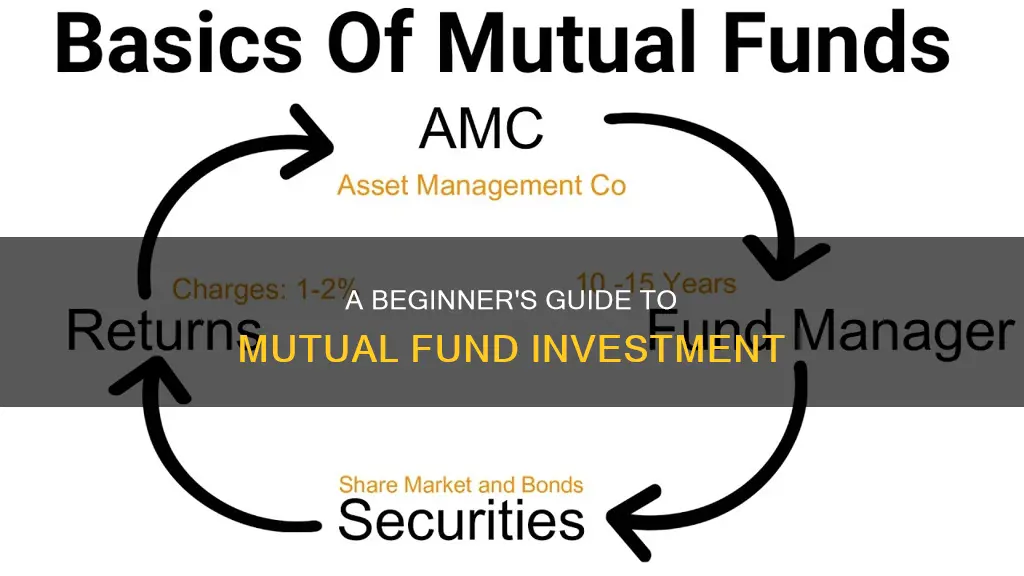

Mutual funds are a popular investment vehicle for those looking to diversify their portfolios. They are a type of investment that pools money from multiple investors to purchase a range of assets, such as stocks, bonds, or other securities. By investing in mutual funds, individuals can gain exposure to a professionally managed, diversified portfolio, potentially benefiting from economies of scale while spreading risk across multiple investments.

Mutual funds are an attractive option for investors as they offer professional management, diversification, affordability, and liquidity. They are also easily accessible, with a small initial minimum investment amount, and are traded daily at their closing net asset value (NAV).

However, it is important to consider the fees and expenses associated with mutual funds, as these can impact overall returns. Mutual funds typically carry annual fees, expense ratios, or commissions, which investors should be mindful of when making investment decisions.

Understanding how mutual funds work, their benefits, and potential drawbacks, is crucial for investors looking to utilize this investment vehicle effectively.

| Characteristics | Values |

|---|---|

| Definition | A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. |

| Benefits | Professional management, diversification, affordability, liquidity |

| Types | Money market funds, bond funds, stock funds, target date funds |

| Risks | Loss of money, volatility in dividend or interest payments |

| Buying process | Buy mutual fund shares from the fund itself or through a broker |

| Selling process | Mutual fund shares are "redeemable", meaning investors can sell the shares back to the fund at any time |

| Fees | Management expense ratio (MER), sales loads, redemption fees, account fees |

| Taxation | Distributions are generally taxable to the investor |

What You'll Learn

Understand the different types of mutual funds

There are several different types of mutual funds, each with its own unique characteristics and risks. Here's an overview of some of the most common types:

- Equity Funds: These funds primarily invest in stocks or equities, offering the potential for higher returns over the long term. They are usually categorized by the size of the companies they invest in (large-cap, mid-cap, or small-cap) or by industry sectors (such as technology or healthcare). Equity funds are typically suitable for investors with a higher risk tolerance and a longer investment horizon.

