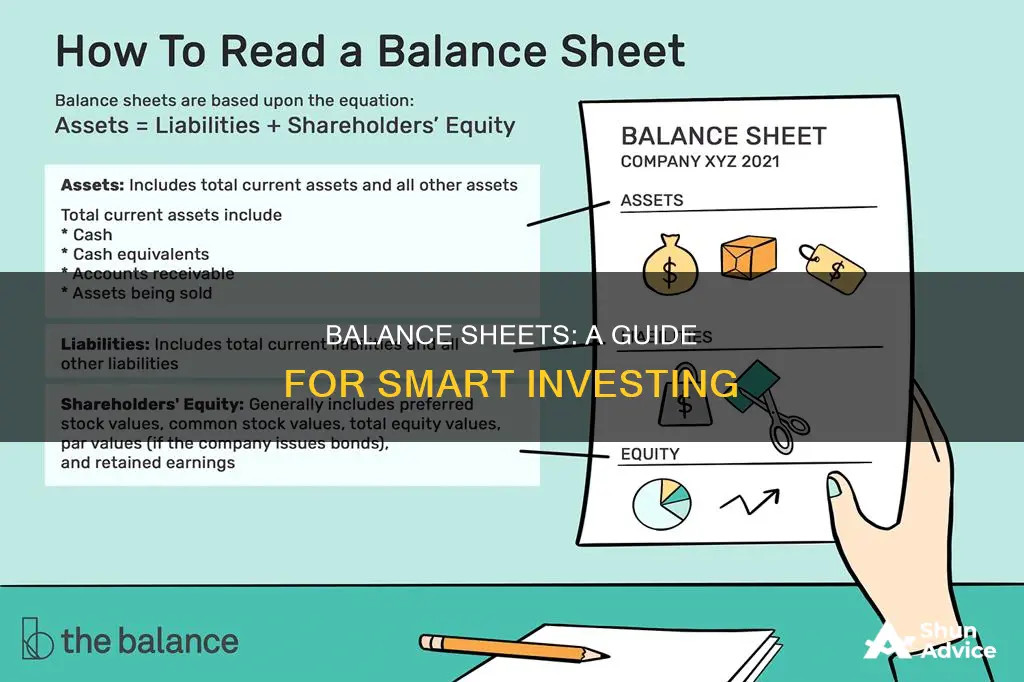

A balance sheet is a financial statement that provides a snapshot of a company's finances at a specific point in time. It communicates exactly how much a company is worth, or its book value, by listing and tallying up its assets, liabilities, and shareholders' equity. Understanding how to read a balance sheet is an essential skill for investors, as it can be used to calculate financial ratios, which can help paint a more complete picture of a company's financial health.

What You'll Learn

Understanding the structure of a balance sheet

A balance sheet is a financial statement that provides a snapshot of a company's finances, including what it owns and owes, as well as the amount invested by shareholders. It is one of the three core financial statements used to evaluate a business, alongside the income statement and the cash flow statement.

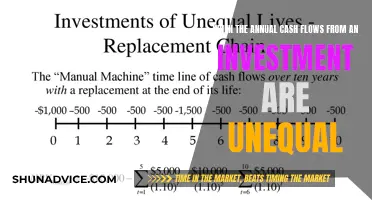

The balance sheet adheres to the following accounting equation:

> Assets = Liabilities + Shareholders' Equity

This formula is intuitive because a company has to pay for everything it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

A balance sheet is structured to provide a summary of a business at a given point in time. It is a snapshot of a company's financial position, broken down into assets, liabilities, and equity.

Assets

Assets refer to anything that is owned by a company and holds inherent, quantifiable value. Assets are typically tallied as positives in a balance sheet and are categorised into current assets and non-current assets. Current assets include anything a company expects to convert into cash within a year, such as cash and cash equivalents, and marketable securities. Non-current assets include long-term investments that are not expected to be converted into cash in the short term, such as intellectual property and equipment used to produce goods or perform services.

Liabilities

Liabilities are the opposite of assets. While assets are what a company owns, liabilities are what it owes. Liabilities are financial and legal obligations to pay an amount of money to a debtor and are typically tallied as negatives in a balance sheet. Liabilities are categorised into current liabilities and non-current liabilities. Current liabilities refer to any liability due to the debtor within one year, such as accrued expenses and wages payable. Non-current liabilities refer to long-term obligations or debts that will not be due within a year, such as provisions for pensions and deferred tax liabilities.

Shareholder's Equity

Shareholder's equity, also known as owners' equity or shareholders' equity, typically refers to anything that belongs to the owners of a business after any liabilities are accounted for. It includes money contributed to the business in the form of investments in exchange for ownership (usually represented by shares) and the earnings that the company generates over time and retains.

