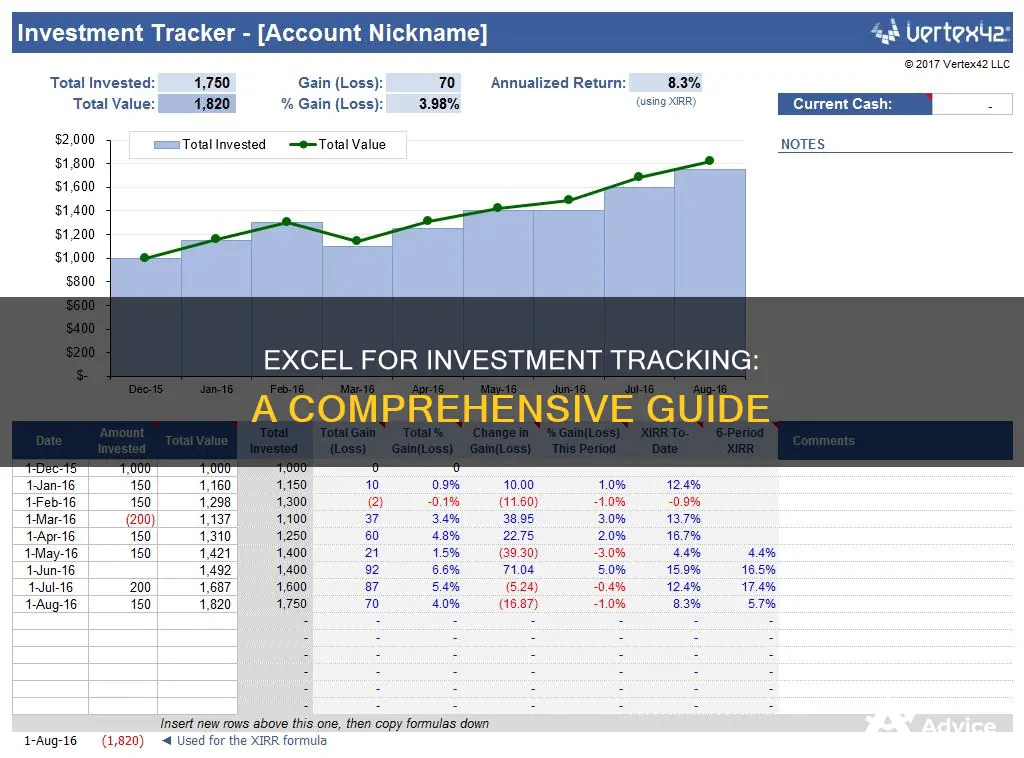

Microsoft Excel is a powerful tool for tracking investments. It can be used to monitor the value of investments over time, whether for personal or business use. With Excel, you can record basic data, identify break-even points, calculate capital gains, and explore prospective investments. The program's calculation capabilities can automatically compute metrics such as standard deviation, percentage return, and profit and loss. This enables investors to make data-driven decisions, assess risk, and evaluate investment performance. Additionally, Excel offers customizable templates for financial management, allowing users to visualize their finances with pie charts and bar graphs. Overall, Excel is a versatile tool that simplifies investment tracking and empowers investors to maximize their financial investments.

| Characteristics | Values |

|---|---|

| Purpose | To keep track of the value of your investments over time |

| Users | Anyone from individuals with personal investments to companies |

| Benefits | Simple yet highly effective; shows entire record of purchases, sells, dividends, return of capital transactions, and splits; can be used as a reference for financial decisions; automatically performs calculations; can be organised into categories; can be used to track international assets and investments; makes rebalancing easier |

| Data to Include | Date, entry, size (number of shares), closing prices for specified dates, difference between closing price and entry price, percentage return, profit and loss, standard deviation |

| Alternative Tools | Google Spreadsheets; commercial portfolio management software that works in concert with Excel |

What You'll Learn

Record basic data

Recording basic data is the first step to successfully using Excel to track your investments. This foundational step will ensure you have all the information you need in one place, making it easier to manage your investments.

Firstly, you should decide what data you want to include. This could be the date, entry, size (number of shares), closing prices for specified dates, the difference between the closing and entry price, the percentage return, profit and loss for each periodic closing price, and the standard deviation. You can also include the number of shares purchased, the buying price per share, the commission you will pay to the brokerage service, and the tax rate.

It is recommended that you use one line for each stock category, with each category written in separate columns. This will make it easier to fill in the data and ensure that each cell is conveniently filled with the information provided by your brokerage firm. If you are planning to buy more shares of the same stock at a new price, create a new row to record this and avoid confusion.

Once you have recorded this basic data, you can move on to identifying break-even points, calculating capital gains, and exploring prospective stock investments.

Commercial Paper: Investing or Cash Flow?

You may want to see also

Identify break-even points

Identifying the break-even point is crucial for any investment venture as it is the point at which total costs and total revenues are equal, resulting in neither profit nor loss. This analysis is essential for strategic planning, pricing, and managing cash flow. It helps companies determine how many units need to be sold to cover all their costs and begin earning a profit.

The break-even point formula is: Break-Even Point (BEP) = Fixed Costs ÷ Contribution Margin. The contribution margin is the selling price per unit minus the variable costs per unit, and it represents the amount of revenue remaining after meeting all the associated variable costs accumulated to generate that revenue.

