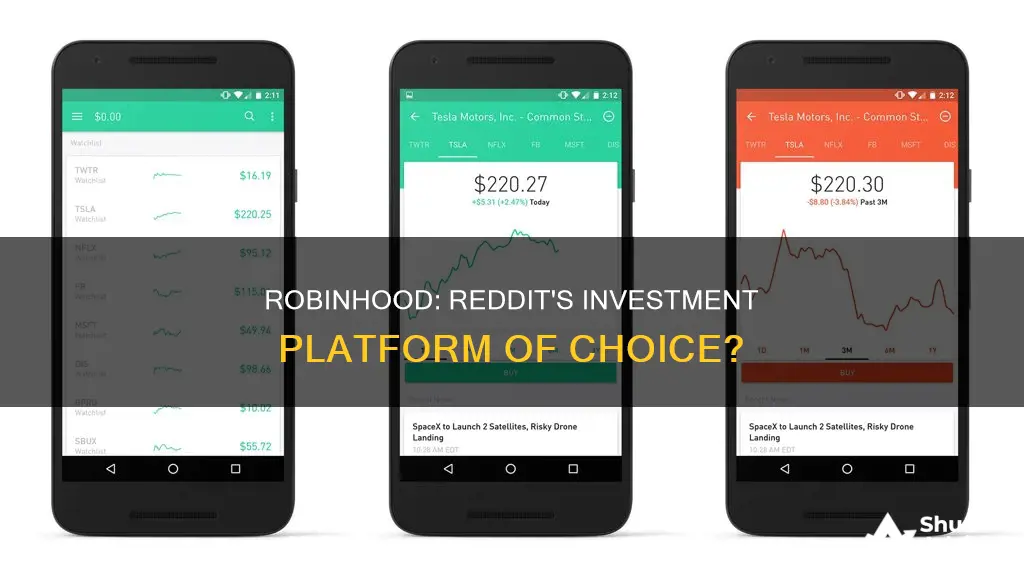

Robinhood is a US-based financial services platform that offers commission-free trades of stocks, exchange-traded funds, and cryptocurrencies. It has attracted millions of users, particularly those new to investing, with its easy-to-use mobile app and low barrier to entry. However, it has also been mired in controversy, most notably during the GameStop short squeeze in 2021, when it restricted trading on certain stocks, drawing accusations of market manipulation. This incident, along with other issues such as poor customer service and gamification of investing, has led to a divided opinion on Reddit, with some users expressing distrust in the platform, while others continue to defend it, citing its user-friendly interface and incentives like IRA matches and high-interest returns.

| Characteristics | Values |

|---|---|

| Ease of use | Very easy to use, particularly for beginners |

| Customer service | Poor |

| Reliability | Unreliable due to freezing of accounts and trading |

| Trustworthiness | Not trustworthy due to freezing of accounts and trading |

| Safety | Safe unless there is a major market event |

| Gamification | Gamifies investing |

| Fees | No fees |

| Reporting | Poor reporting features |

| Long-term investing | Not suitable for long-term investing |

| Short-term investing | Suited to short-term investing |

| Stock picking | Suited to stock picking |

| Cryptocurrency | Good for crypto |

| IRA matching | Good IRA matching |

| Transfer bonuses | Good transfer bonuses |

What You'll Learn

User-friendly interface

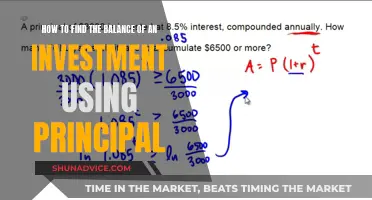

One of the most commonly cited reasons for using Robinhood is its user-friendly interface. The app has been designed with simplicity and ease of use in mind, making it a popular choice for beginner investors or those who prefer a more streamlined investment experience.

The Robinhood app offers a clean and intuitive layout, with a dashboard that provides easy access to market data, news, and your investment portfolio. Buying and selling stocks, ETFs, options, and cryptocurrencies is straightforward and can be done with just a few taps. The app also provides a watch list feature, allowing users to keep track of specific stocks or funds they are interested in.

Another aspect of Robinhood's user-friendliness is its educational resources. The app provides a range of tools and information to help users make informed investment decisions. This includes market news, analysis, and real-time quotes. For those new to investing, Robinhood offers a collection of how-to guides, articles, and tutorials to help them get started and improve their knowledge over time.

The sign-up process for Robinhood is also simple and quick. Users can create an account in just a few minutes and start investing immediately. Additionally, the app includes a paper money feature, a simulated trading platform that allows users to practice and refine their investing strategies without risking their own capital. This feature is especially beneficial for beginners as it provides a risk-free environment to gain experience and build confidence in their trading abilities.

Overall, Robinhood's user-friendly interface and focus on simplicity have contributed to its widespread adoption, particularly among younger and less experienced investors. The app's intuitive design, comprehensive educational resources, and seamless sign-up process have lowered the barrier to entry for investing, making it accessible to a broader audience who prefer a more streamlined and straightforward investment platform.

Zinser Investment: Relevant Cash Flows and Their Impact

You may want to see also

Gamification of investing

The gamification of investing refers to the addition of features to investment apps that make the user experience more intuitive, exciting, or visually appealing. The purpose is to make stock trading more fun for the average consumer, like playing a video game.

While a friendly and approachable investing app might be beneficial in theory, in practice, it can trivialise the experience, and many gamification features border on being manipulative and misleading. As a result, gamification has faced widespread criticism, and regulators are intervening.

