is important because it reduces your overall risk. If you put all your money into one sector and that sector suddenly crashes, you could lose everything. By diversifying your portfolio, you can rest assured that your money is as safe as it can be.

The amount you invest in each sector depends on your goals and risk tolerance. If you're young and looking for aggressive growth, you may want to invest mostly in stocks or real estate. If you're older and looking to protect your wealth, you may want to invest more in fixed-income securities like bonds.

Some examples of sectors you can invest in include technology, energy, healthcare, oil and gas, transportation, and entertainment.

It's important to have a diverse portfolio, but you also want to make sure it's manageable. A good rule of thumb is to invest in 20 to 30 different sectors. This will allow you to spread your risk around without taking on too much.