When the annual cash flows from an investment are unequal, it can be challenging to determine the appropriate table to use for analysis. In such cases, the future value of annuity tables or present value of annuity tables can be utilised. These tables help to calculate the future or present value of unequal cash flows, taking into account the timing and amount of each cash flow. This is particularly relevant in scenarios where cash flow payments are not equal, such as in the case of a small-business owner who saves based on their income level at a given time.

What You'll Learn

Future value of a single sum of cash flow

The future value of a single sum of cash flow is the amount that money invested today at a given interest rate will translate into in the future. This is based on the time value of money.

The formula for calculating the future value of a single sum of cash flow is:

> FV_N = PV * (1+r)^N

Where:

- FV_N = Future value of the investment N periods from today

- PV = Present value of the investment

- R = Rate of interest per period

- N = Number of periods

For example, if you deposit $5,000 in a savings account with a 7% annual compound interest rate, the future value of your investment after 10 years would be:

> FV_N = $5,000 * (1+0.07)^10 = $9,835.76

The higher the number of periods and the interest rate, the greater the future value will be.

When the interest rate is compounded more than once a year, the formula for calculating the future value of a single sum of cash flow is adjusted as follows:

> FV_N = PV * (1 + rs/m)^mN

Where:

- M = Number of compounding periods per year

- Rs = Annual stated rate of interest

For example, if you deposit $2,000 in a savings account with a 7% annual interest rate compounded monthly, the future value of your investment after 10 years would be:

> FV_N = $2,000 * (1 + 0.07/12)^12*10 = $4,019.32

If the compounding period per year is infinite, the formula for calculating the future value of a single sum of cash flow becomes:

> FV_N = PV * e^rsN

Using the previous example, if the 7% annual interest rate were continuously compounded, the future value of the deposits after 10 years would be:

> FV_N = $2,000 * e^0.07*10 = $4,027.51

Cash Investments: Now or Later?

You may want to see also

Future value of an ordinary annuity

An ordinary annuity is an annuity where cash flows occur at the end of each period. These payments are said to be made in arrears, beginning at time t = 1. In other words, mortgages, car loans, and student loans are conventionally ordinary annuities.

The future value of an ordinary annuity is derived as follows:

Consider an annuity amount of A paid at the end of each period for N periods with the interest rate per period denoted by r. In this instance, the future value of equal cash flows is given by:

FV_N = A [ (1 + r)^N – 1 / r]

The factor ((1 + r)^N – 1) / r is termed the future value annuity factor, which gives the future value of an ordinary annuity of $1 per period. Therefore, we multiply any amount by this factor to get the future value of that particular annuity.

For example, assume that you have decided to invest $2,000 per year in a stock index fund that earns 9% per year for the next ten years. The closest value of the accumulated value of the investment after you make the last payment is:

FV_N = A [ ((1 + r)^N – 1) / r] = 2,000 [ ((1 + 0.09)^10 – 1) / 0.09] = 30,385.8594

The future value of an annuity due will usually be higher than the future value of an ordinary annuity. This is because annuity due payments often entail having an additional compounding period, so the money has an extra period to accumulate compounded interest.

Best Places to Safely Invest Your Cash

You may want to see also

Present value of a single cash flow

The present value of a single cash flow refers to how much a single cash flow in the future is worth in the present. In other words, it is the current value of a future sum of money. The present value is calculated by discounting the future cash flow for the given time period at a specified discount rate.

The formula for calculating the present value of a single cash flow is:

Present Value (PV) = Future Value (FV) / (1 + interest rate (r) )^number of periods (N)

Where:

- PV = Present value of the investment

- FV = Future value of the investment N periods from today

- R = Rate of interest per period

- N = Number of periods (years)

For example, if an investor wishes to save $100,000 in the next eight years in a savings account that pays 6% annual interest, the present value can be calculated as follows:

PV = FV / (1 + r)^N = 100,000 / (1.06)^8 = 62,741.24

So, the investor would need to deposit approximately $62,741.24 today to reach their target of $100,000 in eight years.

The present value formula can also be rearranged to solve for the interest rate or the number of periods:

- To solve for the interest rate: r = N sqrt(FV / PV) - 1

- To solve for the number of periods: N = ln(FV / PV) / ln(1 + r)

The concept of present value is based on the time value of money, which states that money in the future is worth less than money today due to factors such as inflation, credit risk, and the potential for alternative investments.

Strategies for Investing Uninvested Cash in a VA529 Plan

You may want to see also

Present value of a series of equal cash flows

The present value of a series of equal cash flows is calculated using annuities. There are two types of annuities: ordinary annuities and annuities due. Ordinary annuities are a series of even cash flows where payments are made at the end of each period, while annuities due are annuities where payments are made at the beginning of each period.