- Bond Funds (or Fixed-Income Funds): These funds focus on investing in various types of bonds, such as government, corporate, or municipal bonds. They generally provide a more stable and predictable income stream, with lower risk compared to equity funds. Bond funds are often categorized by the maturity of the bonds they hold, such as short-term, intermediate-term, or long-term bond funds.

- Money Market Funds: Money market funds invest in short-term, high-quality debt instruments, such as treasury bills, commercial paper, and certificates of deposit. They aim to provide liquidity and capital preservation, making them a relatively low-risk investment option. Money market funds typically offer a modest but stable return.

- Balanced Funds (or Hybrid Funds): Balanced funds invest in a mix of equities and fixed-income securities, providing a balanced approach that offers both growth potential and income. The specific allocation between stocks and bonds can vary; some maintain a fixed ratio, while others adjust their allocation based on market conditions. These funds help reduce risk through diversification across asset classes.

- Index Funds: Index funds aim to replicate the performance of a specific market index, like the S&P 500 or the Nasdaq-100. They invest in the same securities that comprise the index, proportional to their weight. Index funds offer broad diversification and generally have lower expenses than actively managed funds. They represent a passive investment strategy, as the fund manager does not actively select stocks.

- Sector Funds: Sector funds focus their investments within specific industries or sectors (e.g., technology, healthcare, financials, energy). These funds provide specialized exposure to particular areas of the market. However, they carry higher risks due to their lack of diversification across sectors. Sector funds are typically for investors with a higher risk tolerance and a sector-focused investment thesis.

These are just a few of the main types of mutual funds. Each type has its own advantages, risks, and potential rewards. Understanding the investment objectives, strategies, and associated fees of a mutual fund is key before investing. Diversification across different types of funds and asset classes can help manage risk and achieve long-term investment goals.

Tony Robbins' Guide to Index Funds Investing

You may want to see also

Learn about the benefits of mutual funds

Investing in mutual funds offers a wide range of benefits that make it an attractive option for investors, especially those who are new to investing or who have limited time to actively manage their investments. Here are some of the key advantages of mutual funds:

Diversification: Mutual funds allow investors to diversify their portfolios by providing access to a basket of carefully selected securities. This diversification helps to spread out risk, as the performance of one particular security or industry will not have a significant impact on the overall portfolio. Diversification can also be achieved across different asset classes, such as stocks, bonds, and money market instruments, by investing in multiple mutual funds.

Professional Management: Mutual funds are managed by professional fund managers who have extensive knowledge and experience in the financial markets. These experts make investment decisions on behalf of the investors, including selecting securities, monitoring the market, and making timely trades. This active management aims to maximize returns and minimize risks, allowing investors to benefit from the expertise of seasoned professionals.

Lower Investment Thresholds: Mutual funds offer a lower barrier to entry compared to directly investing in individual securities. Investors can start with a relatively small initial investment, known as the minimum investment requirement, which varies among different funds. This makes mutual funds accessible to a wider range of investors, allowing them to participate in a diversified portfolio with a limited amount of capital.

Liquidity: Mutual fund investments are generally liquid. Investors can easily buy or sell their fund units at any time. Open-ended funds, the most common type, allow investors to redeem their units at the prevailing net asset value (NAV). This liquidity provides flexibility and accessibility, enabling investors to respond to market changes or withdraw funds if needed.

Dividend Payouts and Capital Appreciation: Mutual funds can provide regular income through dividend distributions. Certain types of funds, such as equity or stock funds, may distribute dividends when the underlying companies in the fund's portfolio pay dividends. Additionally, mutual funds offer the potential for capital appreciation as the value of the securities in the fund's portfolio increases. This dual benefit appeals to investors seeking both current income and long-term growth.

Simplified Investment Process: Investing in mutual funds streamlines the investment process. Instead of researching individual securities, investors can rely on the expertise of the fund manager and the fund's investment objectives. This simplifies decision-making, as investors can choose funds that align with their financial goals and risk tolerance, whether it's growth, income, or a balanced approach.

By understanding and leveraging the benefits of mutual funds, investors can make informed decisions, build diversified portfolios, and work towards their financial goals.