Sound Investment Principles: Robin Hood Foundation's Strategy

You may want to see also

How to calculate financial ratios

Balance sheets are a snapshot of a company's finances at a given point in time. They can be used to calculate financial ratios, which provide insight into a company's financial health and can be used to compare companies within the same industry. Here are some of the key financial ratios that can be calculated using a balance sheet:

Current Ratio

The current ratio is a simple comparison between current assets and current liabilities. It indicates a company's ability to pay off its short-term liabilities with its short-term assets. The formula for calculating the current ratio is:

> Current Ratio = Current Assets / Current Liabilities

Ideally, the current ratio should be above 1:1, indicating that the company has enough short-term assets to cover its short-term liabilities.

Quick Ratio (Acid-Test Ratio)

The quick ratio is similar to the current ratio, but it excludes inventory from the calculation. This is because inventory may not always be easily convertible into cash. The formula for the quick ratio is:

> Quick Ratio = (Current Assets – Inventory) / Current Liabilities

A healthy quick ratio is typically greater than one, indicating that the company has sufficient liquid assets to cover its short-term liabilities.

Debt-to-Equity Ratio

The debt-to-equity ratio shows how dependent a company is on debt financing. It is calculated by dividing the company's total liabilities by its total shareholder equity. The formula is as follows:

> Debt-to-Equity Ratio = Total Liabilities / Total Shareholder Equity

A lower debt-to-equity ratio is generally considered more favourable, as it indicates less financial risk for shareholders. However, the interpretation of this ratio can vary across different industries.

Working Capital

Working capital is the difference between current assets and current liabilities. It represents the amount of money a company has available for day-to-day operations after meeting its short-term obligations. The formula for calculating working capital is:

> Working Capital = Current Assets – Current Liabilities

Positive working capital indicates that a company has sufficient funds to sustain its operations, while negative working capital may indicate financial difficulties.

These are just a few examples of financial ratios that can be calculated using a balance sheet. Other ratios include the debt-to-total-assets ratio and the solvency ratio. By calculating and analysing these ratios, investors and analysts can gain valuable insights into a company's financial health, liquidity, and solvency.

Cash Investments: Good or Bad Idea?

You may want to see also

How to compare balance sheets

When comparing balance sheets, it is important to understand the financial health of a business and to be able to identify any potential red flags. Balance sheets are a snapshot of a company's finances at a given point in time, so comparing them over time can reveal a lot about the business's performance and financial management. Here are some key steps and considerations for comparing balance sheets:

- Understanding the Components: A balance sheet consists of three main components: assets (what the company owns), liabilities (what the company owes), and equity (the residual value for shareholders). It is essential to understand these components and how they work together. Assets equal liabilities plus equity, which is why it is called a balance sheet.

- Analysing Key Figures: When comparing balance sheets, look for key figures such as the cash balance, long-term debt, and goodwill. The cash balance is crucial as it indicates the company's ability to address problems or seize opportunities. Long-term debt can be a source of financial risk during difficult times. Goodwill can provide insights into whether the company has been growing through acquisitions or organically.

- Identifying Red Flags: Be cautious of "Off-Balance Sheet" arrangements, where debt is related to the company but not reflected on the balance sheet. Stock options can also impact earnings per share if triggered by many people. Additionally, compare the cash balance to receivables or debtors to assess the company's liquidity.

- Assessing Liquidity and Solvency: Calculate the Current Ratio by comparing current assets to current liabilities. A ratio of 1 or higher indicates that the company has sufficient short-term assets to cover its short-term debts. To assess solvency, simply compare the assets to liabilities; if assets are greater, the company is solvent.

- Evaluating Earnings: Retained earnings or accumulated profits can be found at the bottom of the balance sheet in the equity section. By comparing retained earnings from the current and previous years, you can determine the company's profit for the year.

- Analysing Changes: When comparing balance sheets from different periods, pay attention to any increases or decreases in current asset and liability accounts. This can impact cash flow and the overall financial health of the business.

- Calculating Financial Ratios: Utilize financial ratios such as the debt-to-equity ratio and the acid-test ratio to assess the company's financial well-being. These ratios provide valuable insights into the company's performance and risk profile.

- Comparing to Industry Standards: It is important to compare balance sheets with those of similar companies in the same industry. Different industries have unique approaches to financing, so comparing within the same industry provides a more accurate assessment.

- Evaluating Investment Quality: Assess the strength of the balance sheet using investment-quality measurements such as working capital, asset performance, and capitalization structure. Track key indicators like the cash conversion cycle (CCC) and compare them to competitors to identify positive or negative trends.

- Monitoring Equity Changes: Compare balance sheets from consecutive years to track equity changes. Subtract the previous year's equity from the most recent year's equity to determine the dollar amount change. Divide this amount by the previous year's equity and multiply by 100 to get the percentage change.