The present value of an ordinary annuity is given by:

$PV = A\left [\frac {1 – (1 + r)^ {-N}} {r} \right]

Where:

- PV = Present value of the annuity

- A = Annuity amount

- R = Interest rate per period

- N = Number of periods

The present value of an annuity due is given by:

$PV = A\left [\frac {1 – (1 + r)^ {-N}} {d} \right]

Where:

D = r / (1 + r)

For example, let's say you have just retired, and your pensioner agrees to pay you $12,000 per year for the next 20 years, with the first payment today. Assuming an interest rate of 7%, the present value of your payments would be:

$PV = 12,000 + 12,000 \left [\frac {1- (1.07)^ {-19}} {0.07} \right] = 136,027.1429

Or using the annuity due formula:

$PV = 12,000\left [\frac {1-(1.07)^ {-20}} {\frac {0.07}{1.07}} \right] = 136,027.1429

Rent Cash Flows: Turning $15,000 into a Rental Empire

You may want to see also

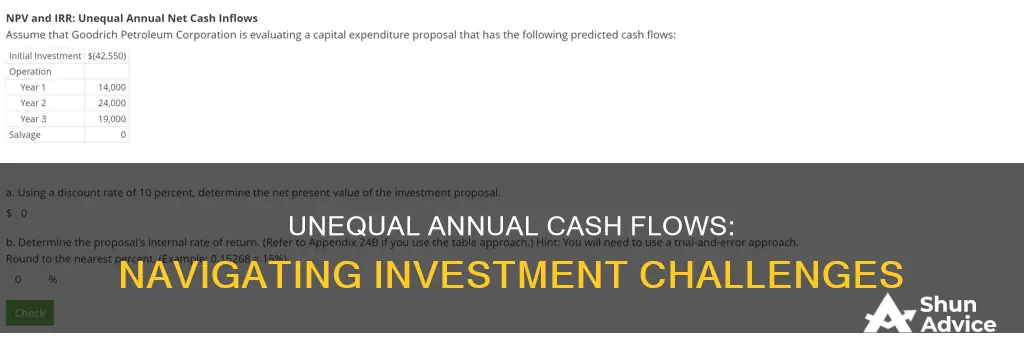

Present value of a series of unequal cash flows

When it comes to investments, cash flows can be unequal or irregular, meaning the cash flow of one year will not be the same as that of other years and can vary from month to month, year to year, and so on. This is known as uneven cash flow. To get an accurate picture of a business, it is important to calculate the present value of these uneven cash flows.

The present value of a series of unequal cash flows is calculated by summing the individual present values of each cash flow. In finance, software such as spreadsheets are used to calculate the present value of a series of many unequal cash flows.

The formula for calculating the present value of uneven cash flows is as follows:

PV = Sum of CFn/(1 + r)^n

Where:

- PV is the present value

- CFn is the cash flow for a given year

- N is the number of years

- R is the discount rate for that year

The discount rate is typically the opportunity rate or the interest that an asset could generate elsewhere.

Let's look at an example to clarify the calculation of the present value of uneven cash flows:

Mr. X has installed a machine in his factory to generate higher revenues. The net cash flows from this installation are as follows:

- Year 1: -$1,250

- Year 2: -$1,000

- Year 3: $1,100

- Year 4: $1,450

- Year 5: $1,500

He wants to calculate the present value of these cash flows at a discount rate of 10%.

Using the formula, the calculation would be as follows:

PV of Uneven Cash Flows = (-1,250) (1 + 0.1)1 + (-1,000) (1 + 0.1)2 + (1,100) (1 + 0.1)3 + (1,450) (1 + 0.1)4 + (1,500) (1 + 0.1)5 = 785.39

So, the present value of these uneven cash flows is $785.39. This calculation helps investors analyze the profitability of an investment. In this example, the total net cash flows are $1,800, but the present value is only $785.39. If an investor were to make a decision based solely on net cash flows, they could potentially suffer a significant loss. This highlights the importance of considering the time value of money and the impact of discounting future cash flows.

Cash Outflow for Land Purchase: Investing Activity?

You may want to see also

Frequently asked questions

The future value of an unequal series of payments is calculated by summing the future values of individual payments. For example, if a small-scale businessman deposits $1,000 in the first year, $2,000 in the second, $5,000 in the third, and $7,000 in the fourth year, into a savings account with an annual interest rate of 7%, the accumulated value at the beginning of year 4 would be $15,864.48.

The present value of a series of unequal cash flows is calculated by summing the present values of individual cash flows. For example, if a small-scale businessman receives $1,000 in the first year, $3,000 in the second, $5,000 in the third, and $7,000 in the fourth year, with an annual interest rate of 7%, the present value of the cash inflows today would be $12,976.65.

When annual cash flows from an investment are unequal, the appropriate table to use is the future value of an annuity table.

Cash flow refers to the amount of money moving into and out of a company, while revenue represents the income earned from sales of products and services.

Cash flow describes the flow of cash into and out of a company. Profit is the amount of money left after subtracting expenses from revenues.