Understanding Target-Date Funds: Strategies for Smart Investing

You may want to see also

Know the risks of mutual funds

Like any investment, mutual funds carry a certain level of risk. While they can be a great way to diversify your portfolio and access a range of different investments, there are some key risks you should be aware of before investing.

Market Risk

Market risk is the possibility that the value of the investments within the fund will decline due to economic developments, changes in government policies, political conditions, regulatory frameworks, interest rates, or external shocks such as natural disasters or wars. This type of risk is inherent in any investment and can impact the entire market, not just individual funds.

Interest Rate Risk

Interest rate risk is relevant to funds that hold bonds or other fixed-income securities. When interest rates rise, bond prices tend to fall, which can lead to a decline in the value of the mutual fund.

Liquidity Risk

Liquidity risk refers to the potential difficulty of selling an investment at a fair price. If there are no buyers for a particular investment held by the fund, it may have to be sold at a loss.

Credit Risk

Credit risk is the risk that the issuer of a bond or other security will be unable to make interest payments or repay the principal when it is due. This can result in a loss for the fund.

Inflation Risk

Inflation risk is the possibility that the purchasing power of your investment will decrease due to a general increase in consumer prices. This can erode the real returns on your investment.

Management Risk

Management risk is the risk associated with the performance of the fund's management team. If the fund managers make poor investment decisions, it will negatively impact the fund's returns. It's important to research the experience and track record of the management team before investing.

Fee and Expense Risk

Mutual funds typically charge annual fees, expense ratios, or commissions, which can reduce your overall returns. It's important to carefully review the fees associated with a mutual fund before investing, as they can vary significantly between funds. Even small differences in fees can lead to large differences in returns over time.

Default Risk

There is also a risk that a company held within the fund could default on its debentures, or that its credit rating could be downgraded, impacting the fund's performance.

Non-Compliance Risk

Non-compliance risk refers to the possibility that the fund manager does not conform to laws, rules, regulations, or internal policies, which could negatively impact the fund's performance and the interests of the investors.

Volatility Risk

The level of volatility, or price fluctuations, in a mutual fund can vary depending on the types of investments it holds. Equity funds, for example, tend to be more volatile than fixed-income funds. It's important to consider your risk tolerance when investing in mutual funds.

HOA Fund Investment Strategies: A Guide to Smart Investing

You may want to see also

How to buy and sell mutual funds

How to Buy Mutual Funds

Before buying mutual fund shares, it is important to identify your goals and risk tolerance. You should also consider the style and type of fund, which will depend on your goals and time horizon. If you are comfortable with volatility and are investing for the long term, a long-term appreciation fund may be suitable. These funds typically hold a high percentage of common stocks, offering the potential for higher returns but also carrying more risk. On the other hand, if you are looking for current income, you may prefer an income fund, which invests in government and corporate debt.

You can buy mutual fund shares from the fund company directly (e.g., Vanguard, T. Rowe Price) or through a broker. Many funds require a minimum contribution, often between $1,000 and $10,000, but some are higher or do not set any minimum. It is important to research different funds to find the one that aligns with your investment goals and risk tolerance. You should also pay close attention to the fees and expenses charged, as these can impact your overall returns. Mutual funds may charge load fees, which are sales fees that are either front-end (paid at the time of investment) or back-end (charged when you sell your investment). There may also be other fees, such as management expense ratios, redemption fees, and account fees.

How to Sell Mutual Funds

When selling mutual fund shares, you will typically need to contact your financial advisor or the mutual fund company to inquire about fees and charges, decide how many shares you want to sell, and provide instructions on what to do with the money. By law, mutual funds must reimburse former shareholders within seven days of redeeming their shares, though there may be exceptions. It is important to be mindful of the impact of frequent trading on fund performance and other investors, and some funds may impose early redemption fees for shares sold within 30 days of purchase.

Monitoring Your Investment Funds: Strategies for Success

You may want to see also

Compare mutual funds with other investments

Mutual funds are a popular investment choice, especially for those saving for retirement. They are a good option for those who want a professionally managed, diversified portfolio with a relatively low minimum investment amount. However, there are other investment options available, each with its own advantages and disadvantages. Here is a comparison of mutual funds with some other common investment choices.

