E*TRADE offers a variety of ways to fund your account, including wire transfers, mobile check deposits, and direct deposits. The time it takes for funds to become available for investment varies depending on the method used. For example, wire transfers may take up to three business days, while mobile check deposits can take longer, with some users reporting delays of up to a week or more. Direct deposits may provide immediate access to a portion of the funds, with the remaining amount becoming available within a few business days. It's important to note that there may be specific rules and restrictions associated with the use of funds, such as settlement periods and verification processes, which can also impact the availability of cash for investment.

| Characteristics | Values |

|---|---|

| Time taken for money to be available for investment | Up to a week |

| Time taken for money to be available for trade | Up to 5 days |

| Time taken for money to be available as cash | Up to 6 days |

| Time taken for ACH transfers to be available | 3 business days |

| Time taken for wire transfers to be available | Same business day if received before 6 pm ET |

| Time taken for check deposits to be available | 4th business day after the date of deposit |

| Time taken for direct deposits to be available | 1-2 pay cycles for initial setup, then immediately |

| Time taken for funds to be available for withdrawal | 1st business day after the date of deposit for the first $225 |

| 2nd business day after the date of deposit for an additional $5,300 | |

| 4th business day after the date of deposit for the remaining amount |

What You'll Learn

Transferring money from an external account

The Transfer Money service is a free online service that allows you to transfer money from external financial institutions to your E*TRADE account. To use this service, select the appropriate accounts, enter the transfer amount, and choose the date and frequency of the transfer. If the transfer request is submitted before 4 pm ET, the money will be available in your E*TRADE account by the third business day.

You can also transfer money via wire transfer, which is an electronic transfer of money between accounts, including those at different financial institutions. To do this, you will need to complete and submit a Wire Transfer Form to your other financial institution, requesting that they wire the funds to E*TRADE. This option is fast and highly secure.

Another option is to deposit checks into your E*TRADE account using the mobile app or by mail. Funds deposited by check will be available for investing or withdrawal on the fourth business day after the date of deposit for items received before 4 pm ET.

Finally, you can set up a direct deposit to automatically deposit your paycheck or other recurring income into your E*TRADE account.

Please note that the availability of funds for investment may vary, and there have been reports of delays in funds becoming available for trade or cash withdrawal.

Marijuana Money: Investing the Green Rush

You may want to see also

Using a wire transfer

Wire transfers are a fast and secure way to transfer money between accounts, including accounts at different financial institutions. To wire money to your E*TRADE brokerage account, you will need to complete the following steps:

Firstly, you must complete and print out the E*TRADE from Morgan Stanley Wire Transfer Form. This form can be found on the E*TRADE website. Once you have completed the form, send it to your other financial institution and ask them to wire funds to E*TRADE.

The receiving institution information is as follows:

Morgan Stanley Smith Barney LLC

PO Box 484

Jersey City, NJ 07303-0484

ABA Routing Number: 056073573

Along with the form, you will need to provide the following information:

- The amount you want to wire

- Your nine-digit ETRADE number (your account number can be found on the Complete View page when you first log on)

- Your name and address

If your financial institution is located outside of the United States, you will need to provide additional information. If the non-US bank has a correspondent US bank, you will need to provide the following:

- Amount of incoming wire in US dollars or non-US currency

- Receiving institution information: Morgan Stanley Smith Barney LLC, 2000 Westchester Avenue, Purchase, NY 10577, ABA Routing Number: 056073573, The bank name for this routing number is Morgan Stanley Private Bank National Association (MSPBNA)

- Your nine-digit Morgan Stanley Smith Barney account number

- Your name and address

If the non-US bank does not have a correspondent US bank, you will need to provide the following:

- Amount of incoming wire in US dollars or non-US currency

- Receiving institution information: Wells Fargo Bank, N.A., 420 Montgomery Street, San Francisco, CA 94104, SWIFT Code: WFBIUS6S, Intermediary: FBO: Morgan Stanley Smith Barney LLC, ABA Routing Number: 056073573, The bank name for this routing number is Morgan Stanley Private Bank National Association (MSPBNA)

- Your nine-digit Morgan Stanley Smith Barney account number

- Your name and address

Wire transfers are typically processed on the same business day if they are received before 6 p.m. ET. You can check the status of your request in the Transfer Activity section of your account, and you will also receive updates online via alerts.

Cash Allocation Strategies: Investing Basics Explained

You may want to see also

Transferring an account

To transfer an account, you can use the Transfer an Account feature, which will guide you through the process step by step. You will need the following information from your monthly statement:

- The name of the delivering financial institution

- Your account number at that financial institution

- The registration or ownership of the account

Alternatively, you can complete an Account Transfer Form and mail it to the provided address.

The time it takes for your assets to be delivered varies. Typically, it takes 10 business days to 3-6 weeks. You can check the status of your request in the Transfer Activity section, where you will also receive updates via alerts.

If you are transferring funds from an external account to your E*TRADE Brokerage account, the funds will be available on the third business day after the transfer request is entered, provided it is submitted before 4 pm ET. If you are transferring from an external account to E*TRADE or Morgan Stanley Private Bank, the funds will be available on the fifth business day.

It is important to note that there may be delays in accessing your transferred funds for investment, as E*TRADE needs to verify the money. This process can take up to a week or more, as seen in the experiences of some E*TRADE users.