One of the red flags that first brought attention to the issue of gamification was Robinhood's confetti feature, which celebrated every trade. This reinforced the idea that each trade was something to celebrate, when in reality, making more trades is a great way to lose money.

Other features of gamified investment apps include inadequate disclaimers and disclosures, an emphasis on trending stocks, and lottery systems that incentivise actions that may not be in the user's best interest.

Gamification can drive investor engagement and literacy, particularly among younger generations, and can democratise investing by making financial markets seem less complex and impenetrable. However, it can also be used by firms to drive excessive trading, encourage trading in complex or risky products, or promote other harmful investor behaviours.

To manage the risks associated with gamification, app design should include features that allow for review and reflection by users. Regulators should also consider warning labels for brokerage communications, including advertisements.

Understanding the Ideal Cash-to-Investment Ratio for Your Business

You may want to see also

Payment for Order Flow

PFOF is controversial due to the inherent conflict of interest it raises. A broker is expected to obtain the "best execution" for their clients, i.e., look across all the market markers and give the trade to the one offering the best price for its client. However, if a brokerage's main source of revenue is PFOF (as in the case of Robinhood), they might try to maximise their profit by giving the order to the market maker that pays them the most, instead of getting the best deal for their customer.

In December 2020, Robinhood paid $65 million to settle an SEC enforcement action for not disclosing how much money it was receiving for routing its orders to firms like Citadel and for failing to seek the best price for its customers' orders. The SEC said that Robinhood customers' orders were executed at prices that were inferior to other brokers' prices, causing its clients $34.1 million in losses.

PFOF was pioneered by Bernie Madoff, although it was not a factor in the Madoff investment scandal. There are multiple well-developed markets where PFOF is banned, such as the UK, which banned the practice in 2012. The UK market's shift to a more efficient market after banning PFOF puts more pressure on the SEC to bring in new regulations.

Some people argue that PFOF is good for retail investors as it has driven down and eliminated most commission costs. However, others argue that it is bad for retail traders as it allows market makers to front-run trades, i.e., see an order coming and place their own first in a way that benefits them.

Smart Ways to Invest Your $25K Windfall

You may want to see also

Customer service

Robinhood's customer service has been described as non-existent and terrible. The company does not offer a customer support phone line, and responses to queries can take up to 2-3 days. One user reported that Robinhood's support team was unable to fix discrepancies between their actual account history and what the app showed. Another user said that Robinhood's customer service was awful and that the company wanted a picture of their ID, a copy of their bank statement, and other personal information before they would release their money.

In contrast, Fidelity was praised for its "phenomenal" customer support, with one user saying that "Fidelity actually has people you can speak to". Another user said that while Robinhood's support took a few days to respond, it "never felt scripted".

One user said that Robinhood's customer service was good for a "buy and hold" strategy but not for active trading, as the company does not offer Level II data or a Drip program for dividends. Another user said that Robinhood's customer service was fine for small amounts but that they would switch to a different broker for larger sums.

Deepwoken Strategies: Using Investment Points Wisely

You may want to see also

GameStop controversy

On 28 January 2021, Robinhood restricted trades for GameStop by preventing users from buying stocks from several companies, including GameStop, AMC and Nokia. The company cited "market volatility" as its reason for the restriction, allowing customers only to sell their shares in these companies.

Robinhood played a critical role when a group of Reddit users saw an opportunity to make money while also jabbing Wall Street and hedge funds. The company's decision to restrict buying GameStop was due to issues with volatile stock and regulatory requirements. Robinhood's role in the trading frenzy led to scrutiny from its users, regulators, and lawmakers.

Robinhood CEO Vlad Tenev explained that the company was required to keep a substantial amount of money on hand to process all the trades happening through its clearinghouse. The National Securities Clearing Corporation (NSCC) gave Robinhood a file with a deposit request of around $3 billion, which was much higher than usual. Tenev said that Robinhood had no choice but to conform to regulatory capital requirements.

The subreddit behind GameStop's skyrocketing share value, r/WallStreetBets, included big users of Robinhood who felt slighted by the decision. The controversy also led to a lawsuit against Robinhood, accusing the company of "purposefully, willfully, and knowingly removing the stock 'GME' from its trading platform in the midst of an unprecedented stock rise." Several members of Congress called for a hearing on Robinhood's actions, and the company faced investigations from state attorneys and the SEC.

Robinhood's decision to restrict trades during the GameStop controversy caused a backlash among its users and led to scrutiny and legal action. The company's CEO, Vlad Tenev, explained that the restrictions were due to regulatory requirements and the need to maintain sufficient capital to process trades. The controversy highlighted the impact of free and easy access to the stock market through trading apps and the power of social media to influence stock prices.

Cash as an Investment: Pros and Cons

You may want to see also

Frequently asked questions

Robinhood is a member of the Securities Investor Protection Corp. (SIPC). This means that any loss of an investor’s securities (e.g., stocks and bonds) and cash held by Robinhood is protected up to $500,000 in the event the firm fails or goes out of business. This includes up to $250,000 protection for cash holdings.

Robinhood is extremely simple to use and understand, and it allows you to invest as little as $1. It is probably the most user-friendly app in the industry. However, it is not very transparent and has horrible customer service.

Robinhood has been accused of manipulating the platform and freezing trading for certain stocks. However, it is commission-free and has a good UI. It is probably not the best platform for stocks, but it is adequate for buying $100 of NVDA or META.

Robinhood seems to be more suited to short-term investing and stock picking. The dashboard page promotes individual stocks and cryptos. The historical reporting is limited to up to 1 year and ALL, but there is no custom time range option.