For example, if a company has $10,000 in fixed costs per month and their product has an average selling price (ASP) of $100, and the variable cost is $20 for each product, the contribution margin per unit is $80. By dividing the $10,000 in fixed costs by the $80 contribution margin, we find that the break-even point is 125 units. This means that if the company sells 125 units of its product, it will make $0 in net profit.

In Excel, the break-even point can be calculated using the "Goal Seek" function. First, link the "Set cell" selection to the net profit cell. In the next step, input zero as the "To value" since the profit we are targeting is $0 (i.e., the break-even point). Finally, set the "By changing cell" to the number of units sold, as this is the variable that Excel will adjust until our target profit value is met.

Investing in the S&P 500: A Guide for Scotrage Traders

You may want to see also

Calculate capital gains

Calculating capital gains is a crucial step in managing your investments and making informed decisions. Here's a step-by-step guide on how to use Excel to calculate capital gains:

- Create a new worksheet: Label this worksheet "Capital Gains" or something similar.

- Set up columns: In this worksheet, create seven columns with the following headings: "Ticker Symbol", "Shares Sold", "Date of Sale", "Selling Price", "Purchase Price", "Capital Gains", and "Long-Term/Short-Term".

- Enter basic data: Fill in the "Ticker Symbol", "Shares Sold", "Date of Sale", "Selling Price", and "Purchase Price" columns with the relevant information for each stock sale.

- Calculate capital gains: In the "Capital Gains" column, input the following formula: =(Selling Price - Purchase Price)Shares Sold. This formula will calculate your capital gains or losses for each transaction. A negative result indicates a capital loss.

- Determine long-term or short-term: In the "Long-Term/Short-Term" column, indicate whether each sale is a short-term gain (held for less than a year) or a long-term gain (held for a year or more).

- Compare with brokerage results: Verify your calculations by comparing them to the information provided by your brokerage firm at the end of the tax year.

- Visualize with charts: Consider creating charts or graphs to visualize your capital gains and losses over time, making it easier to identify trends.

- Update regularly: Remember to update your Excel spreadsheet with new transactions and market changes to keep your data accurate and current.

- Assess tax implications: Capital gains have tax implications, so be sure to consult with a tax professional or refer to tax guidelines to understand your tax obligations.

By following these steps, you can effectively calculate and track your capital gains using Excel. This will provide you with valuable insights into the performance of your investments and help you make more informed decisions about buying, holding, or selling your stocks.

Best Cash Investments to Make Right Now

You may want to see also

Track dividends

Tracking dividends in Excel is a great way to monitor your dividend yield and assess how much income-producing assets you are accumulating.

To get started, you can download a free dividend-tracking template online or create your own. If you're creating your own, the first step is to decide what data you want to include. This could include the ticker symbol of the dividend stock, the number of shares you own, the cost basis for each holding, the current dividend amount, and the expected dividend payment date.

Once you have your template set up, you can start inputting your data. Be sure to update your dividend portfolio regularly with the current market price of the dividend stock. You can also link your online broker to your spreadsheet to automate this process.

To track your forward dividend income, you can create a schedule or table within your spreadsheet that calculates your expected dividend payments for the next 12 months. This will allow you to see how much you can expect to earn in dividend income over the next year.

Additionally, you can use formulas in Excel to calculate important metrics such as the total dividend yield of your portfolio. This will give you an average dividend yield for all the dividend stocks you hold, even if they have different individual yields.

By tracking your dividends in Excel, you'll be able to easily identify when companies increase or decrease their dividends, which can help inform your investment decisions.

Investing Without Cash: Strategies for Building Wealth from Scratch

You may want to see also

Create difference formulas

Creating difference formulas in Excel is a straightforward process. This formula can be used to calculate the difference between an asset's current price and its entry price.

Firstly, you need to enter your data into an Excel sheet. This is the data that you will use to calculate the difference in the next steps. It is important to keep your data organised to prevent errors.

Next, check that your data is in the correct format. To find the difference between two values in Excel, they need to be the same type of data. For example, if you try to subtract a number stored as text from a number stored as numerical data, Excel will give you an error. You can change the data type by selecting the cell or column and choosing a data type from the "Number" drop-down menu on the "Home" tab at the top of the screen.

Now, you can calculate the difference between two values. To do this, click in the cell where you would like the difference to appear. Type the equals sign (=) and then click in the cell containing the first value. Follow this with a minus sign and then click in the cell that contains the second value. Press enter, and the difference will appear in the cell.

If you want to copy this formula to other cells, click on the lower right corner of the cell until you see a dark plus sign. You can then drag the formula to the other cells to find the difference for each dataset.

Understanding Cash Equivalents: A Guide to Investing Wisely

You may want to see also

Frequently asked questions

Record one line for each stock category, with each category in a separate column. Include the number of shares purchased, the stock's buying price, and the commission.

Create a new column to assess the existing information and determine a break-even formula, which identifies the price of sale necessary to achieve a net income of zero. Label this column "Break-Even Price" and use the following formula:

> = (((Buying Price*Shares Purchased+(Commission*2))/Shares Purchased)-Tax Rate*Buying Price)/(1-Tax Rate)

Create a new worksheet and add seven columns: Date, Description, Long-term/short-term, Selling Price, Purchase Price, Shares Sold, and Capital Gains/Losses. Use the following formula to calculate capital gains:

(Selling Price - Purchase Price)*Shares Sold