Strategizing Initial Investment: Deciding Your First Cash Flow

You may want to see also

Depositing a check

- Launch the E*TRADE Mobile app and go to Check Deposit.

- Enter the amount and select your account.

- Sign the back of the check and write "For electronic deposit" above your endorsement on all checks deposited through the Service.

- Take a picture of the front and back of your endorsed check.

- Submit the deposit by tapping the Submit button.

If you choose to deposit a check by mail, follow these steps:

- For checks made payable to ETRADE or Morgan Stanley Private Bank:

- Write your nine-digit or ten-digit account number on the memo line.

- Sign the back of the check and write "for deposit only to [account number]" next to or directly under your signature.

- Attach a deposit slip (if you have one).

- For checks made payable to you:

- Sign the back of the check and write "for deposit only to [account number]" next to or directly under your signature.

- Attach a deposit slip (if you have one).

- Note: The payee name must match the account owner's name on the account for the deposit to be processed.

- Mail your brokerage deposits to:

Regular US mail:

E*TRADE from Morgan Stanley

PO Box 484

Jersey City, NJ 07303-0484

Overnight mail:

E*TRADE from Morgan Stanley

Harborside 2

200 Hudson Street, Suite 501

Jersey City, NJ 07311-1113

Please allow up to five business days for your check to be deposited and cleared.

Corporate Cash Investment Strategies: Maximizing Returns, Minimizing Risk

You may want to see also

Setting up a direct deposit

Access your account information:

Go to the E*TRADE website or mobile app and log in to your account. Navigate to the relevant section to find your account and routing numbers. You will need this information to set up the direct deposit.

Set up the direct deposit:

You can set up a direct deposit through your employer's payroll provider. Update your information or download and submit a Direct Deposit Form if accepted by your employer. If you receive payments from the Social Security Administration, you can set up or change your direct deposit by visiting ssa.gov/myaccount.

Choose the receiving account:

You can choose to deposit your funds into your E*TRADE Brokerage Account or your Morgan Stanley Private Bank Checking or Savings account. Make sure to select the correct account type and provide the appropriate account and routing numbers.

Provide financial institution name:

When setting up the direct deposit, you may be asked to provide the name of the financial institution. For E*TRADE Brokerage Accounts, the financial institution name is "E*TRADE from Morgan Stanley". For Morgan Stanley Private Bank accounts, the financial institution name is "Morgan Stanley Private Bank".

Specify the frequency:

When setting up the direct deposit, you can specify how often you want the transfer to occur. You can choose to have your paycheck or other recurring income deposited into your account on a regular basis, such as weekly, bi-weekly, or monthly.

By following these steps, you can easily set up a direct deposit to automatically transfer your funds into your chosen account. This will allow you to access and invest your money more efficiently, without having to manually transfer funds each time.

Investments, Cash Flows, and the Relationship Between Them

You may want to see also

Frequently asked questions

Funds deposited into your brokerage account will be available for investing or withdrawal on the fourth business day after the date of deposit. For funds deposited into your bank account, $225 will be available on the first business day after the date of deposit, an additional $5,300 will be available on the second business day, and the remaining amount will be available on the fourth business day.

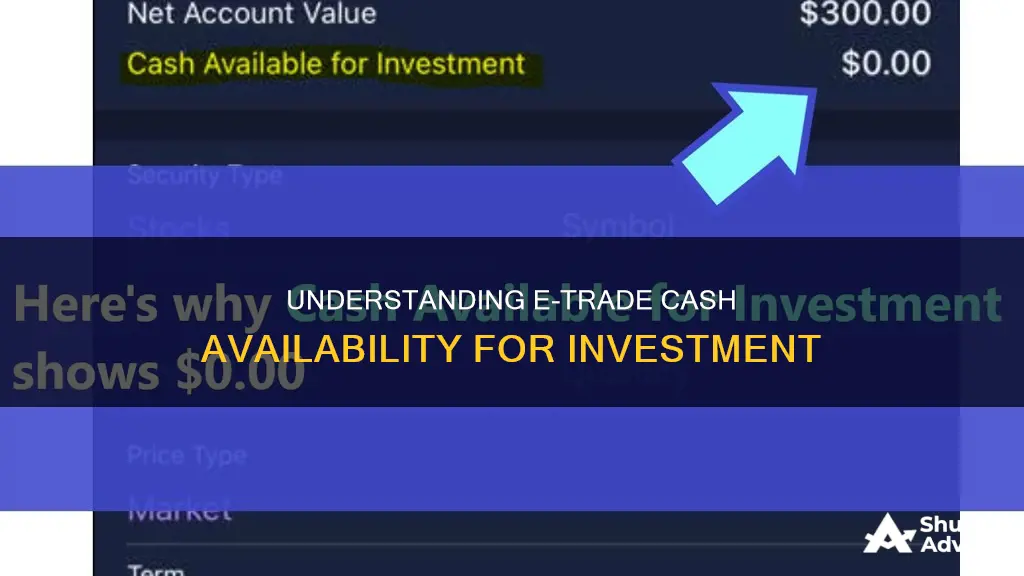

It can take some time for your cash to become available for investment as E*TRADE needs to verify the actual money.

You can make your cash available for investment by holding your position until the sale settles.