Cash Investments: Current State and Trends

You may want to see also

How to identify red flags

A balance sheet is a financial statement that provides a snapshot of a company's finances, including what it owns and owes, as well as the amount invested by shareholders. It is one of the core financial statements used to evaluate a business and can be used to calculate important metrics such as liquidity, profitability, and debt-to-equity ratio. Here are some red flags to look out for when examining a balance sheet:

- Off-Balance Sheet Arrangements: These are complex arrangements where debt is related to the company but does not appear on the balance sheet. This can indicate potential financial risk.

- Stock Options: If a large number of people hold stock options, they may trigger them at a later date, leading to a decrease in earnings per share, which can influence share prices.

- Cash Balance vs. Receivables: Comparing the cash balance to receivables or debtors can indicate whether a company has more liquid cash or is waiting for customers to pay before paying its debts.

- Inventory: If inventory is increasing without a corresponding change in a company's offerings, it may indicate that items are not selling. This can be a problem, especially in industries where products become obsolete or spoil over time.

- Receivables: Mounting receivables can indicate issues with the collections process or credit policies. If receivables are not collected promptly, it may impact a company's ability to compensate.

- Fixed Asset Disposal: Proceeds from the disposal of fixed assets should not be used to pay down debt or cover short-term expenses. This can cause problems for future operating expenses.

- Cash Flow: Even if a business shows a profit, it may still have poor cash flow. Investors may worry about the collection of receivables, exaggeration of revenue, or struggles with loan payments.

- Non-Operating Income: Consistent income from the sale of fixed assets, large one-time sales, or the sale of investments may raise concerns about the stability of a company's revenue streams.

- "Other" Expenses: While many companies have small or inconsistent "other expenses," high values in this category can be a red flag and may indicate issues with financial management.

- Debt-to-Equity Ratio: A rising debt-to-equity ratio indicates that a company is absorbing more debt than it can handle. If this ratio is over 100%, it is a cause for concern.

- Revenue Trend: If a company's revenue has been trending downward for several years, it may indicate underlying issues and may not be a good investment.

Robin Hood Investing: A Beginner's Guide to Trading

You may want to see also

How to determine a company's liquidity

A balance sheet is a financial statement that provides a snapshot of a company's finances, including what it owns and owes, as well as the amount invested by shareholders. It is a critical tool for investors, offering insight into a company's health and helping them decide whether to invest.

Liquidity is a crucial aspect of a company's financial health, indicating its ability to satisfy short-term debts and make agreements. It refers to how easily assets can be converted into cash.

There are several ways to determine a company's liquidity using its balance sheet:

- Current Ratio: This is the simplest method, comparing a company's current assets to its current liabilities. The formula is: Current Ratio = Current Assets / Current Liabilities. A ratio of 1:1 or above is desirable, indicating the company has enough short-term assets to cover its short-term debts. A ratio above 1 means the company can pay off all its current liabilities with its current assets.

- Quick Ratio/Acid-Test Ratio: This is a stricter test, considering only the most liquid current assets, such as cash, accounts receivable, and marketable securities. The formula is: Quick Ratio = (Cash + Accounts Receivable) / Current Liabilities. A good quick ratio would be 1.5:1.

- Cash Ratio: This is the strictest test, considering only a company's cash and marketable securities. The formula is: Cash Ratio = (Cash + Marketable Securities) / Current Liabilities.

- Operating Cash Flow Ratio: This measures how well current liabilities are covered by the cash flow generated from a company's operations. It is calculated by dividing the operating cash flow by the current liabilities. A higher number is better, indicating the company can cover its current liabilities multiple times.

While a high liquidity ratio is desirable, indicating a company's ability to pay its short-term debts, excessively high ratios may suggest inefficient use of liquid assets.

Other considerations for investors include looking at the cash balance, long-term debt, and goodwill (to see if the company has been growing through acquisitions or organically).

Borrowing to Invest: A Guide to Getting Started

You may want to see also

Frequently asked questions

A balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It includes information about a company's assets, liabilities, and shareholder equity.

A balance sheet is split into three sections: assets, liabilities, and shareholder equity. Assets refer to what the company owns, liabilities refer to what the company owes, and shareholder equity is the residual value for shareholders, calculated by subtracting liabilities from assets.

It is important to look at the cash balance, long-term debt, and goodwill. The cash balance indicates the company's ability to address immediate issues or take advantage of opportunities. Long-term debt can be a source of financial risk, especially during difficult times. Goodwill can provide insights into the company's growth strategy, i.e., whether it has been acquiring other companies or growing organically.

To assess liquidity, you can calculate the current ratio (current assets/current liabilities) and the acid-test ratio (current assets minus inventory/current liabilities). If the current ratio is at least 1, it indicates that the company has sufficient current assets to cover its short-term liabilities. For solvency, simply compare the company's assets to its liabilities. If the assets are greater, the company is solvent.