Mutual Funds vs. Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) are similar to mutual funds in that they are also a type of investment fund that pools money from multiple investors to purchase a diversified portfolio of assets. However, there are some key differences between the two. ETFs are traded on stock exchanges like regular stocks, while mutual funds are traded only once daily after the markets close. This means that ETFs offer more liquidity and flexibility, as well as real-time pricing. ETFs may also have certain tax advantages and tend to be more cost-efficient than mutual funds. On the other hand, mutual funds offer the benefit of professional management, which can be valuable for investors who want a more hands-off approach.

Mutual Funds vs. Individual Stocks

Investing in individual stocks can offer higher potential returns compared to mutual funds, as the gains are not diluted by the fund's expenses and fees. Additionally, stocks can provide greater flexibility and control over your investment choices. However, stocks also come with higher risk, as your entire investment is tied to the performance of a single company. Mutual funds, on the other hand, offer diversification, spreading the risk across multiple companies and industries. They also provide access to a professionally managed portfolio, which can be beneficial for those who don't have the time or expertise to manage their own investments.

Mutual Funds vs. Bonds

Bonds are considered a relatively low-risk investment option, especially when compared to stocks or mutual funds that invest in stocks. They offer a fixed rate of return and are typically less volatile than stocks. However, the potential for higher returns in mutual funds comes with higher risk. Additionally, mutual funds offer more diversification than investing in individual bonds, as they pool money to invest in a variety of assets. Bonds may be a good option for more conservative investors or those seeking a stable source of income, while mutual funds may be more suitable for those seeking long-term capital appreciation.

Mutual Funds vs. Real Estate

Investing in real estate can provide several benefits that mutual funds may not offer. Real estate investments can serve as a hedge against inflation, offer potential for capital appreciation, and provide a source of steady income through rentals. Additionally, real estate can be a good diversification strategy, as it often has a low correlation with other asset classes. However, real estate investments also come with their own set of risks and challenges, such as high upfront costs, lack of liquidity, and the potential for vacancies or problematic tenants. Mutual funds, on the other hand, offer more flexibility and diversification, as well as professional management, making them a more hands-off investment option.

Mutual Funds vs. Savings Accounts

While savings accounts may not provide the same level of potential returns as mutual funds, they are considered a much safer option, especially for short-term financial goals. Savings accounts are FDIC-insured up to certain limits, meaning your money is protected even if the bank fails. They also offer high liquidity, allowing you to access your funds at any time without penalties. Mutual funds, on the other hand, are better suited for long-term financial goals, as they typically carry more risk and may have restrictions on early withdrawals. Additionally, the returns offered by mutual funds have the potential to outperform the interest earned in a savings account over time.

A Guide to Investing in SBI Mutual Fund SIPs

You may want to see also

Frequently asked questions

A mutual fund is a company that pools money from many investors and invests in securities such as stocks, bonds, and short-term debt. Mutual funds are managed by professionals and offer diversification, which means that the risk is reduced as your money is spread across multiple investments.

Mutual funds are a popular choice among investors because they offer professional management, diversification, affordability, and liquidity. They also offer three ways to earn money: dividend payments, capital gains distributions, and increased NAV (Net Asset Value).

To invest in mutual funds, you need to decide whether you want to invest in active or passive funds, calculate your investing budget, decide where to buy mutual funds (e.g. through an online brokerage), understand the associated fees, and manage your portfolio.

Mutual funds have annual fees, expense ratios, or commissions, which will lower your overall returns. There are also sales charges or "loads" when you buy or sell shares, redemption fees if you sell shares within a certain period, and other account fees.

Most mutual funds fall into one of four main categories: money market funds, bond funds, stock funds, and target date funds. Each type has different features, risks, and rewards. Money market funds have lower risks, while bond funds aim for higher returns. Stock funds can be further divided into growth funds, income funds, index funds, and sector funds.